Payment gateways have made the digital transformation of lending possible. While the first “online” lending application appeared in 1985, credit-granting became fully digital and widely available only with the rise of PayPal, Amazon Pay, Stripe, etc. Since the payment gateway is the most important integration with the lending software, the right choice of its vendor remains fundamental to the company's success.

In this article, we’re going to explain what things to consider while choosing a payment gateway, how much you can expect to pay for one per month, and review the top world payment solutions.

Read also

- Pay-as-You-Go — the best one for startups with basic features for $0 per month.

- Scale with expanded subscription features for $2,000 monthly.

- Custom with unlimited functionality and development features. The price depends on the chosen set of functions.

- Where’re you going to perform your operations?

- What’s your budget?

- What transaction types do you want to accept?

- What additional services does a payment company offer?

Why Embedded Payments in Lending Are a GamechangerAccording to projections, the alternative lending industry is expected to exhibit a compound annual growth rate (CAGR) of 0.9% between 2020 and 2023, leading to a total market size of approximately US$34,399.9 million by 2023. This means that the alternative lending market is going to beat all records in the annual growth rate terms. And the goal of any lender is to provide appropriate and flexible payment methods — mainly digital — to users to win over the booming competition.

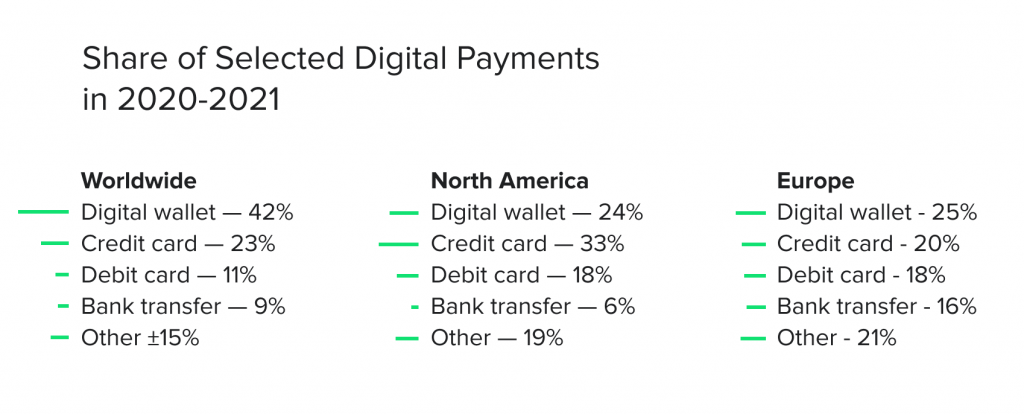

According to surveys by Statista, the total transaction value in the digital payments segment is forecasted to reach over $6 million in 2021 and up to $11 million by 2025 showing an annual growth rate of 12%. Considering digital transactions worldwide, borrowers are more willing to use digital and mobile wallets — over 40%, than bank transfer, credit, and debit cards. However, in the U.S. and North America in general the situation is a little bit different with the dominance of credit card transactions.

Choosing a gateway lending payment system is not a simple task, however. To make a choice, you need to know your customers and business power — location, preferable payment methods, your financial opportunities, ability to integrate the gateway with the existing lending platform, and others. Just as with many other financial choices, it’s significant to wisely compare all your options.

Top Things to Consider Picking Payment Gateway Application

In the case of lending, the first thing you need to note is the transaction process. Unlike in e-commerce with one seller and multiple buyers, lenders act as sellers and buyers all the time. Frequently, the majority of payment gateways are suitable for those operations. However, before picking a solution, it’s better to explore the issue or ask your software developer for some advice. Once you’ve probably cut the list of solutions suitable for pay-in and pay-out transactions, consider the six following aspects to figure out the one-and-only.

Payment processing fees

To start using software, you need to “buy” it. You might face a fee just for a short demo tour around the solution. Besides, the setup process and ability to accept multiple payment solutions might be charged and the cost widely varies.

Pricing for installed payment gateways is mainly based on the types of transactions you process (online or in-person), type of accepted cards (credit and/or debit), and the size of each transaction. These factors form so-called interchange fees — a fee charged for every transaction you process. On average, the interchange rate for credit cards ranges between 1.7% and 2% per transaction, while for debit cards, it is typically around 0.5% per transaction.

