Estimated to be worth almost $30 billion within the next decade, the loan management system market is set to grow exponentially. Its predicted CAGR is 17.8% making it a fast-moving industry, and a point of focus for many traditional and new lenders. For those thinking of upping their digital transformation game, now is the perfect time to put in place a strategy to develop the features of loan management system and add new scope tailored to current and future market needs.

Loan management system overview: how it works?

A loan management system, or LMS for short, is a piece of software used by lenders to manage and track loans. Simply put, it automates the loan management process, including tasks such as loan origination, underwriting, servicing, and collection. In the past, traditional lending systems were used to manage these processes manually, which was not only time-consuming but required managers to manually collect and verify data, making mistakes a probability.

Although loan management systems have come a long way since their introduction, as the market is growing, companies are seeking to take advantage of the latest technology and upgrade their systems with the most recent loan management software features to get an edge over their competitors.

Essential modules in the loan management system

First things first, you need to know what an LMS does and what loan management system modules you need and don’t need for it to work. Let’s take a look at some of the key features of loan management systems as of today.

Client onboarding module

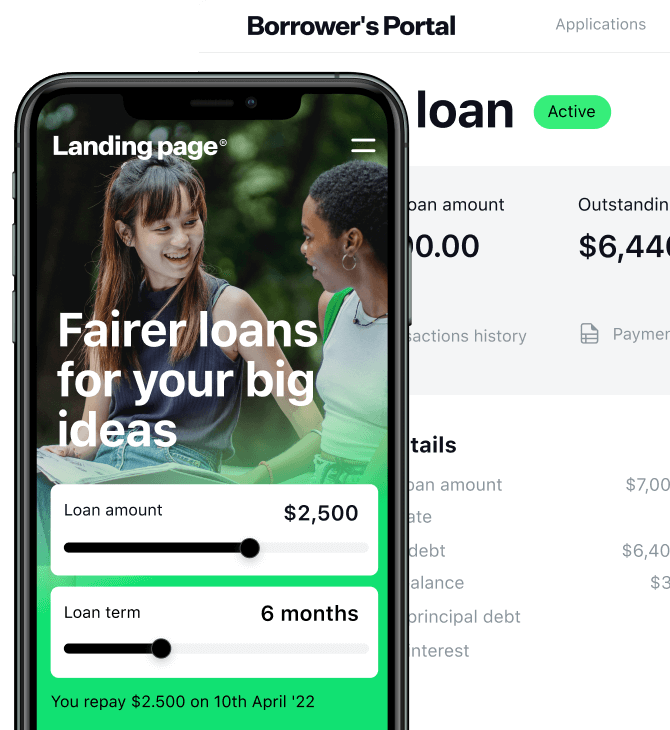

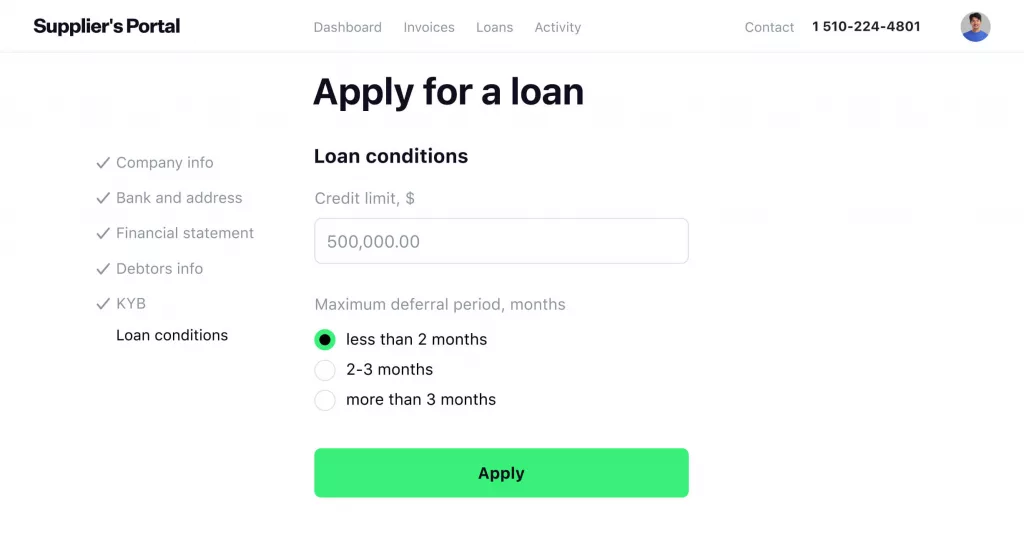

It’s a well-known fact that clients tend to drop off during onboarding the process isn’t as streamlined as possible. This is why onboarding—lending-related or not—is a key element of any successful piece of technology. When it comes to LMS, companies often seek a clear process available where the client can read the terms and conditions, add documents, verify with KYC, and more without any additional effort.

Loan Management Software Features to Invest in at the MVP StageSo much so that 40% of banks surveyed by McKinsey stated that digital KYC processes were already a part of their onboarding, while another 40% were in the process of making these changes. However, only 20% to date have managed to fully digitize the process. Automation at the onboarding stage needs to include auto signatures, KYC checks, and trackers for this documentation to ensure it is properly processed.

