Small and medium-sized enterprises (SMEs) hold in total 99.8% of businesses in the European Union and 99.9% in the USA, meaning they make up the overwhelming majority of the global business landscape. Their dominance reflects the critical role SMEs play in creating jobs, bringing new ideas, and strengthening economic resilience worldwide.

Yet, both small and medium businesses commonly face big challenges when trying to get loans or credit. Many don’t have enough collateral or a long credit history, which makes banks see them as risky. The application process is usually complicated and requires lots of paperwork, and approvals can take weeks, which is too slow for urgent needs. Even when they get approved, interest rates are often high, and the terms can be strict. On top of that, confusing rules and unseen payments make borrowing risky, and businesses, especially in rural areas, have even fewer options.

Lending software for medium and small businesses are able to tackle these challenges, make daily work easier, lower risks, and give customers a better experience through providing all-in-one services, from applying for a loan to organizing payments and keeping track of reports.

In this article, we consider the five best SME lending platforms in 2026, each with verified features and an overview of their advantages, weak sides, and ideal consumers.

Key Takeaways

- SMEs dominate the global economy, but access to financing remains a major challenge due to slow approvals, strict requirements, limited credit histories, and lack of transparency.

- Speed, transparency, and access are the three core benefits of modern SME lending software, with approvals often taking hours instead of weeks and decisions based on real business data, not only credit history.

- Choosing the right platform depends on your strategy, not just features.

Why SME Lending Platforms?

In the best SME lending platforms, modern tools, connected services, and easy-to-use design are combined. From the first application through approval, loans are automated by loan origination SME software.

Loan servicing SME software takes over after the money is disbursed. It handles interest and payment calculations, manages repayment schedules, processes late payments and collections, and provides reporting and analytics.

With lending software, medium- and small-sized businesses address three big challenges:

- Speed: loans are processed in minutes and hours, not weeks

- Transparency: every step of the process is visible and trackable

- Access: businesses can get funding even if they have thin credit files

By 2033, the digital lending platforms market is going to surpass USD 39.8 billion by 2033, exhibiting a CAGR of 11.85%. Contemporaneously, the European digital lending platform market is reaching USD 10.2 billion by 2033 with a CAGR of 19.58%. It proves that digital lending is no longer viewed as a short-term trend but is becoming a foundation of future finance.

Best SME lending platforms: Detailed Overview

Lending software for medium businesses makes it easy to handle both loan origination and servicing. They offer speed, smart use of data, and strong integrations with other systems. The right choice depends on the existing market, company size, target audience, and how much control over the lending process is needed.

HES LoanBox

HES LoanBox is a cloud-based lending platform that helps lenders manage every stage of a loan—from application and credit checks to servicing and collections—in one system. It’s developed by HES FinTech, a provider of ready-to-deploy lending technology.

Ideal for: Banks, fintech lenders, and non-bank institutions offering business loans.

Major attributes

- Online sign-up through borrower portals with automatic identity and compliance checks

- Easy application process with e-signatures and built-in document handling

- Flexible loan management with task tracking and customizable document templates

- Robust collection module with automated disbursement, repayment workflows, dynamic schedule management, and omni-channel notifications

- Smart credit scoring available through integrating an AI-powered GiniMachine engine (if chosen)

