The Covid-2019 pandemic takes all spheres of everyday routine to the next level. Following the latest digital banking news, financial organizations are forced to transform their workflow and deliver a high customer experience. The industry professionals see salvation in digital transformation — an integral part of the global economy of tomorrow.

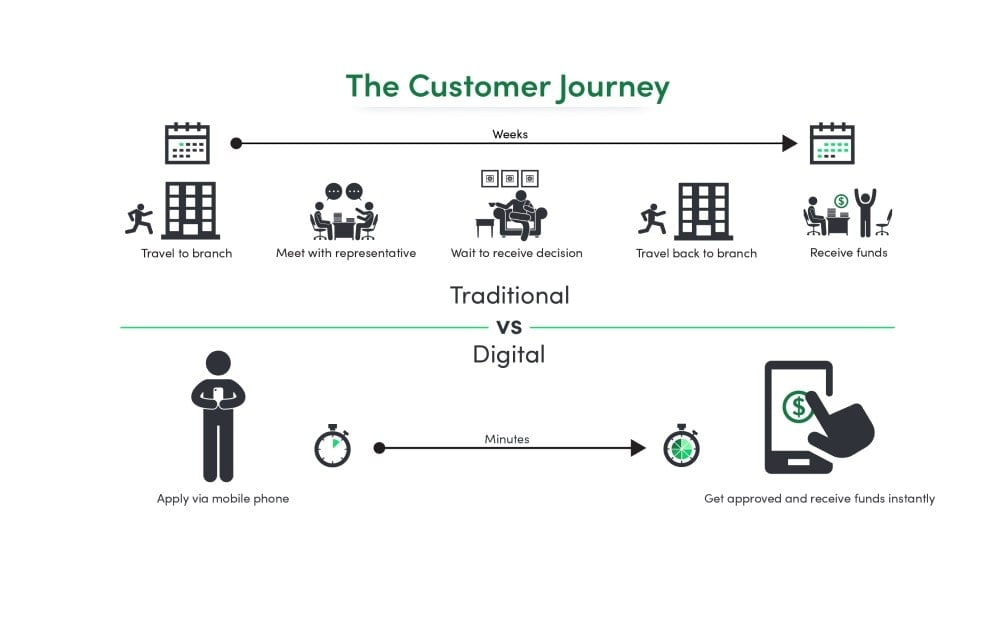

Avoiding top-notch business approaches, banks and financial organizations risk losing customers and money. That’s because you don’t have the opportunity to work quickly and efficiently. Let’s imagine that a bank has 1,000 loan applications, and two weeks to approve or reject them, and issue loans. While its competitor implements digital solutions shortening the lending time, for example, in half. In addition, their clients won’t need to wait in lines and so on. So, who will win customers?

According to Deloitte, about 30% of respondents indicate “creating digital capability” as their main strategic initiative in 2020. While 45% of companies report a positive impact of digital transformation and note higher growth in net revenue.

But what is digital banking itself? To put it briefly, the transformation introduces technology to the business processes and services of a financial institution, allowing them to deliver all their operations online. The common types of digital banking include:

- Account checking and management

- Applications for financial products

- Merchant cash advance services

- Online bill payment

- Business and personal loans.

Digitalization offers much more than just additional channels of online banking services. Within a financial institution, digital transformation comes from the fundamental reform of internal and business processes paired with excessive training of employees. But most importantly, it leads to a mindset shift in the banking sector’s methodology. It’s safe to say that the true meaning of change lies in a modern way of delivering value and driving revenue. For customers, new banking technology brings out a personalized customer journey where all the steps are integrated into a single platform online.