Next, you’ll be probably charged with monthly payments which include a gateway access fee (up to $35 per month), statement fees to cover a provider’s expenses for mailing and sending statements (up to $5-10 per month), and monthly minimum fee. The last one is connected with interchanged fees. Nearly all payment gateways provide a minimal amount of fees a lender should collect per year. For example, the minimal amount is $35. If a lender’s total transaction per month is less, e.g. $20, the gateway provider will charge you $15 to cover up the difference.

Besides, once you decide to terminate your agreement with a provider, it’s better not to do it earlier than it should be. If your budget is limited, you won’t be able to pay extra for early termination. It might cost thousands of dollars, depending on your provider.

There might be quite more payment fees, so it’s significant to discuss everything with a company representative before you integrate it into your lending process.

Accepted transaction types

When your business is money, you might want to provide your customers with all possible payment types to deliver an excellent experience. While e-commerce providers might lose customers if they don't offer handy solutions, lenders providing good credit terms are in the better stead. However, the possibility to choose transaction types will make digital lending easier. You'd better offer either credit and debit transactions, or accept digital wallets like Apple Pay and Android Pay. Considering that the majority of users prefer online transactions, especially younger generations.

Security and fraud protection

Choose the most secure and reliable payment gateway processor on the market. In this case, you need to pay attention to payment gateway reviews outside a vendor's website. Explore Google Reviews, Clutch, and other platforms where software providers cannot edit feedback from customers.

When evaluating software, explore the vendor's website in detail, especially a menu with fraud-protection services where you can find how the system can protect your transactions. Besides, choose only those payment gateway providers who are certified for security standards such as PCI DDS — an information security standard for organizations that handle branded credit cards.

Support and maintenance assistance

Working with a debt pay gateway, you might meet a variety of issues from technical to financial. Several providers limit their support services to emails leaving you manual instruction to fix problems. But this approach isn't effective enough, especially if you've recently switched to a new provider and don't know the system well.

Using a processor with 24/7 support and direct assistance allows you to solve all possible issues faster. Several companies provide users with account representatives to explain and guide them through the system and explain all misunderstandings.

Note that not all companies provide systems able to support international transactions. If you plan to reach the global market, check the platform’s location scope. In addition, not all solutions can be integrated with your lending platform.

Gateway Lending Solutions: What’s on the Market?

The payment gateway market offers a wide range of great solutions, so it’s hard to consider the best gateway lending company. Everything depends on your business needs. We recommend you explore the following list of gateway providers that we consider good for the lending domain. However, your lending-as-a-service provider can suggest something else having more information about your business specifications.

Stripe

Stripe is a payment service provider widely used globally since 2011. It’s available for businesses in 43 countries, including America and Europe. It allows accepting major payments via Stripe with over 130 currencies, foreign credit card networks, Alipay, Apple Pay, ACH, etc. For lenders, Strype offers two solutions — Stripe Connect and API Transfers.

Stripe Connect is designed for marketplaces and platforms. It carries out all transactions through the platform and controls them. When a user wants to make a payment, he or she is directed to Stripe to choose to use a ready-made Stripe account or create a new one. In this case, a lender acts as a middleman who gets access to a user’s account and collects payments.

The payment collection process with Stripe Transfers is a little bit different. It allows you to collect money into your account and transfer funds using ACH payment gateway API (Automated Clearing House — a network that moves funds from one bank to another using a centralized system that directs funds to the final receiver). In this case, you also act as a middleman but with your own Stripe account that collects all transactions (pay-ins and pay-outs). Your borrowers and debtors will provide their banking data directly to your platform. Unlike in Stripe Connect, ACH credit stripe transfer allows to have full control over transactions via Stripe and need to track what amount of money every borrower provides.

Considering costs, Stripe offers two pricing plans — Integrated with basic functionality and Customized. Integrated plan charges you with a flat 2.9% + $0.30 fee per successful card transaction and 1% per international transaction. Stripe charges $0.30 for 3D Secure authentication and $0.12 per screened transaction for Radar machine learning and fraud protection. The provider also offered premium support for $1,800 per month. There is also a $15 chargeback fee and monthly payments for contracting.

