With the best credit decision engines, lenders are able to handle high-volume applications with far greater accuracy, without relying on outdated manual review processes.

In fact, the popularity of specialized credit decisioning software has been on the rise, with the global market expected to reach $24.6 billion by 2033. This growth, as the report points out, can be attributed to factors such as the increasing demand for automation, enhanced risk assessment, and regulatory compliance.

In this article, we’ll outline the 8 best credit decisioning software vendors to watch in 2026 and highlight what makes each platform stand out.

What Is Credit Decisioning Software?

A credit decisioning system is a specialized platform that assists lenders in automating and optimizing the credit approval process.

The solution relies on advanced algorithms and analytics and brings together different data points in order to help lenders make better informed and timely credit decisions and establish a comprehensive picture of a potential borrower’s creditworthiness.

This way, lenders benefit from more consistent and efficient credit-related workflows, and borrowers enjoy quicker lending decisions.

An important aspect to highlight is that generative AI is expected to play a very active role in modern credit risk assessment.

So, according to Deloitte’s insights, GenAI is poised to introduce new capabilities across the credit risk evaluation process, including analyzing documents in context, interpreting complex policies, automatically extracting key information, and generating early drafts of credit memos.

McKinsey also highlights that GenAI tools can take over much of the legwork in the credit decisioning process. They can prepare outreach messages to request missing information from customers, compile and organize borrower data, run preliminary credit analyses, and draft sections of credit memos before an officer steps in.

More advanced agent-style GenAI systems can independently pull data from different sources, calculate ratios, compare them to relevant benchmarks, and produce concise summaries for review.

Who Uses Credit Decisioning Software

Credit decisioning software is used across the entire lending ecosystem — from traditional financial institutions to digital-first fintechs. Each segment uses it for different goals, risk profiles, and customer journeys, but the core purpose is the same: making faster, more accurate, and more transparent lending decisions.

| Lender | What they offer | Key needs from credit decisioning software |

|---|---|---|

| Banks | A wide range of retail and commercial loans | Strong compliance, integrations with core banking, high explainability, enterprise-grade security |

| Credit unions | Community-focused lending with member-first approach | Cost-effective solutions, flexible rules, easy manual review options, simple workflows |

| Fintechs | Digital-first loans with automated onboarding | API-first architecture, rapid decisioning, ML/AI support, alternative data ingestion |

| Micro-lenders | Small, short-term personal loans | Quick evaluation, low-cost processing, automated workflows, fraud detection |

| BNPL providers | Instant point-of-sale credits | Real-time decisions (<1 sec), behavioral and transactional data, high scalability, automated risk models |

| Mortgage lenders | Long-term, high-value loans | Document intelligence, deep verification tools, complex scoring rules, strong compliance audit trails |

| SME / business lenders | Loans for small and medium enterprises | Multi-source financial analysis, cash-flow-based scoring, custom underwriting rules, automation for faster turnaround |

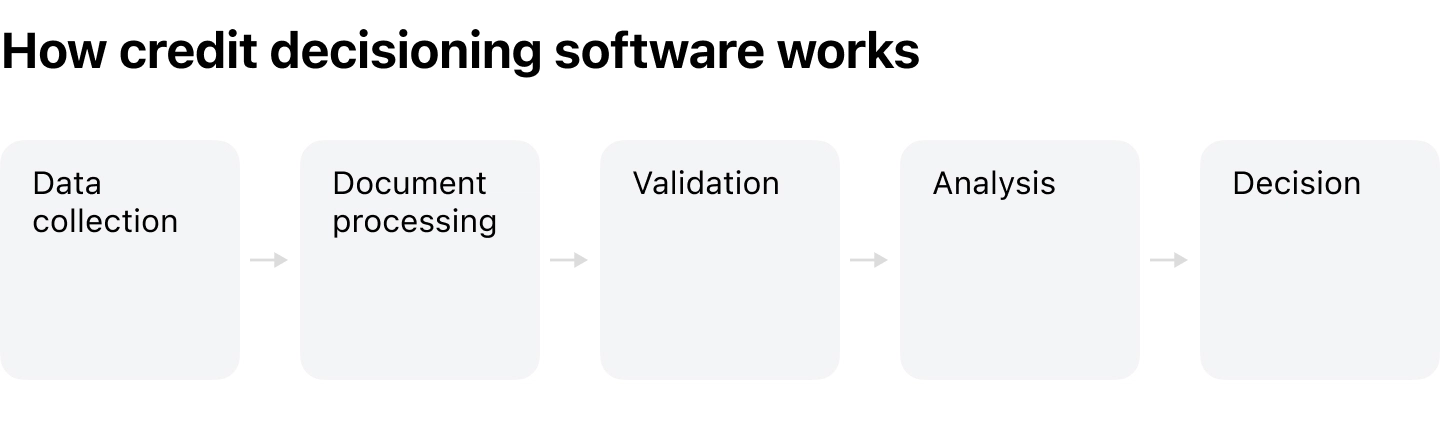

How Does the Best Credit Decisioning Software Work?

Although credit decision tools may work in different ways, the core working principles usually look like this:

1. Document collection. A credit decisioning platform gathers information from diverse data sources such as credit bureau data, financial statements, bank transaction histories (often through open banking), and any other documents that the borrower submits directly. Noteworthy is that this data is pulled automatically from external data sources and bureaus through API integrations.

