Traditionally, the loan application process involved manual work that required the most experienced and attentive workers. But times change, and nowadays this position may cause your business to get left behind. Still, some companies are concerned about applying an automated one. What if it kills all the results of human work?

In this article, you will learn why choosing manual loan processing has become an outdated strategy and why switching to an automated one will be the best decision for your business growth in 2025.

What is Loan Processing?

Loan processing is a sequence of actions aimed at taking evaluation and preparing a loan application for approval by a lender. It’s a pivotal part of any loan origination process, as it connects the application stage with underwriting. All in all, there are six loan application process steps:

| Stage 1: Application Submission. The borrower’s submission of an application to a lender with continual estimation of a borrower’s creditworthiness and eligibility. | Stage 2: Documentation Verification. The analysis of a borrower’s documents, like bank statements, income statements, identification proofs, and tax returns, to confirm their precision and legitimacy. | Stage 3: Credit Evaluation. The estimation of a borrower’s creditworthiness by analyzing their payment history, existing loans, credit score, and outstanding debts. |

| Stage 4: Loan Underwriting. The assessment of a borrower’s credit history and financial profile to make a final decision. | Stage 5: Lend Approval and Disbursement. After the successful underwriting stage, lenders confirm the loan’s conditions, such as payment timelines and interest rates. | Stage 6: Loan Servicing. Managing lender-borrower relationships by checking repayments, responding to borrowers inquiries, providing customer support, regulatory and legal compliance. |

It’s paramount to comprehend each of these stages to more easily navigate the whole process and make better decisions.

Based on our analysis of over 50 lending institutions, we've observed that companies struggle most during stages 2-4, where manual verification and evaluation create the biggest bottlenecks. The key insight from our implementation experience is that automation works best when it mirrors these natural stages rather than trying to reinvent the entire process.

Why Manual Loan Process May Hinder Your Business Growth

Manual loan process may seem more reliable, as it revolves around human intelligence, which is easier to trust than a machine. Unfortunately, human resources are not eternal, and if your company still utilizes manual loan processing, you’ve probably faced these challenges at least one time:

Time-Consuming Processes

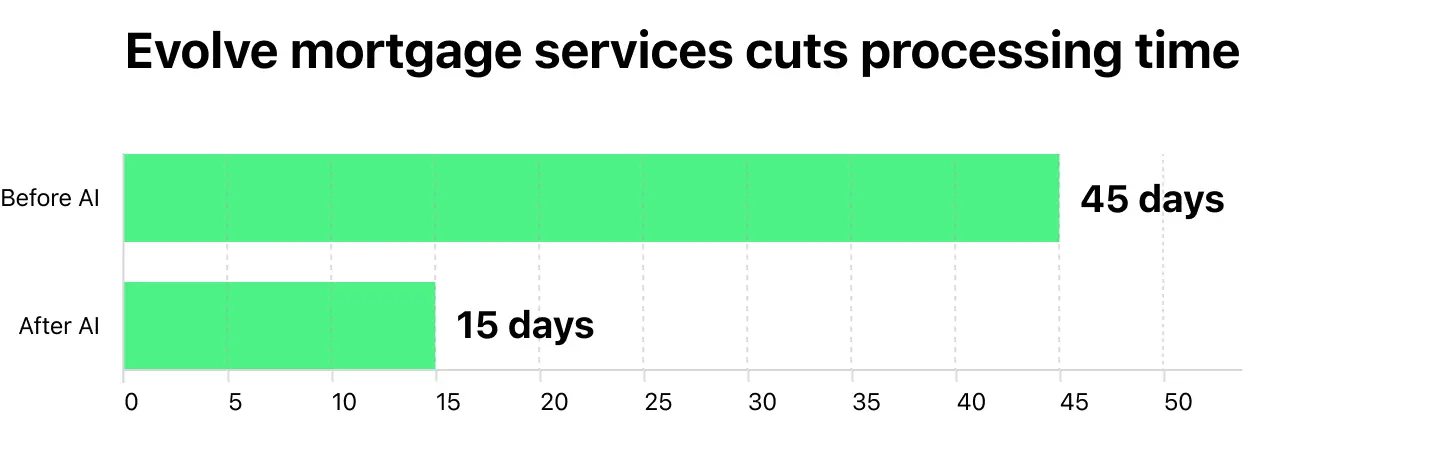

If the information about a borrower and their documents is analyzed by people, it may take several days or even weeks. This delays approval timelines and, as a result, leads to operational efficiency disruption and borrower dissatisfaction.

Inconsistent Decision-Making

In the manual loan process, the interpretation of information significantly depends on underwriters. Different team members can do it differently, which may lead to inconsistencies that can hinder compliance and damage your reputation.

High Risk of Errors

Even the best underwriters sometimes make mistakes. A miscalculation or an unnoticed detail can result in the approval of loans with elevated risks or compliance issues.

Lack of Scalability

A manual loan process can be efficient for a small business, as it doesn’t require analyzing vast amounts of documents. But if you want to enlarge your company, this process can be slowed down because the manual loan process narrows your capabilities to manage increased lending activity effectively.

Increasing Operational Costs

If you want to scale your loan volume, it usually requires bringing on more specialists. The added labor costs can significantly reduce profit margins.

According to industry data, loan underwriters typically require 6-12 months of on-the-job training to reach full competency, as reported by the U.S. Bureau of Labor Statistics and validated by multiple certification organizations. Manual processing costs scale linearly with volume - each additional specialist can handle approximately 80-120 applications monthly depending on loan complexity. The real challenge isn't just direct labor costs; it's the compound effect of training time, inconsistency between reviewers, and what we observe as "reviewer fatigue" - where high-volume manual processing leads to decreased accuracy and slower decision-making over time.

It also should be noted that it still has some benefits:

Adaptability and Flexibility

Manual processing offers flexible advantages for handling unique or non-standard loan applications and scenarios. It is also easily adaptable to loan approval system changes.

Cost-efficiency

Automated loan processing will be a great novelty for a business, but for small companies investing in it may not pay for itself. In this case, it’s better to stay with a manual one.

Targeted Customer Service

Despite machines impressing with their human understanding, they still can’t substitute human empathy. Personal engagement ensures better comprehension of particular circumstances and needs and eventually provides a personalized customer experience. It can also advance relations between applicants due to direct communication.

