With a well-structured commercial loan origination process, businesses can evaluate borrower risk with greater precision, shorten decision cycles, and consistently originate higher-quality assets.

Given these advantages, it’s no surprise that investment in digital loan origination and automated decisioning platforms continues to rise, with the global commercial loan software market expected to reach $16.9 billion by 2034.

In this article, we’ll explore the key strategic advantages that a commercial loan origination system can bring and explain how it strengthens portfolio performance, improves risk management outcomes, and enables lenders to make scalable and data-driven decisions without sacrificing control or regulatory rigor.

Key Takeaways

- Modern loan origination systems combine structured workflows, data-enriched scoring, and AI to improve decision accuracy and speed at scale.

- Adoption of AI and machine learning plays a significant part in the loan origination software sphere.

- Underinvesting in origination increases default risk and slows growth in an increasingly digital lending market.

- Clear strategic goals and reliable data integration are the cornerstone for successful implementation of commercial loan origination process. The right technology partner adds to the confidence.

What Is Commercial Loan Origination?

Commercial loan origination is a structured process that financial institutions rely on in order to assess, approve, and onboard business borrowers.

Being more than a simple application review, it is the stage where risk is first identified, quantified, and priced, and where many future portfolio outcomes are determined.

When designed and implemented correctly, commercial loan origination ensures that every application is evaluated consistently, transparently, and in accordance with the organization’s risk appetite.