2. Document processing. Once the files are collected, the software employs OCR tools, intelligent document processing, and ML-based classification models so as to convert different file formats into a clean structure and organize everything into consistent digital records.

3. Data validation. During this stage, credit decision software verifies the completeness and consistency of the submitted information, checks it against internal policy rules (for example, required minimum income, maximum debt-to-income ratio, or acceptable document types), and ensures compliance with regulatory constraints such as KYC and AML requirements. Then, if it spots any missing data, inconsistencies, or policy violations, it flags them before the credit application moves further.

4. Creditworthiness assessment. Next, it evaluates the borrower’s creditworthiness, considering ratios like debt-to-income, cash-flow stability, repayment history, credit scores, and your own custom risk rules. Importantly, to better manage risk as well as identify patterns that traditional scoring might miss, many platforms apply machine learning models, behavioral scoring, or predictive analytics.

5. Decision generation. After analysis, credit risk decisioning software compiles all results and generates a recommended decision such as approve, decline, or send for manual review. Some tools also produce draft credit memos or summaries so that credit officers can quickly understand the reasoning behind each outcome.

Best Credit Decisioning Software to Look out for in 2026

While there are lots of the best credit decisioning software for banks available on the market, we’ve researched and selected the eight most notable options worth considering.

Let’s take a closer look at their key features and capabilities.

1. HES FinTech

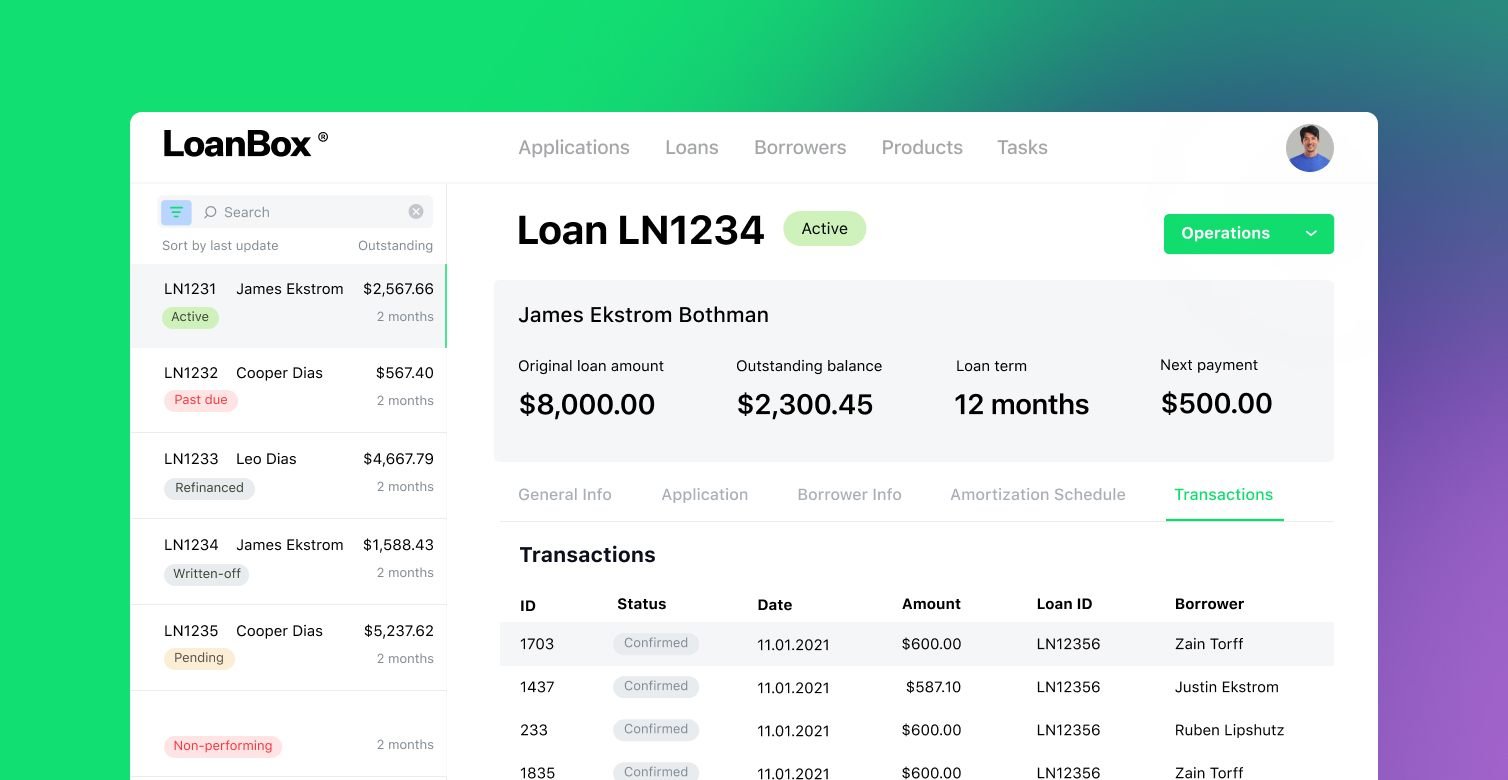

HES FinTech delivers LoanBox, a sophisticated lending platform that makes it possible to shorten the credit decisioning process from hours to minutes.

