Financial institutions worldwide continue to shift towards digital transformation aiming to reduce costs and ensure a smooth and efficient decision-making process. Due to growing financial software demand, this transition seems to emerge in 2023. According to Statista, estimated software spendings in the banking, finance, and insurance industry in the United Kingdom only are expected to reach $524.3 million in the upcoming year, which is almost 12% more than back in 2020. By the end of 2026, total spending on digital transformation worldwide is expected to reach 3.4 trillion U.S. dollars.

While this global trend is gaining traction, finance and lending systems requirements become more strict and advanced. Lending management technology and legislation continue to evolve, so it’s crucial to keep your business up to date with trends. This article will give you a grasp on how to tackle digital age challenges in 2023.

How loan management will evolve over 2023

The future of loan management depends on various factors such as technological advancements, economic conditions, and regulatory changes. However, there are a few trends that are likely to continue to shape the development of loan management systems.

Loan Management System Overview: Features & RequirementsIncreasing use of digital and automated processes. This may include the use of machine learning algorithms to automate parts of the loan application and underwriting process, as well as the use of digital platforms to facilitate communication between borrowers, lenders, and other relevant parties.

Usage of alternative data sources to assess the creditworthiness of borrowers. This trend is called to tackle the “invisible borrowers” problem. The Consumer Financial Protection Bureau (CFPB) revealed that at least 45 million adults worldwide are ‘credit invisible.’ The alternative data toolset may include the use of data from social media profiles, mobile phone records, and other sources in addition to traditional credit reports.

Obviously, loan management systems will continue to become more efficient, transparent, and accessible as a result of technological advancements and changing business practices.

