Before the introduction of RPA in lending, financial operations were weighed down by clunky manual processes. Teams spent countless hours re-entering data, shuffling documents between departments, and chasing approvals. All of this resulted in delays for customers, higher costs for financial institutions, and plenty of frustration on both sides.

But the adoption of RPA has significantly changed that picture. With software bots taking over repetitive rule-based work, loans can now be processed with far greater speed, fewer errors, and improved reliability. Employees, in turn, are freed up to focus on tasks that demand judgment and strategic thinking instead of routine busywork.

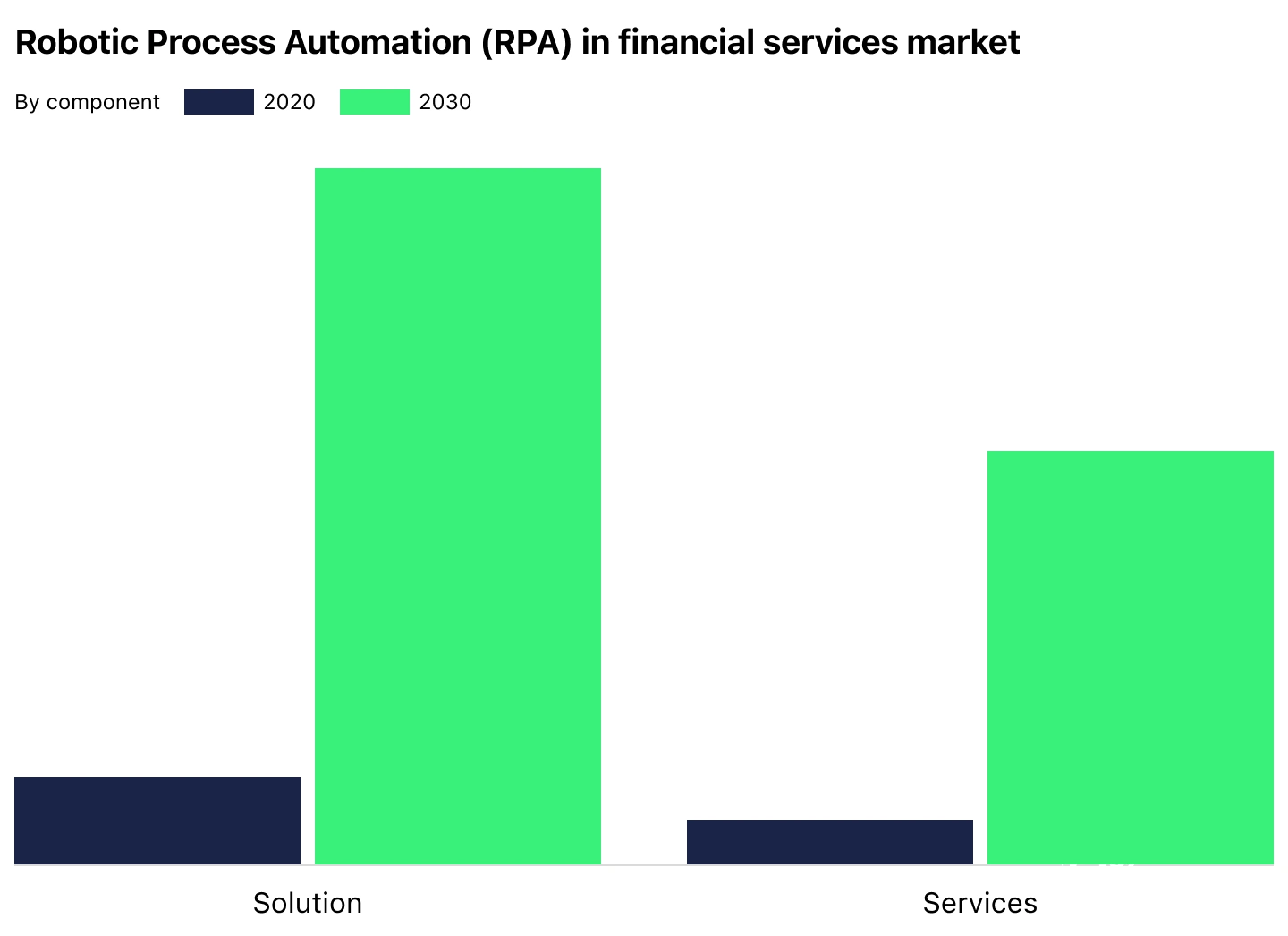

With such benefits, it’s no surprise that the global robotic process automation in financial services market is surging and is projected to surpass $4,883.41 million by 2030. And within this growth, lending processes are among the areas where automation delivers some of the most immediate and measurable impact.

In this article, we’ll look at how exactly RPA is transforming lending, the benefits it delivers, and the most prominent RPA use cases in lending.

What Is an RPA in Lending?

Robotic process automation in lending refers to the use of specialized software bots that can handle routine and rule-based activities across the loan lifecycle.

