Do you know how to get leads for business loans substantially? Smart digital marketing in the banking industry can be paid off in six months already. As digital lending continues to win over in-house banking, it’s significant to figure out fresh business loan leads generation strategies.

Specific marketing strategies for banks and financial institutions are good working if using them in combination. The HES team decided to make a step-by-step guide through marketing lending, including content marketing, search engine optimization, social media lending, online advertising, and email campaigns. In addition, we will prove the profit of digital marketing for banks by highlighting lenders and online financials who already successfully implement it.

The Two Stage Lead Generation Framework

There are many moving parts in business lending, but lead generation often gets narrowed down to marketing alone. We see it quite often. Teams invest heavily in ads, campaigns, content, all with the idea that once traffic comes in, the rest will, somehow, fall into place. It doesn’t quite behave that way.

Successful lead generation unfolds across two interconnected stages:

- One occurs outside your platform, where potential borrowers discover you through various channels.

- The other begins inside your system, the moment people try to explore or complete the application flow.

And strange as it sounds, the second stage is frequently treated as an afterthought. Perhaps because the internal process feels less visible or slightly too technical.

Over time we have watched lenders refine marketing continuously while leaving the internal flow nearly untouched. Borrowers then drop off, not out of disinterest, but because the experience becomes muddled or tiring. You can notice this trend, especially in institutions where the onboarding process has not been reviewed for a while.

External marketing acts as an invitation. The internal journey decides whether visitors stay, progress, or quietly slip away. It is an uncomfortable but important dynamic to acknowledge.

How to Get Leads for Business Loans

Today for any lender to strive and survive, it’s significant to promote its website through digital marketing in the banking industry. You probably know the basics of online marketing and use several platforms popular among your competitors.

Let’s have a sneak peek at each online sales channel before diving into details of effective marketing ideas for loan companies.

Search engine optimization

Search engine optimization is the first thing to consider picking up marketing strategies for banks and financial institutions. It optimizes your lending website for clients who are interested in the financial services and products you offer. 68% of all customer journeys begin with a search engine, while only 0.63% of users get to the second page of Google Search Results. SEO helps to rank higher in organic search results.

According to Infront Webworks, 90% of clicks on Google's search results are attributed to organic links found on the first page. In contrast, paid Google ads account for only 10% of clicks. This is why the position in organic search results is crucial.

- Decide on services and products you offer, such as commercial loans, POS, mortgages, and others. Each service would have its own page on your website. Choose relevant keywords per page and add quality content describing the service in detail without further ado. Don’t forget to add screenshots or eye-catching images to keep users.

- Include calls to action on every page to motivate users to get in touch with your team.

- Create the “About us” page telling your business story and introducing the team to your audience.

- Include use cases or customer testimonials to show users that you have customers, present their success stories.

- Use Google Business Profile to attract customers when they search for you on the web. It gives you a presence on Google Search and Maps. You can respond to reviews, post photos of products or special offers, as well as add your business details.

- Make an individual page with your company’s locations, addresses, emails, working hours, and phone numbers.

- Don’t forget about the “Contact page” to let your customers reach out to you at ease.

Following these important SEO steps, you will optimize your website, increase organic traffic and generate leads.

Content marketing

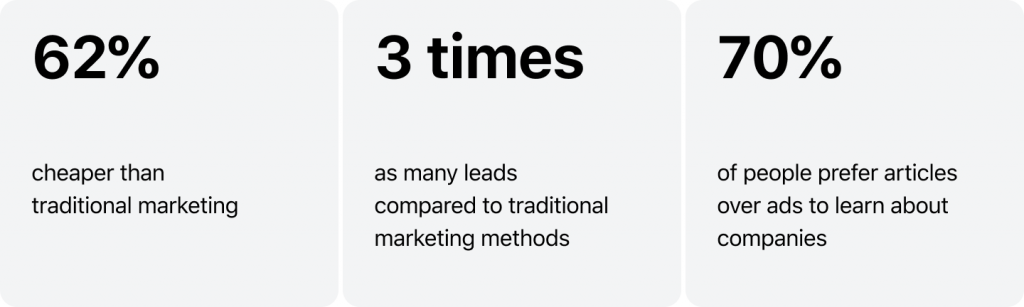

Your financial institution’s web content is the basis on which all your sales online channels are built. Content marketing includes service landing pages throughout the website, blog posts, infographics, and press releases on third-party sites. As per the Content Marketing Institute, content marketing is utilized by 73% of B2B marketers and 70% of B2C marketers as a component of their overall marketing plan. Moreover, it costs about 62% less than traditional marketing channels.