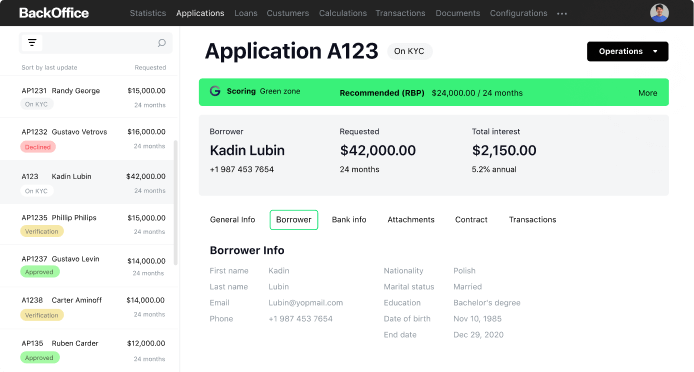

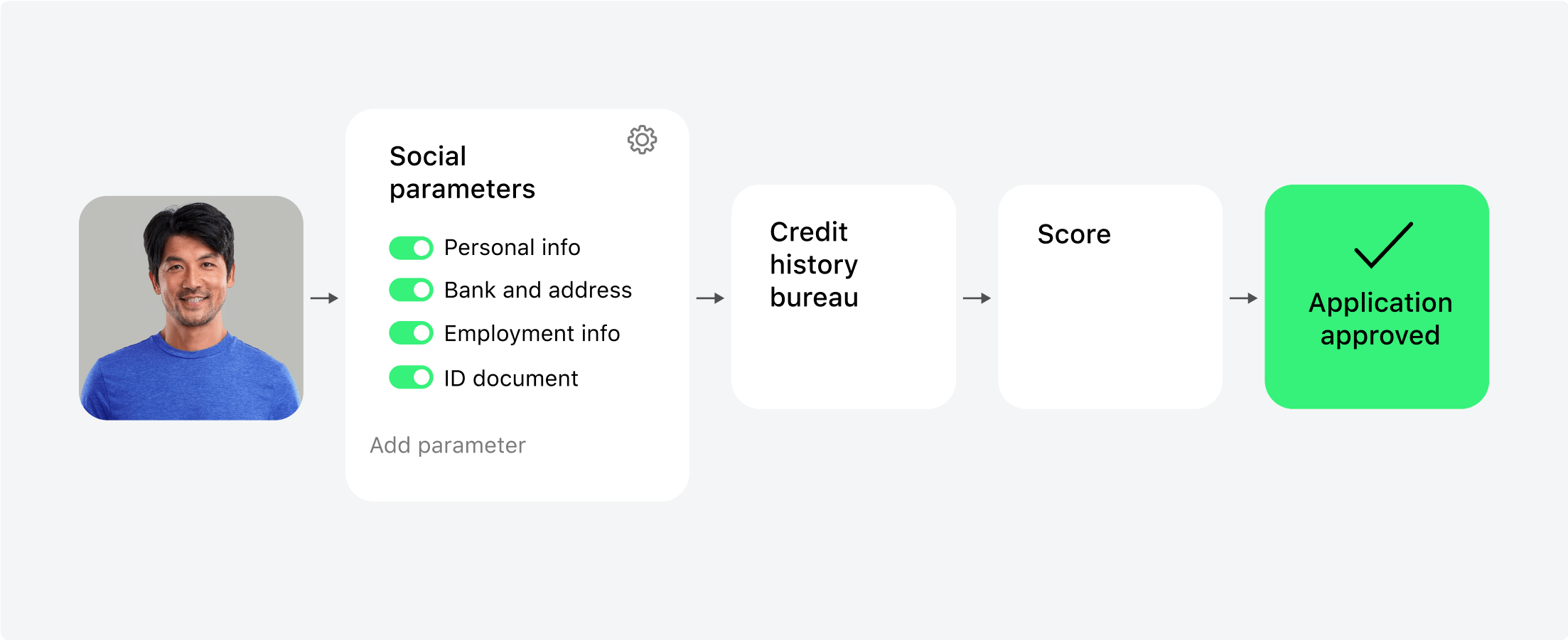

Application scoring process

Credit Scoring Integration: How to Upgrade Your Loan Origination SoftwareApplication scoring allows companies to review and consider loan applications in a more automated, digitized way. Loan scoring systems often utilize AI technology to score an application, and run it through a decision-making engine based on a company’s models, to deliver a decision. Once this is checked by a loan officer, this decision can be approved or denied with the answer given to the client quickly. Such speedy processes at the decision-making stage make this one of the top features of loan management software out there.

