With advantages like streamlined loan origination and servicing, automated credit assessment, and faster decision-making, it’s no surprise that digital lending keeps gaining traction. In fact, the global digital lending market is projected to reach $507.27 billion in 2025 and expand further to $889.99 billion by 2030.

Against this backdrop, fintech businesses are taking different paths to enter the market. Some invest in building custom platforms from the ground up while others prioritize speed and cost efficiency. For the latter, a white label lending platform offers a practical route. It supports a branded customer experience while shifting the complex work of backend infrastructure, integrations, and ongoing maintenance to dedicated specialists.

In this article, we’ll break down what white-label lending platforms are, explore their main benefits, walk you through the key aspects to evaluate before choosing one, and share examples of standout solutions on the market.

What is a White Label Lending Platform?

A white label lending platform is a ready-made software solution that allows banks, fintechs, and other businesses to offer lending services under their own brand without having to build the technology stack from scratch. It provides the full infrastructure needed to manage the lending lifecycle, from loan origination and credit scoring to servicing, collections, and reporting.

With a white-label solution, businesses can rebrand and customize the front-end experience while relying on a proven backend that handles the heavy lifting, including integrations with payment rails, risk models, regulatory checks, and scalability requirements.

This way, businesses can focus on shaping the customer experience and strategy while the platform vendor is responsible for ensuring that the underlying system is secure, compliant, and technically sound.

What’s the Difference between a White Label Lending Platform and a Custom One?

Building a custom lending platform from scratch often means long development cycles, high upfront costs, and the need for continuous in-house maintenance.

In contrast, white-label lending platforms come pre-configured with core infrastructure in place, thus allowing businesses to launch a solution much quicker and at a far lower cost.

At the same time, they’re not one-size-fits-all. Companies can integrate white-label solutions into their existing workflows, configure loan products to match their business needs, and keep full control over the customer journey and branding.In short, white label lending gives you enterprise-grade capabilities without the heavy lift of custom development, which makes it an attractive option for businesses that are eager to move fast without compromising on flexibility or user experience.

| Criteria | Custom platform | White-label platform |

|---|---|---|

| Development time | 12–24 months | Faster approvals, proactive notifications, and a smoother loan journey |

| Upfront cost | High | Low |

| Flexibility | Full control | Configurable |

| Maintenance | In-house | Vendor-managed |

| Scalability | Manual | Built-in |

What are the Key Benefits of White Label Lending?

