Banks and lenders mostly focus on transforming customer experience with digital technologies. Yet, seeking to empower the front office for banking automation, business owners miss a potentially great opportunity they have in their backyard — financial back office automation software with a loan CRM module.

In this article, we decided to explain how to drive automation in banking by transforming digital back office. You’ll find three fundamental approaches significant for digital transformation back office. Also, we prove the importance of business loan CRM for a successful digital company and reveal advantage CRM for back office management.

Statistically, 41% of lenders are mainly focused on front-end changes concerned with delivering personal attention to customers, moving towards omnichannel experience, automating marketing, and finding new ways to connect and expand the customer base. However, if your back-office cannot guarantee an error-free and quality lending process, you’ll never turn visitors into loyal customers.

Simple back-office optimization can lead to higher profitability of lending, but only up to 30% of lenders see it as a top priority. Following the surveys, only 30% of banks feel that their operational processes can quickly adapt to external changes. These prove that lenders overlook back-office features of their business chasing more customers and lose the market competition after all.

According to Capgemini Consulting research, 60% of customer dissatisfaction source originates in the back office. Siloed data sources, disconnected CRM and ERP systems, manual paper-based processes lead not only to customer turnover but also cause high expenditures and poor ability to handle applications and personalize the customer journey. So, digital transformation is unreal without back-office optimization. It’s even slowed by the inability of lending software to handle complex operations.

Based on McKinsey insights, SME lenders and banks can reach over 50% improvement in productivity and customer services by automating back processes, including decision making, data storage, workflow, resource planning, etc. While the effort to digitalize back-end processes is not new, connection and automatization of all of them using a single solution should be a key goal for business owners.

How to Automate the Back Office Process with Loan CRM

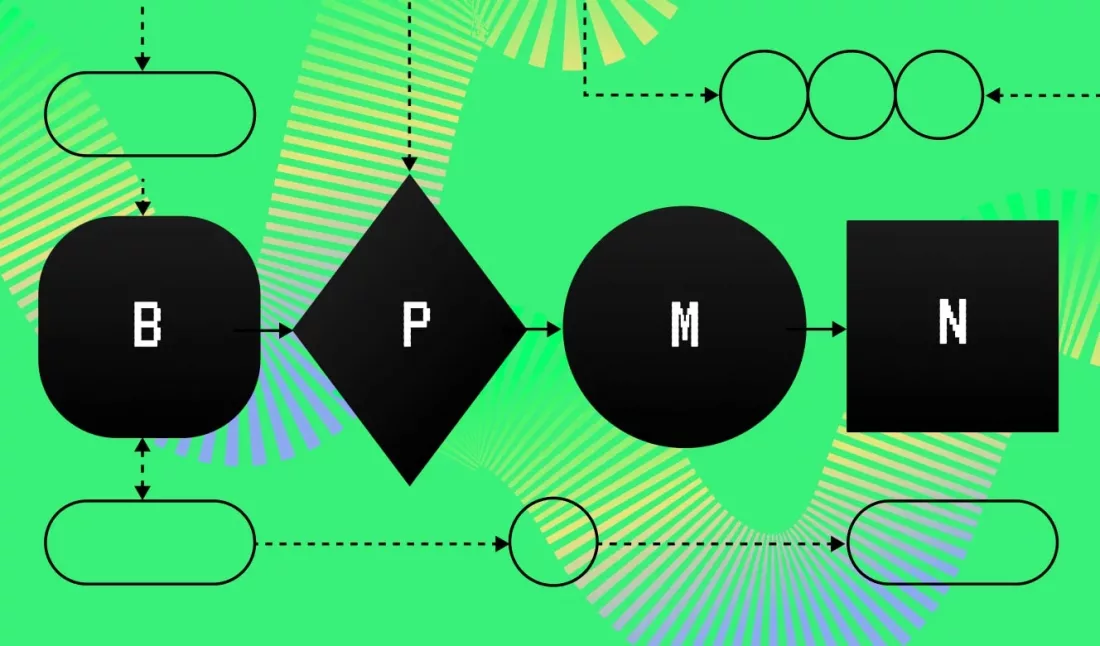

To improve lending management software and update internal banking processes, business owners need to consider the key fundamentals approach — integration, automation, and analytics are a must for effective software workflow.

- Integration allows driving unlimited functionality to your loan origination software. Instead of developing each system component from scratch, it’s easier and cost-effective to integrate your existing solution with an established product for reporting, relationship management, communication, email marketing, and others.

- Automation makes it possible to cut off manual errors and fasten all processes. Considering your business processes, it’s possible to find what tasks can be automated.

- Analytics helps identify gaps in every operation or task you perform from marketing to loan calculations. Applying statistical tools and algorithms you will reach higher results.

