Capable of helping lenders optimize their operational workflows and deliver a much better borrower experience, loan management software has become a must-have tool for financial institutions worldwide. The numbers pretty much prove it, as the global loan management software market is expected to hit around $22.97 billion by 2029.

Still and all, few platforms can cover absolutely every lending need without additional customization. This is because each type of lending software is built to help cope with different pain points and match distinct lending models. For instance, a solution that is suitable for microfinance operations won’t necessarily work for auto finance or commercial lending. Therefore, selecting the right platform ultimately comes down to the specific lending activities and workflows you manage on a regular basis.

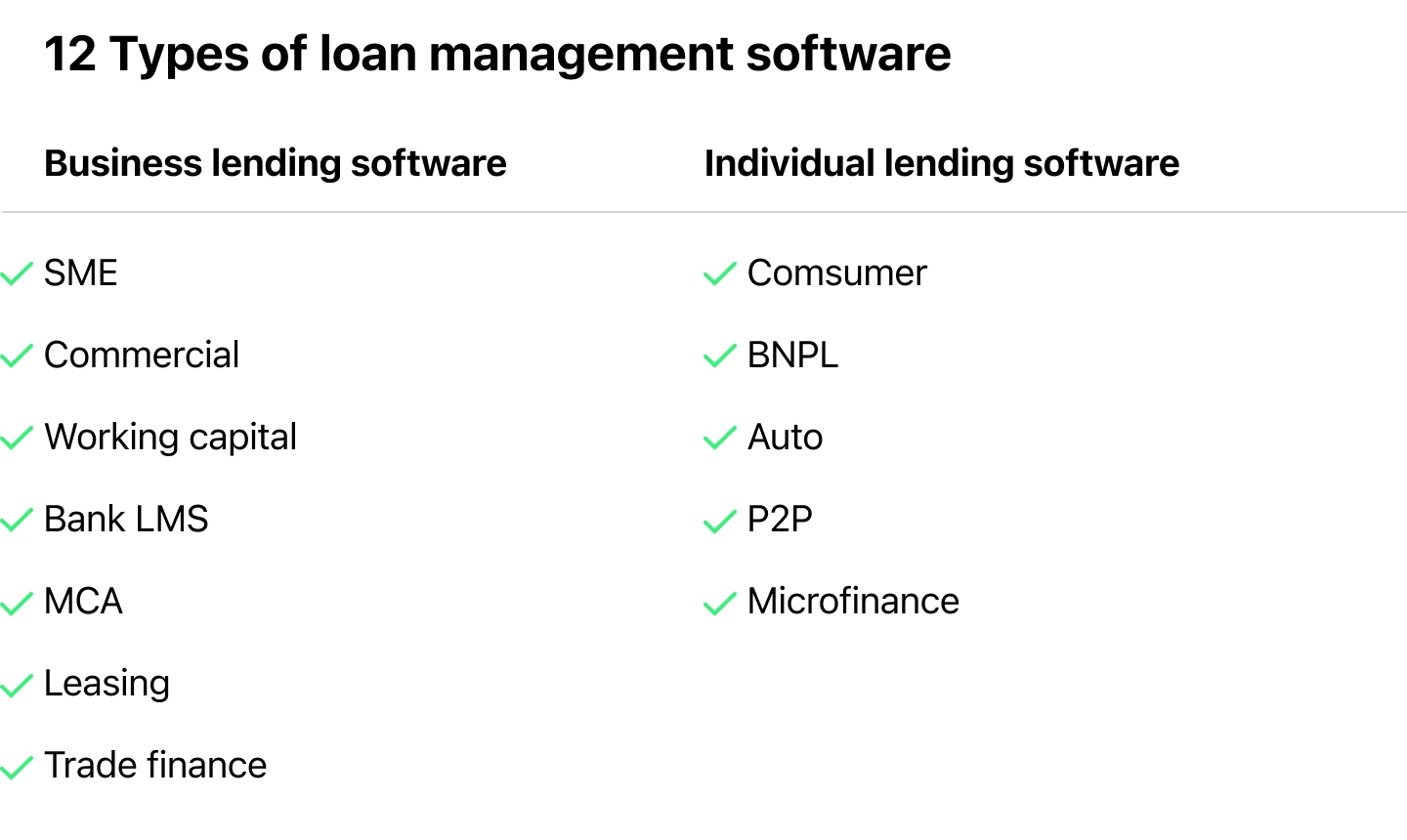

In this article, we’ll explore 12 loan management software types and explain how each one supports different lending goals.

Overview of 12 loan management software types

Each and every solution is unique in its own way, supporting distinct lending workflows or target segments. Some are built to simplify personal lending while others are designed to handle complex business financing.

Below, we’re going to delve into the 12 loan management software loan types and touch upon how each of them supports different operational goals.

For easier navigation, we’ve grouped them into two categories: those focused on individual lending and those designed for business lending, so you can get a clearer sense of which direction might fit your needs best.

Loan management software for businesses

1. SME lending software

The concept of SME lending has been getting a lot of attention. Deloitte even suggests that banks should treat SME lending as a starting point for their broader digital transformation.

As far as SME lending software is concerned, this is a comprehensive solution that helps meet the lending needs of small and medium-sized enterprises. It helps SME lenders efficiently issue and service loans by automating time-consuming tasks such as borrower onboarding, document collection, credit assessment, and loan approval. Plus, the system can evaluate a borrower’s financial health by analyzing key financial metrics such as profitability ratios and liquidity indicators.

Some SME lending software also supports operations such as loan restructuring, refinancing, and flexible rate management, including variable and government-linked rates.

