Automated loan underwriting accelerates and simplifies the lending process by reducing the manual workload and speeding up the approval process while maintaining accuracy and lowering risk.

With AI adoption as a whole more than doubling within the last decade to around 50-60% of all organizations, it’s little surprise that finance organizations and lending bodies are turning en-masse to AI-powered loan underwriting systems and tools to empower their businesses and get the results they need to get the competitive edge.

How AI is Used in Fintech in 2023: Top 8 Use Cases As AI has advanced, the options available to companies seeking AI software for loan origination and underwriting have expanded at the same pace. To help you get to grips with the current market, and make smarter selections for your digital updates, we’ve created this short guide to trends, features, and requirements that we see as the most asked-for on the market today.

AI and automated loan underwriting: the stats

Before we dive into the how, let’s take a look at the numbers behind the growth of AI and how this impacts industry adoption.

- AI is evolving. Splitting from traditional AI and analytics, new industry trends have branched out into advanced AI systems. In terms of total potential annual revenue, traditional AI in fraud and debt analytics is estimated at a not-too-shabby $371.9 billion, while advanced analytics is estimated at $84.3 billion. Showing an interest in both tried-and-tested and new solutions. Meanwhile, in accounting and IT, the total potential annual revenue for advanced AI analytics is estimated at $8 billion.

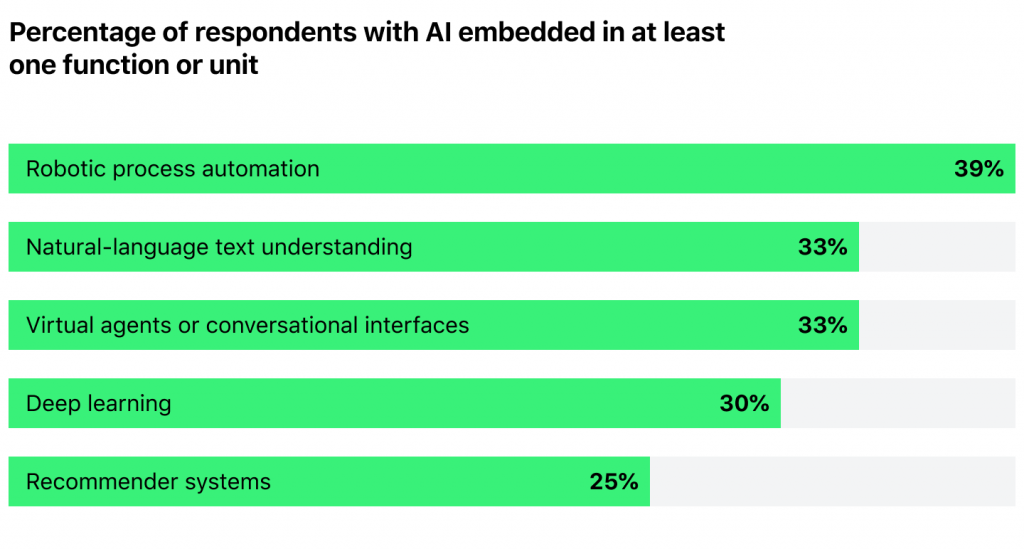

- AI capabilities are also advancing, with organizations placing robotic process automation (39%), computer vision (34%), natural language text understanding (33%), virtual agents and conversational interfaces (33%), and deep learning (30%) in the top spots for embedded industry adoption.

Company budgets for AI were also increasing in 2018, 40% of companies stated that 5% of their budget went to AI tools. In 2022, that increased to 52% or more than half of companies.

- At the same time, the cost of employing AI appears to be decreasing across a variety of sectors. Marketing, sales, product, service development, and strategy and corporate finance are seeing the biggest reductions in costs.

Meanwhile, there is a downside to be aware of. As the growth of AI tech has taken hold, risks are growing too. More and more companies are taking note of AI risk and seek to step ahead of the curve in risk management, with interest in security growing across the board.

AI market trends that could impact your automated loan underwriting system strategy

ChatGTP, AI avatars, and expansive use of AI tech across all industries—the speed at which artificial intelligence is advancing is simply incredible.