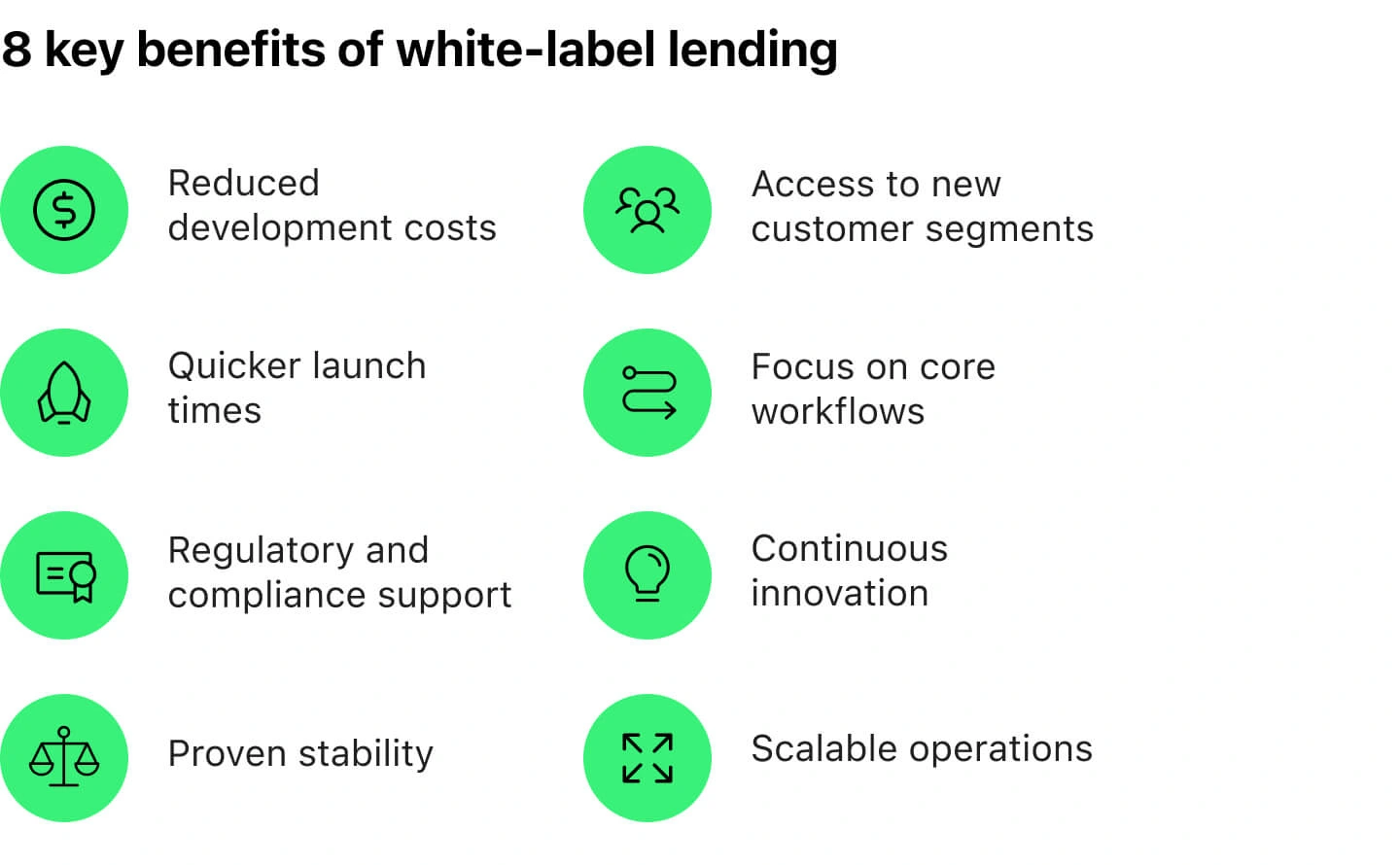

The advantages of white label lending solutions are manifold, spanning everything from faster time-to-market and reduced development costs to new business opportunities and long-term reliability.

Let’s take a look at the most important benefits that make these platforms a powerful choice for fintechs and banks alike.

1. Reduced Development Costs

Developing a lending platform from scratch often requires large engineering teams, ongoing infrastructure spending, and constant compliance upgrades. For many businesses, this creates a financial barrier that slows progress.

White-label platforms can significantly cut those costs by offering ready-made technology that has already been fine-tuned, thus allowing companies to redirect budgets toward growth and customer acquisition instead of backend upkeep.

2. Quicker Launch Times

Time-to-market is often the deciding factor in winning customers or losing them to faster competitors.

Building a custom platform can take months or even years while a white-label solution shortens that cycle to weeks. This speed gives you the ability to test, adjust, and scale lending products in near real-time rather than waiting until the market has already moved on.

3. Proven Software Stability

Early-stage lending systems are often prone to bugs, downtime, and integration hiccups that can frustrate customers and erode trust.

White-label platforms, on the other hand, have already been stress-tested in real-world conditions and refined across multiple use cases. That history of reliable performance gives businesses confidence that they’re operating on a foundation that is built to handle scale without unnecessary disruptions.

4. Regulatory and Compliance Support

Financial regulations evolve and change all the time and staying compliant requires significant expertise and resources. For businesses without dedicated compliance teams, this can become a risky bottleneck and result in undesirable outcomes.

In this case, embracing a white label lending platform can be a smart move. Modern white-label platforms come with built-in regulatory safeguards, from automated KYC checks and fraud monitoring to audit trails and role-based access controls.

For businesses, this means that they can operate with confidence and know that they’re aligned with local compliance requirements without having to build and constantly update these protections on their own.

5. Scalable Operations

Advanced white-label platforms enable businesses to handle rising loan volumes and broader customer bases without reinventing their architecture each time. That flexibility makes it easier to plan for both steady growth and sudden surges.