What’s more, the most advanced SME lending platforms enable lenders to configure custom loan options, manage collateral, and help maintain compliance with local regulations and industry standards, all of which is possible thanks to robust tools for monitoring, reporting, and auditing.

Here’s what one of HES FinTech clients highlights after we launched a SME lending platform for them:

We have chosen HES FinTech as a financial IT provider for several reasons. First, the company has expertise in international financial markets. Second, HES LoanBox is very flexible and easy to use, supporting our partner dealerships.

Roman VavronCEO of Ta Meri and Luxury Cars

Roman VavronCEO of Ta Meri and Luxury Cars

11. P2P lending software

P2P lending software connects individual borrowers directly with investors, thus removing the need to resort to traditional intermediaries. The platform provides a centralized hub where lenders can manage loan listings, bids, disbursements, and repayments within one transparent interface.

P2P lending solutions can also help track account balances, freeze bid amounts, and transfer funds once a loan is fully funded. Most systems also support multiple loan types and repayment models, which gives both borrowers and investors the flexibility to choose products that fit their goals and keep operations fully auditable and efficient.

Also, modern P2P lending platforms integrate advanced features, including AI-driven credit scoring, KYC, and AML verification, which helps better assess an individual’s creditworthiness, reduce fraud, and ensure regulatory compliance.

12. Microfinance software

As the global micro-lending market is projected to grow by over $532 billion in 2029, the demand for microfinance software to manage small-scale loans continues to rise, too.

Microfinance software is purpose-built for institutions that serve individuals and microbusinesses that are either underserved or have limited access to traditional banking services.

Such a platform centralizes all lending activities, including borrower onboarding, loan tracking, repayment, and reporting, and grants organizations a unified view of portfolio health and client performance.

Microfinance solutions also come with built-in pre-scoring tools and automated credit evaluation modules. These allow for consistent and transparent lending decisions, even when working with non-traditional financial data such as business turnover, repayment behavior, or social scoring metrics.

