In lending, speed and precision are everything. Markets shift, regulations evolve, and customers expect timely responses. For banks and fintechs, the ability to adapt quickly while maintaining compliance can be the difference between leading the market and lagging behind.

That’s why we’ve introduced four powerful features designed to give decision-makers more control, reduce vendor dependency, and accelerate time-to-market: Floating Interest Rate, Metabase Reports, Document Templates, and Internal Scoring Models.

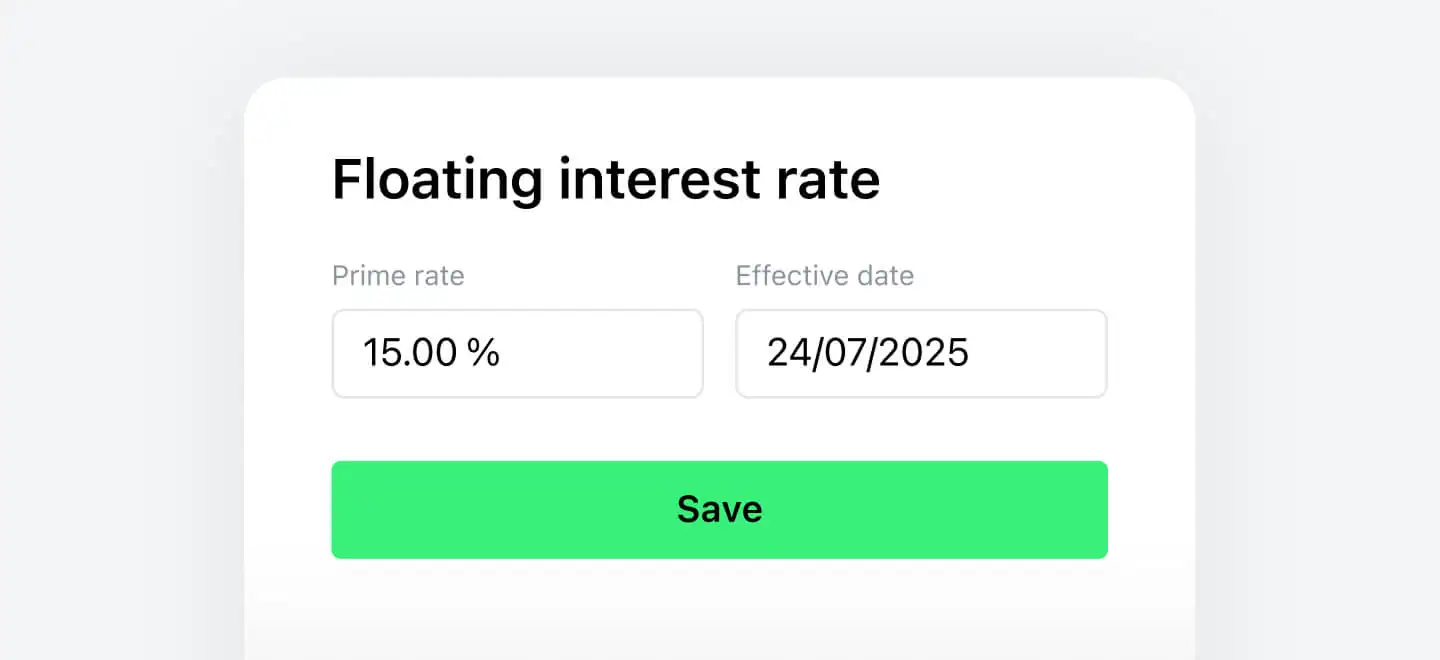

Floating Interest Rate: Staying in Step with Policy and Market

Interest rates often follow official benchmarks. Yet until now, any change—whether triggered by a central bank decision, a loan restructuring, or a payment holiday—meant manual updates across multiple products.

The Floating Interest Rate feature centralizes this process. Rates can be linked to official benchmarks and updated once to apply across the entire portfolio.

For a large bank with hundreds of active credit products, what previously required dozens of manual updates and lengthy approval cycles can now be executed in minutes, saving hundreds of staff hours each year while minimizing human error.

This ensures compliance, reduces operational risk, and allows lenders to react immediately to regulatory or market changes. For institutions requiring even tighter integration, a custom setup can automatically sync rates with the latest official figures.