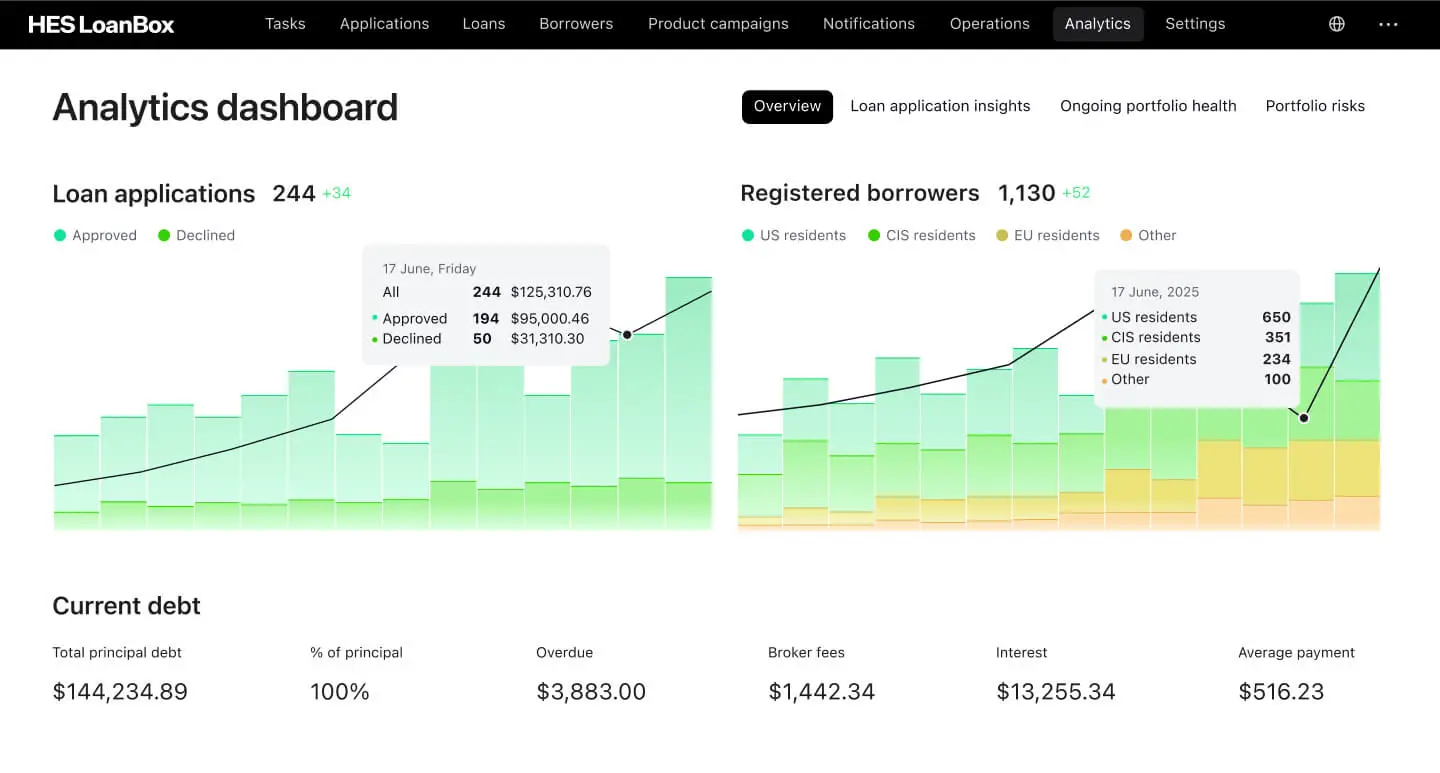

- Advanced analytics: 20+ interactive dashboards for insights-driven decision-making

- Built-in security and compliance with ISO/IEC 27001, SOC 1, and SOC 2 certifications

- Open APIs for embedded lending and third-party integrations (credit bureaus, open banking, fraud-prevention tools)

Main advantages

- Covers the entire lending cycle in one place

- Has high configurability and modularity, with the option to set up an end-to-end product or integrate selected microservices

- Fast implementation (typically 3–5 months)

- Possibility to obtain developer license that eliminates vendor lock-in

Main considerations

- Customization is needed to match local regulations and data sources

- Pricing fits mid-size and large lenders better than small institutions

Pricing

Available upon request

Demo

A free demo with a team representative is offered upon request on the website.

Rating

Capterra – 4.8 / 5

Summary

A powerful and highly configurable lending platform designed for lenders who want to digitize the entire credit lifecycle, automate decisioning and servicing, ensure compliance, and scale new lending products quickly, without building everything from scratch.