Read also

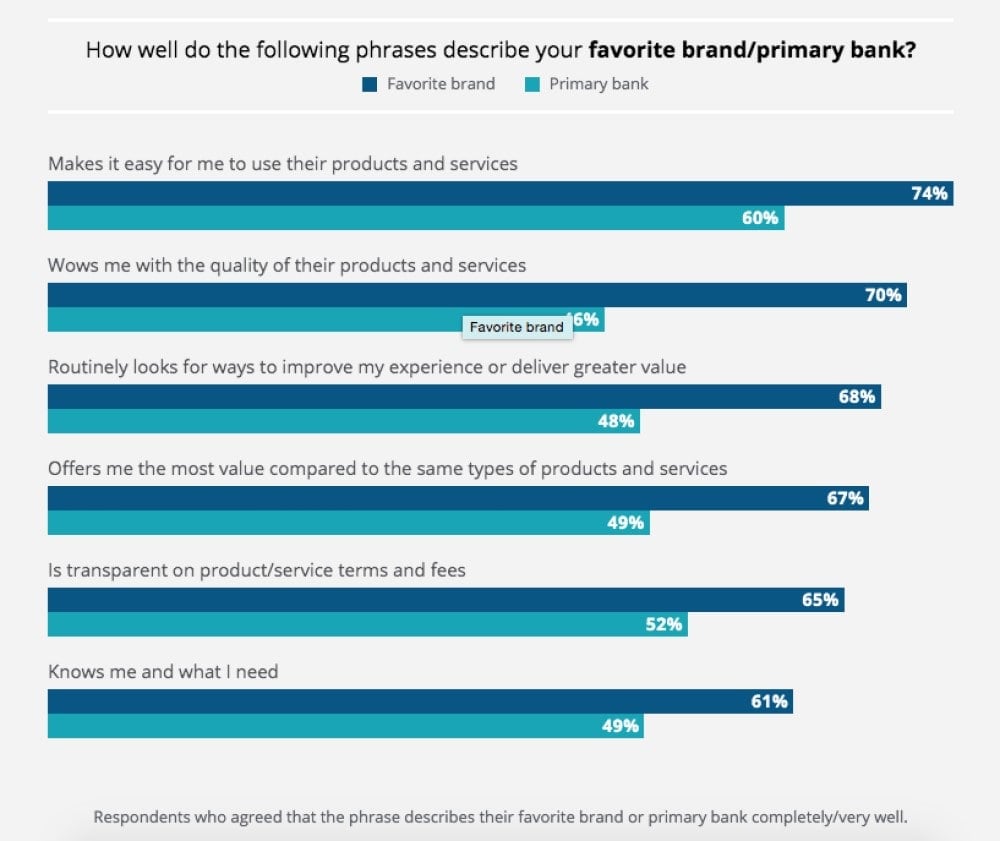

Consumer Journey Shift

Modern customers, with Internet-savvy Millennials as the dominant group, are one of the main advocates of digital banking. They interact with different businesses in various ways, including those that have already begun to transform their working processes. In such cases, clients witness the speed of service and therefore expect the same level of convenience from other enterprises. Deloitte claims that 84% of clients use online banking while 72% access their primary bank via mobile applications. Nessa Feddis, senior vice president at ABA, comments on the new cashless reality: “As fewer people carry around cash and checkbooks, more and more consumers are turning to mobile payment apps to split a tab, send money to family or even pay their rent.”

Digitalization paves the way towards the adoption of the customer-centric approach. Using technologies, banks can predict and address clients’ demands at any stage. The Commonwealth Bank in Australia, for instance, developed an AR application that serves as an AI-driven real estate agent. Using the camera in their smartphones, clients “scan” a building and get its price and sales history on their screens. The CommBank Property app also comes with a mortgage calculator and the possibility to contact local real estate agencies. The solution perfectly describes the idea of a personalized customer journey on a single platform online. And, according to the number of downloads — over 100,000 — Australian customers fully appreciated the innovative approach.

The needs of the growing SME sector are also important as these ventures represent the biggest part of businesses worldwide. According to World Bank SME Finance, SMEs account for 90% of businesses and more than 50% of employment globally. In the US private sector alone, 30 million SMEs accounted for about 65% of new jobs in the last decade. Their basic needs range from account opening to online account balance control, and everything in between. They want those services to be fast, easy, and online. In consequence, SMEs address fintech and neo-banks to support their financial activities. Therefore, to keep up with the growing competition, banks have to be qualified to assist SMEs through advanced digital banking services.