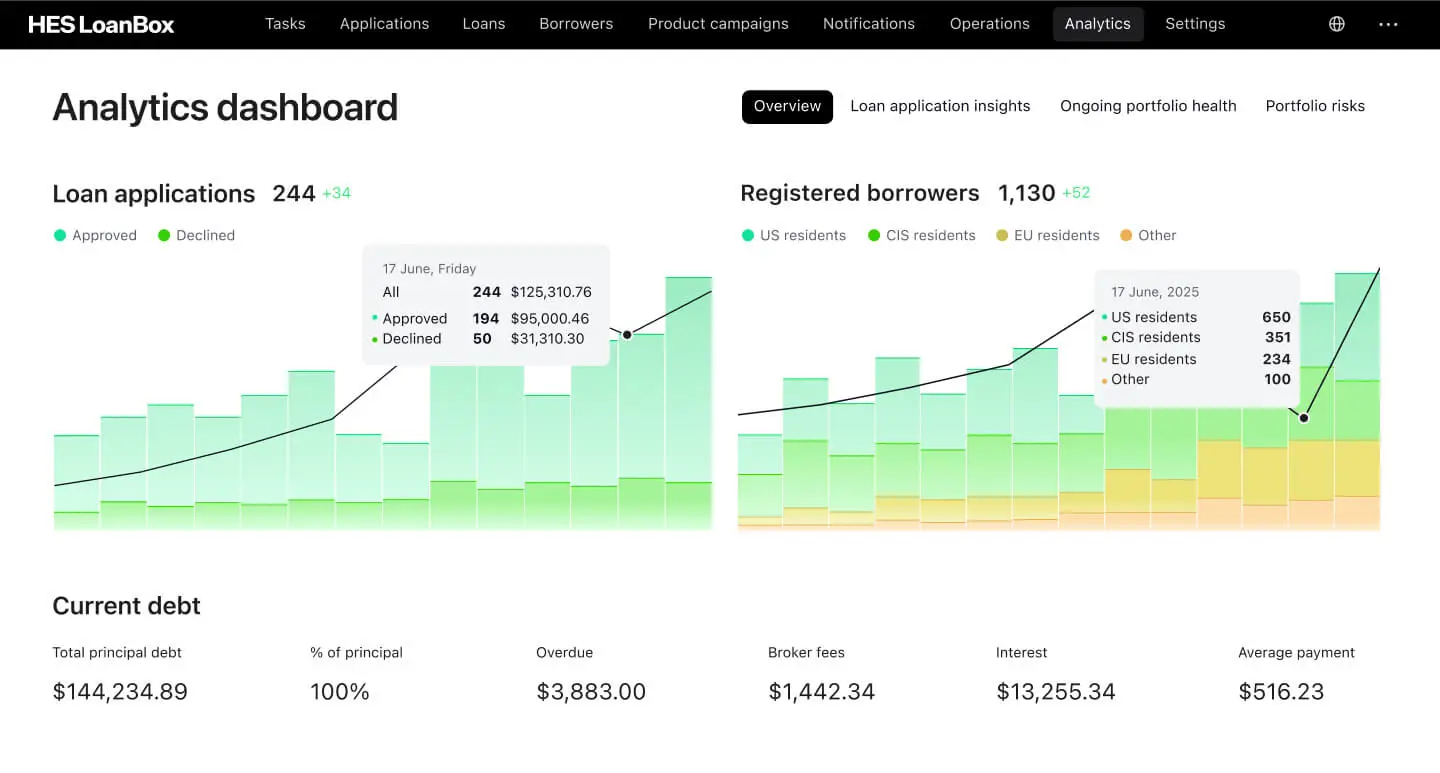

Metabase Reports: Executive-Level Insights at Your Fingertips

Sound decisions depend on clear, timely data. The updated Reports section in HES LoanBox, powered by Metabase, now includes around 20 interactive dashboards covering origination, portfolio performance, repayment behavior, delinquency, financial results, and customer insights. Unlike static reports, these dashboards are dynamic. Executives can drill down into key metrics, apply filters, and adapt views in real time, without waiting for IT or vendor input.

CEOs, Heads of Risk, and CFOs can instantly review indicators such as NPL ratio, early repayment patterns, or delinquency trends across regions.

Instead of waiting for monthly updates, leadership now shares a single, live source of truth—improving both alignment and speed of decision-making. When entirely new reports are required, our team can still support development, but day-to-day visibility is now directly in the hands of business users.