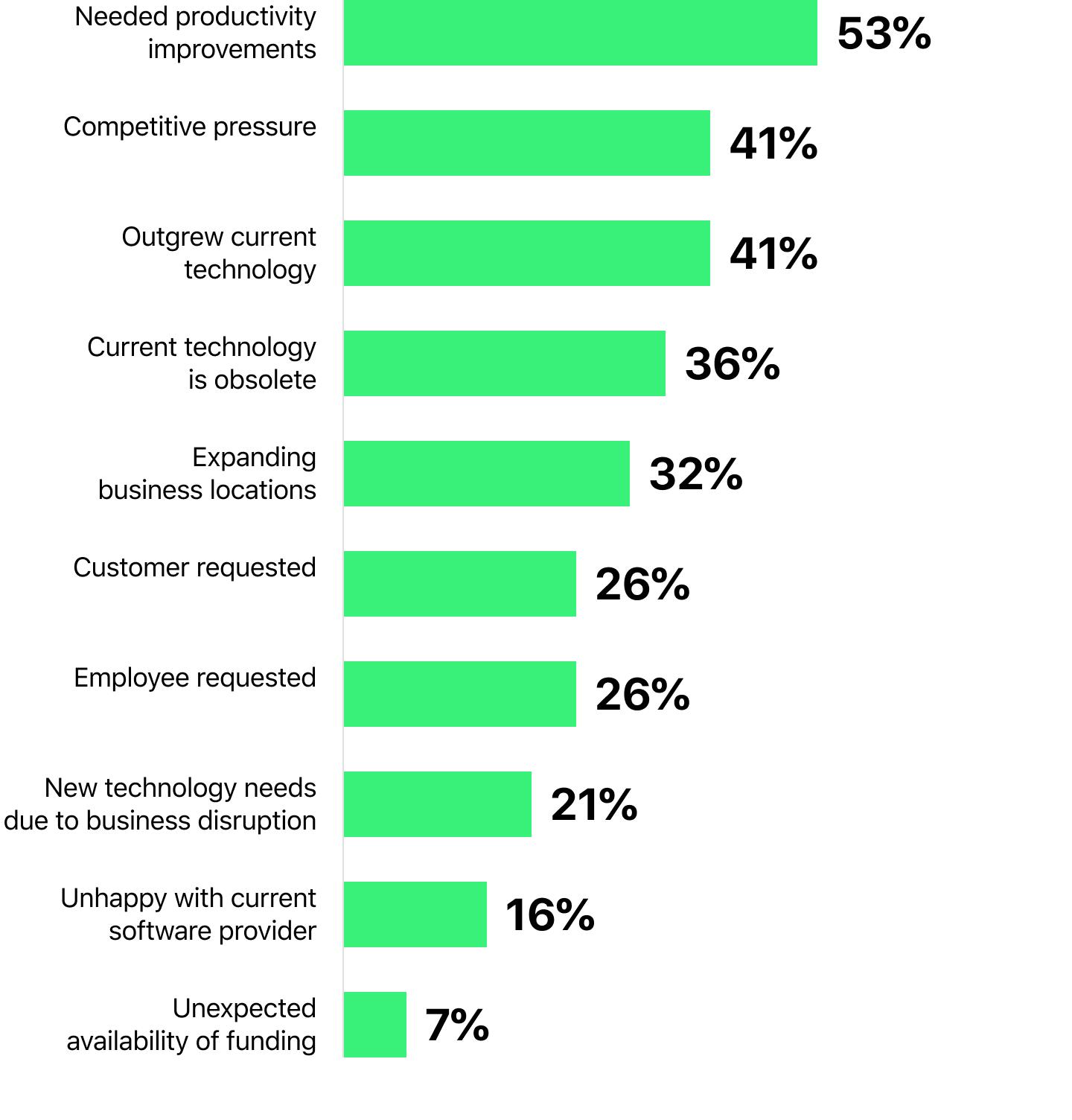

Top reasons buyers invest in loan management software

The trend for AI & ML in loan management systems

Astonishingly fast and effective development of artificial intelligence causes the inevitable entrance of ML in everyday life, and fintech is no exception. The use of AI is becoming more common, as seen by the increase in money being spent on it by companies and the increase in research on the technology. It is expected that the amount of money spent on AI will continue to grow and will double in the next four years, going from $50.1 billion in 2020 to over $110 billion in 2024.

