Try the HES LoanBox lending platform to streamline

your workflow and achieve faster ROI

your workflow and achieve faster ROI

Digital loan origination

Flexible loan servicing options

Automated

underwriting New

underwriting New

One-roof loan management

HES LoanBox includes

White-label lending platform

Offer your borrowers the convenience of applying for loans online.

Integrate a user-friendly loan calculator, and display your loan terms to attract more potential clients. With a responsive landing page, customers can access it effortlessly from any device, ensuring a seamless omnichannel experience.

Learn more

Integrate a user-friendly loan calculator, and display your loan terms to attract more potential clients. With a responsive landing page, customers can access it effortlessly from any device, ensuring a seamless omnichannel experience.

Offer borrowers a dedicated online portal.

In their personal space, clients can effortlessly apply for new loans, track the approval journey,

and securely upload essential documents—all without visiting your physical office.

Efficient loan origination software helps save time for your credit officers and elevates customer

satisfaction.

Learn more

Answer a few questions

for your loan software estimate

STEP:

/

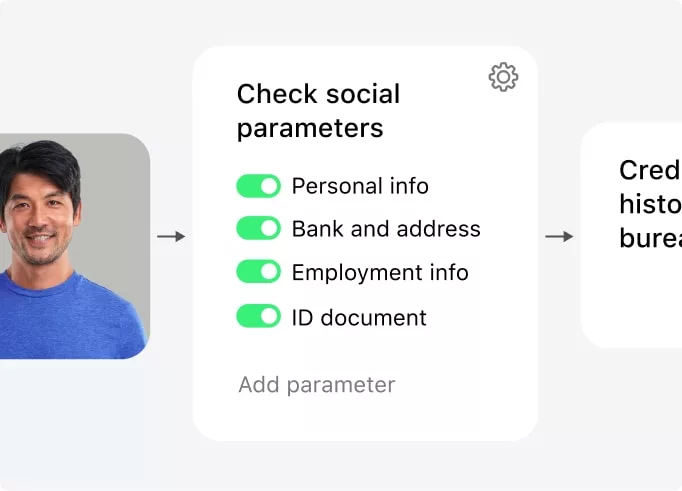

Smart lending software integrations

Lending platform

meets AI power

Leverage the incredible potential

of AI technology to assess loan portfolios, automate debt collection, and gain invaluable data-driven insights.

of AI technology to assess loan portfolios, automate debt collection, and gain invaluable data-driven insights.

Why choose HES LoanBox

3 months to launch

Intuitive and easy to learn

Highly customizable

Grows with your business

Futureproof and secure

Powerful lending

software features

Custom workflows

Streamline workflow visualization and application throughout the system. HES loan

platform supports multiple workflows for enhanced freedom and flexibility.

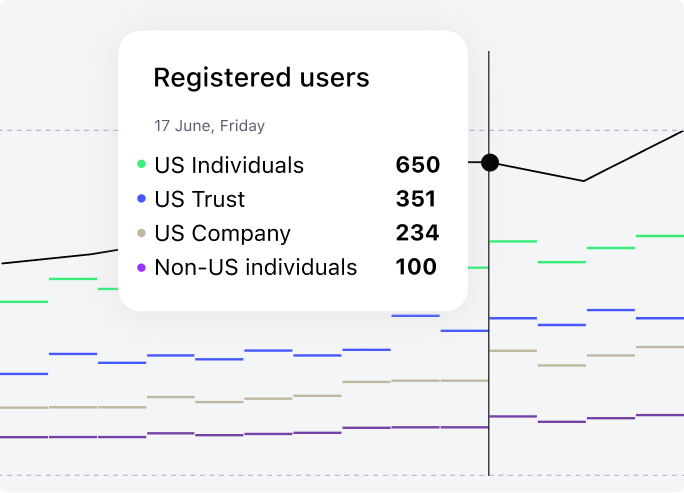

Automatic reporting

Track KPIs with interactive reports and dashboards. Export and customize data as needed.

Stay alert and make informed business decisions effortlessly.

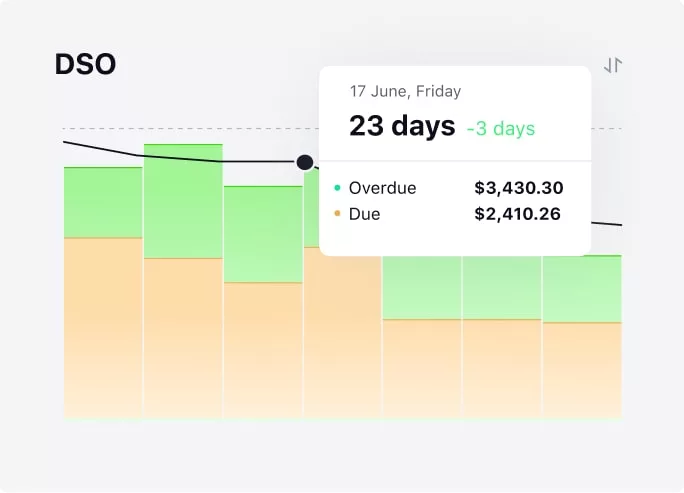

Debt collection

Use an AI-driven debt collection tool to analyze accounts receivable, identifying debts more

likely to be repaid. Get case-tailored collection strategies to improve DSO rate.