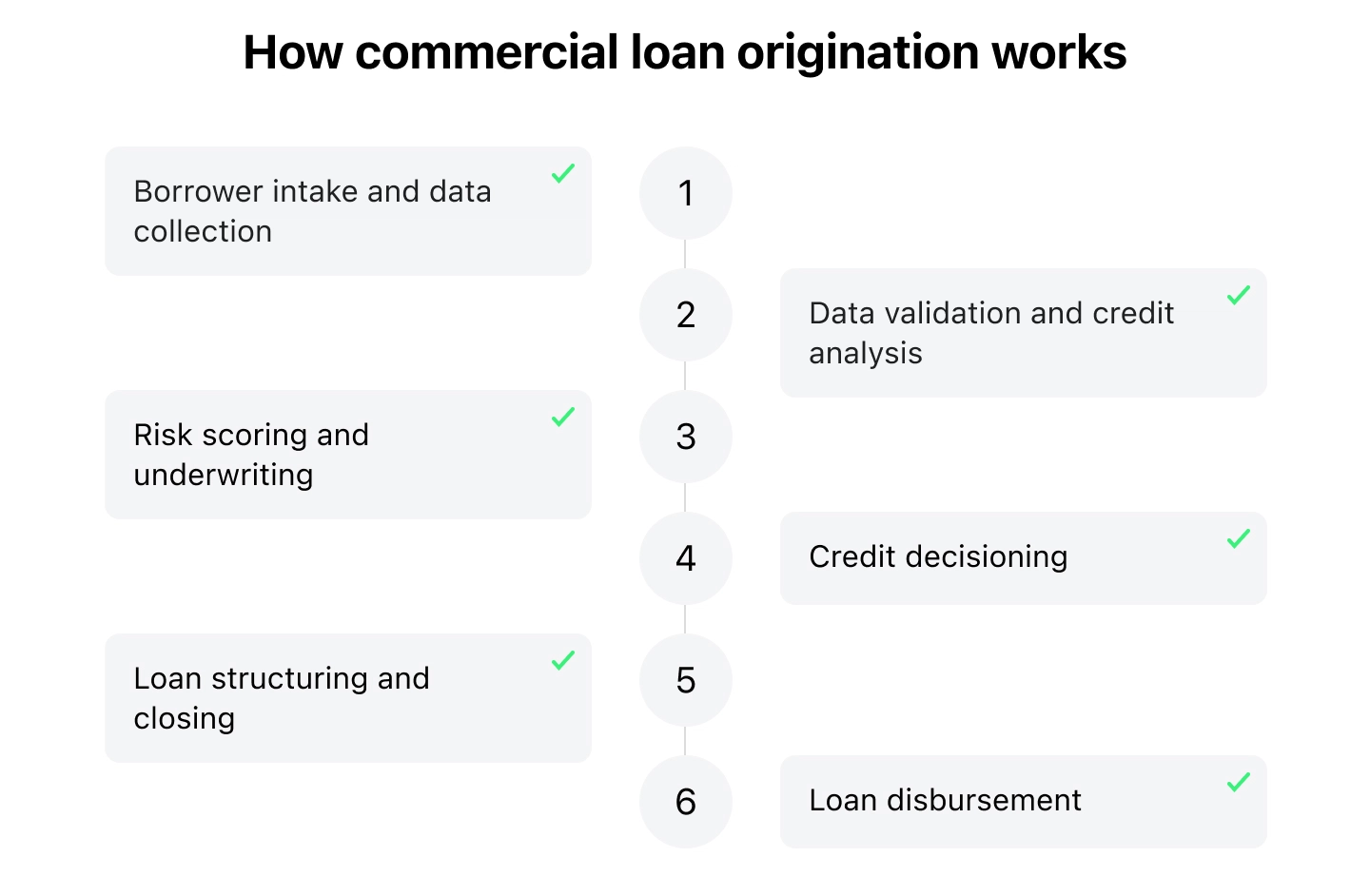

Although the specific implementations of the process may vary across institutions, it generally comprises the following steps:

- Borrower intake and data collection — gathering financial statements, business information, ownership details, and supporting documents;

- Data validation and credit analysis — verifying submitted information and assessing the borrower’s financial health, liquidity, cash flow patterns, and credit history;

- Risk scoring and underwriting — applying data-enriched scoring models, predictive analytics, and policy-based rules (augmented by expert review if/where required) to estimate risk levels and the repayment capacity;

- Credit decisioning — approving, declining, or routing applications for further review based on predefined risk thresholds, lending policies, and portfolio objectives;

- Loan structuring and closing — defining pricing, terms, and covenants, completing compliance and legal checks, and finalizing documentation;

- Loan disbursement — activating the loan, releasing funds, and transitioning the borrower into servicing and monitoring.