Why Automated Loan Processing is the Solution You Need

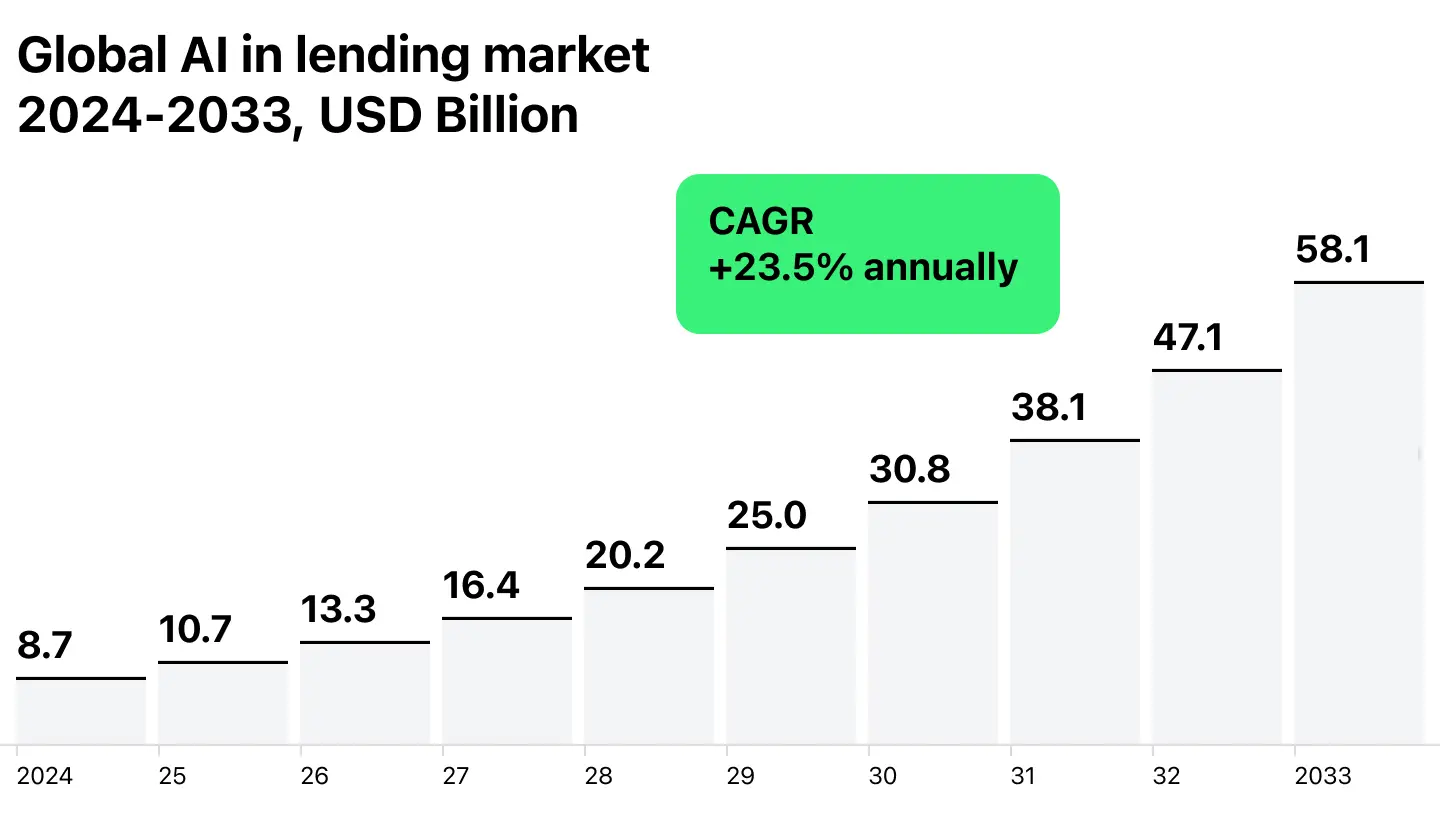

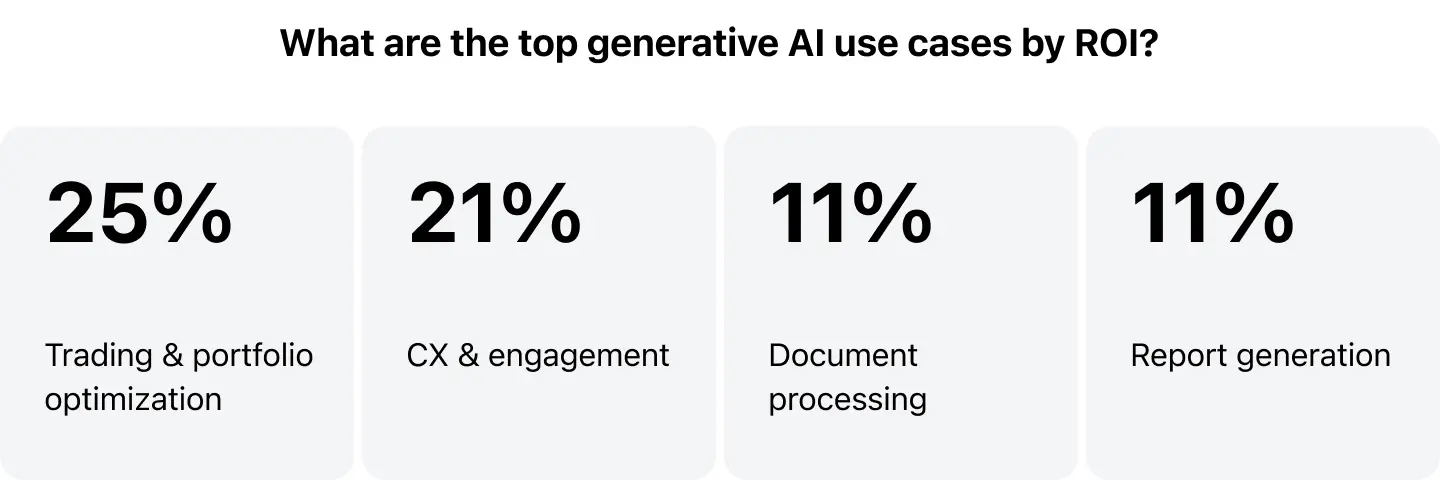

For the past few years, the market has changed a lot. Artificial intelligence has become one of the top lending trends in 2025, which means automated loan processing nowadays is not just a tool to make your workflow more effective but a necessity to stay relevant. With advanced algorithms and machine learning, it enhances application processing by delivering swift and precise borrower evaluations. Here are some other benefits:

Faster Loan Application Processing

Automated loan processing helps to achieve goals more effectively and smoothly not only for lenders but also for borrowers, as, unlike a manual one, it doesn't take weeks or even months to process large amounts of data from multiple sources. Borrowers are placing greater value on speedy decisions to access funds for urgent needs.

With a wide array of providers available, they’re more likely to switch to a competitor if the service lacks efficiency or clarity. Speed with compliance, precision, and diligence is the key to keeping clients in your company.

Automated loan processing allows for efficient extraction and handling of relevant data without relying on expensive manual input or risking data entry mistakes. By automating workflows, routine tasks and application reviews can be completed faster and with greater accuracy, leading to quicker loan approvals and fund disbursements.

For example, documents can be submitted and processed through optimal formats and channels, improving the customer journey and reducing the chances of applicants abandoning the process.

HES FinTech's proprietary AI algorithms can process loan applications in under 15 minutes, compared to the industry average of 3-5 days, giving our clients a significant competitive advantage in the fast-paced lending market.

An automated loan process can help you in these loan processing steps:

- Assessing and analyzing applications

- Initial loan application

- Quality control and checking

- Data collection and underwriting

- Disbursing the loan

- Overseeing the loan.

More Accurate Documentation Verification

Checking the authenticity of information about a borrower is the most crucial part of any process of loan approval. Specialists must be careful in this process not to make a mistake and approve an unreliable client.

This process, especially if it includes alternative methods of credit score, may take a lot of time, and still even the best team members may overlook something. This is where machine learning and artificial intelligence can come to help and eliminate problems that companies previously had due to manual loan process.

Smart software is capable of verifying that all mandatory fields in an application form are filled out, confirming that the application meets the required criteria, and cross-checking the provided information for consistency and accuracy.

One more advantage of such loan processing system is that it allows you to utilize third-party automated systems to bolster verification in real time. Automation helps to ensure the appropriate information is sent to the correct individuals whenever human involvement is needed. As a result, payroll systems, open banking, credit reference agencies, and financial institutions can provide important supporting information.

Document fraud represents a growing challenge across financial services. According to recent industry data, financial services companies experienced a 79% increase in document fraud in 2022, with a global 31% increase in document fraud reported across all sectors. The 2024 Alloy fraud benchmark reveals that synthetic identity fraud has become "the fastest-growing financial crime in the U.S." Meanwhile, Inscribe's analysis shows that 61% of lending organizations have experienced document fraud, making it the most prevalent fraud type they encounter.