The platform supports rule-based decision-making and connects with multiple credit bureaus, which makes each decision more grounded and data-driven. Plus, depending on what matches their internal setup and overall business goals, the solution provides lenders with the opportunity to choose whether they want manual, semi-manual, or fully automated decision flows.

A major strength of this top credit decision software is the high level of flexibility and customizability of its solution. Lenders can choose to embrace the platform as a full end-to-end lending system or integrate only the modules they need, depending on their workflow, regulatory environment, or lending model. Also, the AI-powered credit decision engine can be included to enhance scoring and risk modeling, but it’s optional, meaning you are free to stick to fully rule-based or hybrid setups if you prefer. Importantly, these scoring models can be customized to your specific risk approach, business rules, and product requirements.

The platform also allows for flexible loan products and approval workflows. It can perfectly handle both fast automated applications and more complex cases that require manual or semi-manual review.

What’s more, its built-in compliance automation feature guarantees adherence to security standards, audit requirements, and financial regulations throughout the process.

Key features:

- AI/ML-based scoring with customizable risk models

- Choice of manual, semi-automated, or fully automated workflows

- Integrations with multiple credit bureaus for richer data

- Rule-based decision engine for consistent credit evaluations

- Configurable loan products and segment-specific approval paths

- Flexible setup for rapid automated checks or detailed manual reviews

- High modularity and customizability

2. ACTICO

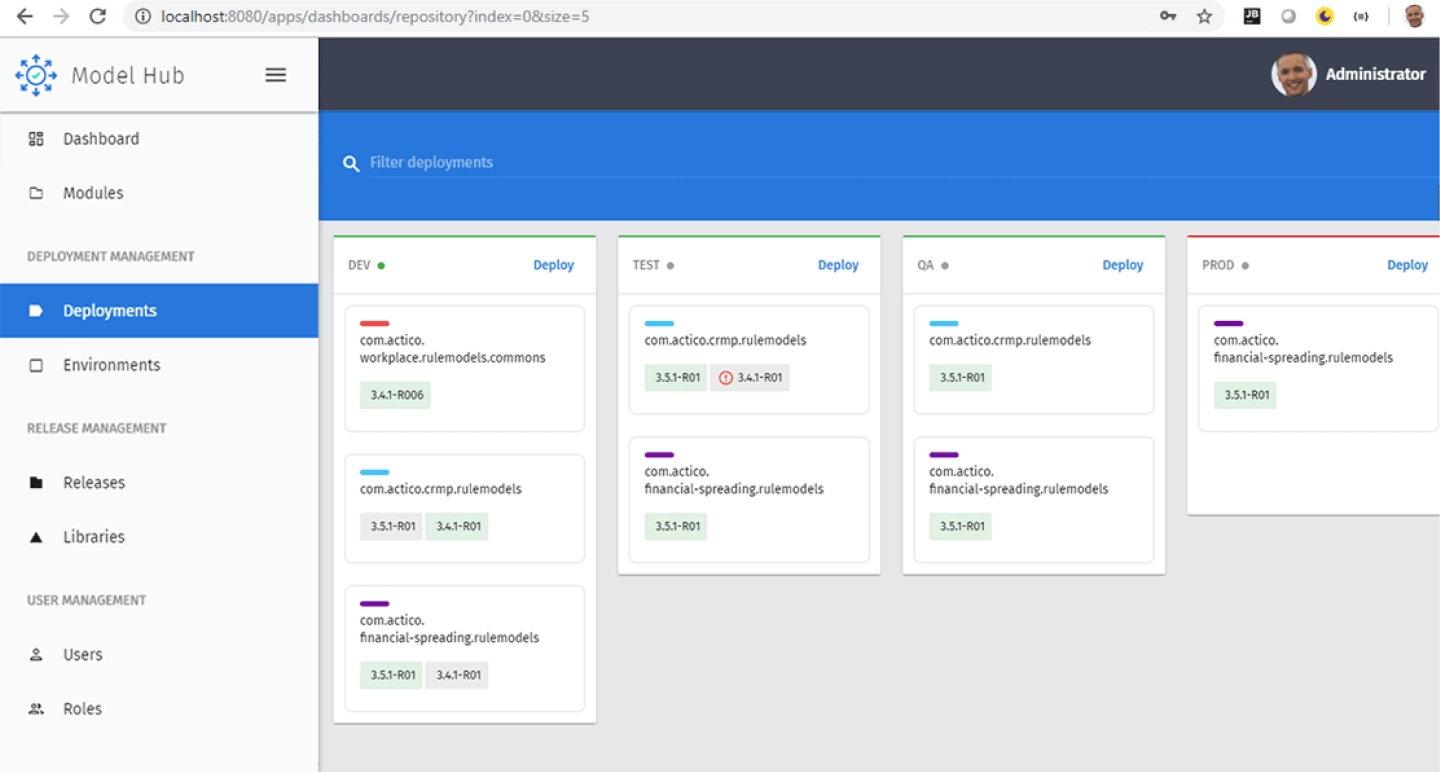

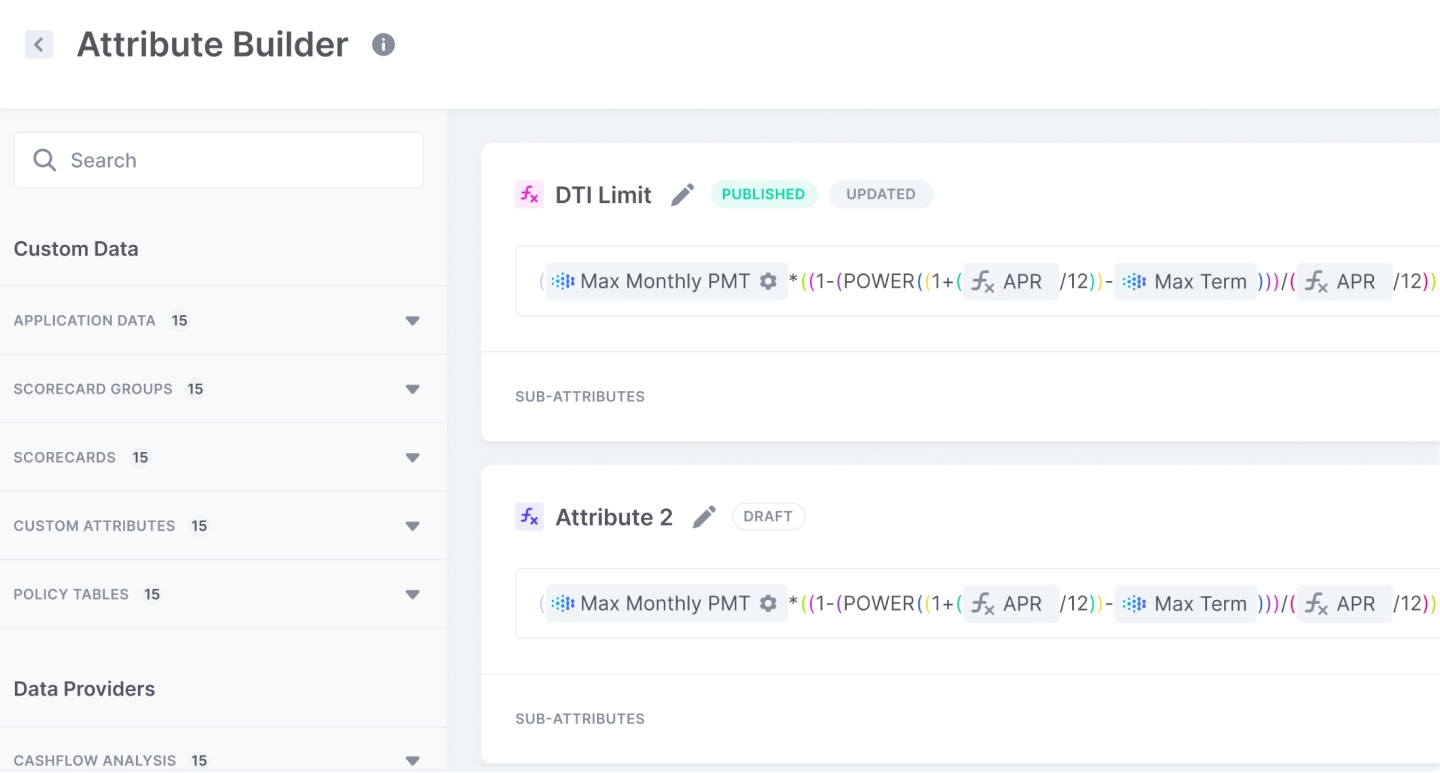

