Ever since the financial crash of 2007/2008, credit portfolio management systems have taken top priority at financial institutions working to avoid history repeating itself. Of course, this event isn’t the only reason to manage loans. Banks and lending providers seek out a loan portfolio management system to manage risk, analyze their portfolios, monitor their current activities, and optimize profits.

As technology continues to develop at an ever-rapid pace, more businesses are onboarding technology solutions, such as Credit Portfolio Management (CPM) systems, to automate and better manage their loan portfolios. According to McKinsey, 60% of respondents surveyed stated they increased the deployment of advanced analytical tools (AI, machine learning, etc.) in the last two years. A sizable 75% expect this trend to continue.

What is a loan portfolio management system?

A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often described as a ‘game-changer’ for institutions, it gives them the power to analyze a vast range of data to deliver insights. This allows top-level teams to make more informed decisions and identify any potential risks at an early stage.

How does loan portfolio management software work?

Although credit portfolio management systems have been integrated into the financial sphere for quite some time, the recent advances in artificial intelligence and machine learning technology have driven solutions forward exponentially in recent years, with more advanced tech emerging all the time.

Credit portfolio management software draws upon advanced financial models and predictive algorithms to transform raw data into actionable insights, and is often packed with a variety of tailored features depending on the organization and its specific needs.

What key features should a viable loan portfolio management system have?

When choosing a loan management software solution, teams often become confused at the variety of options on the market. With expansive features all trying to prove their value, it can be difficult to select tailored tools to meet your needs. Let us break it down for you.

Loan tracking

Loan Management System Overview: Features & Requirements Seeing the dynamics of how your loans perform over time gives insight into the health of your portfolio and helps identify early risks. This allows companies to keep a tighter watch over individual loans and take action quickly should risk present themselves. According to data by McKinsey, utilize advanced loan tracking analytics can help to reduce defaults by up to 40%.

Payment processing

In a modern solution ease-of-use is crucial to operational efficiency. Payment processing systems in the loan portfolio management software allow businesses to process payments and manage accounts all in one place. With an increase level of control, it becomes easier to manage clients and cut the risk of default.

Financial statement tracking

Loan Management System Trends: AI, Security & Compliance in 2023 According to Moody’s Analytics, the ability to analyze financial statements is a top priority in loan portfolio management. Doing so allows lenders to monitor the financial performance of borrowers and make more informed decisions. In turn, this lowers the overall risk of lending and delivers a healthier portfolio.

Collateral management

Utilizing collateral to secure a loan isn’t a new concept. In fact, according to the latest data, it’s one way to reduce default rates for consumers and business lenders. Within a credit portfolio management system, collateral management tools keep track of any collateral offered and help manage it for any loans that were secured.

Covenant tracking

For institutions interested in reducing default rates and increasing performance, the ability to track covenants is a potential must-have. According to a report by Accenture, inclusion of this tool is an effective way to improve the quality of lending. Covenant tracking essentially helps lenders more closely monitor borrower compliance with loan covenants and alerts if something goes wrong.

