-

-

- Borrower pre-qualification—assessing initial eligibility based on basic criteria

- Loan application—collecting and processing customer information

- Evaluation—verifying documents, running credit checks, and assessing risk

- Underwriting—applying decision rules to approve or decline applications

- Loan granting—finalizing terms and disbursing funds

- Disbursement tracking—monitoring the release and utilization of loan funds

- Debt collection—managing repayments, reminders, and follow-ups for overdue loans

-

Automating these steps, as well as others, speeds up decision-making and improves accuracy and consistency. Most importantly, it shortens the all-important ‘time to yes’. According to Deloitte, this translates into a stronger end-to-end customer experience, higher conversion rates, and a 30-40% reduction in origination handling costs.

Key Benefits of a Loan Automation System

| Stakeholder | Benefits |

|---|---|

| Borrowers | Faster approvals, proactive notifications, and a smoother loan journey |

| Loan officers | Less manual data entry, reduced repetitive tasks, and more time for complex credit decisions and client relationships |

| Management teams | Lower operational costs, improved efficiency, stronger risk discipline, and actionable insights |

| Regulators / Auditors | Streamlined compliance, automated audit-ready reports, and transparent decision trails for every loan. |

Let’s break down the key benefits of loan automation and explore how it impacts every stakeholder in the lending industry.

Reduced Operational Costs

Every hour spent on manual data entry, income verification, or document routing adds unnecessary overhead.

Loan automation, on the other hand, cuts expenses per loan and allows staff to focus on higher-value work like complex adjudication and relationship management.

More importantly, it lowers the cost of the entire lending process and increases the platform’s throughput capacity, thus resulting in significantly higher ROI.

Faster Decision-Making and Shorter Cycle Times

Automated lending triggers credit pulls, regulatory checks, and internal approvals in parallel, cutting multi-week waits down to same-day decisions for consumer lending and multi-day decisions for SME and corporate lending. That speed translates into a decisive advantage in the financial services market, like it happened with our client, Euro Groshi.

It took them 2,5 months to go live and start originating hundreds of quality loans per day. Now, the credit application process for new customers takes no more than 15 minutes, while repeat customers receive loan decisions within 5 to 10 minutes.

Greater Efficiency with Existing Resources

Coordinating tasks across underwriting, compliance, and loan servicing often creates duplicate work and unnecessary handoffs.

Loan workflow automation removes those barriers, thereby improving throughput without additional hiring or IT spend. As a result, lending businesses gain the ability to handle larger volumes while maintaining lean operations.

Better Borrower Experience (and higher conversion!)

Instant document checks, proactive notifications, and a user-friendly borrower portal reduce friction and cut down on support needs.

The result is happier borrowers who complete applications more often and return when they need their next loan.

Risk Discipline and Early-Warning Controls

Keeping customer data, bureau scores, and alternative signals within single loan management software helps maintain consistent credit policies.

Automated thresholds, watchlists, and anomaly flags add an extra layer of control while model-driven rules pass only genuine exceptions to humans.

As a result, unexpected losses shrink and risk-based pricing becomes more practical at scale.

Audit-ready Compliance

Automated systems capture every action, like data sources, decision rationale, and approvals, and produce standardized reports on demand. That means faster regulatory responses, cleaner audit trails, and fewer reconciliation cycles across the entire lending process.

Plus, when AI or ML models are involved, these systems also undergo model explainability checks to help ensure compliance with regional regulations such as the EU AI Act or US CFPB guidelines.

Enhanced Scalability

With loan process automation, growing loan volumes require far less additional staff and infrastructure.

Thanks to this, institutions can expand more quickly, sustain rapid growth, and more easily introduce new products, enter new geographies, or open additional channels.

7 Must-Have Features of a Loan Automation System

Loan automation platforms vary in scope and design but certain features are universally essential for making the lending process faster, more accurate, and scalable.

Below, we’ll provide a lowdown on the seven core capabilities that define a high-performing loan system.

1. Secure Identity Verification

Every lending journey begins with confirming who the borrower is. A robust loan automation system supports secure identity checks through digital channels, combining biometric authentication, document scanning, and trusted KYC plugins. These measures help protect against fraud as well as create a frictionless digital onboarding experience for borrowers.

2. Intelligent Application Intake and Document Parsing

Intelligent intake modules are responsible for automating the extraction of information from pay slips, tax records, and bank statements, and then structuring it in a standardized format.