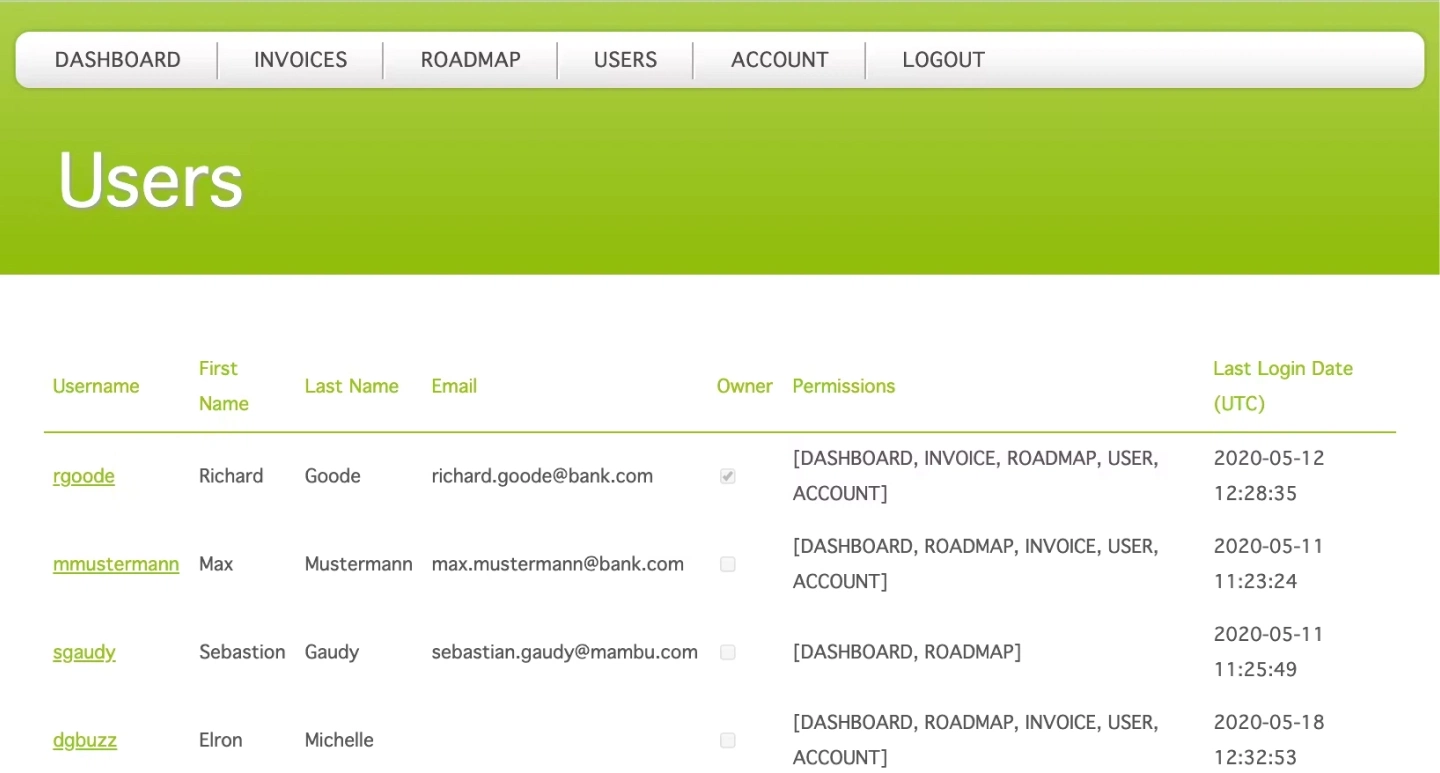

2. Mambu

Mambu is a SaaS cloud-native banking platform built for flexibility and scale. Its modular setup allows lenders to assemble their own financial products, including SME lending solutions.

Ideal for: Banks, fintechs, and digital lenders operating across different markets.

Major attributes

- Composable modules for loans, deposits, core banking, and product management

- Open API architecture for seamless integration with external systems

- Real-time processing and portfolio oversight

- Multi-currency and multi-country support

- Built-in compliance and security elements (including adherence to ISO 27001, SOC 1, and SOC 2 certifications)

Main advantages

- Very flexible for designing custom financial products

- Cloud-native structure that grows with business needs

- Faster time-to-market for new offerings

Main considerations

- Requires technical expertise for setup and API-based integrations

- Usage-based pricing can increase with transaction volume

Pricing

Varies by region and usage.

Demo

Available on request via Mambu’s website.

Rating

G2 – 4.4 / 5 | Capterra – 4.3 / 5

Summary

A modern platform suited for innovative lenders who need a scalable, composable system to build and expand financial products.

QUALCO Loan Manager

QUALCO Loan Manager helps oversee and service loans after they are given out. Banks and loan companies use it to handle big loan portfolios or loans that are hard to collect.

Ideal for: Institutions managing large portfolios

Major attributes

- Full servicing modules across the loan lifecycle

- Advanced tools for restructuring, recovery, and workout strategies

- Automation and AI-based insights for collections and optimization

- Data-driven collections optimization using ML

- Open-API design for smooth integrations

Main advantages

- Suitable for back-office operations and collections

- Supports many loan types: consumer, SME, corporate, mortgage, BNPL

- Both cloud and on-premise deployments are possible

- Strong capabilities for handling complex restructuring scenarios

Main considerations

- Limited origination and front-end lending features

- Implementation generally requires vendor involvement

Pricing

Custom pricing

Demo

Available on request

Rating

Few public software reviews are available.

Summary

A solid option for lenders needing a cloud solution for servicing, collections, and restructuring, supported by automation and compliance features.

American Express Business Blueprint (ex. Kabbage)

Kabbage started as a fintech offering fast credit lines to small businesses. After joining American Express, it now operates as 'Business Blueprint,' providing working capital loans and financial tools for U.S. small businesses.

Ideal for:

Small businesses, freelancers, and online sellers looking for quick access to funds.

Major attributes

- Business lines of credit up to $250,000

- Fast digital application and approval with no origination fees

- Cash-flow dashboard with linked accounts for real-time insights

- Extra tools for invoicing, payments, and expense tracking

Main advantages

- Combines lending, banking, and cash flow management in one platform

- Uses linked account data for smarter credit decisions

- Offers flexible repayment terms (6–24 months)

Main considerations

- Higher cost of capital: interest rates and fees can be higher than those offered by traditional banks, especially for riskier borrowers

- Data dependency: eligibility depends on linking financial accounts and platforms

- Limited international reach, as services are mainly available to US-based businesses

Pricing

Depends on loan amount and business profile.

Demo

Online credit application (software demo not provided).

Rating

Not rated on G2 or Capterra (financial service).

Summary

A good option for U.S. small businesses that need quick working capital through a trusted brand, with the benefit of built-in financial management tools.