Better Data Accuracy

Effective loan processing requires appropriate speed with accuracy. The automated one combines enhanced accuracy, speed, and top-notch technology-based loan data analysis for more effective and explicit decision-making. It also enables pulling data straight from digital resources, both making dependable and steady information flows and increasing audit trails throughout each phase of the loan origination process.

An automated loan processing system can meticulously classify, store, and index all important loan documents, bypassing monotonous tasks and duplications, while developing a centralized data repository. If there are some errors or discrepancies, it can also detect and notify users about them. To uncover deception, it can also use AI-powered systems for fraud detection.

The most successful automation implementations we've seen aren't about replacing people - they're about elevating human expertise. When underwriters transition from data entry to exception handling and complex case analysis, their experience becomes exponentially more valuable. We've observed that organizations making this shift see their senior staff become strategic advisors rather than processors, which ultimately drives both job satisfaction and business outcomes.

Anton LippertHead of Delivery at HES FinTech

Anton LippertHead of Delivery at HES FinTech

Automated Decision-Making

An automated loan process allows you to make data-driven credit choices effectively and swiftly with a proper mixture of speed and accuracy.

You can quickly evaluate loan applications based on eligibility requirements and fast-track the decision process when no additional reviews are required. This way, you can also get access to credit scores and reports in real time, which enables a clear insight into an applicant’s financial standing and defines decision-making rules tailored to different regulatory standards, organizational objectives, and application contexts.

Efficient Compliance Monitoring

According to PYMNTS, 61% of mid-sized banks prefer fully automated lending. For the past few years, the financial services industry has been digitalized greatly, which led to the development of new business offerings and service providers. These innovations have led to the fact that now companies need to ensure security and regulatory compliance across the lending landscape.

It’s easier to comply with these rules if your company has an automated loan processing system that helps to ensure your data has strong security and governance. Real-time checks can run against regulatory standards, with any missing or inaccurate data promptly identified. Complete audit trails document each step of the process, while compliance reports can be generated on demand, ensuring full transparency at all times.

Is Your Business Ready For Automation?

We’ve come up with a list of challenges that might be overcome with automation. Check it out to see if it rings a bell:

- Operational Bottlenecks: Is slow underwriting hindering timely loan approvals and frustrating your clients?

- Resource Constraints: Is your team overburdened, or are raising labor costs holding you back from scaling operations?

- High Volume of Applications: Has manual loan processing made you grapple with carrying on with a rising number of loan applications?

- Error-Prone Processes: Have manual mistakes in the past contributed to compliance issues, borrower dissatisfaction, or even loan defaults?

- Borrower Expectations: Are your borrowers expecting quicker, more transparent application experiences in today’s digital-first landscape?

- Regulatory Challenges: Has keeping up with constantly changing audit trails and compliance requirements become hard for your business?

If you answered “YES” several times, then your business is ready for automation. To do so, you need specialists from both technology and finance. Here is the list of them:

Financial Expertise:

- Underwriters

- Credit Analysts

- Loan Officers

Technology Expertise:

- Implementation Specialists

- Software Developers

- Project Managers

- Data Scientists

- IT Support Staff.

Automate your loan processing

Conclusion

The manual loan process may seem more familiar, but its time has already gone. In the market when borrowers expect from lenders maximum speed, accuracy, and transparency, its inefficiencies may make your company look weaker compared to competitors. Its operational hurdles, such as error-prone processes, rising expenses, and slow approvals, may also hinder your business development.

Automated loan processing, on the contrary, turns these challenges into opportunities to make your company better. With such modernization, your team can concentrate on strategic activities without losing precision and control of their previous tasks.

The future of the loan processing business lies in being more borrower-oriented, and this novelty won’t let you get left behind. As a lending provider of automated solutions, at HES FinTech we can help you to modernize your business so it can comply with all the rules of the modern market and bring in new clients.