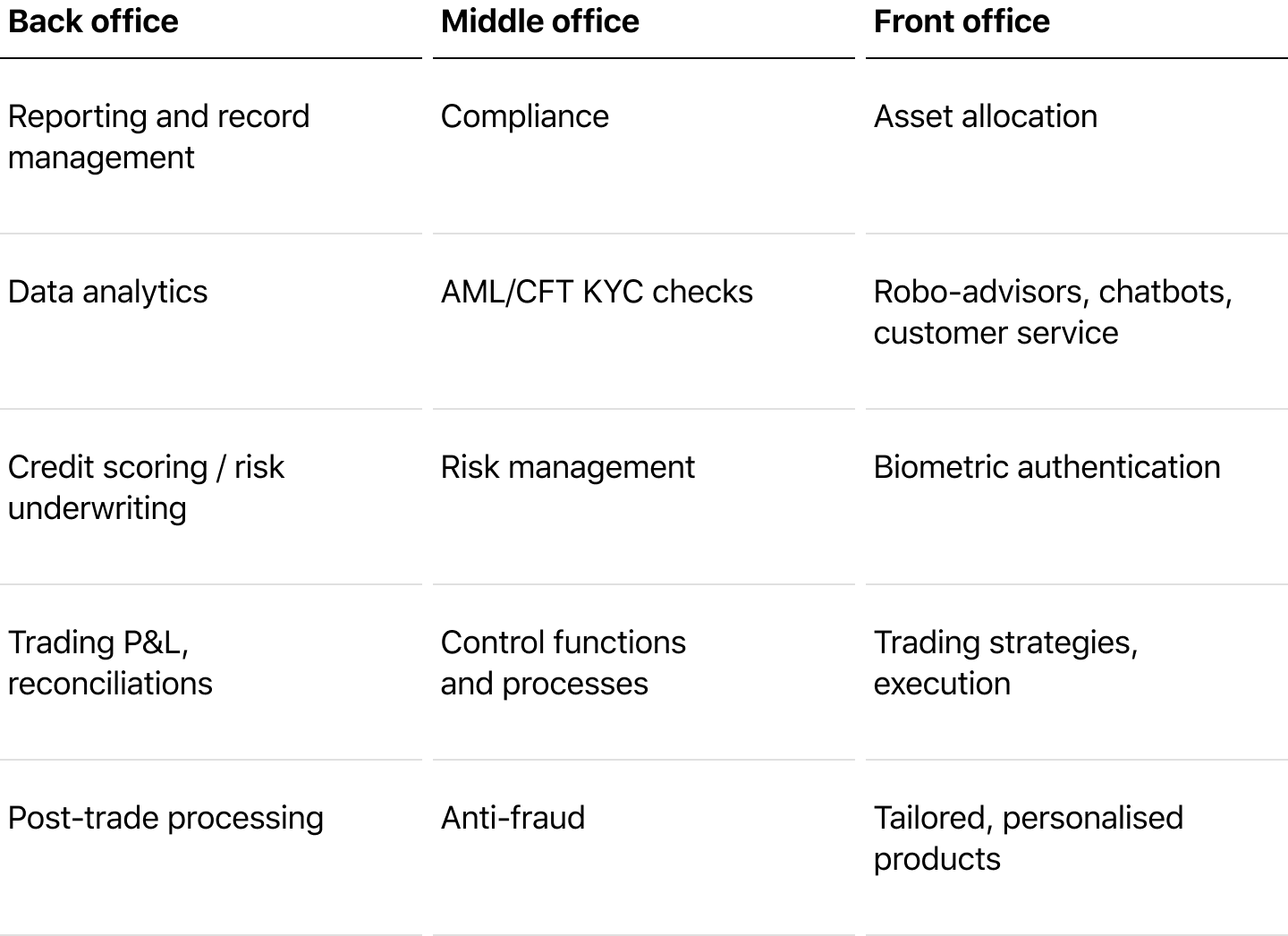

Artificial Intelligence usage in loan management systems

AI can become a game-changer in the next 5 years and serve as a great opportunity to facilitate loan management in a variety of ways. Some potential applications of machine learning technology in lending administration include:

Credit scoring. Loan management can benefit from an automated credit scoring process to save time and eliminate human mistakes. AI builds predictive models by analyzing a wide range of data sources and using machine learning algorithms to predict the creditworthiness of borrowers. In the last few years, the legislation aims to regulate AI usage for credit scoring in order to protect customers’ data from breaches. Gradually AI has become more and more compliant with financial services.

Fraud detection. AI can be used to detect fraudulent activity by analyzing patterns in loan application data and flagging unusual or suspicious activity for further investigation.

Document analysis. Machine learning is able to reduce the amount of paperwork and simplify document flow. AI automates the process of reviewing and analyzing loan documents, such as income statements and bank statements, to help speed up the underwriting process.

Customer service. AI chatbots and other AI-powered customer service tools are applicable to assist borrowers with questions or concerns about their loans, freeing up time for loan officers to focus on other tasks.

Portfolio management. ML technology can perform complex analyses of company assets. With the help of AI financial institutions are able to automate loan portfolio data analytics and identify trends or patterns that can help lenders optimize their lending strategies and minimize risk.

AI has the power to revolutionize the loan management process, bringing a new level of accuracy to an industry that has long relied on manual processes. AI has the potential to be a game-changer in loan management, and I am excited to be a part of this transformation.

Dmitry LushchinskyHead of Engineering at HES FinTech

Game-changing features for loan management software in 2023

The use of automation technologies to streamline and accelerate various aspects of the loan process, such as credit scoring and document analysis, is likely to be a key differentiator for loan management software. This tendency creates a huge trend toward digitalization. Though the future is unpredictable, a few features are likely to be important for loan management software in the coming years.