Working on the content, make sure it contains all the information your customers are interested in. Provide authentic value to your users. Write quality content to get customer conversions.

Let's pay more attention to blogging which is a good way to increase your brand awareness online. A blog is not only about your services. It allows you to let your customers know that you're knowledgeable in the things you do. In addition, it's a great tool to remind your customers once a month by sending notifications about a new article.

Below are some of the most important points to keep in mind while working on a content marketing:

- Content marketing is about building relationships with your audience by providing them with the information they’re looking for. So make sure your content contains it.

- When writing blog posts, we recommend sticking to 1000-1800 words. Research by Marketing Insider Group demonstrates that the most successful blogs publish weekly posts of around 1,000 words or more. This length keeps reading time under six minutes on average. But of course, blog articles should only be as long as they need to be.

- Know your keywords and make sure to include them in your content. If you don’t have the resources to hire an SEO agency or don’t know how to find the right keywords, here’s our advice: think of the questions and challenges your audience has.

- Always have a captivating meta description. It serves as a concise summary displayed in your search ranking on Google. Ensure it is compelling and descriptive, effectively conveying the essence of your content to inform users about what it entails.

- Make your content easy to navigate. Add links to your services and other blog posts.

Considering loan campaign ideas, you can write about the following:

- Educate your followers about credit scores, fees, loan types, debt collection to provide value.

- Guide customers through the services. Make content that describes. For example, the process from loan application to deb collection.

- Inform users about new services and profitable lending terms.

Remember to add links to your services and other blog posts as well as insert keywords for high search engine ranking. In addition, always analyze your blog traffic and positions to take your marketing lending under control.

For example, SoFi has a highly engaging blog and posts articles every day on mortgage rates, lending and corporate news, and other relevant ideas.

Video marketing

Following the statistics, 83% of marketers say that video content helps them with lead generation. and 87% note an increase in web traffic. To promote video content, you can use platforms like YouTube or any social media including Instagram. You can also put your video on your website and use it for demonstrations to your leads.

Video content, if done right, gives a personal touch since customers can interact with you and the team.

Considering video lending ideas, you can film about:

- Again, your services. Show users how everything is done in the office, what people work here, and what you offer.

- Product testimonials to show your successful clients and their business history.

- How-to-video explaining how to apply for a loan or to interact with your website in general.

When it comes to creating a video, it’s better to call for a more practiced hand. Hire a designer if you want to deliver video content constantly, or contact a design agency for a specific video.

Social media marketing

Social media marketing or SMM isn’t as easy as it seems. But it’s a powerful strategy to drive more traffic to your website. For social media lending, you can consider Instagram, Facebook, Twitter, Linkedin, and others. Social networks will help you know your customers, explore their preferences and communicate with them on a daily basis.

Based on market research, lending companies can find their target audience on Twitter and Facebook mainly. CMI's 2021 research indicates that Facebook was the leading distribution channel for B2C marketers over the past year and was responsible for the most favorable outcomes. On the other hand, B2B marketers disclosed to CMI that LinkedIn was the most prevalent and highest-performing organic social media distribution platform. However, the situation might differ in other countries, so we recommend running social networks research first.

Once you pick social networks, it’s time to work on the content. Here things are the same as with a blog - write about things your customers need to know, share your business news, promote your loan services and website, and always respond to comments. And don’t be afraid of experiments. Mix video marketing with written content, and use infographics and images of your employees. The goal is to let your customers trust you and build loyal relations with the business.

Consider scheduling your post for effective SMM lending. Different people browse different social networks at different times all over the world. So if you aren’t a local lender, it’s important to schedule the time you post on networks. Based on our experience, the perfect time is between 12 pm and 3 pm when people are mostly online.

Besides, remember to track the traffic from social networks and analyze it. You can change your strategy at any time to increase your business loan leads.