Commercial Loan Origination System and AI: Current Trends and Impacts

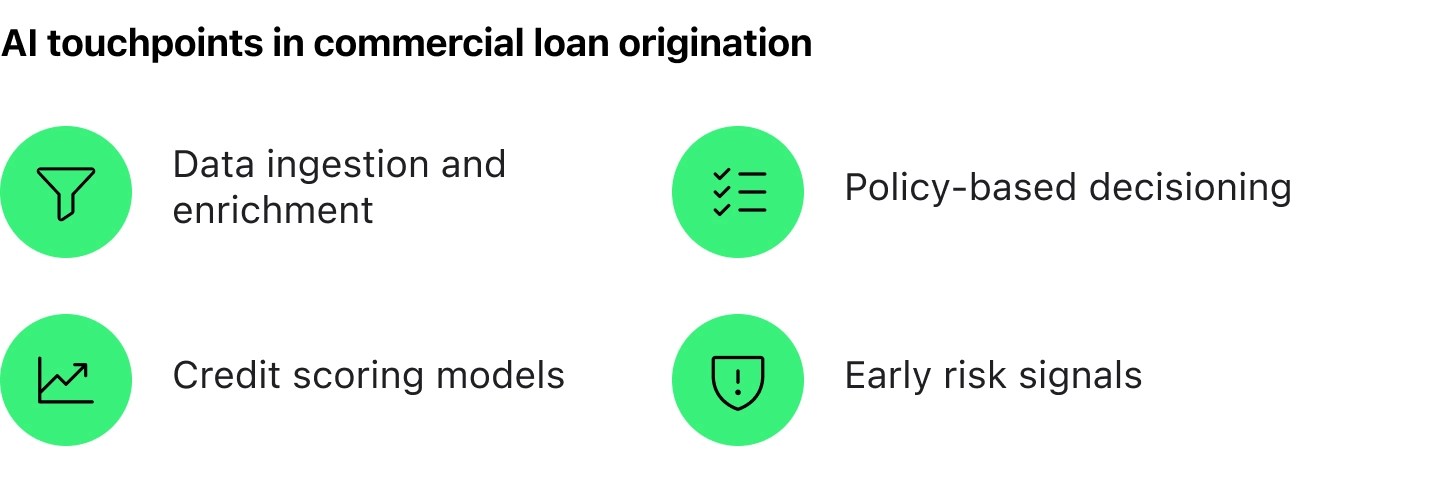

AI seems to have penetrated nearly every industry, with finance and lending operations such as loan management and origination being no exception.

In fact, the integration of AI and machine learning is regarded as one of the key drivers behind the accelerated adoption of commercial loan origination systems.

Besides, 85% of banks globally now use AI to automate parts of their lending processes, from initial data gathering to credit scoring and underwriting.

And as this level of adoption becomes increasingly mainstream, Accenture notes that one of the defining trends shaping commercial banking in 2025 and beyond is banks’ growing investment in generative AI initiatives that are specifically aimed at further improving loan origination and underwriting.

What Does a Commercial Loan Origination System Bring to Businesses?

A commercial loan origination system can help businesses savor numerous strategic and operational advantages

Below, we will look into the core advantages that explain why investing in a well-structured origination process is a smart and practical decision.