Built on a graphical decision automation engine, the credit decision platform by ACTICO enables banks to design, test, simulate, and optimize their internal decision services such as risk scoring, pricing, and even complete credit decisioning strategies. The platform can be integrated into existing origination workflows and can execute bank-internal decision logic in real time.

One of ACTICO’s key strengths is the fully graphical drag-and-drop editor, which makes it easier for business and risk teams to create, implement, and adjust decision models without relying heavily on developers. Plus, all models are stored in a centralized Git-based repository, so version control and collaboration stay organized and transparent.

ACTICO also supports the management and integration of existing models built in Python, Java, R, SAS, or H2O, which gives lenders the freedom to keep using the tools they already rely on.

Moreover, the platform can simulate and refine risk models and decision strategies, helping teams understand potential outcomes before promoting changes into production.

Key features:

- Visual drag-and-drop editor for building and adjusting decision logic

- Real-time execution of credit rules and strategies

- Centralized Git-based repository with full version tracking

- Simulation tools for testing and optimizing risk models

3. CloudBankin

With over 2,000 configurable data points, CloudBankin’s digital lending platform includes a credit decision engine that lets lenders tailor their underwriting logic precisely to their own risk guidelines. Decisions can either be fully automated through straight-through processing or routed to underwriters for manual review when needed.

The system also includes a scoring module that creates custom scorecards based on your criteria. For instance, assigning a score of 10 if a borrower’s credit score is above 600, and 12 if it’s above 650. Beyond that, the rule engine can interpret 100+ parameters such as age, income, and credit history to generate decision outcomes and recommend terms, including interest rate tiers.

