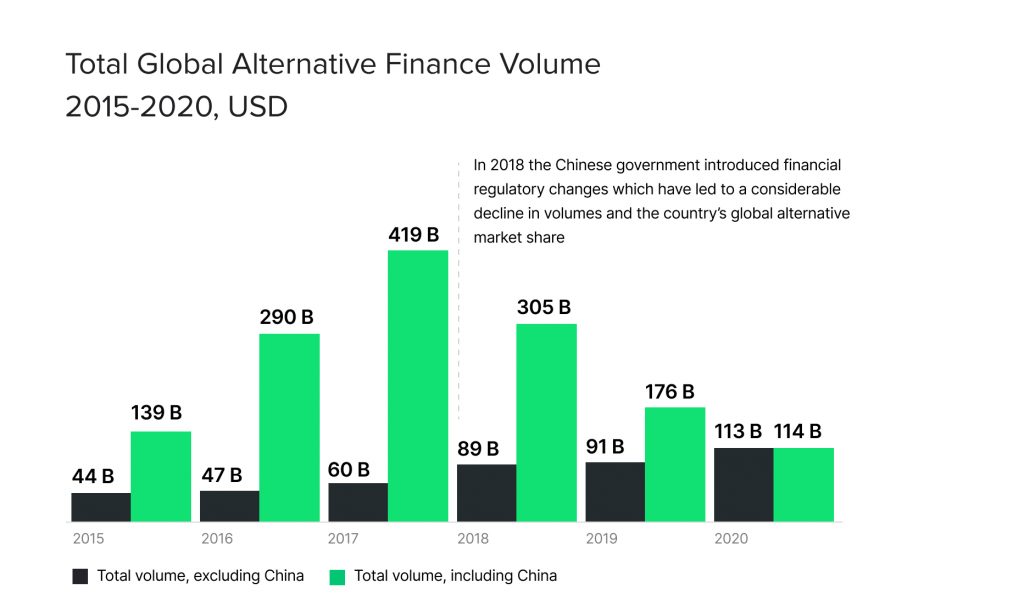

China has been known as the world’s largest online alternative finance market by transaction volume up until 2018. But local market developments, regulatory changes, and the Covid-19 crisis have led to substantial changes in its volumes and market share.

The 2nd Global Finance Benchmarking Report by the Cambridge Centre for Alternative Finance presents data from 2019 and 2020. The report covers data from 1,524 fintech located in the Americas, Europe, APAC, the Middle East and North Africa, and Sub-Saharan Africa. It’s aimed at providing a clear picture of the Covid-19 impact on digital lending and fintech around the world.

The HES team created a short review of the Global Finance Benchmarking Report to highlight the most significant points for the lending domain. Here are eight big takeaways we’d like to share with the community.

Read also

Alternative Finance Volumes Beat Global Records

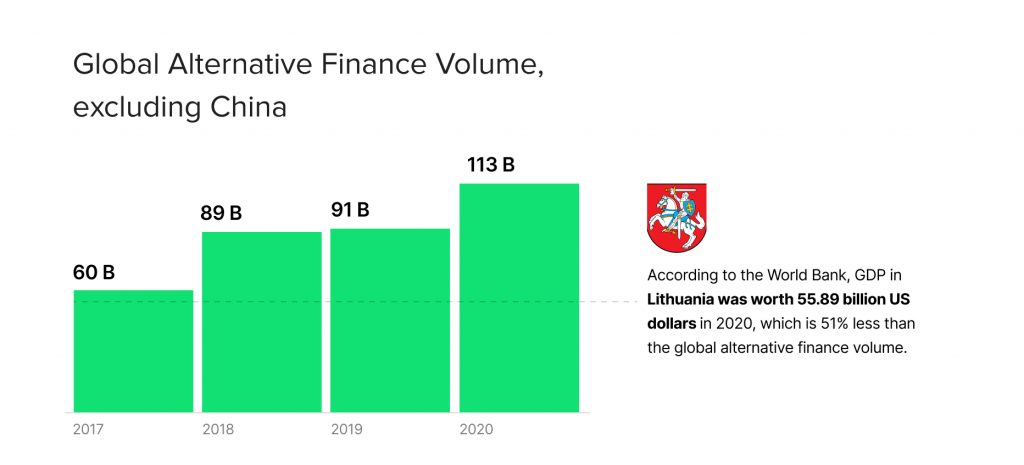

The conducted lending industry analysis proves that the global alternative finance market, excluding the Chinese, shows strong growth results having doubled its volume since 2017. The data shows that alternative finance reached a record high of $113 US billion in 2020.