This leads to cleaner customer data, fewer errors, and faster progression to the next stages of the loan management process.

3. Automated Credit Decisioning and Scoring

One of the central features of loan automation is automated credit decisioning and scoring.

With configurable rules and integrated bureau data that can be enhanced by predictive algorithms, lenders can process applications in record time. Straightforward cases are approved much faster, complex profiles are flagged for expert review, and portfolio-level insights strengthen overall risk management.

A practical example of how an ML-powered decisioning layer delivers real benefits can be seen in our work with Fintuity, a UK-based financial advisory firm.

We helped them customize and launch an ML-driven advisory platform built on our modular white-label HES LoanBox software. The platform analyzes client data in real time and automatically generates personalized investment plans, allowing each client to assume an appropriate level of risk and ensuring that they do not pay excessive fees. It also provides process automation tools and algorithms for faster operations, fewer errors, and greater business efficiency.

Thanks to these advanced capabilities, Fintuity automated over 70% of its processes and achieved ROI within ten months.

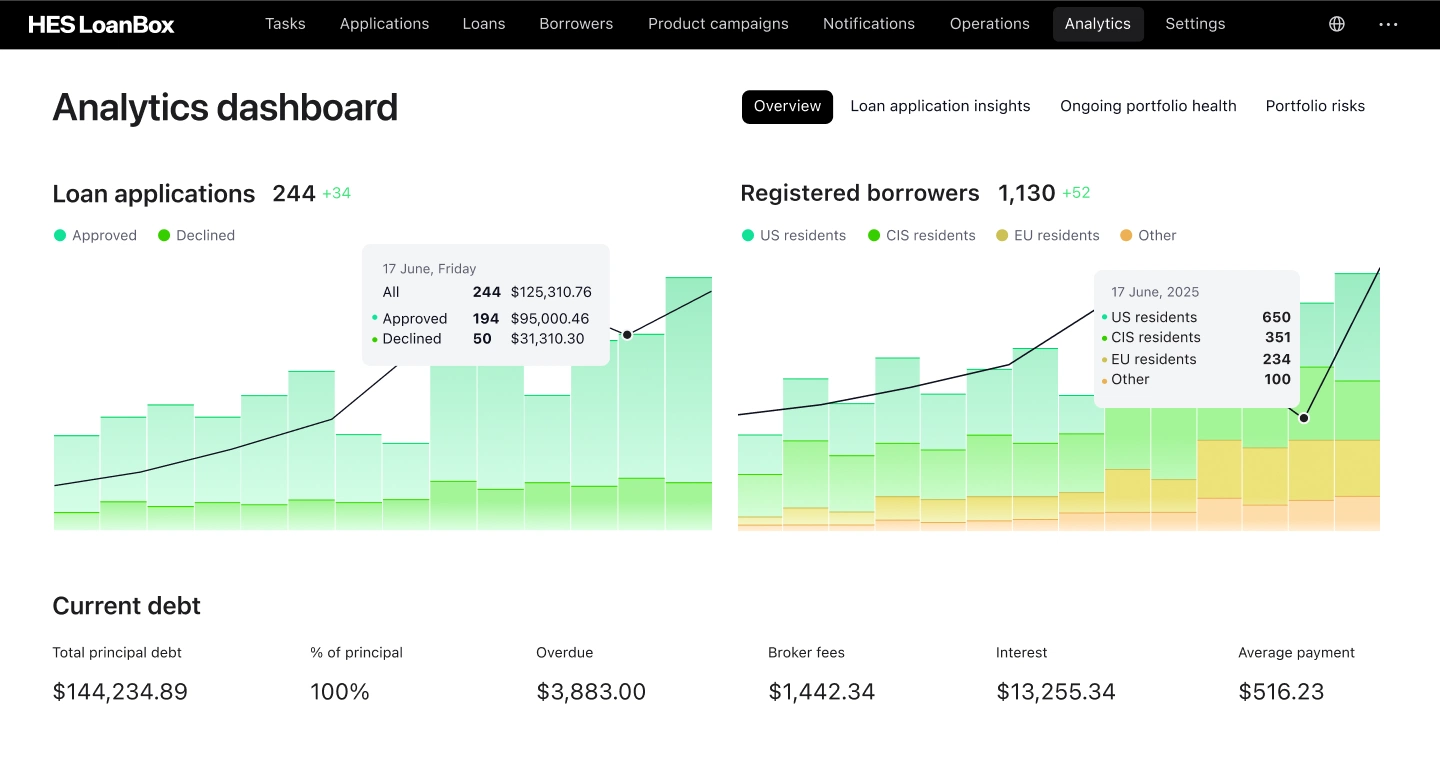

4. Reporting, Analytics, and Dashboards

Visibility into portfolio health is critical for managing performance. Built-in analytics translate raw data into insights on profitability, borrower behavior, and risk exposure.