One of the platform’s most outstanding features is the calculation script module, which allows you to define non-standard financial ratios like debt-to-income without the need to go into traditional software development coding.

On top of that, CloudBankin is highly configurable, which means that lenders can add, tweak, or remove data points and rules to keep their credit decisioning process agile and precise.

Key features:

- Automated straight-through processing + optional underwriter review

- Built-in scorecard creation using custom scoring rules

- Scripted calculation support (e.g., debt-to-income, financial ratios)

- Support for over 2,000 configurable data points

4. Lendflow

Lendflow’s credit engine enables lenders to deliver fast and smart credit decisions by giving them access to a broad set of financial, business, and fraud-related data through a single API. This includes accounting and payroll data, business credit scores, social scoring, personal credit information, and even bankruptcies, judgment liens, and UCC filings. And if/when more information is needed, the platform can automatically pull additional real-time data from multiple sources through conditional triggers.

Apart from this, Lendflow provides lenders with the freedom to build their own proprietary credit scoring models directly inside the platform. An important aspect to highlight is that these models can be customized in accordance with businesses’ specific risk appetites, which allows teams to fine-tune the way they interpret each applicant’s profile. For teams seeking a quicker setup, though, Lendflow offers pre-built scoring templates that assign weight to each data point and generate applicant rankings in seconds.

What’s more, each component of the Lendflow platform such as credit decisioning or borrower onboarding is fully embeddable, which means that you’re free to use individual features as needed or scale them as your platform grows.

Key features:

- Unified API combining banking, business credit, and fraud data

- Custom underwriting workflows with conditional data triggers

- Ability to build proprietary scoring models or use ready-made templates

- Fast applicant ranking powered by flexible scoring logic

- Fully embeddable components for credit decisioning and onboarding

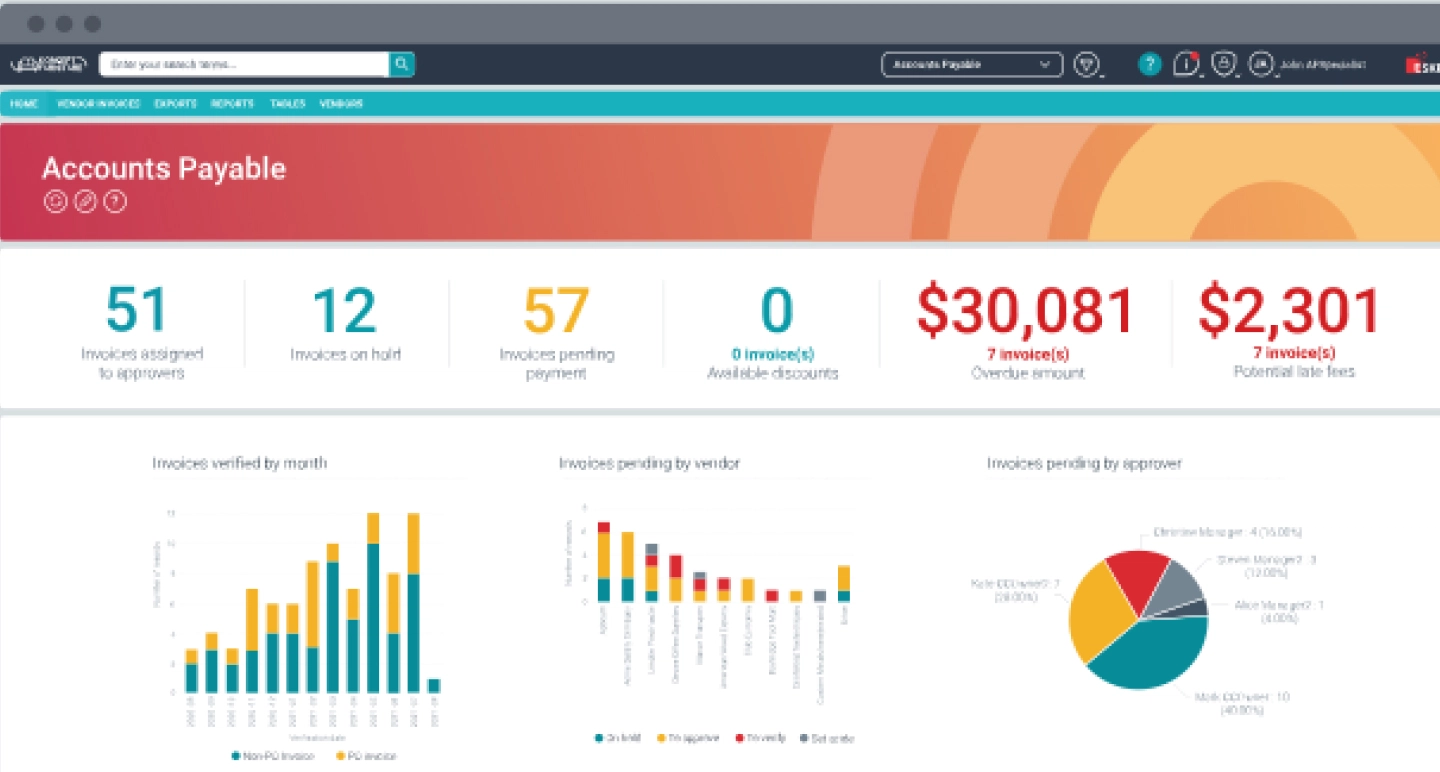

5. Esker

Rather than functioning as a full loan underwriting engine, the Esker credit management platform minimizes non-payment risk within ongoing commercial relationships. It’s primarily focused on accounts receivable, credit limit management, order blocking, and cash-flow risk, delivering a comprehensive credit assessment layer that helps companies evaluate customer payment reliability before extending credit terms.