As stated in the lending industry report, alternative finance volumes raised by businesses increase by 51% year-on-year to record $53 billion in 2020; increasing the share of alternative finance volumes raised by businesses from 38% in 2019 to 47% in 2020. Considering the impact of lockdowns on the world economy, the significant growth seems encouraging.

China Weaken Positions in Digital Market

China dominated the global online alternative finance market up until 2018. Since the introduction of regulatory changes in 2018, the prominence of the Chinese lending marketplace has decreased. In 2017 China accounted for 86% of the total market. For comparison, in 2019 the country accounted for 48%, and in 2020 for less than 1% of the global volume.

USA and Canada Take Over the Volume

In 2020, the United States and Canada are recognized as the largest regional alternative market with a $73.93 US billion share. While the US is the largest national market with $73.62 US billion, which accounted for 65% of global online alternative finance market volume. The country is followed by the United Kingdom with $12.64 billion, Europe excluding the UK with $10.12 billion, China ($1.16 billion), and others.

Alternative Lenders Remain Skewed towards Banked Customers

Considering the banking status of borrowers, alternative lenders still prioritize already banked individuals and customers. The number of underbanked customers of P2P and Balance Sheet Business Models is 25% and 20%, respectively. Lenders focusing on business clients have a higher proportion of underbanked borrowers - about 30% for P2P, 27% - Balance Sheet Business Lending and 27% - Invoice Trading. The only exception is Microfinancing with 72% of clients categorized as unbanked, and 27% as underbanked.

SME Business Benefit from Alternative Lending the Most

Small and medium-sized businesses actively appeal to alternative lenders for funding needs. In 2020, 47% of alternative finance activity went to SME borrowers, issuers, and fundraisers. Debt-based models make up the majority of activity - around 94% of the total.

Analyzing per region, the highest rate of SME financing via alternative lenders was recorded in the United States - $32 US billion, the United Kingdom - $6.4 US billion, and Europe - $5.2 US billion in 2020.

Data prove that volumes going to SME businesses and startups are on the rise and seem to be a long-lasting funding source. What is critical during crises like Covid-19 in overcoming issues with business operations and cash flows.

Low Participation Rates across Female Fundraisers and Funders

Female market participation widely differs across finance models. However, the research shows that women tend to participate at a significantly lower rate (below 40%) than men as both funders and fundraisers.

Considering debt and equity-based models, eight of eleven models reported catering to a lower percentage of female fundraisers in 2020, with P2P/Marketplace consumer lending reporting the largest drop in the share of female fundraisers from 61% in 2019 to 35% in 2020. While donation-based crowdfunding reports the highest number of female fundraisers at 63% of the total.

As for female funders, the rate is below 50%. In debt and equity-based models, women accounted for around 25% of funders. They represent only a third of funders on P2P marketplace consumer and property lending markets.

The highest share of female funders and fundraisers was in the UK - 43% and 54%, respectively.

Read also

Change in Regulations is the Greatest Potential Risk

When considering key risks to platform operations and customer services, the greatest concern of respondents is associated with risks of changes in regulations (what already damaged the Chinese alternative market). Statistically, 50% of P2P, consumer lending firms, and balance sheet consumer lending perceived this to be high risk.

Other risks respondents share worries about were customer fraud, notable increases in defaults, cyber-security breaches, and the emergence of BigTech activity. P2P / Marketplace property lending (42%) consider customer fraud as a major concern.

Implemented Regulations are Largely Deemed Adequate

The researchers note that over a half of platforms across all business models in the USA, UK, Europe, and the Asia-Pacific Region excluding China perceived regulations in their jurisdictions to be adequate and appropriate. In the UK and USA, over 70% of platforms consider regulations to be appropriate. Overall, consistent dissatisfaction with regulations in 2019 and 2020 was especially evident in Sub-Saharan Africa.

Read the full lending industry report here:

THE 2ND GLOBAL ALTERNATIVE FINANCE MARKET BENCHMARKING REPORT

Want more lending reports and insights? Find out trending topics in our company’s blog and subscribe to our email updates.