Digital transformation within the lending industry remains a hot topic, and rightly so. The IMF (International Monetary Fund) estimates that over 60% of global GDP will originate from the digital world this year. In addition, insights from Deloitte show that firms that are more digitally mature can expect a 45% net revenue growth, and 43% net profit margin compared to lower maturity at 15% percent for both markers. Still, many companies struggle to calculate the cost of digital transformation effectively and analyze the estimated return on investment loan software correctly.

All of which contributes to the 84% of companies that fail in digital transformation. So, if it’s not sheer spending power that equals success, what is it? The starting point is knowing at the outset how much it is going to cost.

How to Calculate ROI for a Business? Top Tips

To help you calculate your expected return on investment loan software and make smarter decisions for your company, we’ve created these tips.

Tip 1: Know what’s included in your lending software transformation

Digital Transformation in Banking & Finance Just like a potential lender comes to you looking to know the cost of borrowing money, so too should your business know just how much that digital transformation and software is going to cost. Unlike a simple purchase, you make at a store, digital lending software isn’t just a buy-it-and-done deal. It’s likely it will involve a number of factors, such as initial software cost, maintenance costs, team onboarding costs, additional staff hires, and integrations with your current software, at a minimum. All of which will factor into just how profitable your lending software upgrade will be.

Tip 2: Get your ROI calculations right

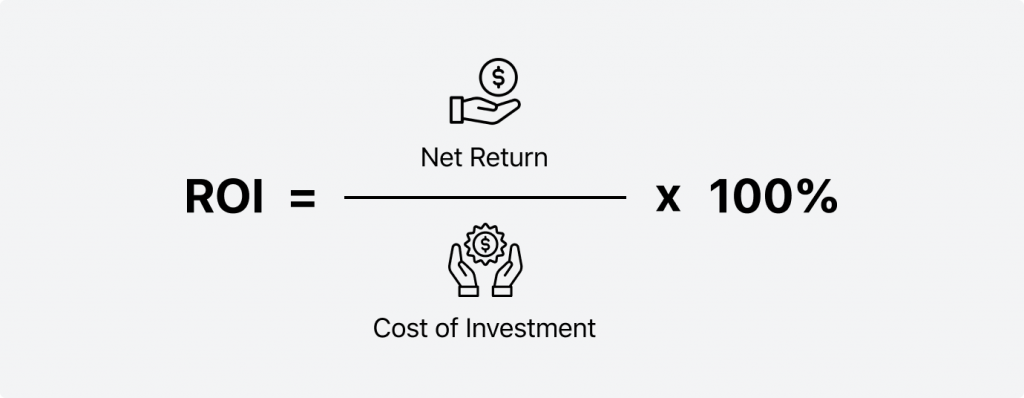

Return on Investment or ROI for short delivers a general measurement on whether an investment is profitable or not. In this case, we’re talking about the return on investment for loan software. To calculate ROI effectively there are a couple of factors to take into account:

- The final value of the loan software investment minus its initial value. This is the Net Return.

- The cost of the investment. How much you pay in total.

Here’s how they interact:

The number you get at the end is your return on investment for your loan origination software solution.

Tip 3: Unlock and interpret your ROI correctly

You wouldn’t take out a mortgage for your house without knowing what is the cost of borrowing, right? Same goes for your ROI. In this case, it’s vital that you’re able to take the results you gathered from Tip 2 and put them into context to understand what they truly mean.

As ROI is expressed as a percentage, this usually gives you an idea of what percentage of profitability it is. However, there is something else that you should be paying attention to as well.

ROI calculations can be in the negative, or in other words, in the Red. This means that the ROI for the loan software investment isn’t profitable under these conditions, and you may make a loss. In which case, it’s time to explore other options or see where you can effectively optimize costs without jeopardizing quality.

Alternatively, if you have planned effectively and the solution is potentially the right one for your business, you may see a positive number (a 1%+ figure). This number shows the percentage your business could gain from this transformation under these conditions and is what’s considered in the Black.

Psss... Wanna start lending within 90 days?

Tip 4: Consider additional measures to calculate profitability

Here, we’ve focused on the estimated return on investment for loan software. However, this isn’t the only metric that you should consider. Calculations such as TCO (total cost of ownership) should also be taken into account to ensure that it’s the best deal for your business and its needs. For example, fully-custom software may house a risk of high TCO due to the need to manage the software and its maintenance on an individual basis. Meanwhile, alternatives, such as the HES solution, offer flexibility and a low TCO, while having the possibility to integrate into your current solutions.

Tip 5: Don’t give up after the first ROI calculation

Often when businesses begin calculating the estimated return on investment for loan software, it can be quite a challenging process where they come to terms with the cost and results expected.

Why Digital Lending is More Powerful than Ever It’s important to remember here that not every solution is the right one for your business. The solution that your competitor is using may be too costly or alternatively not generate the same profit. That’s why, when calculating ROI, you should consider a number of alternatives and weigh them against your company’s needs. In this, you should take into account:

- Your strategic aims in the long term, including your consumer’s pain points—do they want a better ROI mortgage calculator or easier onboarding process or something else—, and the challenges you wish to overcome.

- The type of digital transformation you want to achieve. Common upgrades include data management, internal ecosystem upgrades, optimized workflows, better consumer experience, improved business model, and extended IT infrastructure.

- Finally, decide whether you want to seek out a fully custom, out-of-the-box, or module-based solution (or a combination). This will narrow your search and workload when it comes to finding suitable service providers.

Embrace the Fear and Upgrade Anyway

A popular motivational quote states that FEAR means two things—Forget Everything and Run or Face Everything and Rise. We encourage you to do the latter. Calculating the estimated return on investment for loan software is a challenge for any business, but it doesn’t have to be an insurmountable one. Instead, utilize this analysis to build profitability in your business and stay ahead of your competitors.