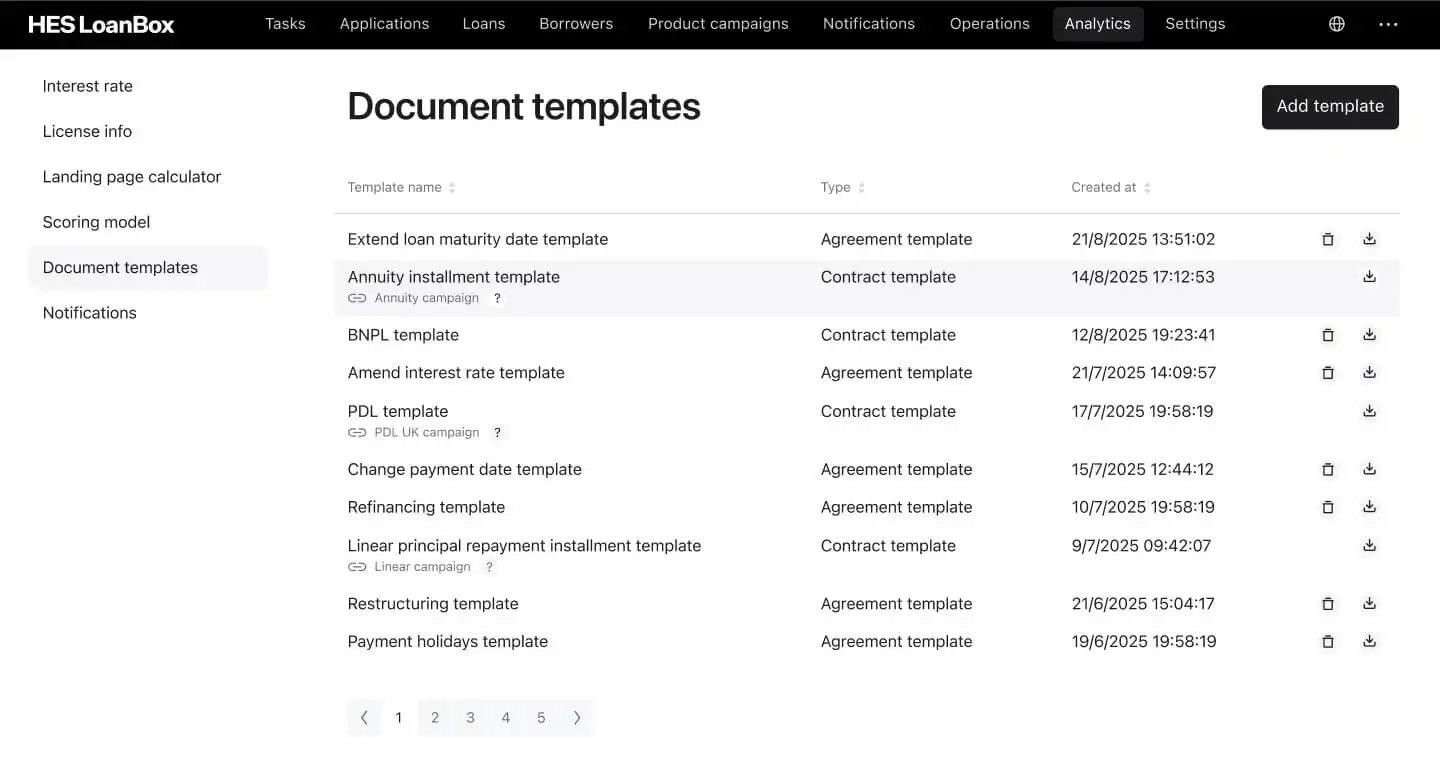

Document Templates: Faster Compliance, Lower Costs

Every product launch or policy update requires contract changes. Traditionally, that meant additional development time and expense.

With the new Document Templates feature, legal and operations teams can create and adjust contracts directly in the platform.

Borrower details, amounts, payment schedules, rates, or any other variables can be added and automatically populated by the system. This keeps every agreement accurate and consistent without extra coding. All versions are stored in the platform, so teams can track updates or revert to earlier templates whenever needed.

For legal departments, this means they can adjust contract language immediately after a new regulatory act is introduced. Within the same day, all generated agreements will include the updated terms, reducing compliance risk, lowering implementation costs, and accelerating time-to-market for new lending products.