All three taken approaches can cut your expenditures on multiple actions as well as distribute labor costs to those tasks that cannot be automated. Let’s consider how to implement these three approaches integrating your lending platform with advanced back office systems — CRM module.

If you've ever worked with a CRM platform, you can hardly imagine business life without it. CRM or customer relationship management offers to manage everything related to customer relationships - data, statistics, loan applications, debts, metrics, and others — in one place. Above all, a CRM tool can be used across all departments to make sure that every customer-facing team works smoothly with fresh and right data. If you adore structure and organization all over, you need CRM lending solutions.

Being an effective tool for workflow organization, many businesses note a great increase in performance figures. According to FinanceOnline, a dedicated CRM solution can deliver the following ROI benefits:

- Improve customer relationships by 74%

- Increase sales quota by 65%

- Boost productivity by 50%

- Reduce labor costs by 40%

In fact, the majority of businesses that decide to adopt a CRM system are mainly looking for the opportunity to change their customer relationships from the core, e.g. better manage contact information, conduct a database with customer applications and preferences, streamline relations with customers in general.

Considering the freshest reports, contact management is a number one feature that 88% of users request, followed by track interactions, scheduling, and software’s ease-of-use in general.

Hardly each mentioned feature is essential for your business. Statistically, clients utilize around 50% of provided functionality of a box solution and the rest only complicate the workflow, slowing it down. So, it’s necessary to distinguish the most important features for your lending business since even every department in your company sees different advantages of CRM. However, there're five main must-haves for every business owner that can change back office operations for the better.

View around customer relationships

A CRM is a joint system that can be easily integrated into your lending platform to have a 360-degree view of marketing and sales activities as well as manage customer relationships in your back office bank. From clicking on google ads and requesting information on services and lending terms to communication towards debt collection, every even minor action a customer takes is recorded and analyzed in your CRM platform. Having all this data at hand, you’ll understand the behavior of your customers and create more targeted and affordable offers. As a result, all your marketing and sales approaches can be idealized when you can look at lending processes from all sides.

Customer segmentation

Using a business loan CRM solution, banking sales specialists can segment customers by any possible parameters to find out those who are more likely to accept loan offers, understand what loans they need, and check who’ll pay back with high probability.

Instead of storing data on a single desktop, a CRM system allows providing access to the necessary data to all possible employees. Each loan applicant has a detailed profile with historical data, provided personal information, requirements, preferable communication channels, and others.

Moreover, loan CRM provides automated reporting and analytics distribution. For that you have to maintain your data scheduled and free from errors, otherwise, the platform could not interpret them into reporting.

Personalized dashboards

Considering a CRM solution for several departments, the opportunity to set up individual dashboards is a great benefit for automation banking.

For example, an advertising manager mostly needs to know how successfully ad worlds, including click-through rates, visibility analytics, ROIs, impressions, and other rates of each campaign. A user can set up a dashboard to immediately display how many people, in particular, reached the ads and who turned from leads into customers.

While a sales specialist would want to know how many calls he or she made per day and which communications resulted in positive action, for example, demo or partnership.

With a personalized CRM lending dashboard, every user can have at hand the most important information without having to search for it among hundreds of menus and back office functions.

Advanced roles and user models

Similar to personalized dashboards, you can also set up functionality per department or single user. A great CRM benefit is that it allows an admin to define permissions, manage roles, assign various roles to users as well as track their activity.

There’s no defined way of setting up roles. You can assign roles vertically when some specialists might have more access and capabilities than others or horizontally when each department has its own autonomous access to appropriate functions in the back office.

Targeted marketing campaigns

Business loan CRM allows creating more personalized email campaigns both manual and automated. Instead of messaging each user, you can put them into groups based on several similarities — for example, marital status, number of children, age, location, job position - and launch drip campaigns. You can automate practically all stages of the sales funnel this way.

For example, you launch a campaign promoting a new offer — favorable lending terms for SME business. Having a database with job titles of possible customers, you can run a targeted drip campaign aimed at owners of small and mid-size companies. Moreover, you can always check who reached your message and didn’t in your CRM back office management software.

Read also

Wrapping it Up

Whether you want to find gaps in your back office banking processes or need to streamline internal workflows and banking automation, the CRM module can be a good companion on your long-lasting lending journey. Most probably you’ll find more benefits of CRM for your business model. Here the main challenge is finding not just a developer but a reliable partner who can guide you through the functionality and possible CRM customizations.

Our team always opts for delivering reliable and truly useful solutions, that’s why we remain a leader among fast-growing loan origination software companies. Our goal is to empower your business’ back office technology and not only. HES FinTech can help you gather more applications, skillfully work with clients, find and understand your mistakes and, of course, grow in revenue using a modern solution for lending.

Need a CRM module for a perfect digital back office? Contact HES to do the best for you.