Using a customizable scoring model that combines internal data with external risk indicators like credit bureau reports, Esker enables credit managers to calculate risk consistently and automatically. In addition to this, its Synergy AI layer suggests optimized credit terms based on historical payment behavior and real-time customer signals, which helps financial teams fine-tune decisions without extra manual work.

Beyond one-off credit decisions, Esker also supports ongoing portfolio monitoring. Thanks to this, teams are able to track shifts in customer health, set real-time alerts, and proactively adjust credit exposure as situations evolve.

Collaboration tools are built in, too. With them, credit teams can loop in sales, finance, or collections colleagues, share context, and gather input through a unified workspace.

Key features:

- Customizable workflows for routine or low-risk credit decisions

- Synergy AI recommendations for optimized credit terms

- Centralized dashboard with complete customer risk profiles

- Built-in collaboration tools for sales, finance, and collections teams

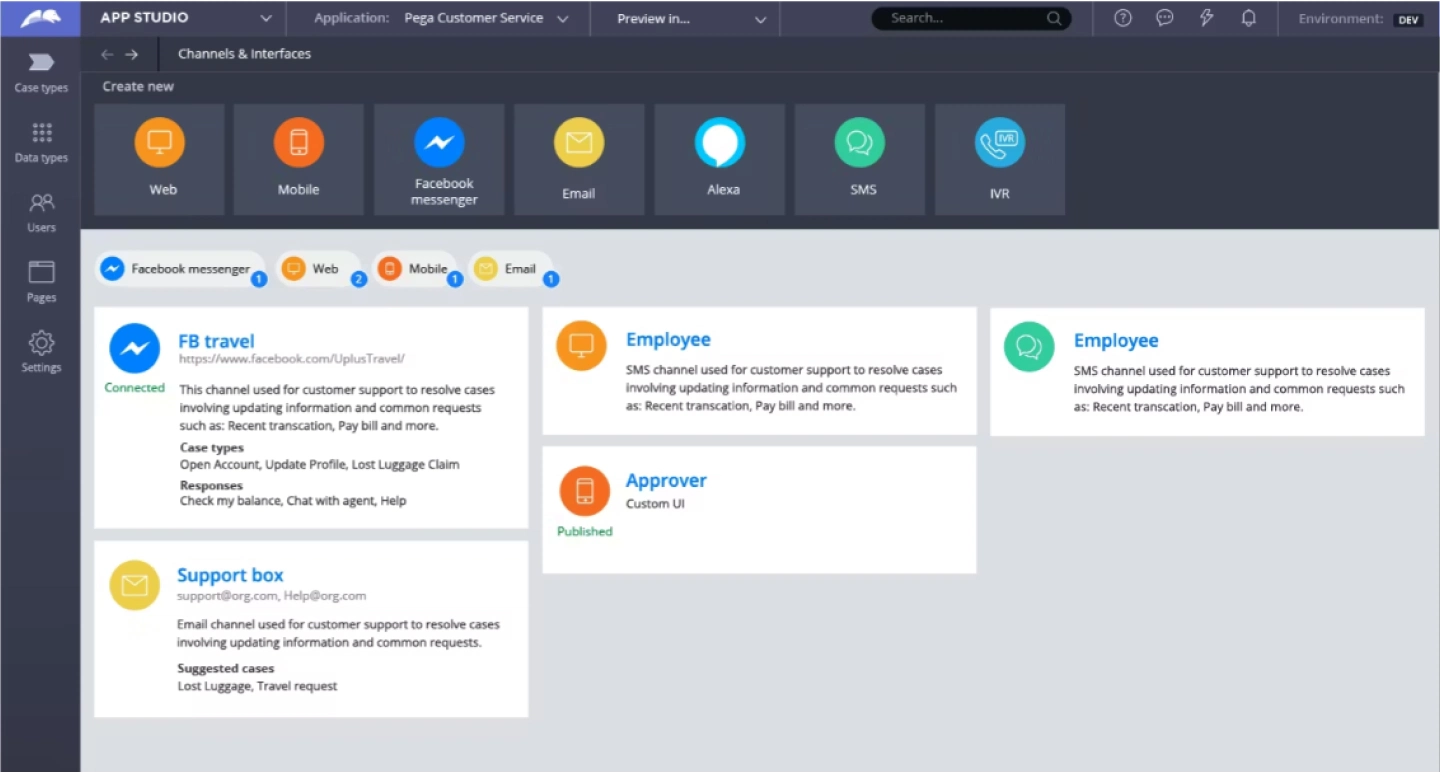

6. Pega Credit Risk Decisioning

Pega’s credit risk decisioning feature delivers context-aware decisions, accelerates time to value, as well as integrates dynamic case management.