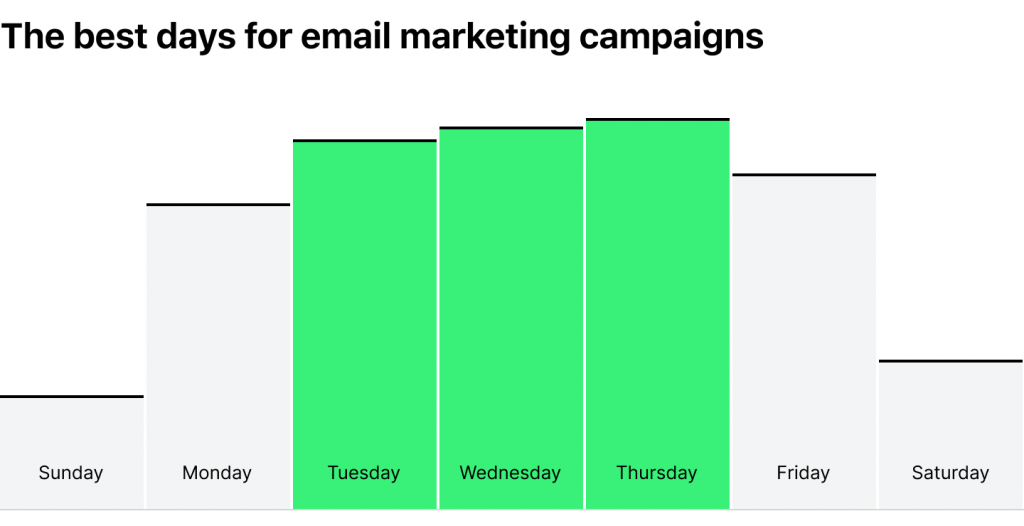

Email marketing

Email marketing is a traditional customer acquisition approach. We offer to integrate it with digital strategies for high changes of successful campaigning.

With email drip campaigns, you can target your existing customers and potential clients by sending a series of emails. You can sort your customers by their banking habits, income, job position, marital status, and others and send emails to separated groups. Track the success of your campaigns using CMR software. Modern solutions can show who opened an email, read it, who clicked on the links to know more, etc.

Google Business Profile

Google Business Profile (formerly known as Google My Business) is a valuable tool for lending businesses, including loan officers, to enhance their marketing efforts and establish a strong online presence. By optimizing their Google Business Profile, lending businesses can increase their visibility in local search results, gain credibility, and attract potential customers. Here are some ways in which it can benefit lending businesses, along with recommendations for utilizing this platform effectively:

1. Enhanced local visibility: A well-optimized Google Business Profile can help lending businesses appear prominently in local search results. When people in your target area search for loan officers or mortgage services, your profile can rank higher, even above larger or national competitors. This increased visibility can lead to more website traffic, inquiries, and ultimately, more clients.

Our recommendation: To maximize your local visibility, ensure that your profile is complete, accurate, and up-to-date. Fill in all relevant business information, including your business name, address, phone number, website URL, and hours of operation.

2. Credibility and trust: Potential customers often rely on reviews and ratings to evaluate the credibility and reputation of lending businesses. Google Business Profile provides a platform for customers to leave reviews and testimonials, which can significantly influence prospects' decision-making process. Positive reviews build trust, showcase your expertise, and differentiate you from competitors.

Our recommendation: Encourage satisfied clients to leave reviews on your Google Business Profile. You can politely request reviews through email, include a review request link on your website, or provide a reminder after completing successful transactions. Respond promptly to reviews, both positive and negative, to demonstrate your commitment to customer satisfaction.

3. Engaging visual content: A visually appealing Google Business Profile can captivate potential customers and make a strong first impression. By regularly updating your profile with high-quality images of your office space, team members, or happy clients, you can humanize your brand and create a connection with your target audience.

Our recommendation: Upload recent photos that showcase your professionalism, expertise, and customer-centric approach. Consider including images of happy clients with their new homes or testimonials that highlight successful partnerships. Regularly refreshing your visual content can keep your profile engaging and relevant.

4. Consistent NAP Information: NAP (Name, Address, Phone Number) consistency across various online platforms is crucial for search engine optimization and user experience. When your NAP information is accurate and consistent, it reinforces your business's legitimacy and improves your chances of appearing in relevant local search results.