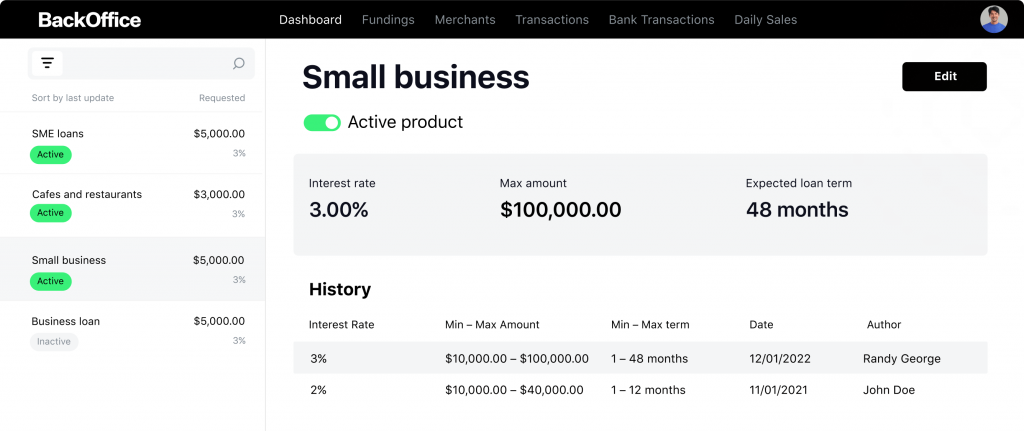

Credit management module for LMS

The benefit of digital systems is that digital storage and management can become so much more efficient. For example, after assigning credit products to a customer, the loan officer can specify the loan amount and disburse it just in a few clicks, allowing the client to receive and use the loan almost instantaneously. In addition, this also allows the client to more effective management their account and repayments.

For example, if the disbursement amount is debited from the lender’s account and credited to the borrower’s account, the borrower will get notified about disbursement, and the loan transits to the servicing module of back office.