Data analytics

The ability to analyze and extract insights from large amounts of data, such as loan application data, portfolio data, and market data, will be important for helping lenders make informed decisions and optimize their lending strategies.

Integrations

Seamless integration with other systems and platforms, such as CRM and banking systems, will be important for providing a smooth experience for both borrowers and lenders. KYC / KYB systems, for instance, simplify loan application and user verification processes. The usage of reporting APIs and business intelligence tools facilitates decision-making.

User experience

A user-friendly and intuitive interface will be important for helping borrowers and lenders easily navigate and use the loan management software.

Security

Ensuring the security and privacy of data and transactions is critical for building trust and maintaining customer confidence.

All in all, the main objective is internal processes optimization and enhancement of user experience for a reasonable cost, which is totally reachable with end-to-end automation.

Get a digital strategy for your lending business

Want to get a personalized roadmap for the digital transformation of your loan management? Take a 5-minute quiz. Select the option that most accurately represents your situation. Once you complete the quiz, you will receive a finance digital transformation strategy tailored specifically for your lending company. No email is required, your answers are totally confidential.

LMS protection from cyber-attacks and data breaches

Legislation security requirements for loan management systems will continue to become more severe along with the growing risks and external threats. There are several steps that lenders can take to protect their loan management software from cyber-attacks and data breaches in 2023 and ensure compliance with relevant laws and regulations.

- Implement strong security measures. This may include measures such as firewalls, intrusion detection, and prevention systems, encryption, and secure authentication protocols.

- Regularly update software and systems. It is important to keep software and systems up to date with the latest security patches and updates to fix vulnerabilities and prevent exploits.

- Conduct regular security assessments. Regularly assessing the security of systems and identifying potential vulnerabilities can help lenders identify and address potential threats before they are exploited.

- Train employees. Educating employees about security best practices and the importance of protecting sensitive data can help prevent accidental breaches and mitigate the risk of insider threats.

- Have a plan in place for responding to breaches. In the event of a breach, it is important to have a plan in place for quickly identifying and addressing the problem and for communicating with customers and other stakeholders.

How to Avoid Fraud in Digital LendingOne more crucial point is to monitor current legislative updates to ensure best practices of data and system protection. The lending services market is heavily regulated, and changes in regulations can have a major impact on the industry. Keep an eye on any upcoming laws that might affect the lending industry, and be prepared to adapt to new requirements. By taking these steps, lenders can mitigate both external and internal risks while staying compliant.

Conclusion: how to tackle 2023 fintech market changes

Staying informed about the latest trends in the rapidly evolving fintech market can be a challenge. To stay up-to-date with the latest fintech developments, consider these options:

Follow industry news and publications. Track the important updates of the websites, blogs, and newsletters that cover the latest trends in fintech. Insider Intelligence, Finovate, Fintech Futures, PYMNTS.com, and Gartner provide insightful analysis of the latest developments in financial technology. Follow a few of these sources to get regular updates on what’s happening in the industry.

Attend industry events and conferences. Attending fintech conferences and events provides a unique opportunity to learn about the latest trends and developments in the field, and network with other professionals and experts. Look up to Money 20/20, Finovate conference, and LendIt Fintech in 2023. You can gain valuable insights into loan management here, apart from connecting with others in the industry and building valuable relationships.

Connect with other fintech professionals. Join online communities or professional organizations related to fintech and connect with other professionals in the field.

- Follow thought leaders and experts on social media (Reddit, LinkedIn, TechCrunch)

- Join offline fintech communities (lender associations, tech enthusiasts organizations)

- Participate in fintech training and education programs

One more way to keep up with the fast-changing online lending market is to leverage fintech innovations. The latest technologies like blockchain, artificial intelligence, and machine learning are all having a major impact on the fintech industry and are likely to keep evolving. Reach out to the HES FinTech team to get a free demo of how innovative loan management software can enhance your productivity.