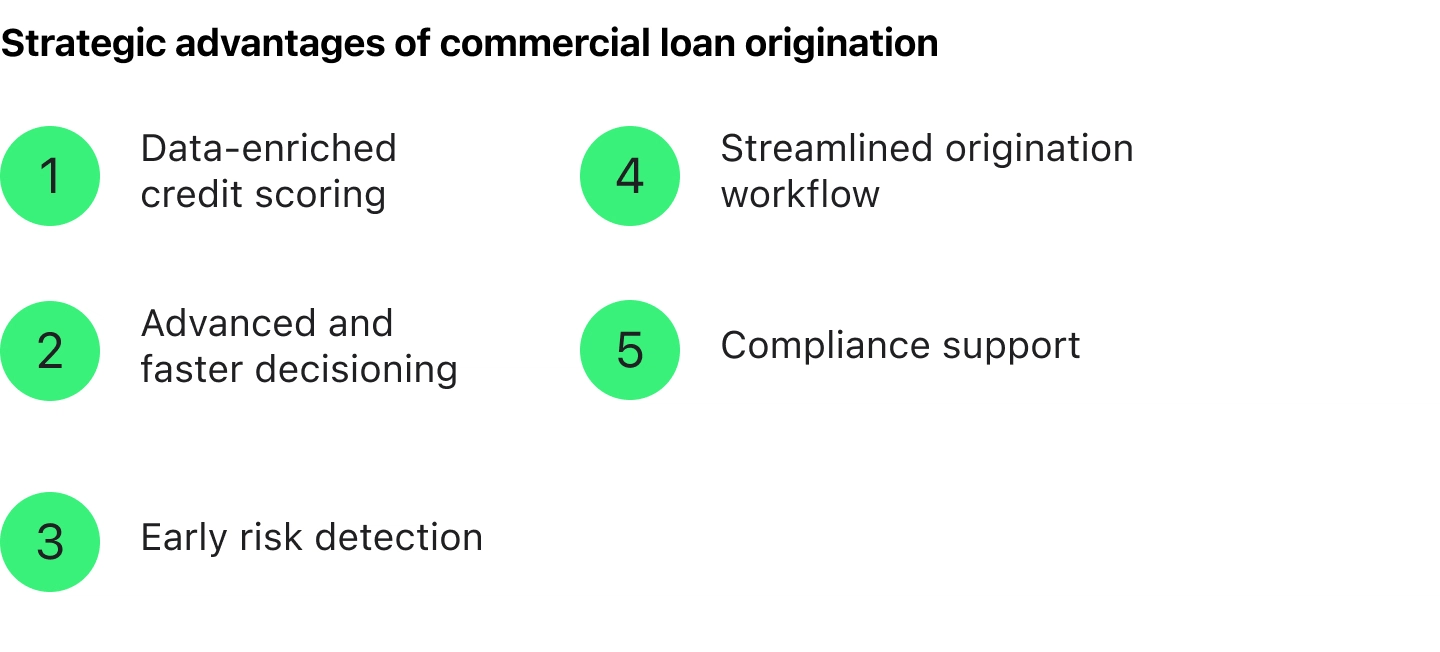

1. Data-Enriched Scoring

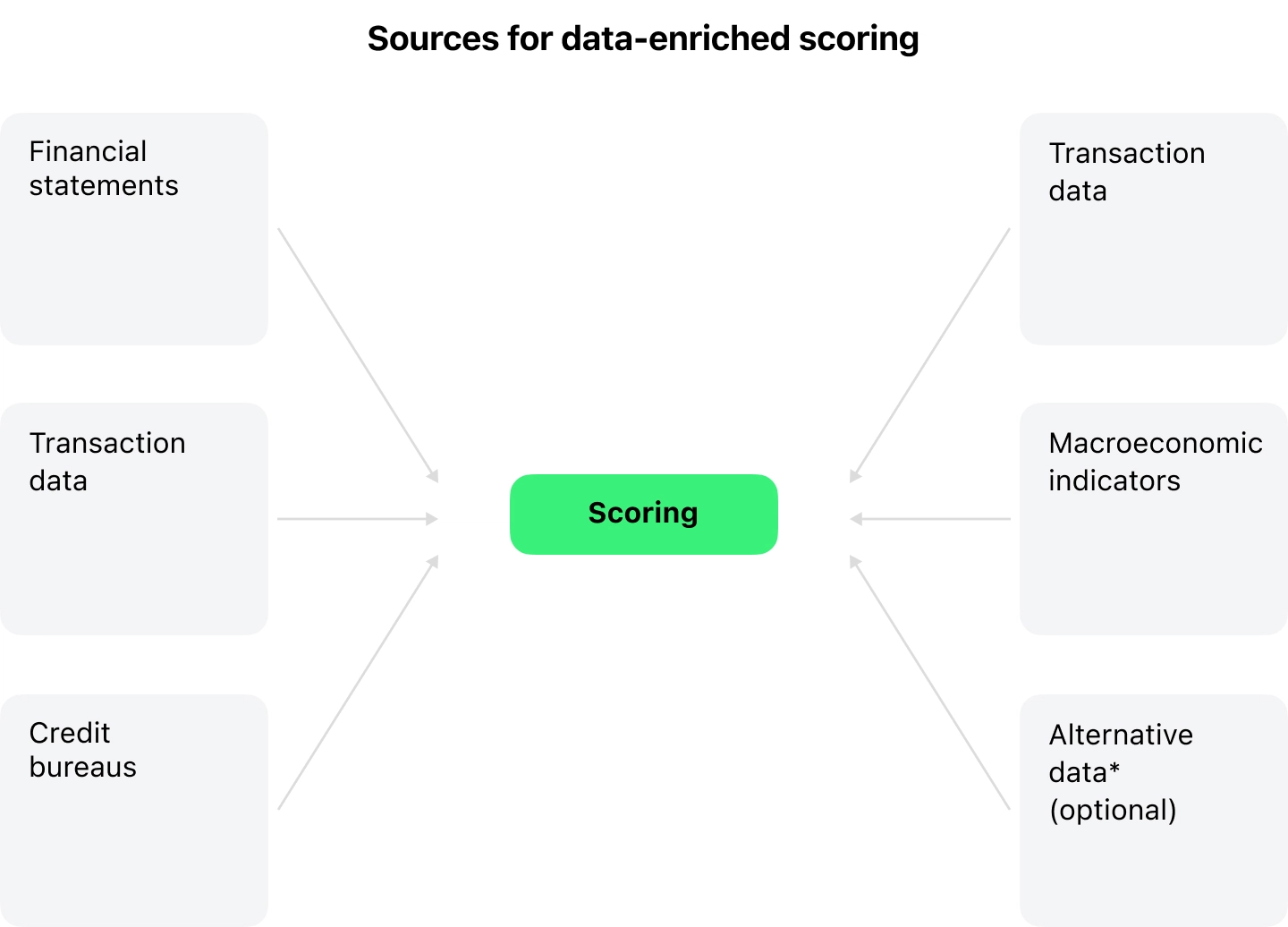

Modern commercial loan origination systems leverage data-enriched scoring to evaluate borrowers with greater precision and context. They are able to analyze a broad spectrum of data sources, including but not limited to financial ratios, historical repayment behavior, transaction data, industry benchmarks, and relevant macroeconomic indicators. Besides, where appropriate and permitted, alternative data sources may also be included to enrich risk assessment.

Thanks to this capability, lenders gain a much more comprehensive understanding of a borrower’s creditworthiness, resilience, and risk drivers, as well as stand to enjoy more accurate risk segmentation, better pricing alignment, and fewer blind spots at the point of origination.

Research shows that scoring models powered by AI can shorten decision times, improve predictive accuracy, and reduce default rates by up to 15%, particularly in portfolios with complex or heterogeneous borrower profiles.

Crucially, AI-driven credit scoring platforms extend these capabilities by allowing lenders to build custom scoring models based on their own historical credit data. They’re capable of analyzing past credit-granting decisions and repayment outcomes, and help create scoring models that reflect institution-specific risk policies, industry focus, and underwriting logic.

2. Advanced and Faster Decision-Making

Decisioning is often where commercial origination slows down, not because risk is unclear, but because processes are fragmented.

The advanced decisioning capabilities of a business loan origination system such as policy-based decision rules, risk thresholds, model-driven recommendations, and structured escalation paths for exceptions allow financial institutions to automate, speed up, and standardize credit decisions and gain greater control and transparency.

When decisions are made faster, teams face less friction, can act quickly on high-quality borrowers, and stay on top of the workload. At the same time, more consistent and structured decision-making supports better portfolio steering. With it, businesses are able to adjust approval strategies in line with their risk appetite, capital constraints, or sector exposure, without having to redesign processes each time conditions change.

3. Early Risk Detection