However, 55% of industry experts are doubtful. They believe it to be ‘too fast’, citing the challenges of keeping up, misunderstood and misapplied technologies as the primary reasons for this.

Credit Scoring Integration: How to Upgrade Your Loan Origination Software That said, despite the doubt, companies are still keen to see what AI has to offer, if a little cautious. Here are the top 3 AI finance trends to watch this year that could impact your automated loan underwriting strategy.

- Enhanced communication tools, such as chatbots based on AI modules or automated email systems that tailor loan communications, can be used to build deeper connections and stay connected to the client throughout the lending process. We are seeing this trend in other industries as well, with Gartner predicting that AI chatbots will be a must-have by 2027 and adopted by 25% of organizations. For automated loan underwriting, such tools can help inform the borrower of the loan process while reducing the time spent by the employee.

- Automated document management ensures the correct control of documents during the lending process. This can mean making sure all have been uploaded for loan underwriting approval to begin to make data collection simpler.

- Risk management solutions, mistakes, poor calculations, and changes, make loan underwriting manually a tricky business. AI tools can step in to bridge the gap by automating risk calculations based on a wider variety of data.

But take care…

Trying to keep up with the latest trend to hit the market is a losing strategy. Not only is the AI market moving so fast that it’s impossible to keep up, the solutions that are being released are often in their infancy and need time to mature into fully-fledged modules.

Knowing this is vital to your automated loan underwriting system’s success, as onboarding immature products can prove critical to your system’s effectiveness and security. With this in mind which tools should you really look out for.

Key features and modules of loan underwriting software to consider

How to Choose the Top Loan Origination System for Your Business AI is packed with potential for automated underwriting systems, but knowing which tools to use and how to embed them the right way can be the difference between success and failure. Here are our top suggestions for your next upgrade.

Efficiency and accuracy in loan evaluation

Manual loan evaluation has been in practice for a long time. It’s a tried and trusted practice, that even with digital integration still requires human involvement. This has two primary minuses. One, that it limits the number of applications that can be processed, and two, it’s open to human error.

New automated loan underwriting solutions, based on AI technology, utilize advanced algorithms and machine learning capabilities to analyze applications on a whole new level. When integrated correctly and given the right data, they can analyze borrower information, credit history, financial data, and other relevant factors with ease to deliver a more well-rounded overview of the borrower and their creditworthiness.

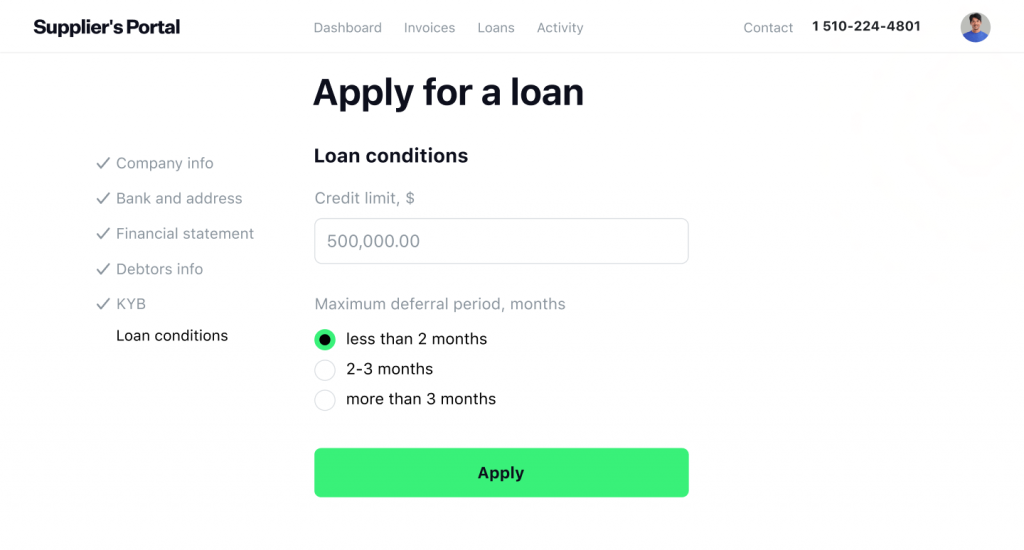

Client onboarding module

68% of fintech app users abandon the process during onboarding. This indicates there is a problem. Although there are many reasons that this could be—ease-of-use, lack of interest, challenges with documents—one area where artificial intelligence can help is by taking a more complex approach to the document and onboarding process, simplifying it for both users and lenders. But what does this mean in practice?

