Success story from Canada

An automated commercial lending platform for one of the largest Canadian financial institutions

One of the leading commercial lending providers in Canada has chosen HES FinTech for the complete update to

legacy lending software.

Challenge

Commercial lending powered by effective software

Lenders must remain up-to-date with the

latest

technologies and enhance their product offerings. The company found it complicated to adapt to

new requirements because of its legacy core system, and decided to upgrade to a more flexible

front-to-back-end lending platform.

Approach

Introduction of multi-faceted updates

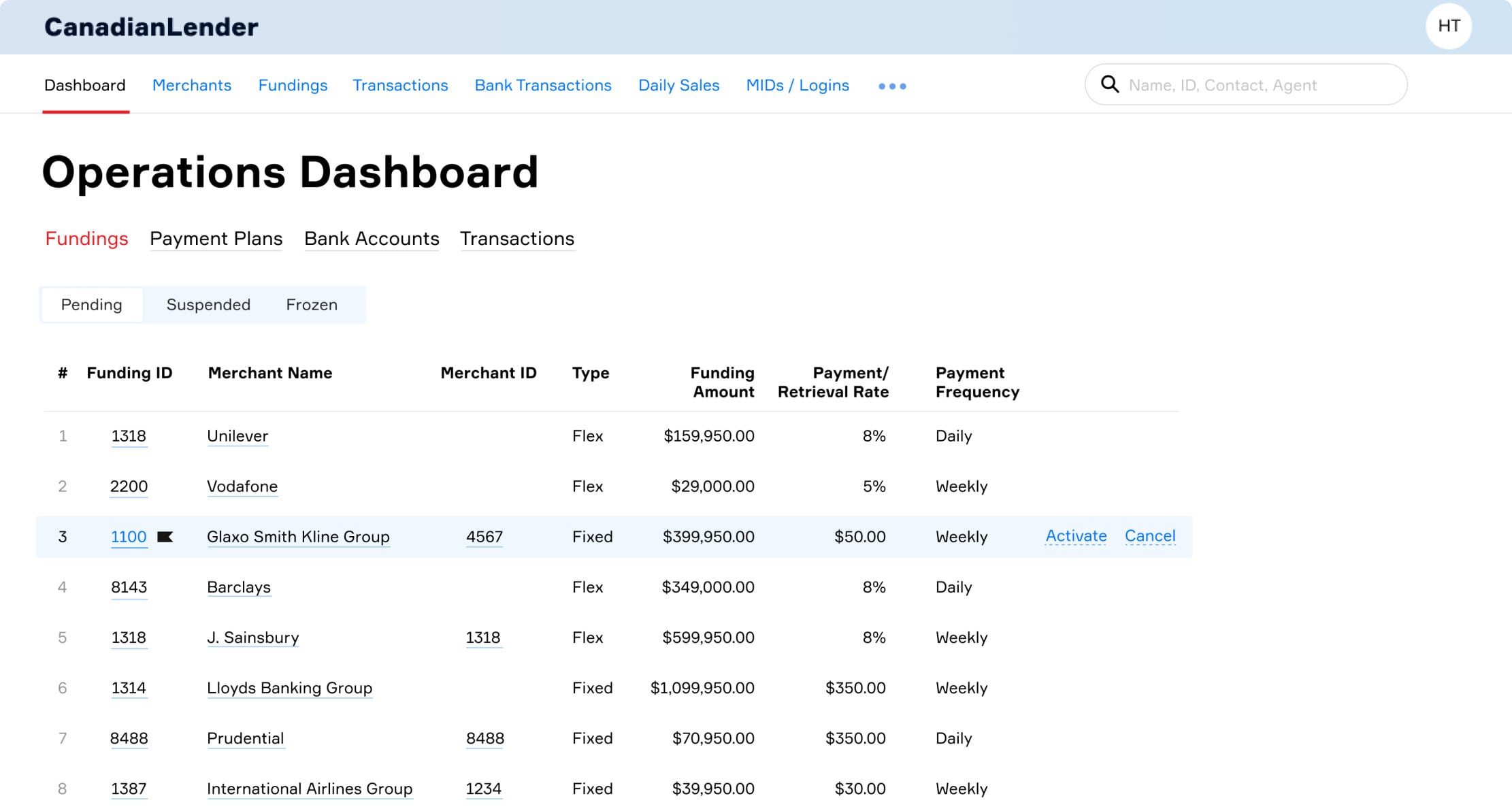

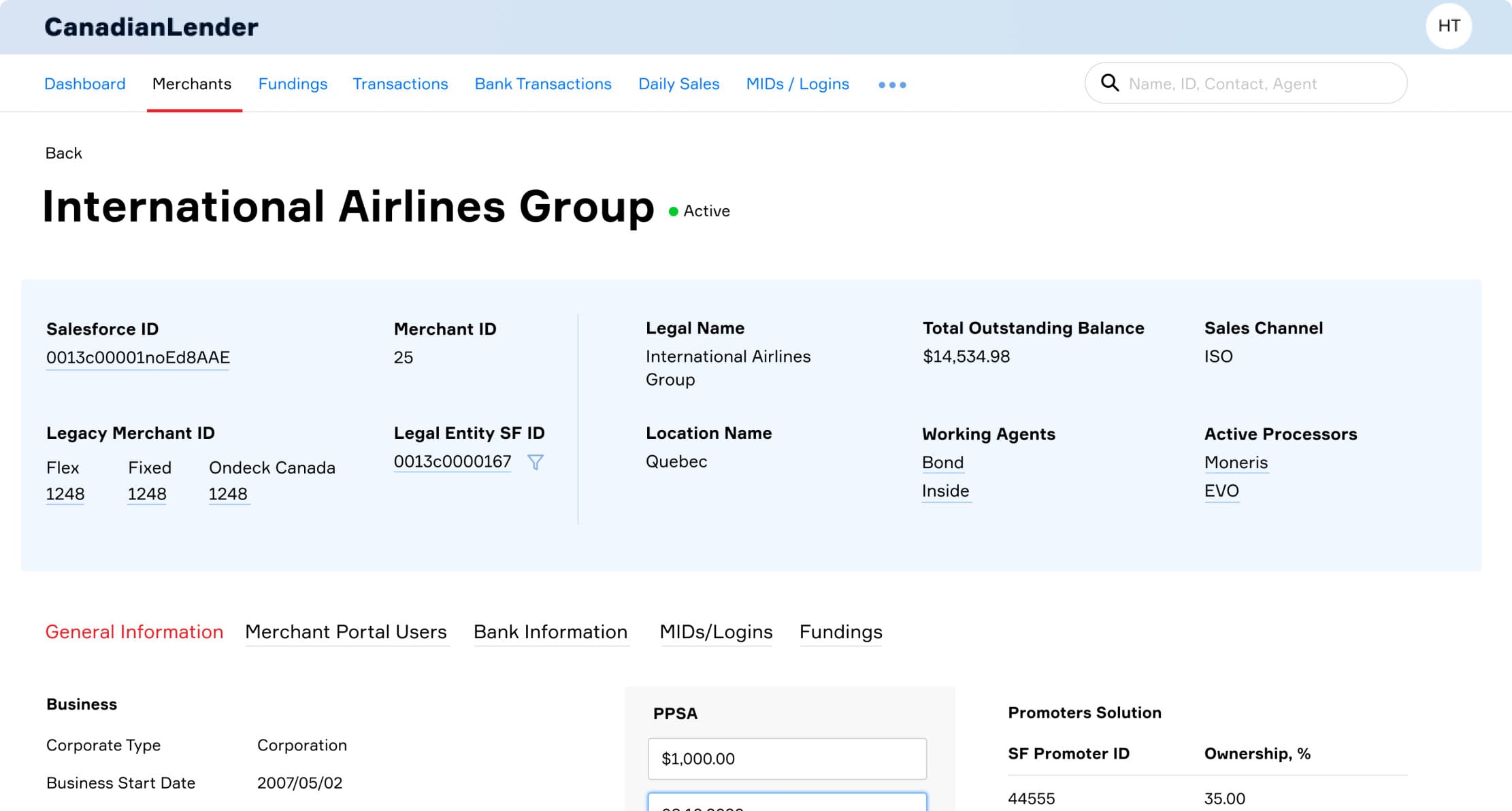

The project was divided into two stages: transformation of the current

platform to ensure that mission-critical operations run smoothly, and extension of functionality

with new global components. HES LoanBox empowers the company to streamline its lending

workflows and activities by integrating a variety of third-party services and automating a

number of manually administrated tasks.