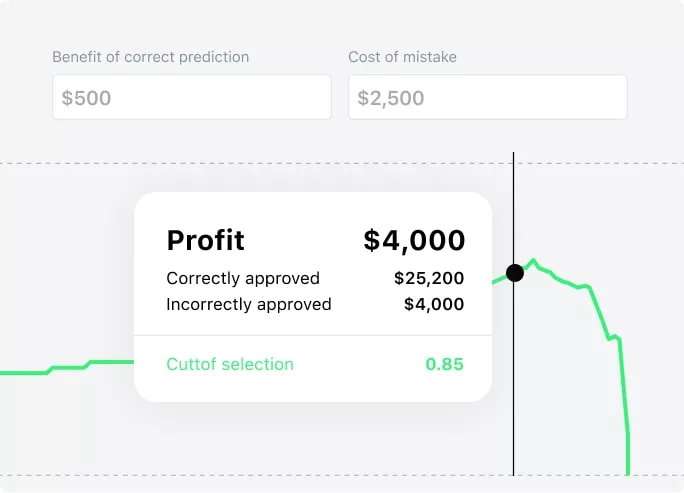

Risk management

AI credit scoring predicts defaults and assesses risk. Set cut-off thresholds to define

risky assets and control NPLs. Receive insights for smarter credit portfolio management.

Online transactions

Track automatic disbursements, repayments, and daily transactions effortlessly with our

loan software. Enjoy unified online access for streamlined management.

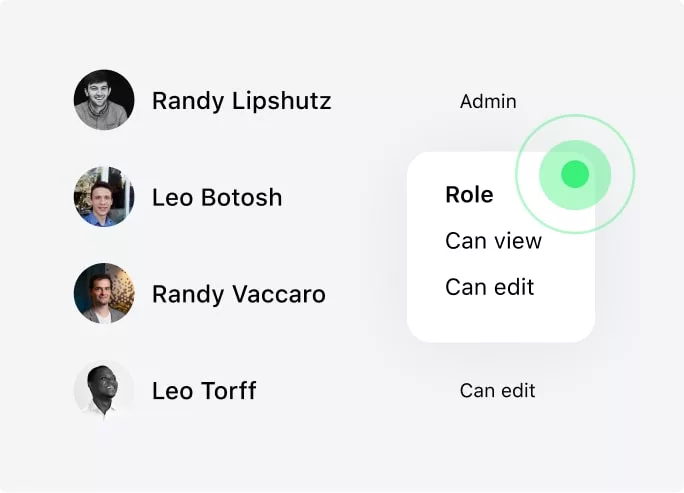

Roles-based access

Enhance security with role-based user permissions. Limit access to system functions based on

specific user roles, ensuring a robust and controlled environment.

Digital signature

Streamline loan origination with an e-signature. Our online lending software reduces

paperwork and eliminates physical office visits for added convenience and security.

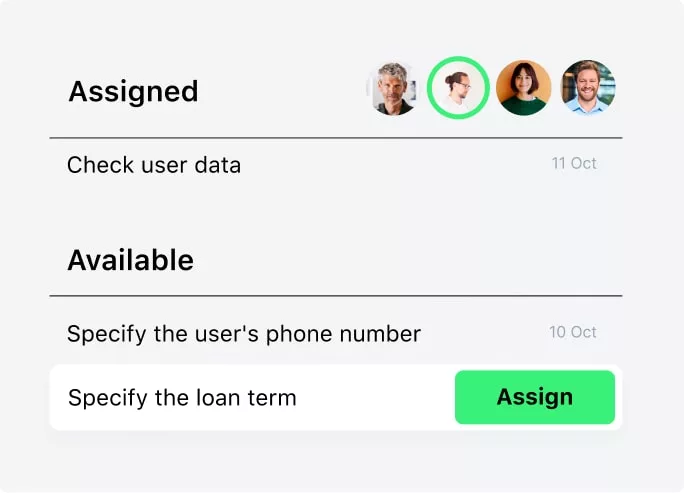

Task management

Synchronize loan officers' work with the HES LoanBox solution. The built-in task management

module facilitates task allocation and performance monitoring for seamless operations.

Enjoy the flexibility

of lending software

HES FinTech's lending software is versatile and easily adaptable to various

lending business types

lending business types

Alternative lending

Point of Sale finance

SME commercial lending

PayDay cash advance

Auto lending business

Invoice financing

Request a

demo

Proven efficiency

of lending software

Reduction in loan processing time

Issue more loans per time unit. With HES LoanBox, application processing takes up

to 30 minutes, boosting a credit department throughput.

5-30 min

for application

processing

processing

Reduction in loan processing time

Issue more loans per time unit. With HES LoanBox, application processing takes up to 30

minutes, boosting a credit department throughput.

Staffing optimization

Reduce staff costs. Case studies show that HES solutions save the worktime of

employed loan officers, reducing the need in hiring new managers.

12.5k hhrs

yearly worktime

savings

savings

Staffing optimization

Reduce staff costs. Case studies show that HES solutions save the worktime of employed loan

officers, reducing the need in hiring new managers.

42%

Increase in data

entry speed

entry speed

x2.5

More accurate loan

decisions

decisions

90%

Fewer human

mistakes

mistakes

35%

Faster turnaround

and payback

and payback

Pricing

Enterprise

Launch your platform in 3 months with expert

guidance. Embrace flexibility with solutions

custom-fit to your business workflow

Starting from $75,000

Unlimited custom features

API for flexible workflow management

Tailored calculation logic

Advanced security, user and role management

Extensive range of local integrations

Lending product engine

Disbursements and repayments automation

Portals for agents, brokers, and merchants

Automated debt collection

FAQ

Is HES LoanBox solution user-friendly and easy to learn?

How much does loan management software cost?

Is HES LoanBox lending solution scalable?

Does HES FinTech offer customer support services?