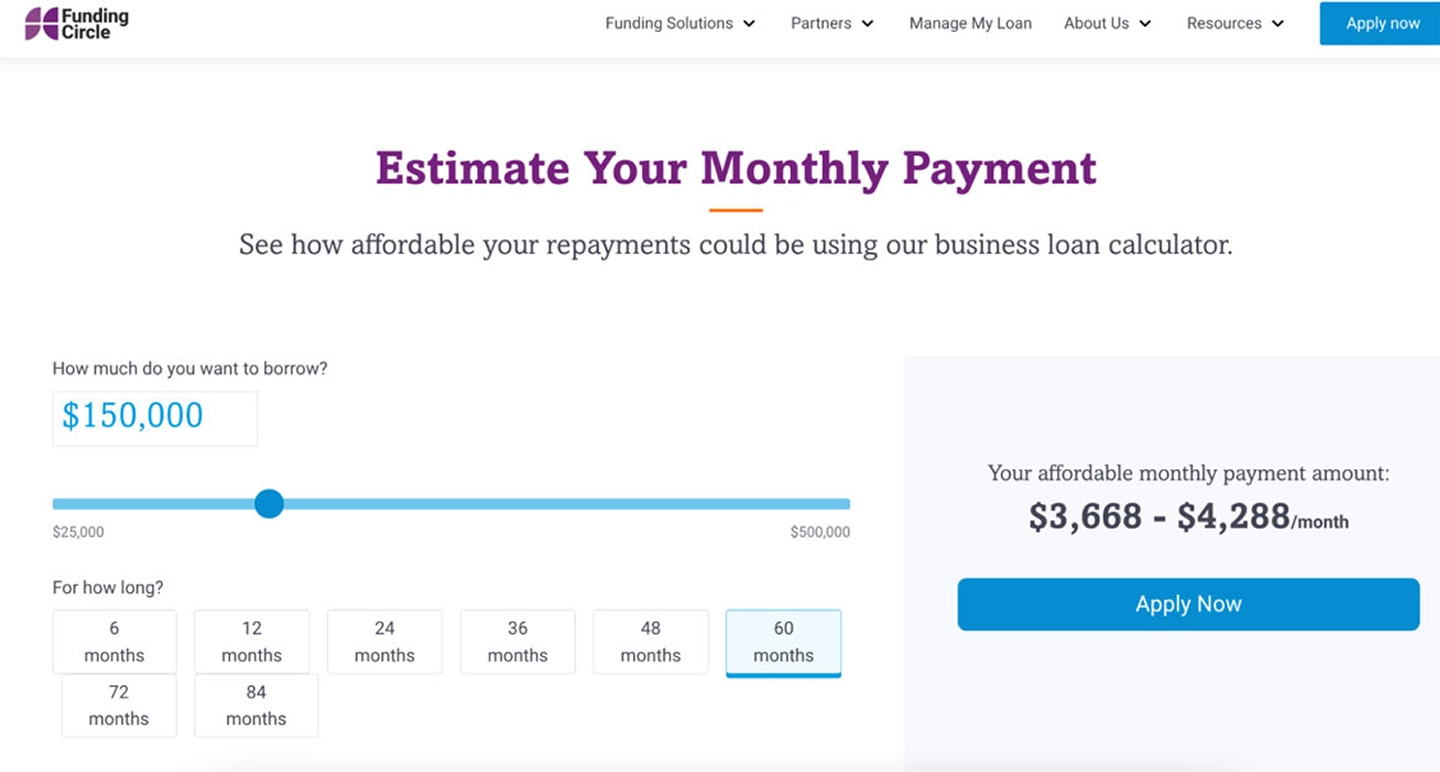

Funding Circle

Funding Circle connects small businesses with institutional investors. It simplifies SME lending through data-driven underwriting and a fast digital process. It offers term loans, revolving credit, and business credit cards backed by data-driven credit assessment.

Ideal for: Small and medium businesses, investors, and institutions funding SME loans.

Major attributes

- Fast online loan applications and decisions

- Advanced credit scoring and analytics

- Term loans and working-capital finance

- Marketplace model enabling investor-backed lending

Main advantages

- Strong track record and large lending volume

- Fast processing (automated initial decisions in 6 minutes)

- Transparent application loan process

- Access to institutional funding pools

Main considerations

- Terms and availability differ by country (check local/regional presence)

- Best suited for standard business loans, not microcredit

- Origination fees apply. Rates and terms may differ from traditional bank lending

Pricing

Rates depend on region and borrower profile.

Demo

A demo online loan application is available.

Rating

Limited software reviews (service model).

Summary

A consistent choice for SMEs looking for business loans with transparent terms and quick turnaround. If you are outside the USA, check local availability and product terms.