How Banks & Finance Companies Can Digitally Transform Loan Origination Process Adopting AI loan underwriting software modules can help seamlessly integrate various data sources, such as ID information, credit history, employment, and more to create a more comprehensive overview of the borrower’s financial potential and their ability to repay a loan. This can be utilized whether the borrower is an institution seeking funding to grow their business or an individual looking to purchase a vehicle, its flexibility, when employed correctly, can prove a very powerful asset to the lender.

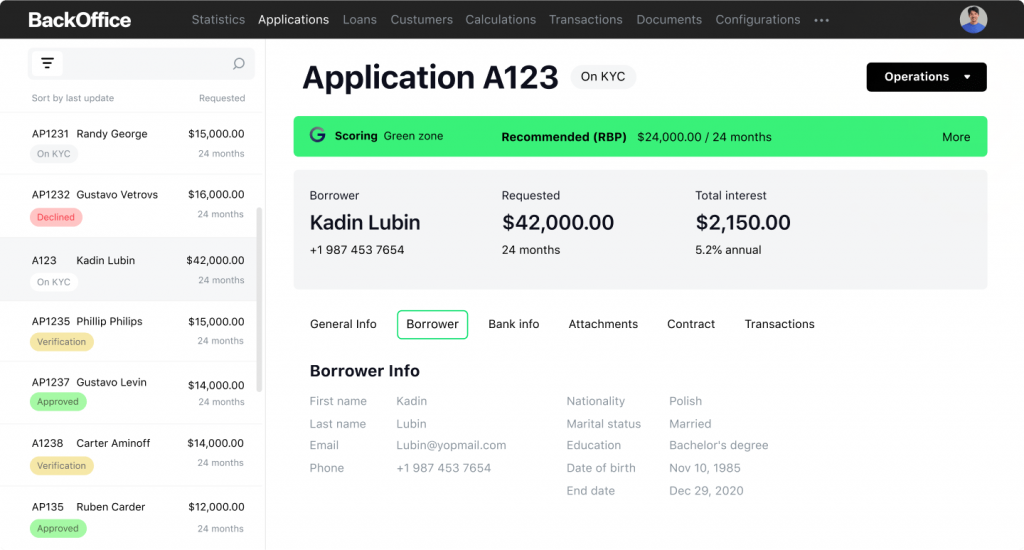

Application scoring process

Combining data points, including credit scores, financial statements, employment records and more, application scoring processes enabled by AI can provide next-level tools for application scoring. In the past, traditional systems only took into account a set number of factors. Updated solutions allow for a more robust approach that is closer suited to the diverse needs of the modern market. Onboarding AI application scoring tools as part of a wider loan underwriting system is a smart way to get the information required while delivering a simple, stress-free service.