Some leading platforms also incorporate a loan calculator that shows users the terms and amount they can receive and helps them choose the most suitable credit product based on personal needs.

| Software type | Primary users | Core purpose | Key features | Who benefits most |

|---|---|---|---|---|

| 1. SME lending software | SME lenders, banks, fintechs | Manage SME loan origination and servicing | Automated onboarding, document collection, financial health analysis, custom loan options, collateral management, compliance tools | Lenders working with small and medium businesses |

| 2. Commercial lending software | Banks, large financial institutions | Handle complex business loans and credit lines | End-to-end commercial lending automation, advanced underwriting, risk assessment, multi-stakeholder workflows | Business lenders dealing with high-value, complex transactions |

| 3. Working Capital finance software | Banks, fintechs, factoring providers | Support short-term financing and liquidity management | Credit limit setup, invoice financing, revolving credit lines, automated scoring, cash flow assessment | Lenders offering working capital and liquidity products |

| 4. Bank loan management software | Banks, credit unions | Unified platform for all personal and corporate lending | Custom scorecards, bureau checks, AML/KYC integrations, core banking APIs, Basel III and IFRS 9 compliance tools | Banks needing secure, compliant, multi-product lending |

| 5. Merchant Cash Advance (MCA) software | MCA providers, fintech lenders | Manage revenue-based financing linked to daily sales | POS integrations, real-time cash flow tracking, automated underwriting, KYB/KYC checks | Lenders offering cash advances to small merchants |

| 6. Leasing management software | Leasing companies, auto dealers, banks | Manage the full leasing lifecycle | Residual value and depreciation calculations, lease models, scoring, document management, IFRS 16 accounting | Companies dealing with equipment, auto, or asset leasing |

| 7. Trade finance software | Banks, global trade institutions | Manage international trade transactions | Letters of credit, guarantees, supply chain finance, SWIFT connectivity, configurable workflows | Institutions supporting international trade operations |

| 8. Consumer lending software | Banks, credit unions, fintech lenders | Support personal loan lifecycle | Automated credit checks, decisioning, variable rate management, restructuring tools, portfolio analytics | Lenders offering personal or unsecured loans |

| 9. BNPL software | BNPL providers, e-commerce businesses | Enable installment-based checkout financing | Instant credit checks, automated decisioning, repayment tracking, checkout integration | Merchants and fintechs offering point-of-sale credit |

| 10. Auto finance Software | Auto lenders, banks, dealerships | Manage vehicle financing | Proposal generation, multi-channel applications, scoring tools, loan servicing | Institutions financing car purchases |

| 11. P2P Lending software | Marketplace lenders, fintech startups | Connect borrowers and individual investors | Loan listings, bidding, repayment automation, AI scoring, AML/KYC | Platforms enabling investor-funded loans |

| 12. Microfinance software | Microfinance institutions, NGOs, rural banks | Manage micro loans for underserved clients | Pre-scoring, onboarding, loan tracking, alternative-data underwriting, calculators for borrowers | Organizations lending to microbusinesses and low-income borrowers |

Key features of loan management software

As we’ve already said above, every loan management software is designed to tackle specific lending objectives. Still, there are some key features that you’ll find in nearly all of them.

Below, we’ll take a quick look at the most essential loan management software features (or at least those that any reliable system should include).

1. Identity verification and user onboarding

From the outset, it’s necessary for every borrower to go through a proper verification flow and pass it without friction. To make sure that happens, a solid loan management system usually features either built-in KYC digital lending functionality or integrates with reliable external KYC plugins. These tools check user identity using document scans, personal data, or biometric info and help you instantly verify applicants while staying compliant.

On top of this, a well-thought-out borrower portal makes onboarding feel smooth. Features like a loan calculator, personal dashboard, application status updates, and email/SMS notifications all contribute to a more transparent and intuitive borrower journey.

2. Loan application intake and processing

Regardless of the loan type you’re dealing with, it always starts with an application. That’s why you need a system that can smartly handle the intake part, from collecting borrower data to preparing it for review.

The best solutions come with integrated intelligent intake and processing modules that automate the extraction of data from pay slips, tax records, or bank statements and put it all into a unified format ready for further in-depth analysis.