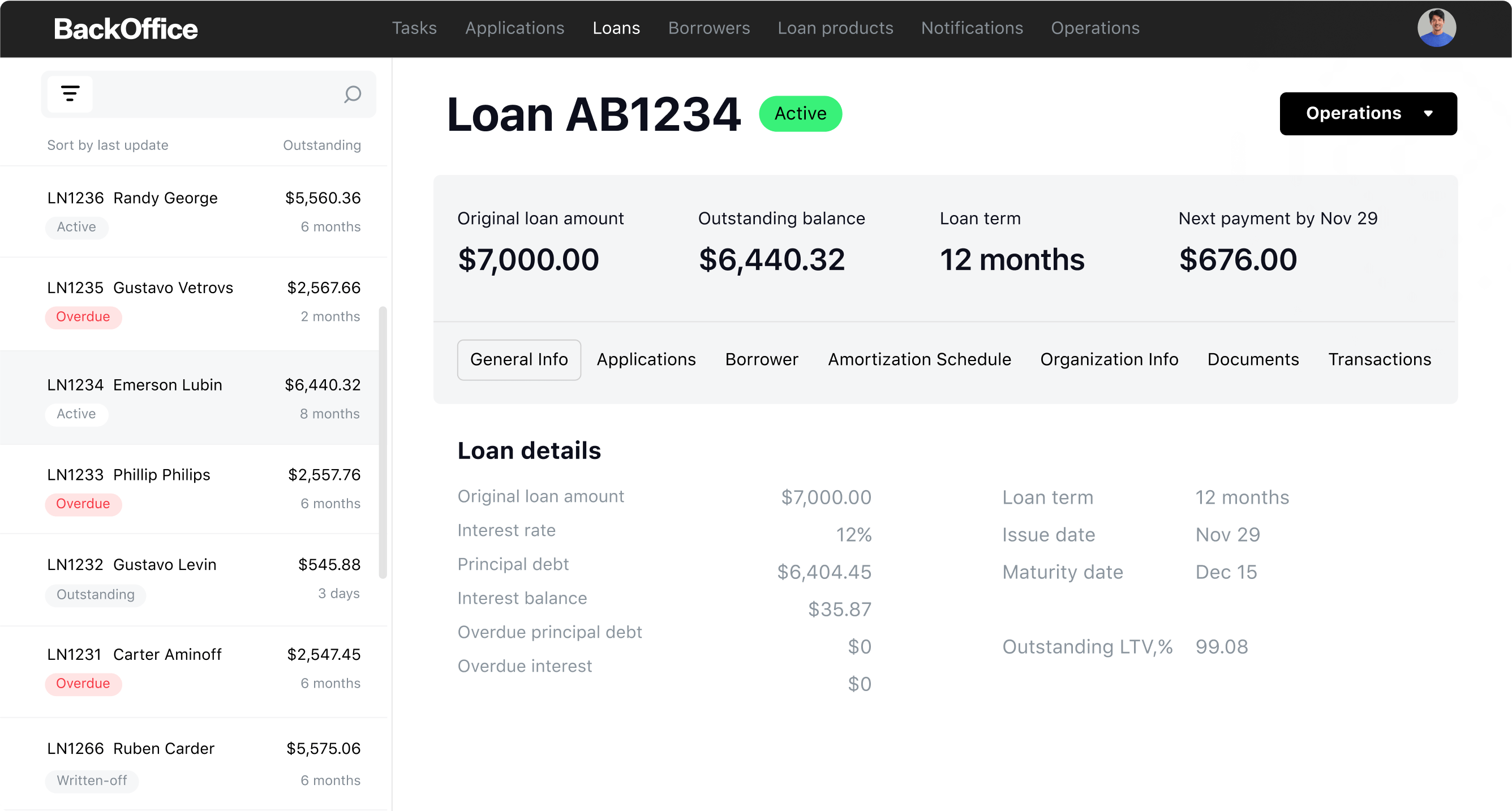

Loan servicing module

Loan servicing is usually implemented through calculation modules that allow an organization to complete full loan servicing activities. For example, these include loan status, repayments, and amortization schedules. Automation of these loan management system features is supported by the back office and ensures they can carry out their work effectively. It automatically calculates repayments, payment holidays, interest rates, penalties, and more, so that the loan officers can focus on client communication and ensuring repayment.

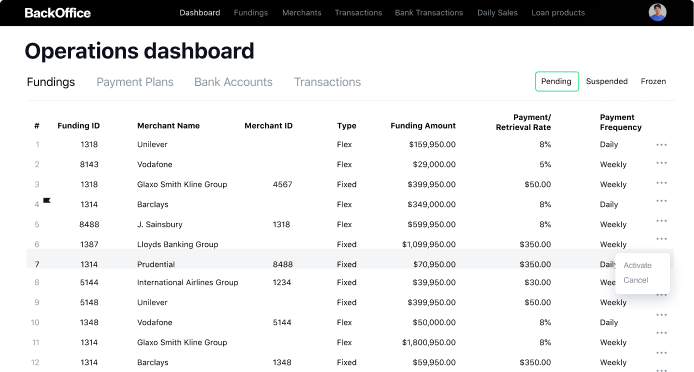

Transaction processing tools

No system, of course, would be complete without the right tools to ensure payments can be successfully processed. Automating such systems allows clients not only to pay, but to ensure that these payments automatically integrate with the repayment system so there is no discord between the client’s account and the company account. In doing so, the process is simpler for both client and lender.