At the core of the solution lies the Pega Customer Decision Hub that acts as the platform’s central intelligence layer. Powered by AI and real-time insights, it evaluates each credit situation in context and recommends the next best action.

What’s more, all audit trails, version control, and governance can be handled right within the platform, which gives companies greater oversight and, consequently, allows them to gain extra confidence when performing credit risk operations. Besides, Pega comes with strong compliance and security capabilities. The platform also supports major privacy and data protection requirements, including GDPR, the California Consumer Privacy Act / California Privacy Rights Act, FDA regulations, and the Data Privacy Framework through built-in security controls, governance tools, and policy automation.

Another prominent feature of Pega is that it promotes consistency across every interaction. It keeps the customer at the center by delivering a unified contextual experience across all channels for both customers and employees.

And because Pega connects credit risk functions with marketing, sales, and service teams, organizations are able to collaborate more effectively and keep credit decisions in sync with overall business goals.

Key features:

- Real-time credit risk decisioning powered by a centralized AI-powered hub

- Unified data, workflows, and decision logic across business functions

- Unified decision logic across all customer and employee channels

- Dynamic case management for more efficient processes

- Built-in audit trails, governance, and version management

7. RiskSeal

With RiskSeal, businesses are able to tap into more than 400 alternative data signals per applicant. The credit decision platform analyzes a borrower’s email, phone number, IP address, full name, location, and photos, and evaluates their digital footprint across more than 200 online platforms. All of this comes together in a single API call, delivering a detailed client profile, a ready-to-use digital credit score, and actionable insights in one place.

The credit decision platform makes use of digital footprint data and AI-driven analytics to deliver precise identity verification and solvency assessments. Plus, it also explains each applicant’s score so that lenders can better understand how credit decisions are made. Importantly, all processed data is then returned to the lender to guarantee full control and transparency over the inputs used in credit decisions.

Apart from standard credit risk scoring, RiskSeal allows teams to build custom features for their scoring models so as to boost predictive power and decision accuracy.

Chiefly, the RiskSeal platform is designed with strict adherence to privacy regulations and ensures full compliance with GDPR and the California Consumer Privacy Act.

Key features:

- AI-powered identity verification and solvency checks

- Customizable scoring features for maximum predictive power

- Financial discipline evaluation via subscription data

- Identity verification through multiple names, photos, and email/phone number links