3. Credit scoring

To assess potential risks and shape your approval policy, loan management software relies on a credit scoring module that can combine credit bureau data, internal rules, and alternative info like cashflow behavior or transaction patterns.

Essentially, modern lending software employs AI to remove human bias and improve accuracy when analyzing profiles. In some cases, it even allows you to tweak or train scoring models to fit your own business rules so as to better manage risks and keep decisions consistent across different loan types.

4. Document management and e-signature

Lending is always paperwork-heavy and requires proper handling of contracts, disclosures, ID copies, and collateral docs. And if your lending system doesn’t have a proper document management module, things might get messy.

A solid document management module, on the other hand, gives you a secure place to store and track all files, control versions, and share docs safely.

Besides, when paired with an e-signature tool, you can basically go paperless. Borrowers can sign agreements from anywhere, and you get deals closed within a relatively short timeframe without waiting for scanned copies or physical visits.

5. Configurable product and workflow engine

Every loan type works differently and has its own logic, terms, and fees. For instance, what applies to an SME loan won’t fit a BNPL one.

That’s why, if you opt for a white-label loan management system software and decide to tailor it to your needs, make sure it includes a highly configurable product engine. This one will make it possible to define interest types, repayment schedules, approval chains, or even restructuring flows without having to significantly tweak the code.

6. Portfolio monitoring

Lenders want a full view of portfolio health, i.e., which loans are performing best, which are late, where they might need provisioning, etc. Borrowers, for their part, should be able to see their progress, payment status, and plans on their side.

In other words, the goal here is to make sure that you have a reliable loan system that helps both lenders and borrowers keep abreast of the portfolio status.

7. Debt collection module

The debt collection module helps manage overdue accounts, track missed payments, and support restructuring or settlement cases.

In addition to this, integration with communication channels like email or SMS helps teams stay connected with borrowers and send them timely payment reminders, follow-ups, or settlement updates.

8. Analytics, dashboards, and reporting

With analytics and dashboard functionalities, you’ll be able to see what’s going on with approval rates, default trends, profitability, customer activity, and lots of other aspects.

Some loan management systems even go the extra mile and incorporate predictive analytics (like HES LoanBox did by incorporating the GiniMachine engine), so you can spot risk patterns early instead of reacting later.

9. Regulatory adaptability

A loan management software needs to include strong regulatory adaptability. It should support AML and KYC verification capabilities, data encryption, comprehensive audit logs, and ready-to-use regulatory reporting templates.

Pay close attention to this specific functionality when choosing a lending system, as it will assist you in maintaining compliance with local and/or international financial regulations and make adapting to new requirements easier.

Conclusion

We’ve covered the 12 types of loan management software, though the list doesn’t end here. If you’re exploring which lending system type fits your business best or just need some expert input before you start, feel free to get in touch with HES FinTech team. We’ve got strong hands-on experience designing and customizing all kinds of lending software and can help you figure out what works best for your specific goals.

See if we are a good fit

We have chosen HES FinTech as a financial IT provider for several reasons. First, the company has expertise in international financial markets. Second, HES LoanBox is very flexible and easy to use, supporting our partner dealerships.

Roman VavronCEO of Ta Meri and Luxury Cars

Roman VavronCEO of Ta Meri and Luxury Cars

11. P2P lending software

P2P lending software connects individual borrowers directly with investors, thus removing the need to resort to traditional intermediaries. The platform provides a centralized hub where lenders can manage loan listings, bids, disbursements, and repayments within one transparent interface.

P2P lending solutions can also help track account balances, freeze bid amounts, and transfer funds once a loan is fully funded. Most systems also support multiple loan types and repayment models, which gives both borrowers and investors the flexibility to choose products that fit their goals and keep operations fully auditable and efficient.

Also, modern P2P lending platforms integrate advanced features, including AI-driven credit scoring, KYC, and AML verification, which helps better assess an individual’s creditworthiness, reduce fraud, and ensure regulatory compliance.