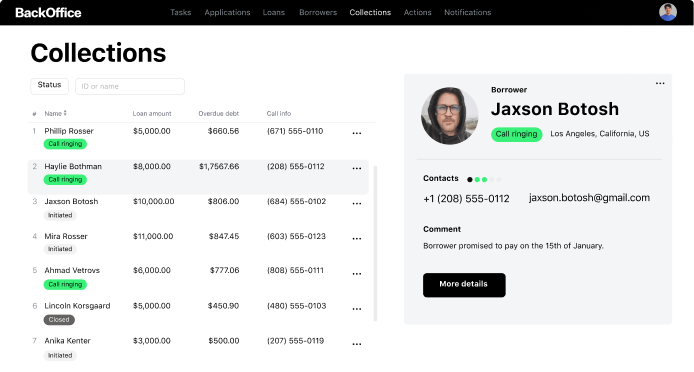

Debt collection module for loan management system

Not all loans go to plan and, unfortunately, sometimes loan officers must engage in debt collection. Having such tools on hand in advance ensures payments are not allowed to run over for an extended period of time, incurring more debt, and are dealt with swiftly.

Automated loan management systems allow loan officers to automatically calculate debt owed and offer optimal repayment schedules and methods of debt collection to suit a variety of cases instantly.

Get a personalized list of loan management system features

Want to get a personalized roadmap for the digitalization of your lending business? Take a 5-minute quiz. Select the option that most accurately represents your situation. Once you complete the quiz, you will receive a loan management system features implementation strategy, tailored specifically for your lending company. It’s completely free, your answers are totally confidential.

Top loan management features to implement in your LMS

Now you know some of the top features of loan management software, let’s look at the best tools on the market today and what they do in the loan management system workflow.

