ATM Online success story

An online lending platform that offers instant loans in Vietnam

Discover how ATM Online has entered the Vietnamese market within 4 months with the help of HES LoanBox, an

end-to-end lending platform.

HES LoanBox is the end-to-end lending platform that covers the entire business process—from customer onboarding and credit calculation to underwriting, with varying levels of automation. It has been incredibly valuable for us!

Hai Do

CFO at ATM Online

Challenge

End-to-end automated lending process

The client needed a flexible lending solution to take their business online. Following a

requirements analysis, the HES FinTech team created a full-circle loan platform that fully

automates the microfinance lending process and provides integrations with third-party payment

systems.

Approach

Business analysis followed by development

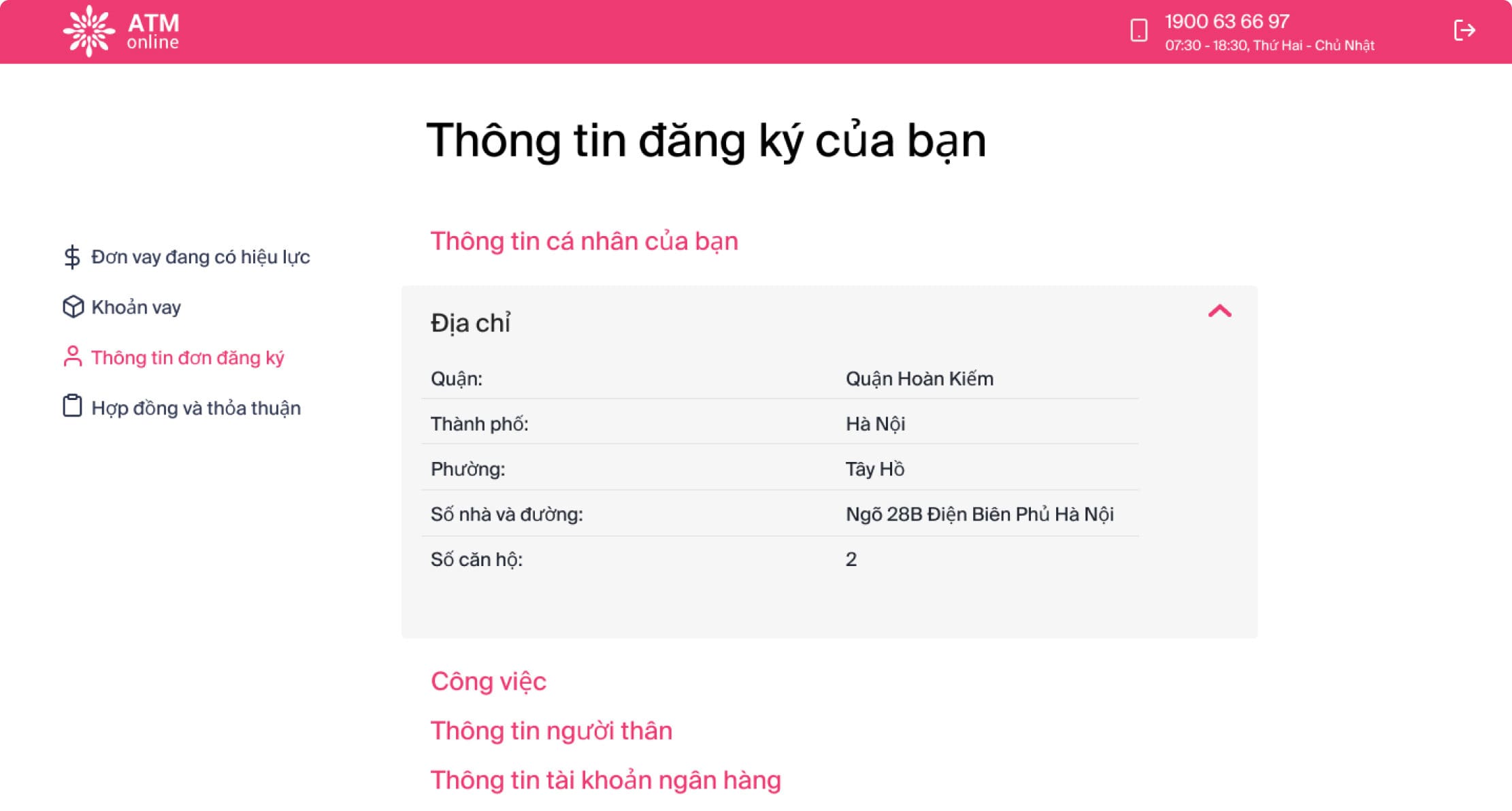

The outcome of the project is a robust loan management platform that allows borrowers to

register and apply for a loan via their mobile phone, access their application/loan data, and receive

money into a bank account within 5 minutes. The solution processes borrowers’ loan applications

from the initial step until the full repayment.

4 months

time-to-market

80%

faster decisions due to

a custom decision-making system

6%

increase in applications

Result

ATM Online outperformed many competitors in the Vietnamese market and demonstrated impressive business results

HES LoanBox helped the client to scale up and offer loans to a growing customer database. Now, ATM Online is one of the leading consumer lending companies in Vietnam, known for its low interest rates and fast application processing time.