6. Sharper Focus on Your Core Workflows

For most businesses, the real value comes from strengthening customer relationships and shaping long-term strategy rather than managing databases, patching integrations, or wrestling with compliance scripts.

A white-label platform takes care of all that technical heavy lifting, so your team can put its energy where it drives growth and competitive advantage.

7. Access to New Customer Segments

Modern white-label platforms often come with tools that support varied loan types and customer journeys, which makes it easier to serve new demographics and expand into markets that might have been too complex to approach otherwise.

8. Continuous Innovation and Upgrades

Technology in lending evolves quickly and keeping systems up to date can overwhelm internal teams.

With a white-label platform, though, the vendor delivers ongoing updates, new integrations, and feature improvements in the background.

As a result, businesses automatically benefit from the latest capabilities without having to fund separate R&D projects or manage costly upgrade cycles on their own.

Aspects to Consider when Choosing a White Label Lending Platform for Your Business

| Aspect | What to look for |

|---|---|

| Customization capacity | Flexibility to adjust interfaces, loan products, and workflows to fit your business model |

| Cost | Clear understanding of all costs, including licensing, setup, and ongoing maintenance |

| Data security and compliance | Built-in protections like encryption and access controls, plus proactive handling of regulatory updates and secure hosting |

| Vendor support and reliability | Responsive support and a proven track record for helping clients scale |

| Integrated feature set | Core tools like loan management, credit scoring, payment scheduling, and analytics dashboards |

If you’re ready to adopt a white-label lending platform, the next step is to evaluate the features and capabilities that matter most to your business.

Below, we’ll highlight the critical aspects to review to ensure your chosen solution fits your operational needs and growth plans.

1. Customization Capacity

A strong white-label solution should allow you to customize user interfaces, lending products, loan parameters, reporting formats, and more to fit your business, rather than forcing you to adapt to rigid templates.

Without this flexibility, you’ll risk ending up with a system that may look modern on the surface but doesn’t align with how your teams or customers actually operate.

2. APIs and Integrations

As you know, modern lending doesn’t happen in isolation. In fact, it’s tied to payment processors, credit bureaus, CRMs, and core banking systems.

Thus, a solution with robust API management and pre-built connectors will make it far easier to plug into your existing ecosystem without heavy custom coding. In other words, the more open and well-documented the API layer is, the quicker your developers will be able to roll out new features or partnerships.

Weak integration capabilities, on the other hand, will slow down growth and create costly workarounds.

3. Total Cost of Ownership

License fees are just one part of the financial picture. Implementation, customization, training, and ongoing maintenance can add up quickly if they aren’t clearly outlined from the start.

Assessing the total cost of ownership means considering both immediate expenses and long-term commitments, including potential white label services vendor lock-in, upgrade fees, and ongoing platform management costs.

4. Data Security and Compliance

Financial data is highly sensitive, and the stakes for breaches are significant. In its 2025 Cost of a Data Breach report, IBM highlights that financial firms experienced the second-highest average breach cost across all industries, at $5.56 million, with only healthcare breaches being higher at $7.42 million.

To prevent data security incidents, the platform should include built-in protections such as encryption, secure hosting environments, role-based access controls, audit trails, and compliance certifications aligned with your target markets.

Beyond these technical safeguards, it’s also vital to evaluate how the vendor manages regulatory updates (i.e., whether they proactively adapt to new laws or leave compliance responsibilities entirely to clients).

5. Vendor Support and Reliability

If issues with your white label loan management system arise, you’ll want the confidence that expertise is just a phone call or ticket away, rather than waiting days or even weeks for resolution.

Therefore, look for providers that offer clear service-level agreements, responsive technical support, and boast a proven track record of helping clients navigate scaling challenges.

6. Integrated Feature Set

A platform’s strength lies in the ecosystem of tools it provides out of the box.

Features like automated underwriting, AI-powered credit scoring, loan management, payment scheduling, analytics dashboards, digital onboarding, and customer communication modules can dramatically cut down on the need for third-party add-ons. The more of these elements that come pre-integrated, the less you’ll spend patching together external solutions.

Top 5 White-Label Lending Platforms

The market for white label lending software is broad, with numerous providers offering their own mix of features and specializations.