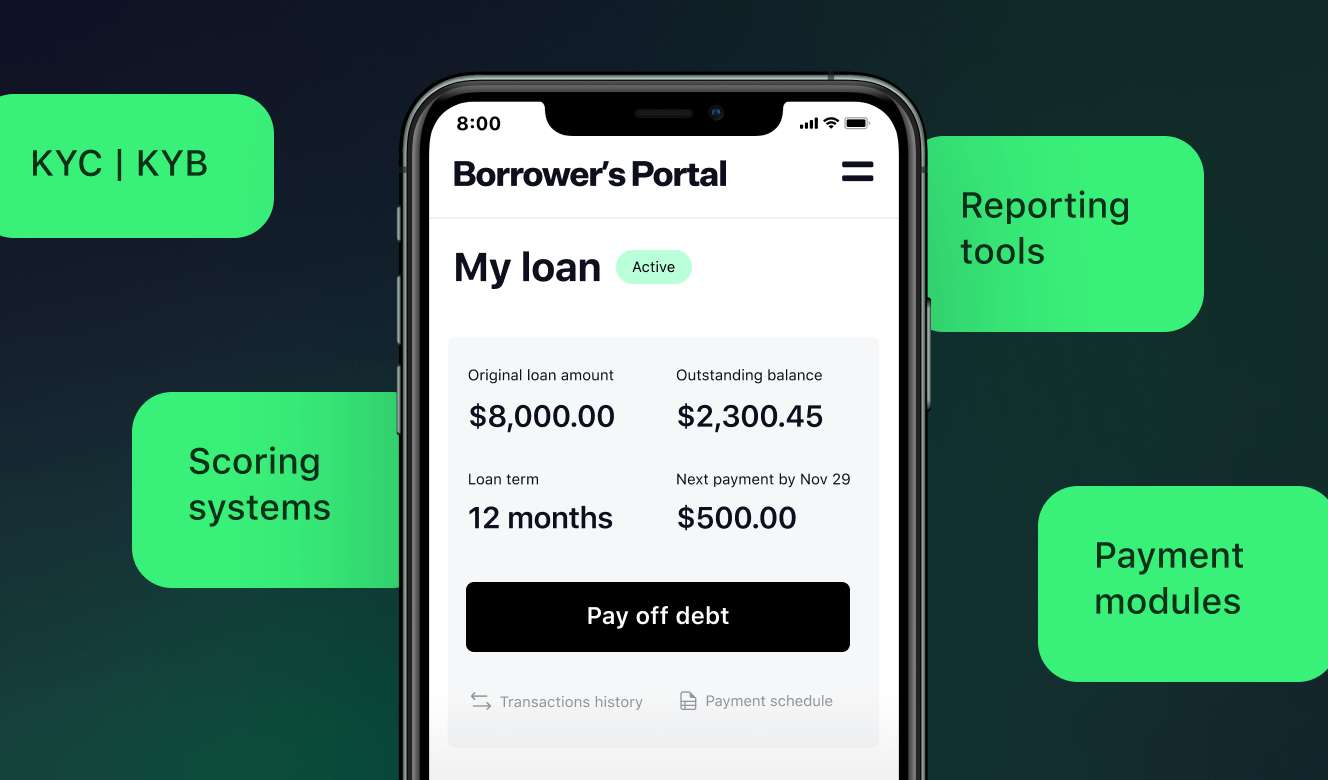

KYC | KYB loan management system features

How Automation Improves Compliance in LendingKnow Your Customer / Know Your Business tools are essential for a lending company. Not only do they help protect your business, but they are also standard requirements with many regulators, meaning they are a must-do. Ondato and Seon are two of the foremost companies engaged in automating these processes today, so always worthwhile seeing how they could integrate into your system.

Bank account verification

Avoiding fraud or getting incorrect payment details should be top of any company’s priority list. So, it’s no surprise that companies like Stripe, Merge, and G2 Deals have been thriving in recent years. Getting these tools onboard helps you make sure your repayments work exactly as they should—with no surprises along the way.

Payment features

When it comes time to make and receive payments, you’ll want technologies such as Square and Amazon Pay on hand. With many banks charging heavily for payments, these systems make it easier and often cheaper than traditional providers.

Scoring systems

Gone are the days of traditional scoring, face control checks or paper reviews. In their place stand smart scoring systems, such as GiniMachine and Kreditech, that allow businesses to assess their clients’ score faster than ever before—no waiting around for decisions.

Document workflow systems

Paperwork can be tedious for both clients and companies. That’s why tools such as PandaDoc, Zoho, and DocuWare have seen a rise in popularity. Adopting these loan management system modules allows companies to manage the document loan process paperwork without any extra stress or issues with signatures.

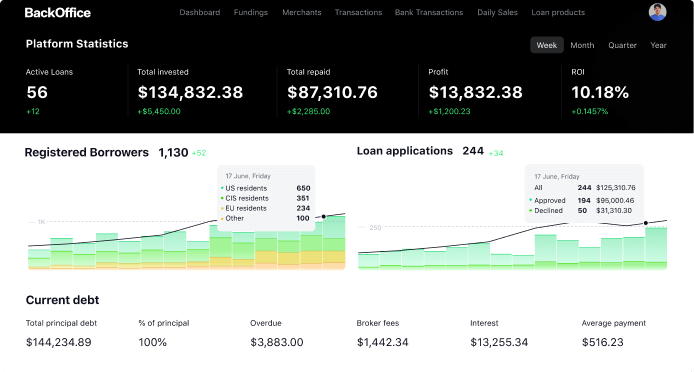

BI / Reporting tools

What You Need to Know About BI for Your Customer Service StrategyGood loans are smart loans, and it all starts with analytics. By having BI and reporting tools in place, you are better placed to assess how effective your loans actually are versus the perceived impact. Microsoft Power BI, and Looker, among others, can help automate this process and deliver valuable insights.

Collateral registry / PBX

Keeping track of collateral is an important part of any lending process. However, with so many loan types available, this is becoming harder to do. Instead, many companies are choosing to automate the process with collateral registries or PBX, such as Bsystems and Creditinfo, which store all the details required for a later date.