Risk assessment

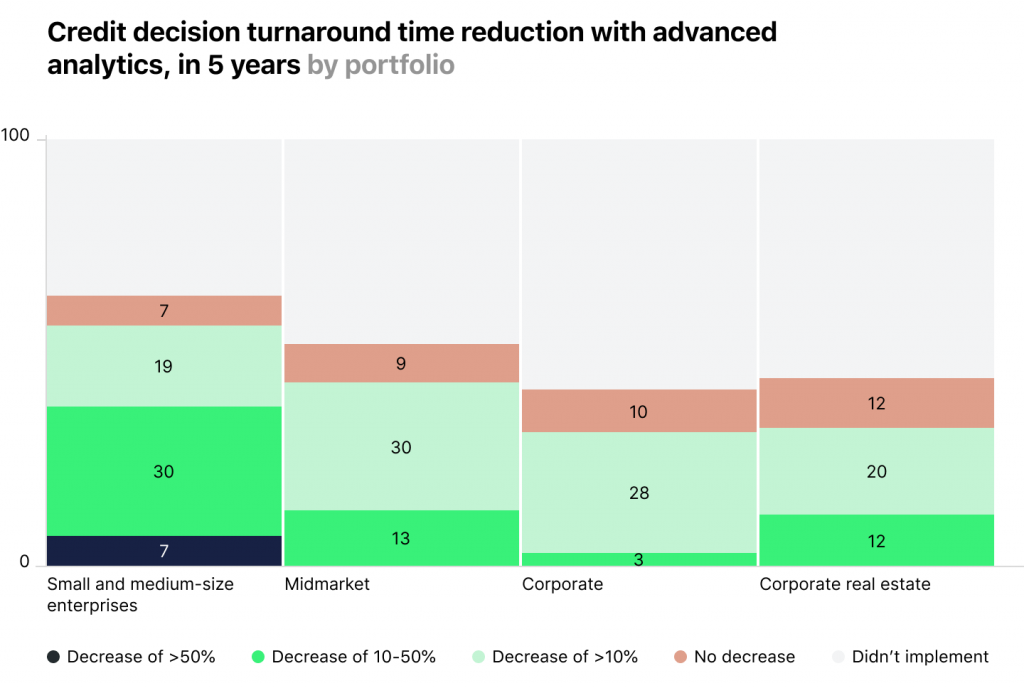

Although risk is a natural part of any loan, credit should never be considered too ‘risky’. With the latest technology on hand, companies are seeking out new ways to manage either risk, assess the creditworthiness of clients and reduce their exposure in their loan portfolio. It’s becoming a widely adopted trend to automate and engage AI/ML tools for this purpose. For example, McKinsey noted that 30% of SMEs surveyed stated they automated their credit portfolio risk assessments, with a significant improvement in turnaround time—up to 37% reported a 10% decrease in time required.

By leveraging advanced technology and data-driven algorithms, we empower financial institutions to make informed decisions, minimize uncertainties, and optimize their credit portfolios. In a world where speed and precision are paramount, embracing automation is key to unlocking new opportunities and safeguarding long-term success.

Dmitry DolgorukovCo-Founder and CRO of HES FinTech

Renewal automation

Loan renewal can be labor-intensive for portfolio managers. Meanwhile, studies show that this investment can be reduced by 90%+, if the right technology is engaged at the correct entry point to automate the process. The challenge is in borrower creditworthiness and the risk that auto-renewed loans could have on the health of the portfolio. Having technology on board to reduce the impact of this, can improve the overall sustainability of the portfolio.

Profitability evaluations

Delivering probabilities and insights into the profitability of particular loans, this technology reduces the risk of underperforming portfolios and increases the likelihood of performing loans. For example, companies may choose to integrate profitability ratios into their technology. These tools monitor the financial performance of the lender, and give insights into their ability to generate income and be profitable.

Compliance management

In the fintech world, it almost appears that regulatory practices are evolving at an ever quicker pace — perhaps even more so than in the tech world. That’s why when it comes to loans, companies are happy to get their hands on technology that not only works, but is compliant too. By constantly following up on the latest regulatory notices, companies can adjust and manage their compliance expectations to ensure they get lowers risk and costs.

These are just some of the tools that can be engaged when designing a custom or low-code system for loan portfolio management. As technology advances, more solutions will emerge, so always be mindful of this.

Do you trust compliance management to software?

Loan portfolio management systems — where to start?

Now, you might be ready for take-off on your new loan portfolio management system. But let’s pump the breaks for just a minute and review.

- Loan portfolio management is a technology that helps you effectively manage your loan portfolio.

- Up to 60% could already be using these tools to benefit their portfolio

- Numerous modules are available. You don’t need to select them all. Instead, choose the ones that work for you.

So, where do you start when it comes to credit portfolio management software? Before you get started, having the right information on hand is key. Visit our extensive blog to find out more or get in touch directly and we’ll do our best to walk you through it.