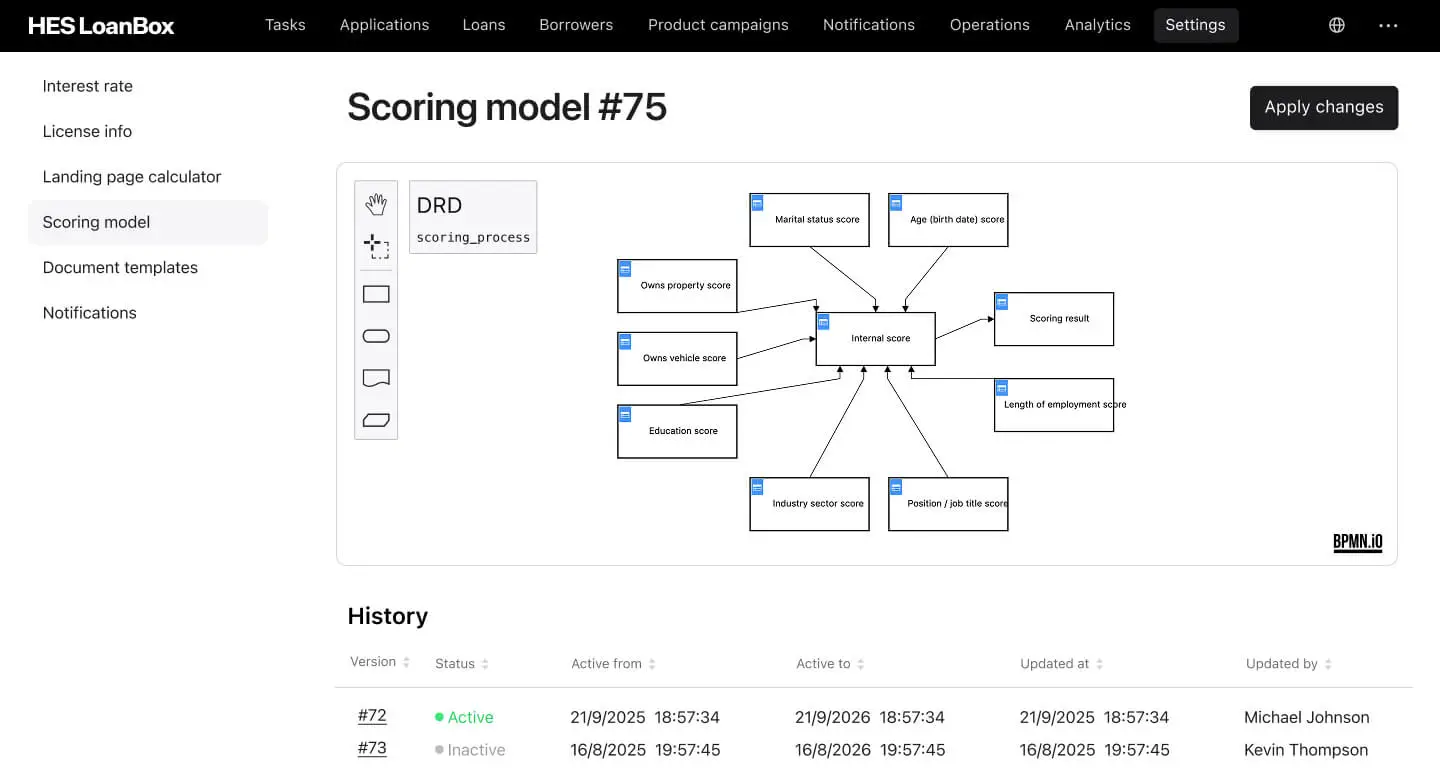

Internal Scoring Model: Smarter Risk, Greater Transparency

Risk management is central to every lending decision. But adapting scoring models to new strategies or market realities often meant waiting on technical teams.

With the updated Internal Scoring Model capabilities, this process is now fully controlled by the lender. Risk officers can configure conditions, assign scores, and define results directly in the system, without IT involvement.

Standard models for both individuals and businesses are available out-of-the-box, with the flexibility to tailor them as needed. Each version is logged and traceable, making decisions auditable and transparent. Multiple models can also be tested in parallel, enabling risk teams to experiment with strategies before rolling them out across the portfolio.

What previously required weeks of technical support—testing, approval, and release—can now be handled in hours by risk teams themselves. The result is greater agility, faster adaptation to market shifts, and stronger compliance.

A Platform That Puts You in Control

Across these four updates, the ultimate result is clear: less dependency, more autonomy. HES LoanBox now gives decision-makers direct control over critical tools—compliance, reporting, documentation, and risk management—while reducing cost and time-to-market. Together, these updates can cut product launch timelines by up to 90%—reducing them to just a few hours—while also lowering reliance on external development and freeing up hundreds of team hours each year.

For banks and fintechs, that means being able to adapt at the speed of regulation, the market, and the customer.