Below, we’ll highlight five of the most notable white label lending solutions and explore their core features and functionalities.

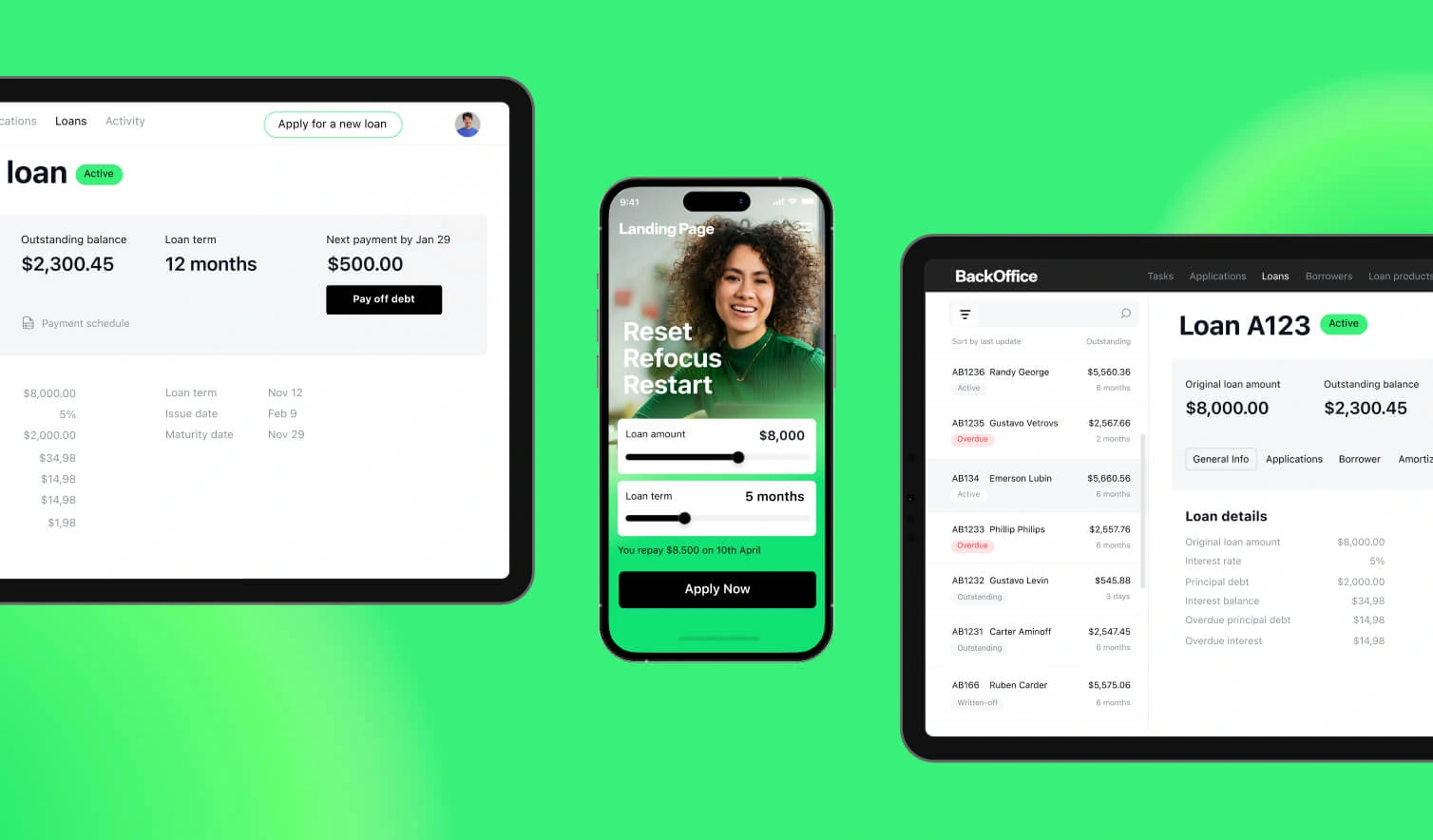

1. HES LoanBox

HES LoanBox is a modular white-label lending system designed to adapt to businesses of any size, from startups to enterprises. It offers a comprehensive suite of features, including AI-driven credit scoring, loan calculators, flexible servicing options, automated underwriting, and debt collection tools. High configurability is one of its strongest advantages, which gives institutions the ability to design lending workflows that match their own requirements and budget.