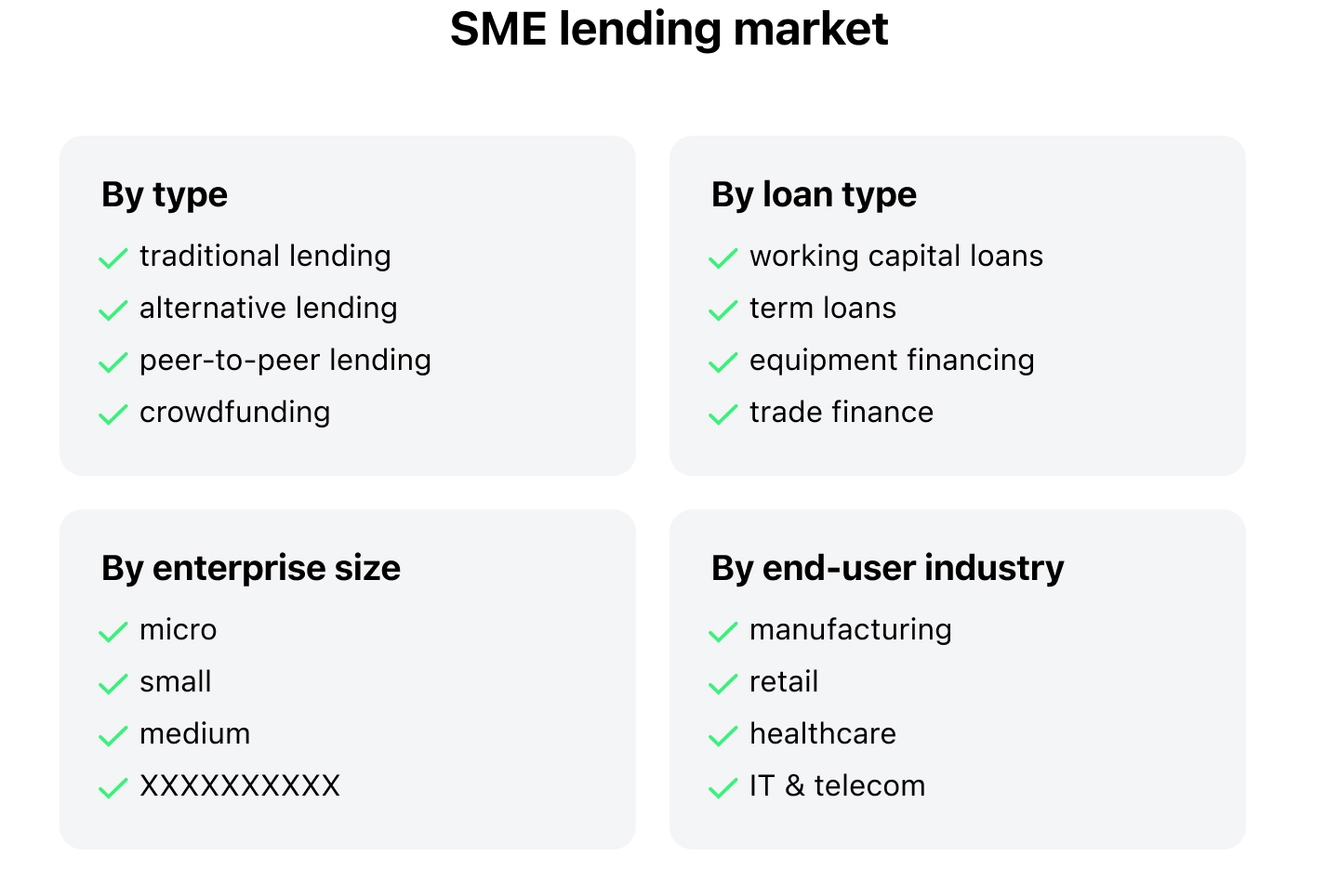

What Are the Types of SME Lending Software

SME lending software supports various lending models, loan types, business sizes, and industry needs. These platforms are divided into a few main categories.

By Lending Type

- Traditional lending platforms are made for banks and regulated financial institutions. They focus on structured credit processes, compliance, and risk management.

- Alternative lending platforms are built for fintech lenders. They offer faster, data-driven credit decisions and flexible underwriting models.

- Peer-to-peer (P2P) lending systems let investors lend directly to SMEs. These systems include tools for assessing borrowers and managing investors.

- Crowdfunding platforms help SMEs raise funds from groups of contributors. They often include features for managing campaigns and guaranteeing compliance.

By Loan Type

- Working capital loan systems help with short-term financing and offer flexible repayment schedules.

- Term loan platforms manage long-term loans and can offer fixed or variable repayment plans.

- Equipment financing software is used for asset-backed lending. It includes features like equipment valuation and tracking the equipment’s lifecycle.

- Trade finance solutions help finance cross-border trade, invoices, and supply chain transactions.

By Enterprise Size

- Micro-enterprise lending systems are lightweight platforms that provide easy onboarding and automated decisions.

- Small business lending platforms combine automation with customization to support growing businesses.

- Medium enterprise lending solutions provide advanced risk assessment, analytics, and management of multiple loan products.

By End-User Industry

- Manufacturing platforms support financing for asset-heavy businesses and help manage longer cash conversion cycles.

- Retail platforms focus on inventory financing and handling large numbers of transactions.

- Healthcare platforms address regulatory requirements and manage specialized cash flow structures.

- IT and telecom platforms deliver flexible financing models for fast-growing, service-based businesses.