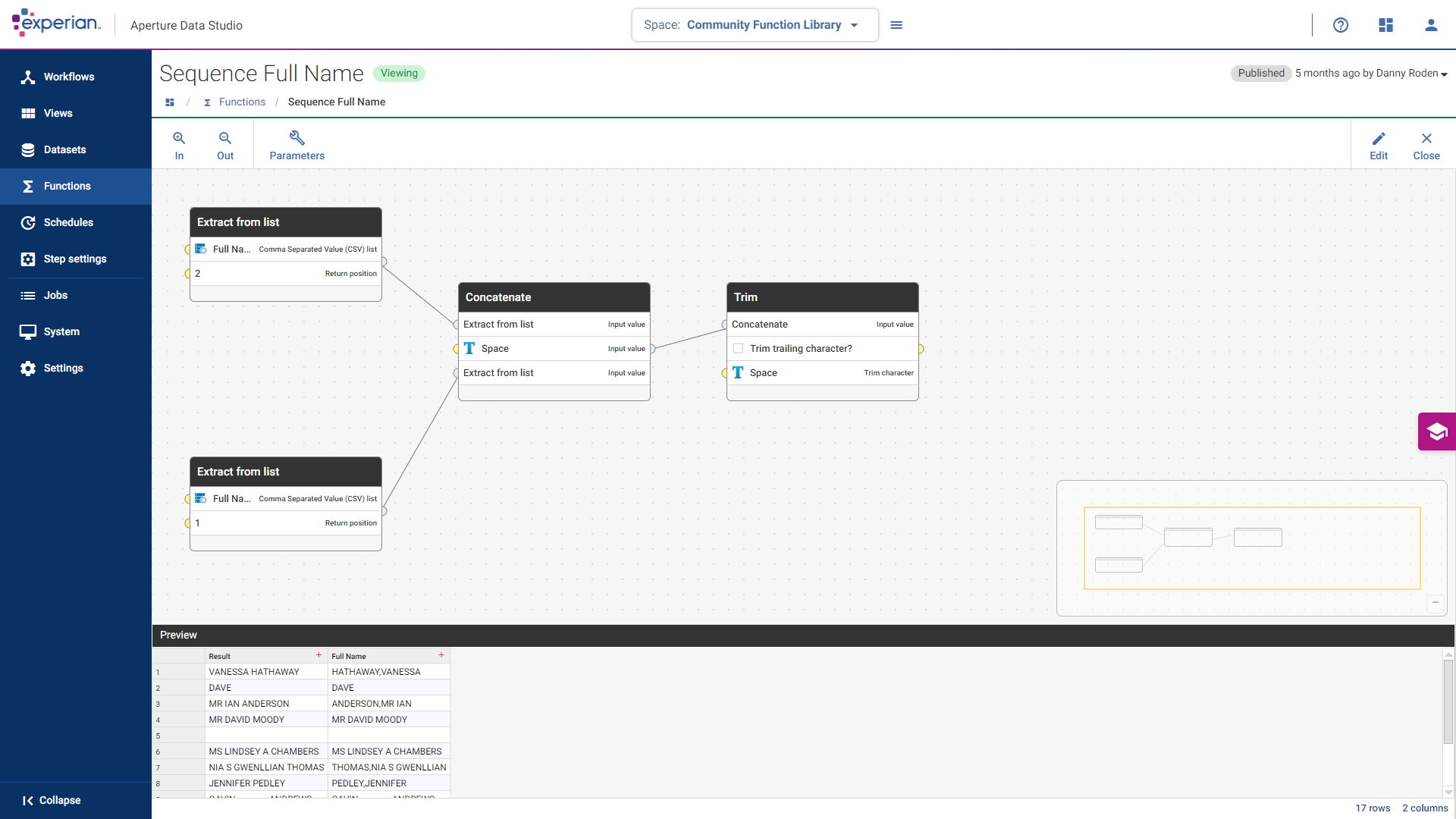

8. Experian

Experian’s credit decisioning engine enables lenders to combine machine learning with Experian’s proprietary and partner data to produce an optimized credit decision. Its flexible orchestration and built-in advanced analytics let lenders run thorough risk assessments, apply targeted verifications, and tweak decision flows in real time.

Importantly, the platform provides a 360-degree view of both consumer and business accounts, which allows lenders to identify tricky or high-risk debtors, spot trends and patterns, and uncover predictive insights that guide smarter decisions. By pulling together a wide range of data sources, including consumer and commercial credit information, contact data, and analytical services, lenders manage to establish the full picture of borrowers’ creditworthiness, make more informed credit decisions, and optimize their overall profitability.

As well as this, Experian supports proactive risk management and enables lenders to catch inconsistencies early, prevent potential fraud, and step in confidently before small problems turn into bigger ones.

Key features:

- Full view of consumer and business accounts

- ML-powered decisions enriched by proprietary and partner data sources

- Proactive risk controls that surface inconsistencies earlier

- Decisioning workflows optimized for speed, accuracy, and consistency

Main Benefits of Credit Decisioning Software

| Benefit | How it works |

|---|---|

| Faster credit decisions | Automated workflows allow lenders to reduce decision times from hours to minutes and approve credit applications faster |

| Reduced manual workload and fewer errors | Streamlined processing minimizes manual effort and reduces common mistakes related to data entry, document verification, and policy compliance |

| Better-quality credit assessments | Models leverage data from multiple sources, including credit bureaus, open banking, and alternative data (e.g., utility bills, rental payments, and social scoring), which enables teams to build more accurate borrower profiles and improve risk assessment |

| Stronger compliance and auditability | Detailed logs ensure decisions remain transparent, fair, and easy to review |

| Higher customer satisfaction | Faster responses create smoother borrower experiences, which translates into stronger loyalty |

| Stronger portfolio security | Built-in fraud checks identify risks before they impact lending operations |

The best credit decisioning software brings several big advantages for businesses.

Let’s take a look at the most significant ones.

1. Faster credit decisions

Given that the loan decision software automates the data collection, validation, and initial analysis processes without requiring substantial involvement of the staff members, lenders can move through applications much faster and, therefore, generate lending decisions much quicker.

2. Reduced manual workload and lower risk of errors

With the best credit decisioning software, manual data entry is reduced to the barest minimum.

A large portion of the repetitive work such as sorting documents, checking for missing details, calculating ratios, and pulling bureau data gets handled by the platform, which frees up underwriters to zero in on the more nuanced and higher-risk cases.

Plus, this also cuts down on human errors and overlooked details.

3. Better-quality credit assessments

With access to richer datasets, open banking transactions, and historical trends, lenders can establish a more comprehensive picture of a borrower’s financial behavior alongside their overall creditworthiness profile.

4. Stronger compliance and auditability

In the best credit decisioning software, every step of the decisioning process is logged and can be easily traced, which is crucial for regulatory checks.

Modern credit decision software assists lenders with demonstrating fairness, transparency, and non-discrimination under regulations such as the European Union Artificial Intelligence Act (EU AI Act) or the U.S. Equal Credit Opportunity Act (ECOA), Regulation B, by providing a transparent record of what influenced each credit decision.

Another important aspect is the explainability of AI/ML models, which lets lenders show both regulators and applicants how automated scoring works, providing clear reasoning for approvals or declines.

5. Higher customer satisfaction

As far as borrowers are concerned, they benefit from quicker responses, fewer back-and-forth requests, and a generally more satisfying user experience.

For businesses, higher customer satisfaction translates into stronger loyalty, improved conversion rates, and a more competitive offering.

6. Stronger portfolio security

Some advanced credit decisioning solutions come with robust fraud detection capabilities that can flag mismatched details, unusual transaction patterns, or documents that don’t match the known data sources.

Thanks to this, lenders can step in early, prevent fraudulent cases from advancing through the pipeline, protect portfolios, and preserve the overall decision quality.

Conclusion

The best credit decisioning software delivers a range of meaningful benefits, including faster decisions, stronger compliance, deeper risk insights, and better protection against fraud. Altogether, these advantages allow lending teams to operate much more efficiently and provide borrowers with a more satisfying experience.