The ever-evolving Artificial Intelligence solutions have been reshaping the business environment for a few years now. The global AI market is expected to reach a mind-blowing $407.0 billion by 2027, valued at $67.9 billion in 2022.

AI-enabled software is increasingly becoming one of the disruptive factors for the fintech domain as well. The AI fintech market was forecast to reach $26.67 billion with a CAGR of 25.3% between 2022 and 2027.

Fintech startups and lending companies are starting to attract millions of users and dollars in funding to craft AI-fueled software. So why has AI become so vital for fintech companies, and how has AI gained so much traction?

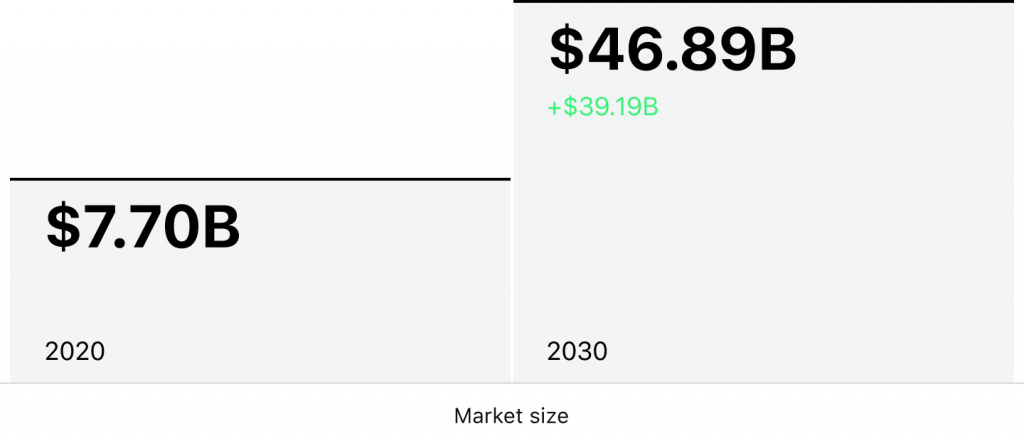

Global AI in FinTech Market

How is AI used in fintech

Before diving deeper and identifying real use cases, let’s outline what AI in fintech is in the first place. Compared with traditional or legacy lending software, AI favors faster goal achievement and better results. Why? AI-powered technologies can help fintech institutions in a variety of ways:

- Analyze customer data and behavior patterns

- Improve decision-making process

- Ensure rock-solid data security

- Forecast future outcomes and trends

- Provide a robust fraud detection

- Automate credit scoring and document analysis

- Reduce user support costs

- Keep in touch with customers 24/7

For instance, AI improves bank service quality by enabling real-time customer services. Chatbots, voice, and virtual assistants can be deployed for reporting and money transactions. In lending, AI easily identifies individuals, evaluates creditworthiness, and detects fraudsters.

The fintech domain produces colossal amounts of data. And fintech companies can no longer make all that data work without disruptive innovations in place.

Artificial Intelligence is best shown in tandem with machine learning (ML), natural language processing (NLP), deep learning (DL), and Big Data. AI-based lending systems anchored by ML features go far beyond human limits and process data with speed and accuracy that is yet impossible for any human.

AI market growth prognosis

The more information you have and the more data AI ingests, the more detailed and precise data-driven insights you get. These insights help streamline the entire workflow and provide customers with personalized services.

Let’s now take a sneak peek at some real use cases to understand how AI will help fintech companies cope with their pain points.

How to use AI in fintech: outstanding examples

You might need to consider a few details before strengthening your current fintech ecosystem or integrating an AI-powered platform from scratch.

- Focus on your issues. Identify your key pain points and bottlenecks that AI-based solutions can fix or optimize. Make sure you understand what business goals and results you need to achieve.

- Find the right experts. With all the features AI can offer, you might need a professional team of seasoned specialists to get expert consulting on what benefits this technology can provide for your business.

- Consider MVP development. To test your initial ideas with real users and check your project viability, consider making an AI-powered MVP or find a robust off-the-shelf solution. For a lending provider, it’s a great way to test market demand and draw early adopters.

The intense market competition and emerging customer demands forced leading financial companies to put their trust in Artificial Intelligence, and it proved to be a reliable assistant. So, what kinds of AI software are used in fintech, and how can they help?

Investment management

Challenge

AI-powered fintech software helps build predictive models that analyze market trends, identify patterns, and make investment decisions. Without those data-driven insights, businesses can jeopardize their investments due to unpredictable circumstances like inflation, default, marketability, and other risks.

Solution

BlackRock leverages AI-based Aladdin to analyze massive data chunks, monitor market trends, and make data-driven investment decisions. It combines complex risk analytics with portfolio management helping investment professionals make smarter decisions.

Risk management

Challenge

Risk management is crucial for identifying issues to provide sufficient assurance they are visible and monitored. AI can develop risk models that analyze historical data to spot and mitigate potential risks. With an AI-based solution on board, risks are systematically identified, evaluated, and controlled.