These bots can overtake a range of lending tasks, including but not limited to:

- Reviewing and extracting data from loan applications, credit reports, and income verification forms

- Assisting with customer verification and onboarding

- Streamlining and accelerating data entry.

Unlike humans, though, RPA bots are capable of executing these operations much faster, with far fewer errors and no fatigue.

What makes today’s RPA systems even more powerful is their growing integration with artificial intelligence and analytics.

According to Gartner’s 2024 survey of finance leaders, 44% of finance functions are now using intelligent process automation that blends RPA with AI to drive higher efficiency, more consistent accuracy, and broader operational impact.

Key Problems That RPA in Lending Helps Solve

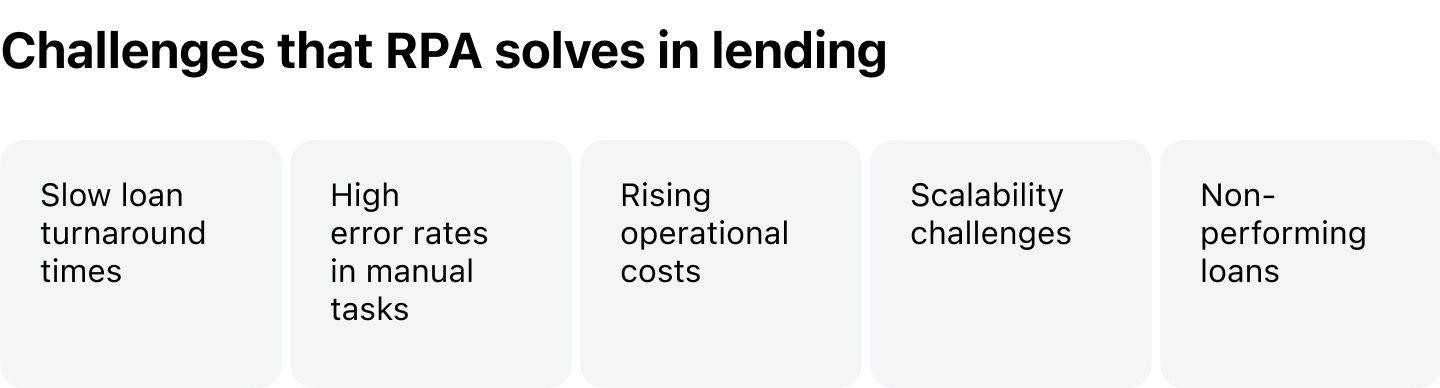

By using robotic process automation in lending, financial organizations are able to overcome some of the most pressing operational challenges.

- Slow loan turnaround times—RPA automates data entry, document validation, and approvals, thus enabling applications to move from submission to decision much faster;

- High error rates in manual tasks—Bots follow predefined rule-based workflows, which substantially reduces human error and allows for more reliable outcomes;

- Rising operational costs—Automation RPA allows larger workloads to be processed without extra hiring, helping institutions reduce costs and achieve significant cost savings;

- Scalability challenges—RPA allows institutions to flex operations up or down depending on loan demand and maintain efficiency even during spikes;

- Non-performing loans—By automating credit checks and risk monitoring, RPA enhances decision accuracy and reduces exposure to risky borrowers.

What Are the Benefits of Using RPA in Lending?

| Benefit | What it means for business |

|---|---|

| Faster loan processing | Speeding up approvals enables faster decision-making and delivers borrowers the quick responses they expect |

| Improved accuracy and reliability | Reliable and error-free workflows ensure lending decisions are based on clean and consistent data |

| Significant cost savings | Automation reduces overhead while reallocating staff toward higher-value and revenue-generating work |

| Enhanced customer experience | Smooth onboarding, quick responses, and transparent updates increase customer loyalty and trust |

| Greater employee productivity | RPA makes it easier to adapt to fluctuating lending volumes without costly staffing changes |

| Greater operational agility | Collaboration with automakers, insurers, and fintechs enhances growth and ecosystem strength |

| Long-term resilience and future readiness | Automated systems provide stability and are easier to update to changing regulations |

Using RPA in lending opens the door to a wide range of advantages, from faster processing time and significant cost savings to improving productivity and building greater operational agility.

Let’s explore each benefit in greater detail.

1. Faster Loan Processing

RPA in loan processing eliminates bottlenecks caused by manual data entry, document validation, and system updates.

Instead of waiting for staff to rekey information or shuffle paperwork between systems, bots complete these tasks much faster than manual processing ever could. This substantially speeds up the decision-making cycle and gives borrowers the quick responses that they expect.

2. Improved Accuracy and Reliability

Manual tasks in lending processes such as entering borrower details or validating supporting documents often leave room for errors that can delay approvals.

RPA, for its part, reduces these mistakes by applying rule-based checks, cross-referencing records, and keeping every step aligned with defined standards.

The outcome is a smoother and more dependable workflow where applications advance without unnecessary interruptions.