Accounting APIs

When it comes to must-have modules in a loan management system, accounting APIs top the list. FreshBooks and Xero are some of the most popular, but not the only, tools on the market that help businesses to better manage their finances and get things done.

Are reporting tools necessary for lending business?

Loan management system workflow automation

Features—covered. Tools—check. The next step is to automate and streamline loan processing workflow to reduce mundane work. Here are the three approaches that may help you.

AI/ML decision-making

Artificial intelligence and machine learning decision-making tools automate routine processes and reduce the risk of error. For example, these can include tools, such as GiniMachine, that automatically evaluate and score loans, giving the end-user a decision almost instantly. Such automation improves not only the speed at which a decision is taken but the accuracy too.

RPA for the loan management system workflow

RPA (Robotic Process Automation) automates repetitive tasks such as data entry, reporting, and repetitive payments, among others it can also help with communication needs, such as programmed chatbots that instantly reply to clients. Such technologies automate routine, but time-consuming processes and ensure they go much faster than before.

BPM-based (Business Process Management)

BPM for the loan management system workflow automation, also known as business process management automation, streamlines loan processes, such as data entry, onboarding, and more to make the interaction between client and business more pleasant than before.

Looking for your lending workflow automation?

Check-list of the loan management system requirements

As the loan management system market is growing, there is time for companies to strategize on which tools will improve their business case in the most valuable way. These are our top loan management software requirements that are crucial to explore and integrate into your future lending system:

1. Customer data security

Data is king and keeping your clients’ data safe marks you as a reliable business. Data protection rules may vary, but they do exist all over the world that’s why it’s vital you follow the top standards when keeping your clients’ data secure.

2. Automated workflow

Speed and agility set you aside from the competitors. By automating your lending workflow, you can take advantage of the latest technology and ensure that your business runs as efficiently as possible. Reduce mistakes and errors, while speeding up routine processes.

3. Auditability of scoring

Following the rules of business means you’re less likely to get hit with problems later. Auditability of scoring allows you to accelerate your approval rates for loans while ensuring they make sense financially—with all the right paperwork in place.

4. Compliance

From CySEC to the FCA to the FED to others, no matter which regulatory body your business falls under, it’s vital your activity remains compliant. Compliance and regulatory tech are required for the loan management system to advance in the coming years, so this area is one to watch and think about for your business.

5. Automated decision-making

Faster decisions mean more risks, right? Well, no. In fact, with the right tools in place, automated decision-making can improve your lending process, making it faster and more accurate. Got questions about loans? Now your employees have the time to investigate—lowering the risk for your business while improving the profits.

6. Streamlined client onboarding

As we said previously, getting your clients to take that first step can be tricky. That’s why it’s a requirement for a loan management system to invest in the onboarding process. Carry out user experience research to identify pain points and work to improve them with more efficient onboarding practices.

Is it worth it? Benefits of the loan management system

Transforming your loan management system features often means investing valuable resources into this project, so are the benefits of this update worth it? Let’s overview what automated loan management system workflow can do for you.

- Reduces calculation errors. Calculation errors can cost more than your budget. They can be a regulatory issue. That’s why this one tops our list of reasons to invest. By reducing calculation errors, you increase your profits and lower the likelihood of legal issues at the same time.

- Saves time. The ability to process an increased amount of loans means more in terms of profit. Meanwhile, smart technology reduces the risk of error.

- Optimizes revenue. Spending tons on endless paperwork or routine processes? Don’t! Instead, optimize it with smart software tools that ensure work is done efficiently so that profit can be boosted.

- Improves security for client data. Having the latest tools on hand reduces the risk to client data. Meanwhile outdated systems not only poorly handle data, but it also becomes a risk if it is exposed as the latest protection tools may not have been applied.

- Automates reporting. From C-level to management to everyone in between. Reporting helps keep the company on the correct track. Automated reports do this even faster to ensure it’s always the latest data that informs results, not outdated metrics.

Loan management system overview: next steps

Now that you know the types of tools available and the ones that some of your competitors are already onboarding, now is the time to create a strategy for your loan management system’s digital transformation. Getting the right technology on hand can make your process operate more efficiently to build better results for your company in the long term.