Euro Groshi success story

Employing industry best practices to launch a PDL platform in 2.5 months

Find out how the HES MFI solution gives Euro Groshi a competitive edge by

allowing it to provide quick underwriting responses.

It took us 10 weeks to go live and start originating hundreds of quality loans per

day.

Vladimir Khorvyak

CEO at EuroGroshi

Challenge

Meet the European lending standards

Euro Groshi needed to implement and comply with European money lending standards. The company

was planning to operate online without any physical branches and was looking for a field-proven

technology solution for payday loan

management .

Approach

Robust functionality combined with well-thought-out UI/UX

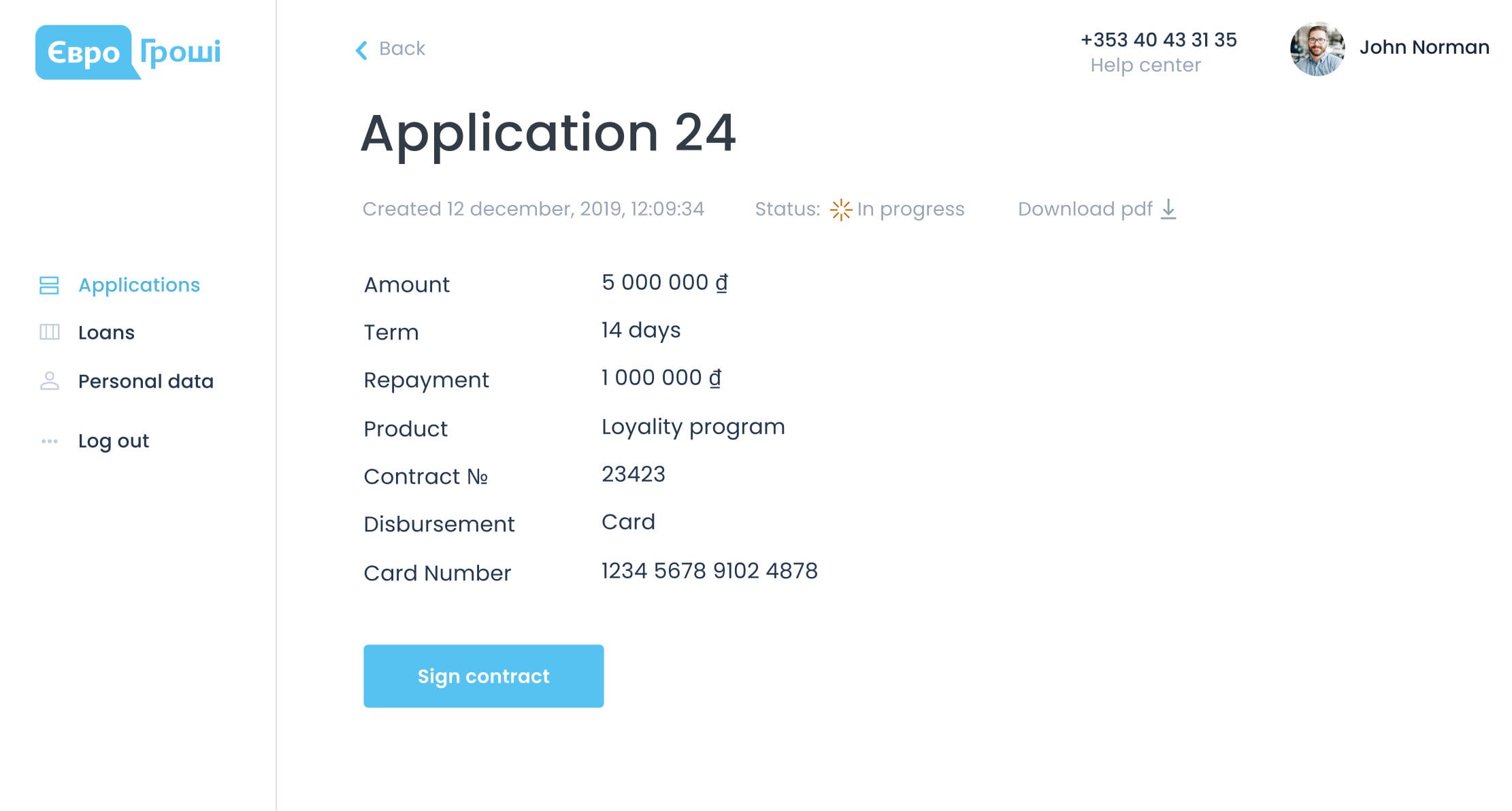

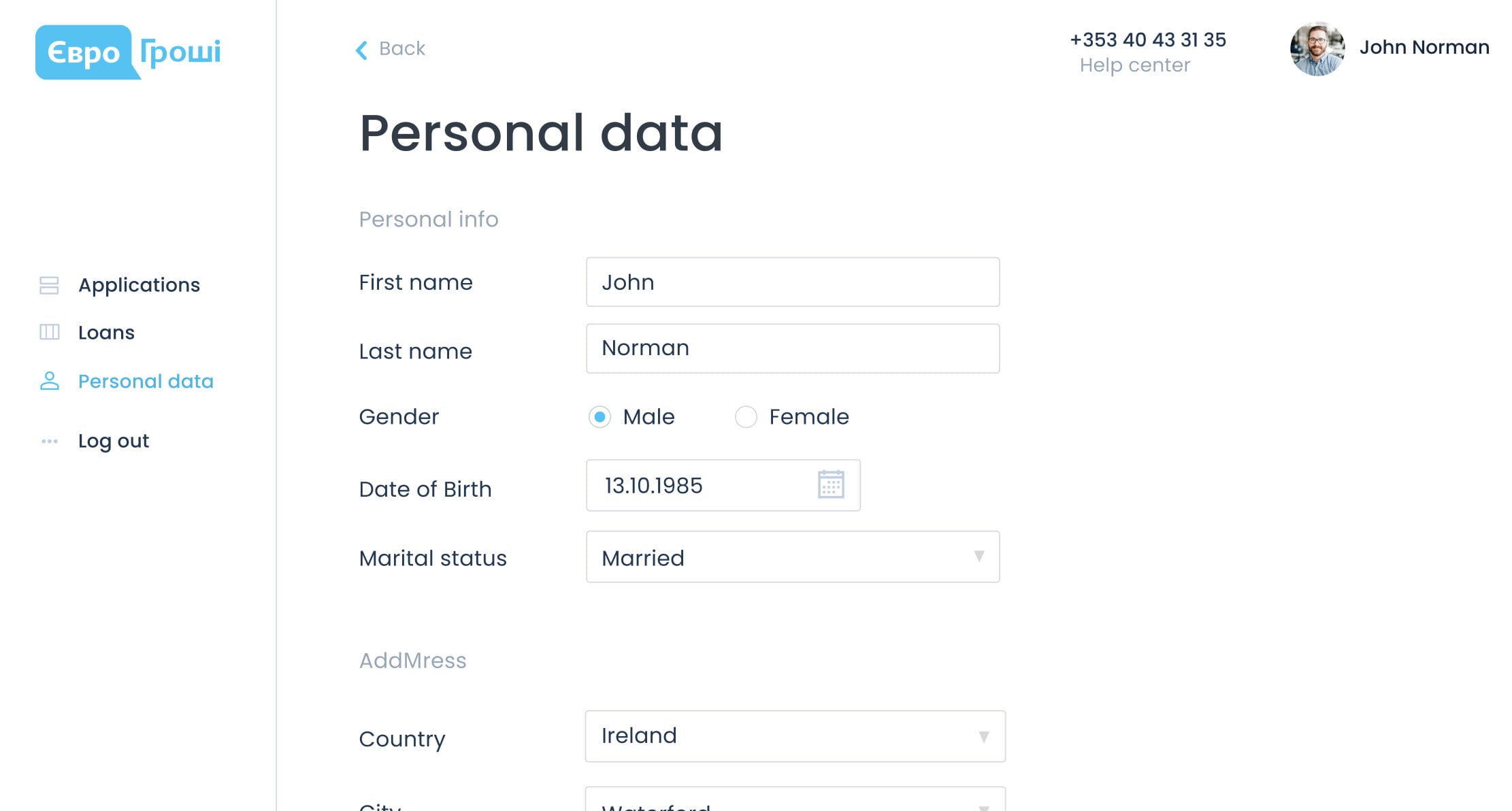

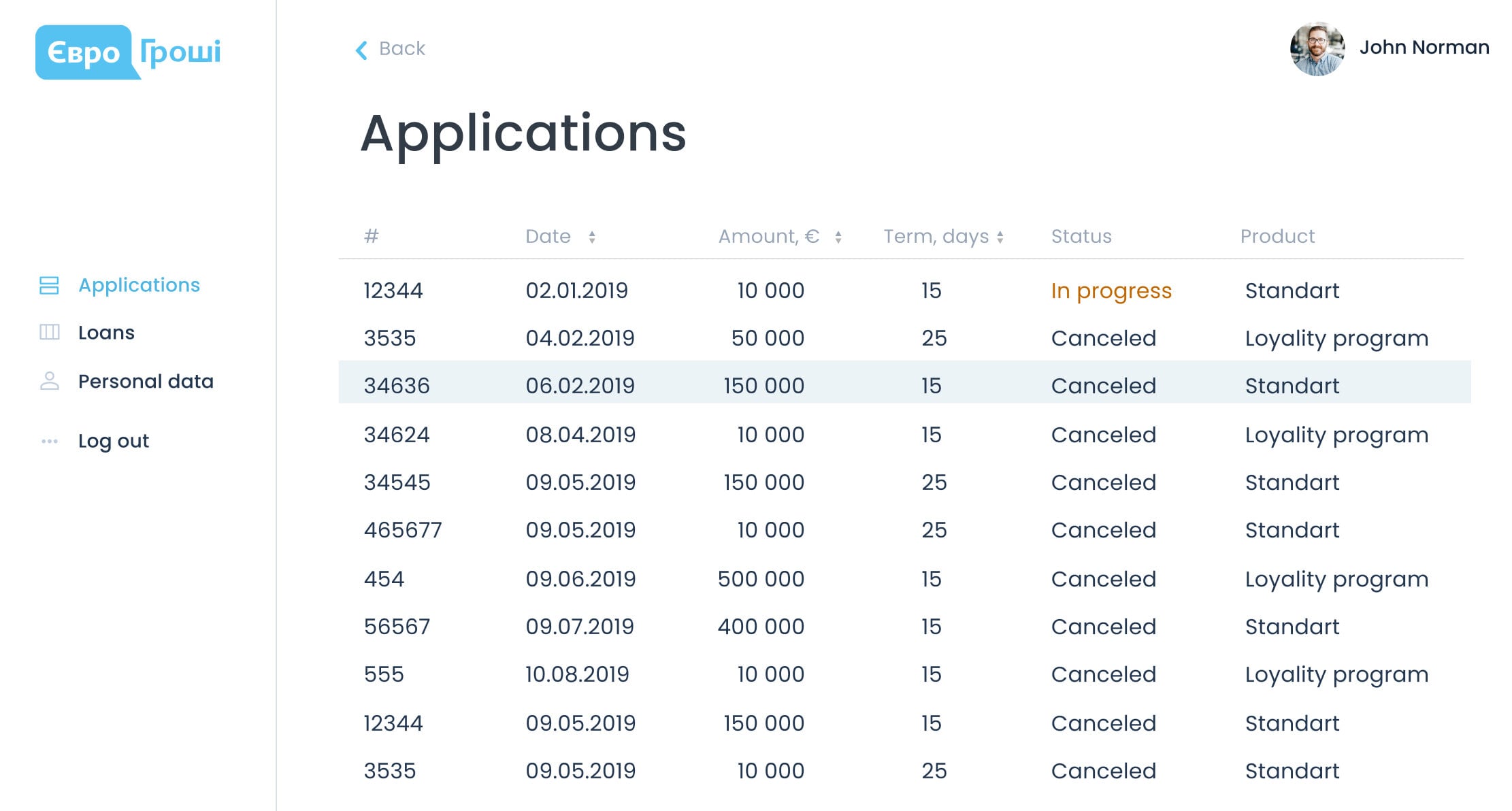

HES not only fulfilled all functional requirements expected behind the scenes, but also created a

user-friendly UI experience for Euro Groshi’s clients. Now, HES LoanBox handles multiple loan

workflows in a single automated environment.

2.5 months

Time-to-market

30-40%

More customers in the first three months

75%

of customers apply online

Result

Online customer acquisition and loan decisions in minutes

HES LoanBox gives Euro Groshi a competitive edge by allowing it to make quick underwriting

responses and design customized loyalty programs. The credit application process for new

customers takes no more than 15 minutes. Repeat customers receive loan decisions within 5 to 10

minutes.