Interactive dashboards then make those insights actionable, empowering teams to track delinquencies, refine scorecards, and adjust lending strategies without delay.

5. Transaction Automation

Behind every loan are numerous financial movements such as payments, settlements, and reconciliations that require accuracy and timeliness.

The automated transaction handling feature integrates directly with banking systems to execute transfers, update balances, and log activity in real time. By doing so, it provides a dependable operational backbone while supporting faster, scalable loan processing as volumes increase.

6. Document Management

Managing documentation is essential for both compliance and efficiency.

A loan automation system centralizes this process and enables borrowers to upload files and sign contracts digitally while the platform securely stores records, maintains audit trails, and enforces compliance rules. That integration reduces administrative workload and strengthens regulatory readiness.

7. Regulatory Adaptability

Modern loan automation solutions help businesses adapt on the fly to ever-changing regulations.

Whether it’s tweaking workflows, updating decision rules, or generating new compliance reports, integrated compliance tools make it easier to maintain regulatory alignment without slowing down core operations.

While every lender’s tech stack looks different, most of these core features are already integrated into modern modular systems like HES LoanBox. Designed with configurable modules for KYC, scoring, underwriting, reporting, and regulation adherence, a loan automation software allows institutions to adopt the functionality they need first and expand over time.

Loan Automation System Implementation Best Practices

Adopting loan automation can indeed give a boost to your lending operations. Yet, success requires more than simply installing software.

In fact, effective implementation depends on careful planning, thoughtful integration, and attention to both technology and people.

Below are the key practices that can guide your loan automation journey and help ensure it succeeds well into the future.

1. Prioritize Processes for Automation

It’s important to emphasize that this is one of the two most critical steps in implementing a successful loan automation system.

Before automating, you will have to review your entire loan process from pre-qualification to disbursement and decide which lending processes you can automate.

Look at the tasks that are most repetitive, slow, or prone to errors such as loan pre-screening, application process review, credit checks, and approvals (normally, these are where automation can have the greatest impact).

Equally important is carefully planning the automation itself: map out the logic, define workflows, and design different scenarios to ensure the system can handle both typical and exceptional cases. Plus, consider how your legacy systems will interact with new tools so integrations are seamless and disruptions are minimized.

Thus, by understanding the workflow and targeting the most impactful steps, you’ll make automation more efficient, reduce mistakes, and ensure a successful adoption of automation tools within your team.

2. Choose the Right Vendor

The next vital step is selecting a vendor who can serve as a reliable partner in your automation journey.

Look for a partner that offers guidance, regular updates, and proactive support. Make sure they understand your business needs and can keep your automated system aligned with regulations.

Plus, when evaluating different options, check whether the vendor’s platform is flexible and highly customizable. Responding to this demand from multiple clients, we designed HES LoanBox to deliver robust functionality with the flexibility to adapt quickly to diverse workflows and client requirements.

3. Show Clients that Their Data is Safe and Handled Responsibly

Building trust with your clients starts with showing that your business handles their data responsibly and transparently.

With loan automation happening mostly online, clients can’t always see how their sensitive information is processed.

In this way, implementing clear and practical financial data security practices can give clients a clear view of how their personal data is used.

These might include:

-

-

- Explain data usage clearly. Use plain language to show borrowers how their data is collected, stored, and used, building transparency and trust.

-

-

-

- Comply with laws and regulations. Follow rules like PSD3, GDPR, GLBA, and KYC/AML to protect sensitive financial information and demonstrate reliability.

-

-

-

- Add visual elements of security. Use visible cues such as HTTPS, trust badges, and secure connection indicators to reassure borrowers.

-

-

-

- Offer extra security tools. Let users enable features like two-step authentication, biometric verification, or fraud alerts to give them more control.