A robust commercial loan origination system supports early risk detection. It assists in identifying warning signals during and immediately after onboarding through integration with servicing and monitoring systems. These signals may include deteriorating cash flow trends, inconsistencies in submitted data, early covenant stress, or behavioral anomalies revealed through transaction analysis.

When risks are spotted as early as possible, lenders are able to intervene and execute some proactive measures such as tightening monitoring, revisiting exposure limits, or adjusting loan structures where permitted.

4. Streamlined Application Workflow and Underwriting

Commercial loan origination helps significantly simplify and speed up application intake and underwriting by automating document management and collection, validation, and workflow orchestration. Besides, integrated workflows reduce manual work, eliminate data duplication, and ensure that all required information is captured and verified upfront.

But the benefits don’t end here. In fact, optimized underwriting processes translate into shorter approval cycles and lower operational costs. And surely, borrowers notice the difference as well since there are fewer follow-ups, clearer timelines, and faster responses. Plus, credit teams can focus on judgment-heavy work rather than administrative clean-up, which becomes increasingly important as application volumes grow.

5. Enhanced Compliance and Reporting

As you know, compliance requirements are tightly interwoven with commercial lending, and the origination stage is where many regulatory controls are first applied. These generally include procedures such as verifying borrower identity, ensuring that all the required documentation is properly collected, and confirming that credit decisions adhere to internal policies and regulatory expectations.

Loan origination systems support these procedures by embedding compliance-related controls directly into origination workflows. They ensure that all the required checks cannot be bypassed, approval paths are clearly defined, and decision logic is documented as part of the process rather than after the fact.

As well as this, most modern origination systems also support the collection and structuring of data for further reporting tied to KYC and AML requirements, internal credit governance standards, and broader regulatory frameworks such as Basel III/IV and IFRS 9, where applicable.