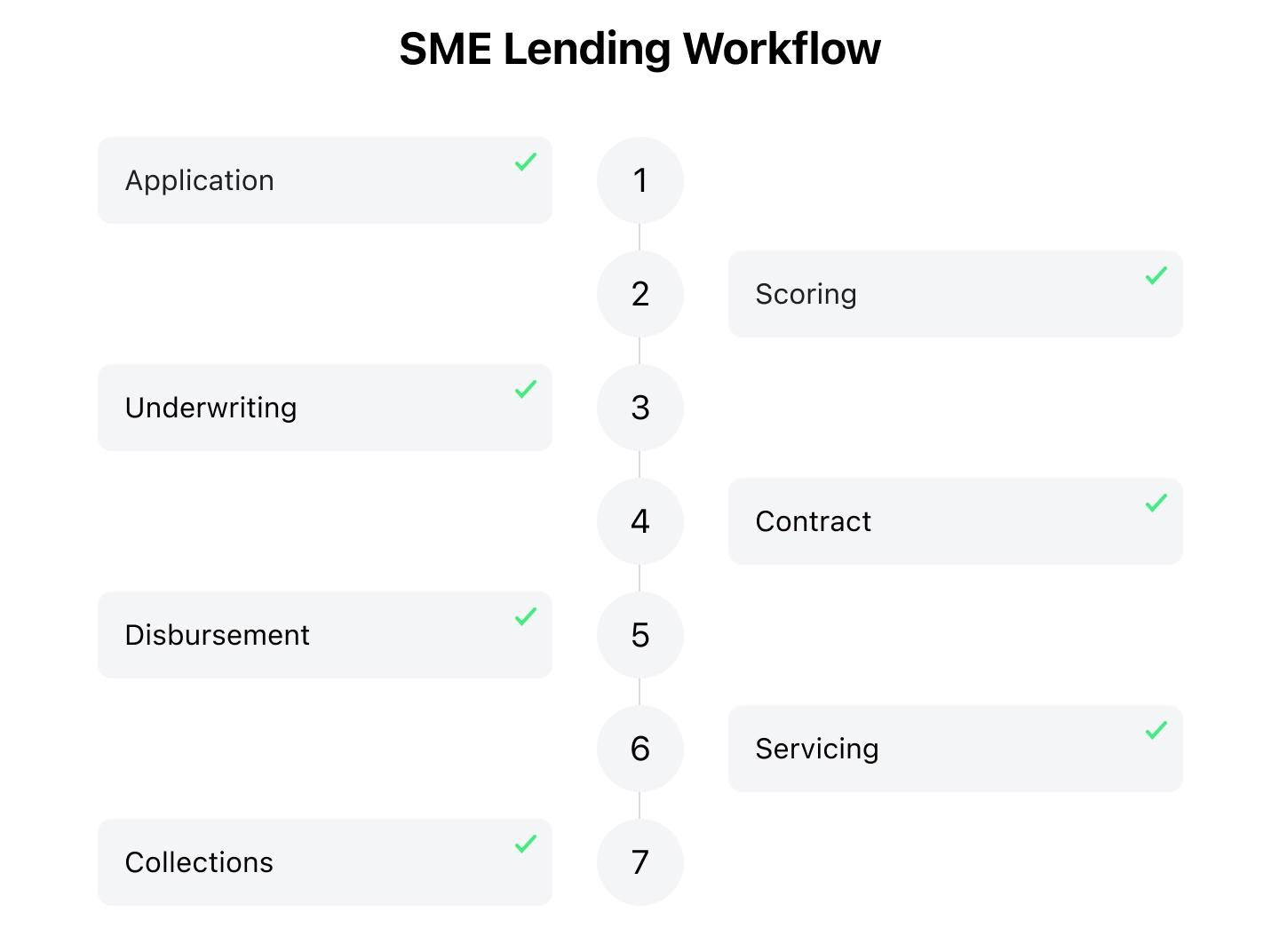

How SME Lending Platforms Work

Regardless of the type, all advanced SME lending platforms cover the main steps of the lending process, either as a full-stack solution or as independent modules integrated into an existing architecture.

At the top of the flow, platforms handle application intake, capturing and validating borrower and business data via APIs or UI components.

This is followed by scoring and underwriting, where credit policies are executed using rule-based logic, external data integrations, and, in some cases, manual review workflows.

Once a decision is made, platforms support offer generation and contracting, including terms configuration, document generation, and e-signature flows.

After contract execution, disbursement and servicing modules manage payouts, interest calculations, repayment schedules, and lifecycle events such as early repayment or restructuring.

Finally, collections and recovery functionality tracks delinquencies, triggers collection actions, and maintains audit-ready activity logs.

Capabilities such as reporting, access control, and integrations usually span all stages to guarantee operational continuity throughout the loan lifecycle.