-

4. Educate Your Team

Even the best system can fail if your team isn’t on board. Thus, you need to take the time to educate staff, clearly explain how their roles will evolve, and highlight that automation is there to lighten repetitive work, not replace their expertise.

With proper training and support, staff begin to see automation as a tool that simplifies their workload and allows them to apply their expertise where it matters most.

5. Monitor and Optimize

After implementing a lending management system, it’s important to regularly review its performance.

Look at loan processing metrics, spot bottlenecks, and gather feedback from both staff and borrowers. Making small, continuous improvements can boost operational efficiency, reduce errors, and enhance the overall lending experience over time.

For instance, in HES LoanBox, we’ve added dashboards with in-built analytics of loan application insights and portfolio risks, so that lenders can react to the portfolio shifts on time.

Aspects to Look at When Choosing a Loan Automation Solution

| Factor | What to check |

|---|---|

| Customization and Configurability | Check if workflows, approvals, and credit products can be customized to your processes |

| User Experience | Make sure the interface is intuitive for both borrowers and employees |

| Vendor’s Proactive Support | Look for ongoing guidance, proactive updates, and strong client support |

| Implementation Flexibility | Consider vendors offering phased rollouts or pilot programs to ease adoption |

| Scalability Capacity | Ensure the system can handle growing volumes, new products, and geographies |

| Cost and ROI | Evaluate total ownership costs against operational gains and revenue potential |

| Vendor Reputation and References | Check client references, case studies, and industry recognition for credibility |

| Security and Compliance | Ensure the platform follows security standards and complies with relevant regulations |

Here are some key aspects to keep in mind when choosing a loan automation system for your business.

1. Customization and Configurability

Check whether the partner can configure the system’s workflows, approval hierarchies, and credit products to fit your specific processes.

Doing so will help ensure that the system can grow with your needs and let your lending operations scale efficiently without constant IT intervention.

2. User Experience

Select a platform with an intuitive interface that works well for both borrowers and your team.

Smooth navigation, streamlined borrower portals, and comprehensive back-office tools can help reduce friction, enhance usability, and keep the loan process running like a clock.

3. Vendor’s Proactive Support

It’s worth looking at how the vendor supports its clients. Reliable guidance, proactive updates, and ongoing assistance can make a big difference in keeping your system performing well while evolving alongside your lending business.

4. Implementation Flexibility

Vendors that support phased rollouts or pilot programs can make adoption much easier than jumping straight into a full-scale launch.

Gradual implementation gives your team time to refine workflows, train staff effectively, and tackle challenges early. Plus, it helps ease the path to scaling the system across your entire lending process.

5. Scalability Capacity

A loan automation system should grow with your business, handling higher loan volumes, expanding into new geographies, or supporting additional products without requiring major redesigns.

Besides, opting for a cloud-native automation platform with client-side data storage combines scalability and security in one go, allowing you to meet increased demand while keeping data safely on your side. This combination of flexible architecture and strong security can guarantee that your operations remain agile and reliable as your lending needs evolve.

6. Cost and ROI

Take a close look at the total cost of ownership, including licensing, support, and training.

Afterwards, compare this with the efficiency gains, faster approvals, and potential revenue uplift to understand the real return on investment.

7. Vendor Reputation and References

Take the time to look at case studies, client feedback, and industry awards.

Choosing a partner with a strong history of success can help ensure your loan automation system is reliable, secure, and built to support both current operations and future growth.

8. Security and Compliance

Opt for a solution that follows strong security standards and stays compliant with all relevant regulations. This will help keep your platform safe, your business credible, and your clients confident.

Conclusion

A loan automation system can deliver tangible benefits across operational efficiency, borrower experience, compliance, and portfolio performance.

Businesses that adopt loan workflow automation can shorten decision cycles, reduce costs, and strengthen resilience in a dynamic fintech environment.

At the same time, it’s important to carefully evaluate your options before implementation. Consider the platform’s features, assess its scalability and configurability, and pay attention to data security and staff training to ensure successful adoption and long-term value.

At HES FinTech, we’ve supported alternative lenders, MFIs, and embedded finance providers across 30+ countries in automating their loan processes and optimizing workflows with HES LoanBox. Our ready-made lending platform offers AI-based credit scoring, end-to-end loan management software, configurable loan products, and multiple calculation logic options that help businesses speed up loan approvals and reduce operational bottlenecks.