Our recommendation: Ensure that your NAP details are consistent across your Google Business Profile, website, social media profiles, online directories, and any other online listings. Regularly review and update this information whenever necessary.

Online advertising

We’ve covered approaches driving organic traffic to the website. With paid online ads, you can add another dimension to your marketing campaign. Search advertisement appears at the top of the results and should attract potential customers. According to AdWords research, search ads have the potential to enhance brand recognition by up to 80%.

- Create ad groups of your lending services, where, for example, "mortgages" and "auto loans" have their ad groups. This will help you take all groups under control.

- Add keywords into ad text, call to action, and an image describing the product in detail.

- Targeting local competitors to appear in their search results, and poach their customers to your site.

- Since Google is the leading search platform, use Google AdWords to set up and check all your ad campaigns.

- Send your target audience to specialized landing pages where the needed service or product is described in detail.

- Run remarketing campaigns to engage previous website visitors. They will see your ads on the other websites which they visit after yours.

- Create your directories on other websites like Trustpilot.

- Focus on business news websites to publish your paid articles and news there. Use the potential of paid banners and ads on such websites too.

Together with paid ads in Google, you can pay attention to Linkedin and Facebook advertising. You can promote your posts by setting up the target audience you’re interested in.

Read also

Online Lending Success through Digital Brand Awareness Strategy

To gain success in marketing lending, it isn’t enough to research several strategies on the internet and follow them. Every aspect of your marketing activities should be created to target a specific audience and carefully lead everyone through the customer journey. So let’s figure out how to drive an excellent customer journey for an online lending business.

Step 1: Define your target audience

Defining each person that can be interested in your business services is the first step towards customer journey development.

You need to identify a profile of your perfect customer. The identification should be based on market research, data from networks like the online interaction of users. Note that you'll likely have several types of "target" persons.

The profile of lenders' customers should include the following information:

- Job type

- Income range

- Personal goals

- Behavior patterns

- Marital status, etc.

This research will help identify the population segment that comprises the largest customer segment and understand who brings the largest profit margin.

Step 2: Inquire customers’ lending goals

The next step is to identify the personal banking goals of your customers. Based on this information, you can define the content type to include in your marketing campaign. Start with the analysis of your competitors’ websites and your own. This information will show you what questions are important for users and let you help them in difficulties.

For example, a couple that got married several years ago has a newborn. While they’re busy with children’s chores, they might need some financial assistance from lenders to buy a baby carriage or renovate an old room. It’s not a priority they have in mind daily, but your reminder can encourage them.

The goal of digital marketing in banking industry is to show your customers that you care about their experience and prove they could save money by getting loans at better interest rates. Having clearly defined your customers’ banking goals, you’ll be able to develop a more successful digital brand awareness strategy and outperform competitors.

Step 3: Maximize touchpoint levels

Once you figured out who your customers are and what they need, it’s time to establish communication with the audience.

At this stage, you need all the communication types we’ve mentioned before: paid ads, content marketing, email campaigns, SEO, and social media marketing. These channels will be touchpoints making up financial services internet marketing.

Working on these touchpoints, you let your customers meet your company during their internet routine. For example, your potential customer owns a company and might stumble upon your ads on Instagram or finds your post on Facebook about profitable credit terms for business. Constantly providing quality content to users through all possible channels drives more leads and grows your brand awareness.

Creating touchpoints, remember that user experience also affects whether they’ll be your loyal customers or not. So customer onboarding and the ability to choose communication channels are important.

Step 4: Keep track of your campaigns and results

Measure the success of your campaigns and touchpoints. Understanding the performance of marketing lending, you can finds breaches in your campaigns.

You can create KPIs (key performance indicators) to define your marketing goals and measure your success on the way. Analyze click-through rates, organic and paid traffic on your website and blog, measure the dependence of social media posts frequency and growth in followers, etc. You can also check what campaigns perform better on different devices. For example, paid ads on Instagram usually perform better on mobile devices while Google ads might be more profitable on desktops.

To simplify your analytics, use tools like Google Analytics and Search Console, try the platform for keyword research and monitor the positions of your web pages in Google, Bing, etc.