4 months

Time-to-market

+20%

Customer base growth

6x

Faster application processing

Result

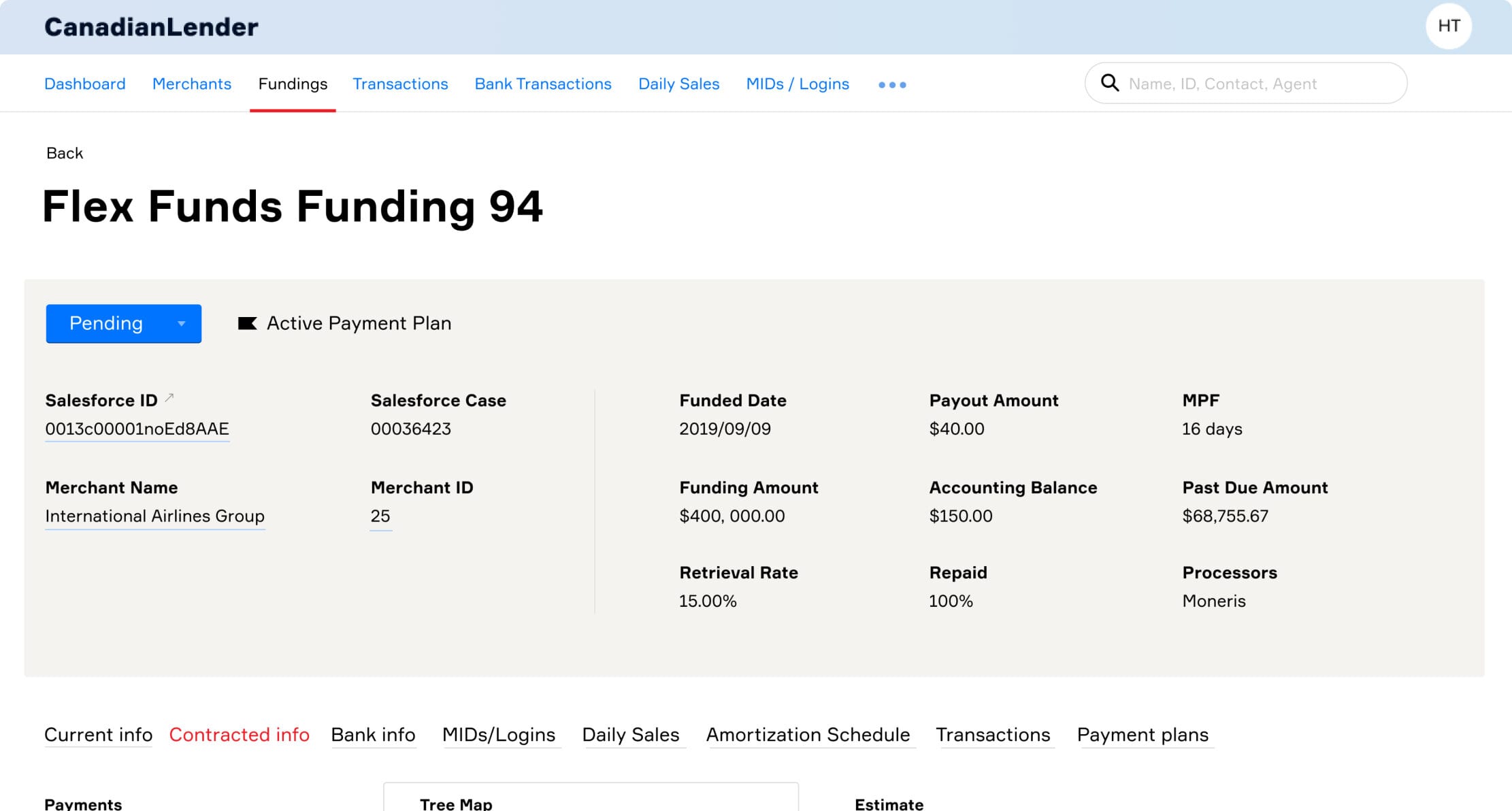

Scalable commercial lending platform with rich functionality

Since deploying HES LoanBox, the company has achieved greater efficiency and

automated mission-critical processes. With a scalable lending platform, the Canadian

lender reduced application processing from 24 hours to 4 hours, and quickly introduced a new product —

merchant cash advance.