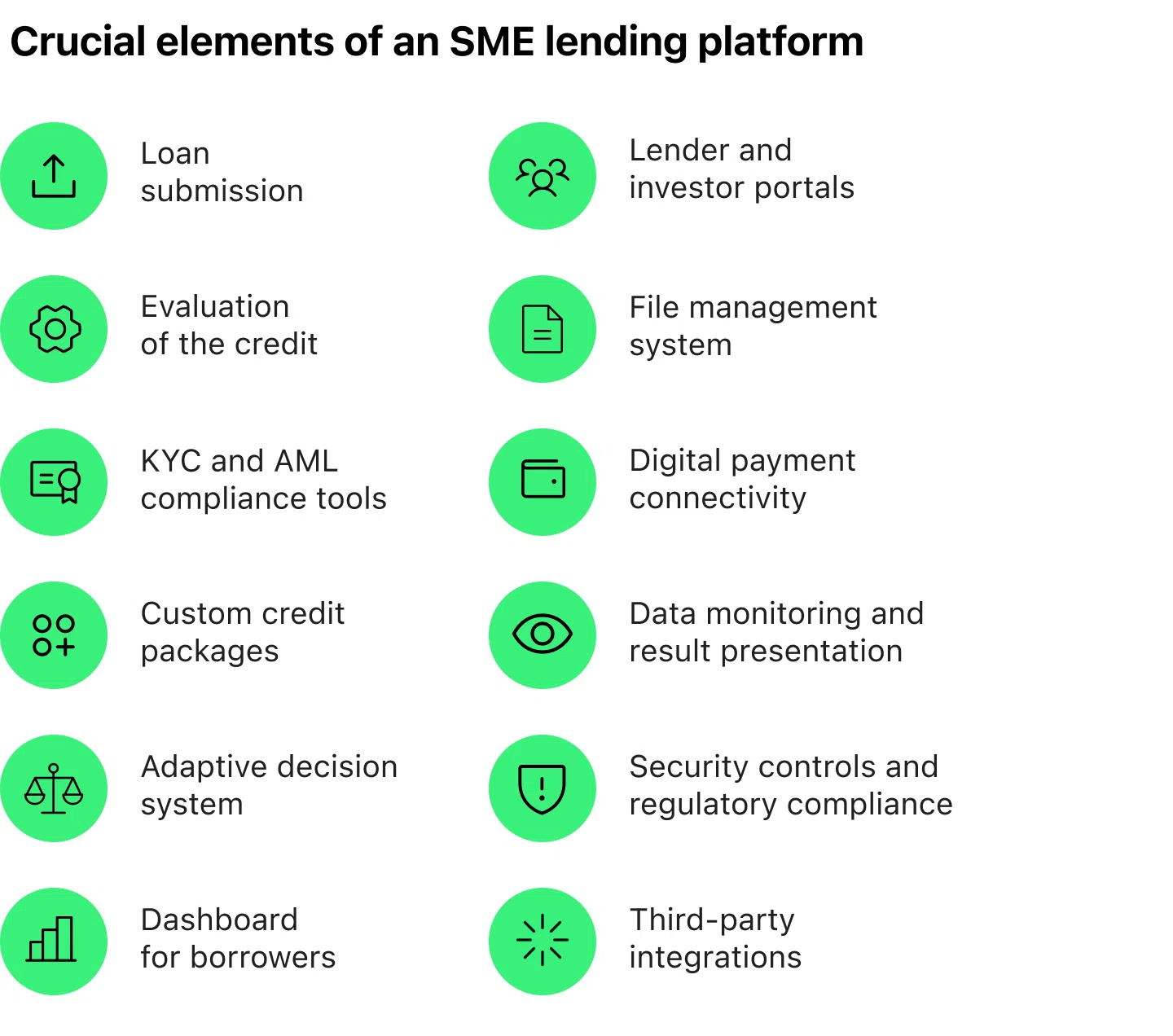

Crucial Elements of an SME Lending Platform

A well-built SME lending system is generally created to manage the full lending journey. This covers onboarding new clients, verifying their financial reliability, overseeing loan activity, meeting regulatory standards, and data analysis.

The following available functionality defines a well-developed platform:

1. Loan submission

- Easy-to-fill-in forms

- Accessibility from any device

2. Credit scoring

- Insights from alternative data sources (e.g., cash flow, invoices, e-commerce activity) to evaluate creditworthiness

- Integration with accounting software, bank feeds, and credit bureaus

3. KYC and AML compliance tools

- Built-in identity verification (e.g., biometric checks, document upload)

- AML screening and fraud detection

4. Custom credit packages

- Shifting interest rates, flexible installment structures, and bespoke collateral settings

- Dynamic loan rates, versatile payment arrangements, and configurable security settings

5. Adaptive decision system

- Electronic loan review powered by AI and ML technologies

- Responsive credit analysis tools suited to SME profiles

6. Dashboard for borrowers

- Loan progress monitoring, payment timetable, and file handling

- Reminders for payment dates, confirmations, and payouts

7. Lender and investor portals

- For platforms using peer-to-peer or marketplace models

- Tools for portfolio management, risk analysis, and performance tracking

8. File management system

- Safe file upload, protected storage, and easy access to financial records

- Digital signature support for flawless signing of the agreement

9. Digital payment connectivity

- Automated disbursement and repayment via bank transfers, cards, or digital wallets

- Support for recurring payments and early repayment options

10. Data monitoring and result presentation

- Insights for both borrowers and lenders (e.g., money movement patterns, loan usage)

- Legal and fiscal reporting systems

11. Security controls and regulatory compliance

- Secure encryption protocols for information handling

- Alignment with regional and industry-specific data protection standards

- Audit trails and activity logs for transparency

12. Third-party integrations with:

- Open banking APIs (Plaid, Tink, TrueLayer, Salt Edge)

- Payment processors (Stripe, PayPal, Square, Adyen)

- Accounting and ERP systems

- Credit bureaus and risk data providers

- E-commerce and marketplace platforms

- Tools for analytics, reporting and monitoring (Power BI, Tableau, Looker, Amplitude)