Step 5: Solve problems

The results from analytics metrics will show you the breaches in your work and help improve processes.

The analytics can help you optimize your website content by highlighting the unclickable buttons and irrelevant content. You will understand which ad campaigns don’t drive leads and which blog articles need to be rewritten.

Having so much data and useful tools at your fingertips allows you to access an in-depth analysis of touchpoints you need to improve.

Step 6: Provide quality services

Since we’re talking about successful lending marketing, quality products and services remain the deciding factor for customers on whether to keep working with you or not. Here at HES FinTech, we have only one goal - to deliver quality software with custom functionality and in the short term.

No matter how good your marketing is, your ability to fasten decision-making, drive omnichannel experience, let choose a payment type, set up notifications when debt collection comes, and more helps you get loyal customers. If you don’t know what exactly your business needs, our team will advise you and guide you through our finished products. We set no limits, the success of our clients is exactly what we work for.

Critical Elements of User Friendly Loan Origination

This chapter covers several areas that shape borrower experience. We approach each differently so the structure does not repeat itself, but the theme stays consistent: improving clarity, speed, and usability without sacrificing professionalism

1. Simplified Application Forms

Borrowers expect digital processes to be relatively intuitive. Not overly simplified, just approachable. When someone lands on a lengthy or slightly outdated form the interest can drop almost immediately (we have seen this repeatedly in user sessions).

A few principles help:

- showing only fields that are relevant

- using small, quiet bits of pre filling where data already exists

- making sure the layout responds well on mobile

- giving a sense of where the user is in the process

- allowing applicants to pause and return later

Shortening a form is helpful, though clarity tends to have a stronger effect. Borrowers usually want to see a logical path, nothing more, nothing less.

2. Instant Pre Qualification and Decisioning

Speed shapes expectations in lending. People compare multiple offers, often in the same afternoon, and the lender who responds first usually earns more attention. This does not mean rushing, but rather creating space for immediate clarity.

A balanced pre qualification model may include soft credit checks, quick decision rules, and short explanations of next steps. Real time engines contribute to a predictable experience. And transparency around timing has a calming effect on borrowers who are trying to make decisions under pressure.

We have seen that when the initial wait time drops, early abandonment rates tend to fall as well.

3. Document Management Made Easy

Document handling is still one of the most frustrating points in lending. Traditional methods, with scanning and forwarding files across departments, cause friction at every stage.

A more modern approach helps people stay engaged. A few examples:

- Borrowers appreciate being able to upload documents directly from a phone or pull statements through secure integrations. Clear visual examples improve accuracy. Multiple upload options reduce confusion. Real time validation prevents the repetitive back and forth that slows applications.

These improvements are not superficial. They reduce operational overhead and create a far smoother journey.

4. Transparent Communication Throughout the Journey

Silence is rarely neutral in lending. Borrowers interpret it as uncertainty, and uncertainty increases stress. Automated messages help, but only when they deliver real information instead of vague “in review” notices.

Meaningful communication may include short status updates, a simple tracking interface, or notifications when something needs attention. We also believe, based on experience, that offering easy access to human support matters more than some teams initially assume.

The outcome is a steadier process for both sides and fewer avoidable calls to support teams.

5. Smart Personalization and Guidance

Borrowers seldom fit into a single pattern. Their needs vary by industry, business history, and future plans. So personalization has to mean more than inserting a name into a message.

Here the structure can differ a bit. For example:

A food service business might need quicker access to working capital. A technology firm may look for different types of credit. Tailored recommendations, contextual explanations, or comparison tools help borrowers understand which option suits them without overwhelming them. Calculators or small contextual hints also support better decision making.

Wrapping it Up: Financial Services Internet Marketing

Digital marketing for financial institutions is complex yet drives lots of organic traffic. You can follow many of mentioned steps and customize them based on your previous experience. Remember that digital marketing for banks allows gaining high results when using the strategies together. Here at HES, we can help you automate your marketing efforts with advanced lending management software, have your traffic analytics around, and note all rate movements right away.

These elements guide borrowers gently rather than pushing them through a uniform flow.

Psss... Wanna start lending within 90 days?

Need quality software? Get in touch with HES to generate business loan leads.