12. Microfinance software

As the global micro-lending market is projected to grow by over $532 billion in 2029, the demand for microfinance software to manage small-scale loans continues to rise, too.

Microfinance software is purpose-built for institutions that serve individuals and microbusinesses that are either underserved or have limited access to traditional banking services.

Such a platform centralizes all lending activities, including borrower onboarding, loan tracking, repayment, and reporting, and grants organizations a unified view of portfolio health and client performance.

Microfinance solutions also come with built-in pre-scoring tools and automated credit evaluation modules. These allow for consistent and transparent lending decisions, even when working with non-traditional financial data such as business turnover, repayment behavior, or social scoring metrics.

Some leading platforms also incorporate a loan calculator that shows users the terms and amount they can receive and helps them choose the most suitable credit product based on personal needs.

| Software type | Primary users | Core purpose | Key features | Who benefits most |

|---|---|---|---|---|

| 1. SME lending software | SME lenders, banks, fintechs | Manage SME loan origination and servicing | Automated onboarding, document collection, financial health analysis, custom loan options, collateral management, compliance tools | Lenders working with small and medium businesses |

| 2. Commercial lending software | Banks, large financial institutions | Handle complex business loans and credit lines | End-to-end commercial lending automation, advanced underwriting, risk assessment, multi-stakeholder workflows | Business lenders dealing with high-value, complex transactions |

| 3. Working Capital finance software | Banks, fintechs, factoring providers | Support short-term financing and liquidity management | Credit limit setup, invoice financing, revolving credit lines, automated scoring, cash flow assessment | Lenders offering working capital and liquidity products |

| 4. Bank loan management software | Banks, credit unions | Unified platform for all personal and corporate lending | Custom scorecards, bureau checks, AML/KYC integrations, core banking APIs, Basel III and IFRS 9 compliance tools | Banks needing secure, compliant, multi-product lending |

| 5. Merchant Cash Advance (MCA) software | MCA providers, fintech lenders | Manage revenue-based financing linked to daily sales | POS integrations, real-time cash flow tracking, automated underwriting, KYB/KYC checks | Lenders offering cash advances to small merchants |

| 6. Leasing management software | Leasing companies, auto dealers, banks | Manage the full leasing lifecycle | Residual value and depreciation calculations, lease models, scoring, document management, IFRS 16 accounting | Companies dealing with equipment, auto, or asset leasing |

| 7. Trade finance software | Banks, global trade institutions | Manage international trade transactions | Letters of credit, guarantees, supply chain finance, SWIFT connectivity, configurable workflows | Institutions supporting international trade operations |

| 8. Consumer lending software | Banks, credit unions, fintech lenders | Support personal loan lifecycle | Automated credit checks, decisioning, variable rate management, restructuring tools, portfolio analytics | Lenders offering personal or unsecured loans |

| 9. BNPL software | BNPL providers, e-commerce businesses | Enable installment-based checkout financing | Instant credit checks, automated decisioning, repayment tracking, checkout integration | Merchants and fintechs offering point-of-sale credit |

| 10. Auto finance Software | Auto lenders, banks, dealerships | Manage vehicle financing | Proposal generation, multi-channel applications, scoring tools, loan servicing | Institutions financing car purchases |

| 11. P2P Lending software | Marketplace lenders, fintech startups | Connect borrowers and individual investors | Loan listings, bidding, repayment automation, AI scoring, AML/KYC | Platforms enabling investor-funded loans |

| 12. Microfinance software | Microfinance institutions, NGOs, rural banks | Manage micro loans for underserved clients | Pre-scoring, onboarding, loan tracking, alternative-data underwriting, calculators for borrowers | Organizations lending to microbusinesses and low-income borrowers |

Key features of loan management software

As we’ve already said above, every loan management software is designed to tackle specific lending objectives. Still, there are some key features that you’ll find in nearly all of them.