Digital Banking Innovation in Big Data

IDC study claims that by 2025, the global amount of data will exceed 175 zettabytes (175 trillion gigabytes). The manufacturing industry and financial sector are recognized as the most promising ones for Big Data usage. Doug Laney, a renowned data analyst, formulated three basic components that describe data in banking:

- Diversity. Banks have to deal with a huge amount of different types of data. The data ranges from small details in transaction history to credit points and risk assessment reports from banks.

- Speed. The speed of adding new data to the database. This point is vital as it is not unheard of for a respectable bank to reach the threshold of 100 transactions per minute.

- Volume. The amount of space that this data takes for storage. For instance, huge financial institutions such as the New York Stock Exchange generate terabytes of data daily.

The most common data use cases in banking are:

- Definition and analysis of customer expenses’ structure

- Detection of the transactions’ main channels

- Dividing customers into segments based on their profiles

- Cross-selling products

- Management and fraud prevention

- Risk assessment, compliance with safety requirements, and reporting to the regulator

- Analysis and response to customer reviews

Accuracy and predictability are especially vital for the domain of lending. With data analysis, banks and credit unions can identify more business opportunities and reduce costs. The industry has come to realize that borrowers represent much more than just their credit scores. So it’s important to take into account alternative sources (i.e. behavioral triggers and spending patterns) to determine their financial eligibility. As a result, the use of data analytical tools welcomes underbanked borrowers with thin file profiles that the traditional credit score system would certainly reject.

The opportunity to predict a borrower’s creditworthiness while originating a loan becomes the first step towards running a profitable lending business. It’s all about the decision-making economy – to outperform competitors, businesses have to make insight-driven decisions in real-time. That’s why big data is playing an increasingly starring role in the lending domain including auto finance, mortgages, as well as business and personal loans.