Best SME Lending Platforms Compared

| Platform | Type / Focus | Users | Major attributes | Main advantages | Main considerations |

|---|---|---|---|---|---|

| HES LoanBox | Full lending system (from application to collections) | Banks, fintechs, SME lenders | Digital onboarding, automated checks, optional AI scoring, servicing and collections, secure cloud | Complete end-to-end system; quick setup; strong borrower experience | Requires local customization; pricing better for mid-large lenders |

| Mambu | Composable cloud banking/ lending platform | Banks, fintechs, neobanks | Modular loan and deposit management, real-time data, open APIs, multi-currency | Flexible, scalable, fast product creation | Requires technical expertise; usage-based pricing can grow |

| QUALCO Loan Manager | Loan servicing and portfolio tool | Banks, loan servicers | Servicing, restructuring, collections automation, analytics | Great for back-office and complex portfolios | Limited origination features; vendor-led implementation |

| American Express Business Blueprint | Automated SME credit lines | U.S. small businesses, e-commerce sellers, freelancers | Data-based underwriting, fast credit lines, cash-flow dashboard, invoicing and payment tools | Quick funding, uses real-time business data, and easy to apply | U.S.-only; potential higher fees; operates under American Express |

| Funding Circle | SME loan marketplace | SMEs, investors | Term loans, risk scoring, digital application, investor funding | Proven platform; large-scale, quick loan decisions | Availability varies by country; less suited for microloans |

Further Insights Based on the Comparison

The comparison table shows that each lending platform focuses on a different part of the SME lending process.

HES LoanBox offers the widest coverage of the full lending cycle, from onboarding to collections, making it suitable for lenders who want an all-in-one system or opt for specific microservices. Its strength is high configurability and modular system quick setup, and an AI-supported scoring engine for various lending tasks, but smaller lenders may find the price high or need local adjustments.

Mambu stands out for flexibility. It lets lenders build and change products easily, thanks to its modular design and strong APIs. This works well for teams with technical skills, but the setup may be harder for those wanting something ready out of the box.

QUALCO Loan Manager specializes in servicing, restructuring, and collections. It is a solid choice for lenders handling large or complex portfolios, though it lacks origination features and usually requires pairing with another system.

American Express Business Blueprint focuses on automated credit for small businesses and freelancers. It is fast, data-driven, and simple to use, but it operates mainly in the U.S. and can be costlier than traditional lenders.

Funding Circle provides a large SME loan marketplace that connects borrowers with investors. It is known for quick decisions and proven scale, but availability is limited to certain regions, and it is less suited for very small loans or highly specialized lending.

How to Сhoose the SME Lending Platform That Fits Your Business

Here is a checklist to help you decide which SME lending platform is right for your business:

Functional coverage

- Does the platform handle the complete loan process: signing up, checking credit, underwriting, managing repayments, compliance, reports, collection, etc., or does it offer specific modules?

- Can it offer the variety of loans you need: working capital loans, invoice financing, and equipment loans?

- Is the platform available on web, mobile, and through APIs?

Risk management and credit scoring

- Does it use smart credit checks with the help of advanced models and extra data like bank transactions or sales history?

- Is there fraud protection: spot fraud instantly during sign-up and payment?

- Flexible risk handling: Can it change interest rates based on risk level or macrofinancial factors?

Compliance and security

- Does it meet legal requirements and industry standards: AML, KYC, GDPR?

- Is data safety provided: is all data encrypted and stored securely?

- Does it keep full logs for reporting?

Integration

- Can it link to banks for account checks and transfers?

- Does it have accounting tools like QuickBooks, Xero, or ERP systems?

- Can it automate repayments?

User experience

- Is the application process simple for SMEs and available in multiple languages?

- Can users track loans, see payment schedules, and get financial tips?

- Does it offer support: chatbots and real human help?

Analytics and reporting

- Is it possible to see default rates, recoveries, and profits?

- Does it have strong forecasting to predict risks and customer churn?

- Does it show cash flow and credit health?

Scalability and performance

- Is it cloud-based and can grow easily as your business expands?

- Does it run 24/7 with backup systems?

- Are decisions and payments processed quickly?

Cost and licensing

- Pricing model: Is it subscription-based or a one-time payment?

- Can you adjust workflows without huge costs?

- Are there hidden fees like extra charges for APIs or upgrades?

Vendor reputation

- Has the provider verified experience in working with SME lending before?

- Are there any case studies or references?

- Do they provide training and onboardings to help your team get started?

Conclusion

SME lending platforms clearly help small and mid-sized businesses get the funding they need with far less hassle. Firms can apply online, avoid long paperwork, and receive decisions much faster. These systems don’t rely only on credit history, but also take into account real business activity such as cash flow, sales, and invoices. This gives more companies a fair chance, even if their credit score is not perfect.

All five platforms reviewed above cover important stages of the lending process. Still, there is no single best SME lending platform, and the choice depends on many factors: whether your business needs a full end-to-end system or separate particular modules, how much customization is required, the country you operate in and its regulatory requirements, and the size and complexity of the loan work.