Below, we’ll take a quick look at the most essential loan management software features (or at least those that any reliable system should include).

1. Identity verification and user onboarding

From the outset, it’s necessary for every borrower to go through a proper verification flow and pass it without friction. To make sure that happens, a solid loan management system usually features either built-in KYC digital lending functionality or integrates with reliable external KYC plugins. These tools check user identity using document scans, personal data, or biometric info and help you instantly verify applicants while staying compliant.

On top of this, a well-thought-out borrower portal makes onboarding feel smooth. Features like a loan calculator, personal dashboard, application status updates, and email/SMS notifications all contribute to a more transparent and intuitive borrower journey.

2. Loan application intake and processing

Regardless of the loan type you’re dealing with, it always starts with an application. That’s why you need a system that can smartly handle the intake part, from collecting borrower data to preparing it for review.

The best solutions come with integrated intelligent intake and processing modules that automate the extraction of data from pay slips, tax records, or bank statements and put it all into a unified format ready for further in-depth analysis.

3. Credit scoring

To assess potential risks and shape your approval policy, loan management software relies on a credit scoring module that can combine credit bureau data, internal rules, and alternative info like cashflow behavior or transaction patterns.

Essentially, modern lending software employs AI to remove human bias and improve accuracy when analyzing profiles. In some cases, it even allows you to tweak or train scoring models to fit your own business rules so as to better manage risks and keep decisions consistent across different loan types.

4. Document management and e-signature

Lending is always paperwork-heavy and requires proper handling of contracts, disclosures, ID copies, and collateral docs. And if your lending system doesn’t have a proper document management module, things might get messy.

A solid document management module, on the other hand, gives you a secure place to store and track all files, control versions, and share docs safely.

Besides, when paired with an e-signature tool, you can basically go paperless. Borrowers can sign agreements from anywhere, and you get deals closed within a relatively short timeframe without waiting for scanned copies or physical visits.

5. Configurable product and workflow engine

Every loan type works differently and has its own logic, terms, and fees. For instance, what applies to an SME loan won’t fit a BNPL one.

That’s why, if you opt for a white-label loan management system software and decide to tailor it to your needs, make sure it includes a highly configurable product engine. This one will make it possible to define interest types, repayment schedules, approval chains, or even restructuring flows without having to significantly tweak the code.

6. Portfolio monitoring

Lenders want a full view of portfolio health, i.e., which loans are performing best, which are late, where they might need provisioning, etc. Borrowers, for their part, should be able to see their progress, payment status, and plans on their side.

In other words, the goal here is to make sure that you have a reliable loan system that helps both lenders and borrowers keep abreast of the portfolio status.

7. Debt collection module

The debt collection module helps manage overdue accounts, track missed payments, and support restructuring or settlement cases.

In addition to this, integration with communication channels like email or SMS helps teams stay connected with borrowers and send them timely payment reminders, follow-ups, or settlement updates.

8. Analytics, dashboards, and reporting

With analytics and dashboard functionalities, you’ll be able to see what’s going on with approval rates, default trends, profitability, customer activity, and lots of other aspects.

Some loan management systems even go the extra mile and incorporate predictive analytics (like HES LoanBox did by incorporating the GiniMachine engine), so you can spot risk patterns early instead of reacting later.

9. Regulatory adaptability

A loan management software needs to include strong regulatory adaptability. It should support AML and KYC verification capabilities, data encryption, comprehensive audit logs, and ready-to-use regulatory reporting templates.

Pay close attention to this specific functionality when choosing a lending system, as it will assist you in maintaining compliance with local and/or international financial regulations and make adapting to new requirements easier.

Conclusion

We’ve covered the 12 types of loan management software, though the list doesn’t end here. If you’re exploring which lending system type fits your business best or just need some expert input before you start, feel free to get in touch with HES FinTech team. We’ve got strong hands-on experience designing and customizing all kinds of lending software and can help you figure out what works best for your specific goals.