The Risks of Neglecting the Commercial Loan Origination

So far, we’ve covered the strategic advantages that commercial loan origination can bring.

But now, let’s consider the other side of the coin and explore the potential risks and missed opportunities that can arise when businesses neglect or underinvest in this critical stage.

| Types of risk | What it means for business |

|---|---|

| Higher default rates | Without data-enriched scoring and early risk detection at the origination stage, higher-risk borrowers are harder to identify upfront, thus increasing the likelihood of elevated losses later in the portfolio. |

| Slower decision-making | Manual reviews, fragmented data, and inconsistent workflows delay approvals, frustrate commercial borrowers, and result in missed market opportunities. |

| Operational inefficiency | Limited automation leads to duplicated work, higher processing costs, and a greater risk of human error across data entry, document handling, credit review, and the entire loan origination workflow. |

| Inconsistent credit decisions | In the absence of advanced decisioning frameworks, outcomes often vary by underwriter or team, which might reduce predictability and weaken overall portfolio quality. |

| Regulatory and compliance gaps | Manual processes and disconnected systems make it harder to consistently enforce policies, maintain audit trails, and demonstrate compliance during reviews or examinations. |

| Reduced competitiveness | Those lenders that rely on legacy origination approaches may struggle to match the speed, precision, and adaptability of competitors who are using AI-driven and automated origination systems. |

| Poor portfolio insights | Without structured analytics and early-stage risk signals, it becomes more difficult to detect emerging trends, identify concentration risks, or proactively refine lending strategies. |

Best Practices for Implementing a Successful Commercial Loan Origination Process

Below, our experts have compiled some best practices that can help businesses implement and operate an effective loan origination process and drive improvements in decision quality, risk control, and portfolio performance.

1. Clarify Your Objectives Before Adoption

It is highly advisable to define what your business expects from the origination process before initiating it. No matter if your key priority is faster decisioning, improved portfolio quality, a better borrower experience, or even all of them altogether, you need to establish clear goals and keep to them throughout the process.

2. Consider Data Quality and Integration Capabilities

A loan origination process heavily depends on access to reliable and well-structured data from internal sources such as historical lending and repayment data, as well as external inputs from financial statements, credit bureaus, and industry benchmarks.Another vital aspect to consider is how the aforementioned systems connect. Therefore, look for loan origination platforms that support API-based integrations with core banking systems, data providers, and downstream servicing or monitoring tools so as to ensure seamless and reliable data flow.

3. Preserve Flexibility for Complex or High-Value Cases

As we’ve discovered, automation is critical in the commercial loan approval process, yet not every loan fits a standard template since there are situations when complex borrower structures, large exposures, or non-standard deals do require human judgment.

The key here is balance. This implies that routine cases can move through automated paths while exceptions, for their part, need to be escalated and delegated for expert/human review.

4. Partner With an Experienced Vendor

With so many vendors on the market, choosing the best one for your business might be challenging. For this reason, make sure to carefully analyze each one and what they have to offer. Ideally, a good commercial loan origination system vendor should provide strong configurability, integration flexibility, and ongoing product development.

Plus, the platform needs to be scalable. For example, HES LoanBox uses a modular architecture that allows businesses to add new features and adjust workflows over time. This means that the system can handle increasing loan volumes, support new products, and evolve alongside your business goals, all while ensuring that your origination process remains efficient, flexible, and future-ready as your operations grow and evolve.

5. Measure Performance and Continuously Refine the Process

We know that it sounds a bit primitive, yet it pays to constantly execute an ongoing review of your commercial loan origination system.

With regard to this, try to regularly review key metrics such as decision turnaround time, approval consistency, portfolio performance, and operational cost as this provides the feedback that you may need to refine workflows and recalibrate models.

Conclusion

A well-designed commercial loan origination process plays a decisive role in shaping portfolio quality, risk outcomes, and operational efficiency.

Implementing such a process successfully requires having clear strategic goals, reliable data integration, and the right long-term technology partner.