Solution

Discover realized that personal loan charge-offs had unexpectedly doubled over a 3-year period, so they stopped advertising the product to “near-prime” customers. Seeing the potential to expand their loan portfolio while reducing risk and losses, Discover reached out to Zest to integrate AI that would help improve understanding of borrower risk.

By switching from classic loan models to AI-powered underwriting and reviewing hundreds of applicant data, Discover was able to reduce charge-offs by more than half, saving millions of dollars per year.

Is AI a reliable tool for risk management?

Fraud detection

Challenge

37% of fintech companies and 31% of regional banks lost between $1–10 million to fraud back in 2022. AI-driven fintech software identifies patterns of fraudulent behavior (transaction history, location data). Thus, financial institutions can detect and prevent fraudulent activities and ensure robust security measures.

Solution

Due to an old-hat fraud detection system with only a 40 percent success rate, Danske Bank used to generate more than 1000 false results per day. With a new AI-based tool anchored by deep learning features, Danske Bank managed to improve fraud detection by 50 percent and reduce false positives by 60 percent.

Customer authentication

Challenge

The global biometric authentication and identification market is forecast to reach $100 billion by 2027. It might sound promising, but like any other technology, biometric verification can bring significant profits or pose a threat. AI verification platforms can streamline and secure biometric authentication, facial recognition, and digital ID verification based on social media profiles and online activity.

Solution

A biometric authentication system powered by Artificial Intelligence called ID Check has been developed by MasterCard to verify a user’s identity during a payment transaction. The system detects if the user is trying to authenticate the transaction with a photo or video of someone else’s face, thus reducing fraud by 99%.

Looking forward to improving your processes with AI?

Customer service

Challenge

Global savings from chatbots will reach $8 billion in 2023. It’s no wonder financial institutions will keep leveraging virtual assistants and artificial intelligence to interact with their customers. Artificial Intelligence technology can help create smart chatbots and other conversational agents that can assist customers with financial questions and concerns.

Solution

Erica is a virtual AI-fueled assistant that helps Bank of America enhance customer service. Using NLP and ML algorithms, Erica checks account balances, transfers funds, pays bills, and provides financial advisory services. The assistant has surpassed 20 million users and proved to be a user-friendly solution that customers love and enjoy using.

Algorithmic trading

Challenge

Algorithmic trading relies on automated pre-programmed trading instructions or quantitative analysis. AI technology is utilized to build trading algorithms that analyze market data and execute trades in real time.

Solution

Back in 2017, Two Sigma built an algorithm using RL to trade futures contracts. Powered by ML features, the algorithm predicted market conditions and traded based on those predictions. Two Sigma’s algorithm outperformed other traditional trading strategies and allowed the organization to reach the top 20 all-time performers.

Credit scoring

Challenge

Lenders use credit scoring to identify creditworthiness and decide whether to approve or deny credit. Experts adopt AI technologies to build credit scoring models that can predict the likelihood of default or delinquency on loans and other credit products.

Solution

Upstart created an AI-powered lending platform that uses ML algorithms to assess creditworthiness. The solution leverages a proprietary underwriting model that analyzes big data chunks and surpasses traditional FICO scores in accuracy when predicting risk. Multiple finance companies have incorporated Upstart’s technology into their environment, resulting in the same rate while seeing 75% fewer defaults.

Coupling the power of AI with credit scoring is a game-changer for financial institutions. With the ability to analyze vast amounts of data in real-time, AI credit scoring can enable lenders to make more informed decisions, reduce risk, and increase access to credit for individuals and businesses alike.

Dmitry DolgorukovCo-Founder and CRO of HES FinTech

Compliance monitoring

Challenge

Maintaining compliance monitoring in a fast-paced fintech sector while staying up-to-date is quite a formidable task. AI can help monitor financial transactions and detect potential violations of regulations and policies.

Solution

HSBC suffered fines and reputational damage resulting from ineffective money laundering prevention. It was then decided to adopt an AI-based anti-money laundering system (AML) to strengthen risk management and regulatory compliance initiatives.

The AI-powered system can analyze transactional data and identify potential money laundering activity thanks to ML algorithms. As a result, the number of false positives has decreased, allowing for more accurate targeting.

Wrapping up

So how can AI help fintech? As we can see, Artificial Intelligence and Machine Learning are now available worldwide. It is forecast that average investments in AI will continue to grow and reach $110 billion in 2024. The potential to expand services, reduce costs, and improve customer experience through automation no longer seems impossible.

However, fintech institutions require close collaboration with developers, designers, engineers, and technical specialists to implement disruptive ideas fast and monetize effectively.

Our in-house software engineers, with over 10 years of expertise in lending development and consulting, will analyze your pain points and recommend the best solution your business requires at the moment. If you need advice, please don’t hesitate to drop us a line any time you see fit.