3. Significant Operational Cost Savings

Software bots process high volumes of applications around the clock and are capable of completing tasks much faster than human staff and at a fraction of the cost. Meanwhile, employees can shift their attention to higher-value work such as analysis, customer advisory, or new product design.

Over the long term, this smarter resource allocation will help lenders strengthen profitability and build more sustainable business operations.

4. Enhanced Customer Experience

In an industry where customer loyalty is fragile, delivering a frictionless lending experience can make all the difference – and RPA plays a key role here.

Automating backend operations such as loan status updates, document verification, and payment scheduling helps lenders provide faster responses and more accurate information. Plus, it shortens decision times, reduces errors and call volumes, and boosts customer satisfaction and NPS, thus creating a more effortless experience that builds lasting trust.

What’s more, combined with digital onboarding, this creates a more transparent and smoother journey that strengthens relationships and encourages long-term loyalty.

5. Greater Employee Productivity

As RPA takes over repetitive and low-value work, employees have the ability to focus on higher-level responsibilities such as credit analysis and relationship management.

This translates into greater efficiency as well as boosts morale, since employees feel that their skills are being put to meaningful use.

6. Better Operational Agility

Lending volumes tend to swing due to seasonal demand, economic cycles, or unexpected market events.

RPA provides institutions with the agility to scale operations up or down quickly, without the complexities of hiring, training, or downsizing teams. Software bots can absorb sudden surges in loan applications during peak periods and adjust when demand falls, thus keeping workflows stable and efficient.

7. Long-Term Resilience and Future Readiness

Adopting RPA is both about solving today’s inefficiencies and preparing for tomorrow’s challenges.

By automating and standardizing core lending processes, financial institutions make themselves less vulnerable to disruptions while staying adaptable to new technologies, customer demands, and changing regulations. In other words, financial organizations that adopt automation now are much better equipped to thrive amid future challenges and seize emerging opportunities.

Robotic Process Automation in Lending: Main Use Cases

Robotic process automation use cases in lending are wide-ranging and each directly tackles a long-standing operational pain point.

Let’s take a closer look at how exactly RPA automates various tasks crucial to the lending process and creates measurable business impact.

1. Loan Application Processing

The application stage is often where delays pile up, with staff rekeying the same borrower details into multiple systems. With specialized loan processing software, however, that workload disappears as the technology helps automate the entire loan processing cycle.

RPA bots capture and validate information in seconds, cross-check records, and even run parallel checks for credit and documents. This allows for an application process that moves forward without friction and frees customers from long wait times.

2. Customer Verification

Identity verification has always been a balancing act between compliance and convenience.

Instead of lengthy manual checks, software bots can instantly scan ID documents, compare them against official databases, and confirm eligibility. The outcome is a near-instant onboarding process that combines speed with accuracy, which gives customers a smoother start while enabling financial institutions to uphold stringent regulatory standards.

3. Fraud Detection and Monitoring

Fraud prevention is another area where automation delivers huge value.

RPA systems can integrate with authorized APIs and KYC tools, orchestrating data transfers to fraud detection engines and managing the workflows triggered by potential fraud signals.

Thanks to this, suspicious activity is flagged early on, and lenders have the time to react before fraud escalates.

4. Underwriting and Risk Assessment

Evaluating creditworthiness is very complex and time-consuming and requires heaps of data from bureau scores, income statements, and spending histories.

With RPA, all of that groundwork is automated. Bots streamline the underwriting process by standardizing inputs and organizing files before they reach underwriters. If the data is structured enough or additionally structured by AI, specialists then only need to focus on evaluating insights and exercising judgment rather than preparing data.

As a result, the underwriting process gets faster, more consistent, and more strategic in driving sound lending decisions.

5. Loan Disbursements

The final step of the lending journey is also one of the most critical – getting approved funds into the borrower’s hands.

Traditionally, this stage has been prone to delays due to manual payment initiation and back-and-forth system updates.

With RPA, disbursements become way faster. Bots trigger payments, sync records across loan management systems, and automatically send confirmations to customers. Importantly, every action leaves behind a digital audit trail, so the process gets faster, fully transparent, and compliant.

6. Customer Support

Not every borrower needs an agent on the phone to answer simple questions, and this is where virtual assistants come in.

Virtual assistants and chatbots integrated with RPA can instantly respond to queries, guide applicants through forms, and provide real-time status updates.

This kind of 24/7 support keeps customers engaged, reduces the workload on service teams, and allows for a better and more responsive lending experience.

Conclusion

Robotic process automation helps lenders optimize the entire loan cycle, from application processing and customer verification to fraud monitoring and loan disbursements.

RPA takes repetitive busywork off the table, reduces errors, and paves the way for greater efficiency, faster processing time, and significant cost savings. Thanks to this, employees can focus on higher-value activities like client engagement and financial analysis while customers benefit from quicker approvals and a more optimized experience.

With automation and intelligence at its core, it accelerates the loan processing cycle, enables automated credit origination, and delivers an exceptional borrower experience.