On the customer side, borrowers benefit from a dedicated portal where they can apply for new loans, track application progress, securely upload documentation, and review payment schedules with clear installment dates and repayment terms.

For lenders, HES LoanBox provides an all-in-one back office for managing applications, servicing loans, customizing credit products, and handling collections.

Security is also central to the platform. It incorporates KYC plugins, biometric authentication, role-based access controls, and advanced protocols to keep sensitive financial data safe.

2. FinMkt

FinMkt delivers fully white-labeled loan origination software that banks, credit unions, and fintech businesses can deploy under their own brand. Its flexible design integrates into existing workflows, helping institutions modernize lending operations without disrupting established processes.

The platform covers the entire lending journey, from application and underwriting to funding, with real-time decisioning and the ability to adjust dynamically to market shifts.

FinMkt also emphasizes risk management and security. It provides automated KYC and fraud checks, device verification, knowledge-based authentication, ID uploads, and compliant handling of consumer credit reports.

Beyond processing, the platform features robust analytics and customizable reporting dashboards that generate actionable insights, thus helping institutions fine-tune credit policies and achieve revenue goals.

3. Jifiti

Jifiti offers an API-driven platform that embeds digital lending capabilities directly into a company’s existing tech stack. The solution supports both consumer and commercial loans and seamlessly connects with third-party services while maintaining regulatory alignment across different jurisdictions.

The vendor points out that businesses can choose to deploy Jifiti’s individual modules that include customer onboarding, core lending capabilities, orchestration layers, and reporting tools, or use the full platform for an end-to-end solution.

The platform’s customer access points are rather flexible: loans can be offered through websites, mobile apps, or embedded into third-party channels. Approved funds can then be disbursed instantly through multiple methods. On the back end, a customizable lender portal serves as the central hub for managing digital lending operations.

Importantly, Jifiti provides Aurora™, its own BI platform that consolidates all lending data into one environment and delivers real-time insights into adoption, conversion, KPIs, and market performance.

4. LenderKit

LenderKit’s white-label software enables businesses to build and grow P2P lending or debt crowdfunding platforms. It supports the full lending lifecycle, from origination to repayment, with functionality customized for both borrowers and investors.

The platform’s key features include third-party credit scoring, pre-built loan calculators, automated payment processing, and dedicated borrower and investor portals.

The back office is robust, supporting CRM and marketing automation, KYC/AML verification, e-signatures, wallet management, currency exchange (including crypto), repayment scheduling, and auto-investing tools.

As far as security is concerned, it’s addressed through strong encryption and role-based permissions that let businesses assign responsibilities to advisors, loan managers, compliance officers, and other stakeholders.

5. ChargeAfter

ChargeAfter focuses on point-of-sale (POS) and merchant-driven lending and offers a white-label platform that enables businesses to create and distribute embedded financing products. Its platform supports a wide spectrum of credit options, from BNPL and revolving credit to B2B and B2C financing models.

The platform is API- and SDK-driven, which allows for fast merchant onboarding and broad distribution. It also seamlessly integrates with eCommerce platforms and POS systems, thus enabling businesses to deliver financing to customers wherever they shop: online, in-store, or across omnichannel touchpoints.

What’s more, ChargeAfter combines bank-level security with built-in compliance features to ensure safe handling of sensitive financial data.

Plus, it grants merchants access to detailed transaction data and portfolio insights so as to make it easier for them to track performance, identify opportunities, and optimize lending strategies.

Conclusion

White-label lending platforms stand out because they cut down development costs, speed up time-to-market, and provide businesses with reliable infrastructure. At the same time, they offer flexibility to configure loan products and embed compliance and security features, allowing teams to focus on strategy, customer experience, and growth rather than technical maintenance.

When evaluating different white-label solutions, it’s worth putting customization capacity, scalability, data security posture, and vendor support at the top of your priority list. Also, pay close attention to how well the system can integrate with your current workflows and systems since seamless connectivity will save countless hours down the road.