Stripe ACH API stands out for its development tools and customized options. It allows users to customize their reports and develop unique payment pages. There is also 24/7 support for all users.

PayPal

PayPal is the most knows payment platform founded in 1998. For the unique challenges of marketplace businesses and crowdfunding platforms, the company developed PayPal for Marketplaces. The solution remains the provider with the greatest scope of countries it supports — over 160. It accepts Android Pay, Apple Pay, American Express, Visa, Mastercard, etc. The same as Stripe, PayPal ACH API allows you to choose how to run your lending operations. There’re two options — connected and managed path solutions. There’s also a mass payments option.

The connected path is a model where you and your customers need to have their business account on PayPal to provide transactions. In this case, all payment processes undertake the gateway platform.

The managed path doesn’t require users to own their personal accounts. And the whole lending process relies on you or the administrator.

For advanced domestic credit and debit card transactions, PayPal takes 2.90% + fixed fee and adds a 1.5% rate for international. It takes monthly fees up to $30 depending on the payment type you use and charges $0.30 per successful transaction. PayPal offers an account monitoring service for $19.95 per month + $29.95 for setup. There’re advanced fraud management filters for $20 per month + $0.05 per transaction and protection services for $10 monthly + $0.05 per transaction.

Dwolla

Dwolla is a US e-commerce marketplace that provides an online payment system since 2010. The platform provides ACH payments and accepts credit cards with linked bank accounts, everything only in U.S. dollars. However, the platform doesn’t support international payments, Dwolla loan recipients must be located in the U.S.

Similar to Stripe, Dwolla allows managing payments through your lending platform using transactions API. Having integrated Dwolla with your platform, you access an admin dashboard and receive payment insights. The system allows access to multiple members, so your team can easily manage all transactions. Moreover, Dwolla supports mass payments using a ready-made tool to send hundreds of loans without any limitations.

Dwolla has three pricing plans:

For all sent and received payments, the platform charges you with a 0.5% fee of the transaction amount with a minimum fee of $0.01 and a maximum of $5.00. If you need a standard ACH transfer type, you will pay 5% per transaction.

There’s also a dedicated security program and risk detection system certified with PCI DDS level 1.

Adyen for Platforms

Adyen is a Dutch payment company founded in 2006. The company introduces its payment gateway for platforms in 2015 tailored specifically for marketplace needs. Adyen operates worldwide, including Middle East, Europe, North and Latin Americas, Africa, and Asia. The platform allows accepting payments online, on mobile, and at the point of sale. Their payment methods include Alipay, PayPal, Mastercard, Visa, UnionPay, Amazon and Apple Pay, Klarna, etc.

The same as the previous payment gateway process, Adyen allows users to maintain complete control over the lender and borrowers' experience with their API. The platform lets you split payments between multiple recipients and maintain multiple bank accounts. There is 24/7 support.

Adyen charges a processing fee + payment method fee per transaction. For example, if you transfer money to Google Pay eWallet, the processing fee is $0.12 and the payment method fee is defined by the card user. While carrying money to Blik Online Banking (Poland), you’ll pay €0,10 + 1.5% fee. Besides, there’re no setup fees.

Psss... Wanna start lending within 90 days?

Read also

Wrapping it Up: Payment System Integration for Secure Lending

All mentioned marketplace payment gateway platforms have relatively simple functions, but the market is not limited by them. Looking for a P2P lending software, money loan software, or any other for your business, remember our recommendations and find out:

To deal with all those issues, carefully explore service providers, book demo tours, and ask all possible questions. Find out all possible pitfalls that may occur during your lending operation and figure out a plan on how to overcome them.

Smooth integration of your new payment gateway application with the loan servicing system is a task for HES FinTech. We have deep experience within the lending field and can help you decide which payment solution will fit your business needs. Our team knows how to streamline your transactions, monitor the results, and automatically perform loan calculations as appropriate. Get a fully customized platform with top-notch gateway lending payment integrations to expand your lending boundaries.

Need a quality solution for lending? Get in touch with HES FinTech.