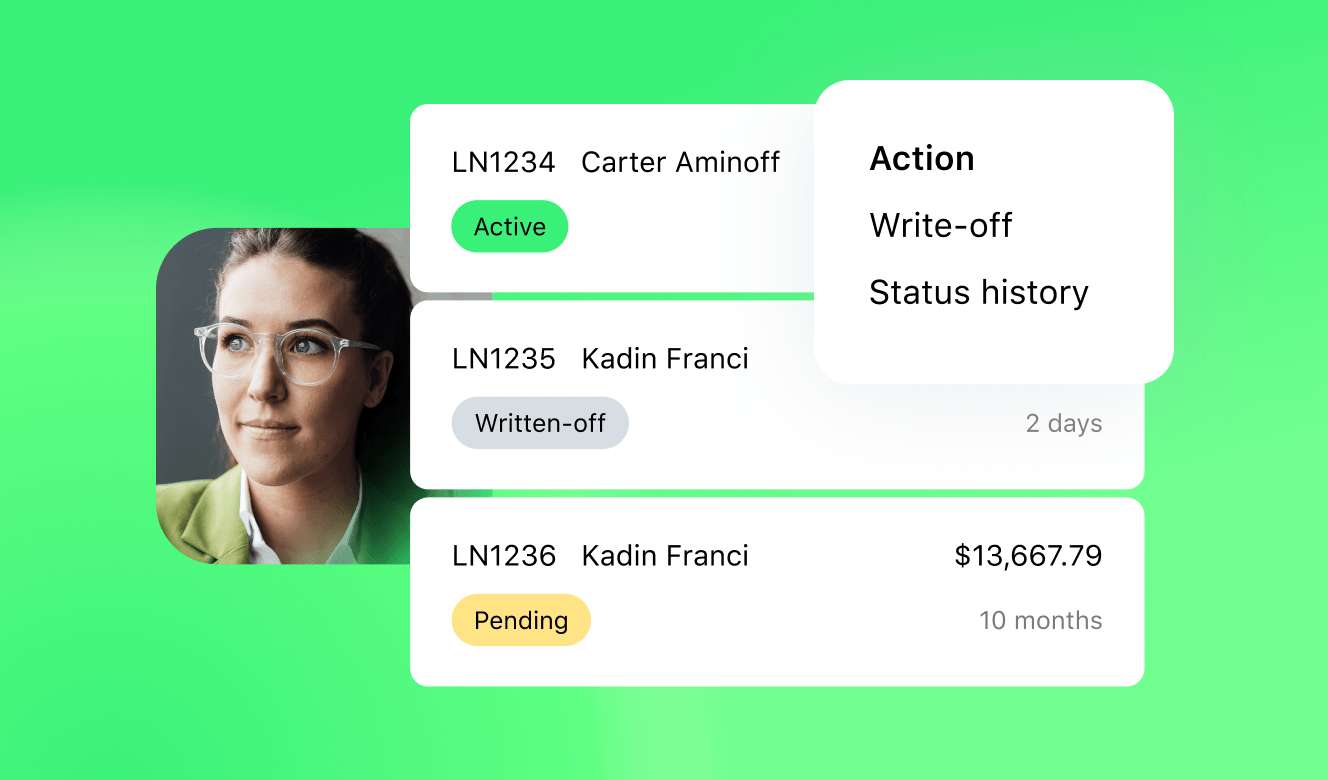

Credit management module

The previous top-down approach to credit management, wherein the bank essentially invoices the borrower, is falling out of fashion. In its place is a far more integrated approach that keeps both borrowers and lenders on track with their obligations. This is integrated into the wider system to give a comprehensive overview of the borrower’s ability to pay, and opens the discussion, whenever that number drops below the optimal rate. This time of tool, integrated alongside underwriting software, helps get buy-in and agreement from the client, thus making them more responsible for their loan, while the business remains transparent in their processes.

Industry requirements driving next-level automated underwriting systems

Upgrading your automated loan underwriting system can be an expensive exercise. However, many argue that it’s worth the outlying costs. So, if you’re still on the fence about if or when to implement AI, consider how these three factors impact your business as a whole:

Increased integration

Are your clients asking for your systems to work more efficiently? Are your team suggesting that processes could be made simpler? If so, it’s time to consider how AI could automate and embed into your current solution to make life easier for everyone. From loan approval to following up on payments, modern solutions can take care of this with ease.

Demand for smarter tools

Outdated banking software is not only frustrating, it’s also a marker for trust. With the advancement of neo-banking systems, including digital-only lenders, the bar for providers has been raised. Having user-friendly, transparent software if a must for those upgrading their underwriting software today.

How does digitalization impact your business performance?

Renewed interest in technology

Interest in AI has ignited like a flame. This has posed a challenge for less technology-advanced organizations who have struggled to match the acceleration. However, not to fear, slow and steady can still win the race if you onboard the right underwriting tools in the right way to impress your borrowers and simplify the work for your team.

Kickstart your lending in 3 months

Commercial and consumer loan underwriting automated: your next steps

Thinking of taking the next step like the 50-60% of companies we mentioned earlier that already invested in AI? You’ve made the right choice. The next step is to implement it right so your automated commercial loan underwriting solution or its consumer equivalent is the right fit for your business. Where to start? First things first, write down your requirements, next, get in touch with the HES team, who’ll take the time to walk you through the best way to embed AI so you get the result you need when you need them.