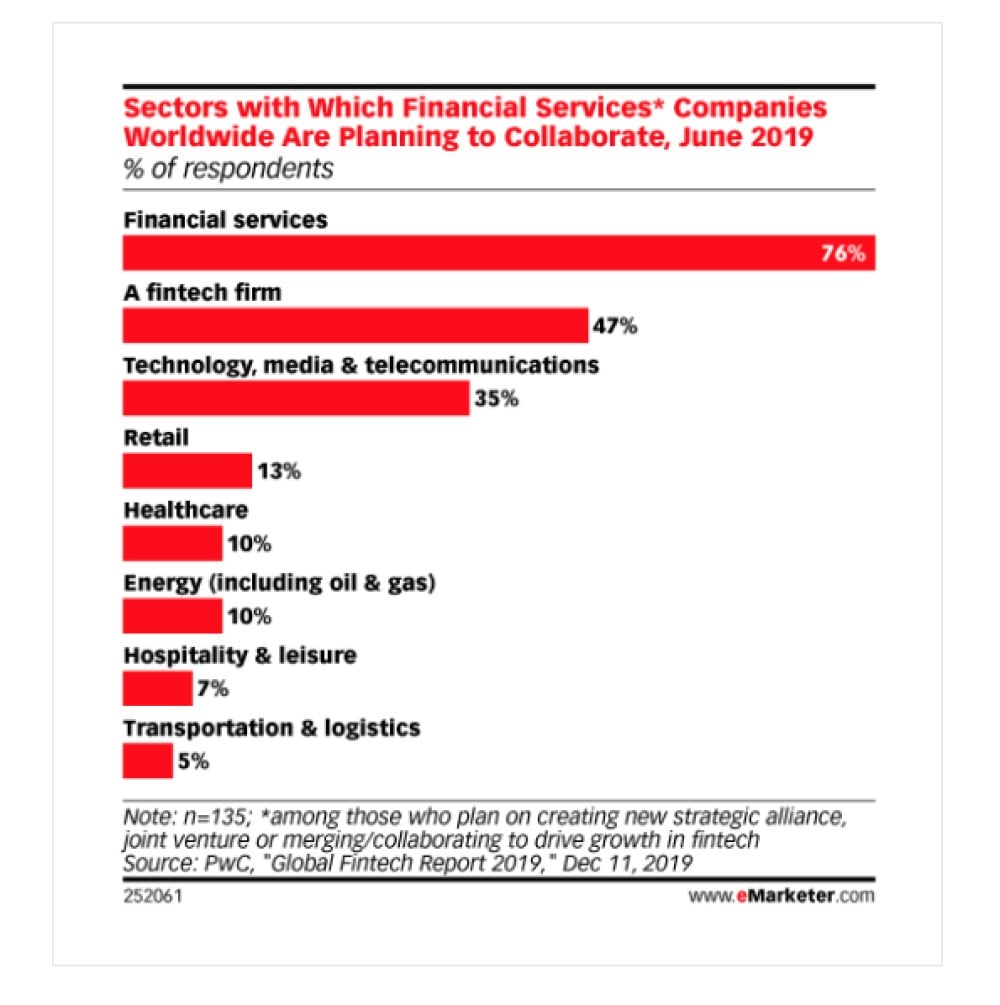

Issues towards Banking Transformation: Fighting the Old System

According to the World Retail Banking report, 28% of banks see FinTechs as competitors since they misunderstand the essence of fintech development. Financial institutions resort to separate digital initiatives with little success because they lack the expertise and technical skills to accomplish it on their own. As a result, they are either disappointed in digital transformation banking or lag far behind their competitors.

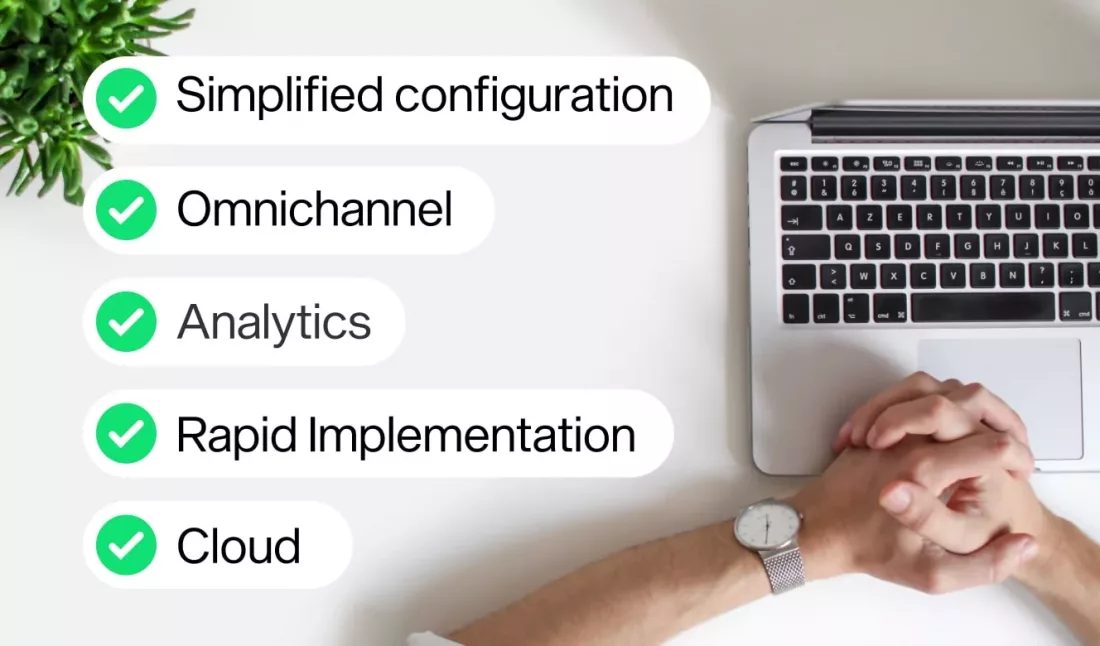

However, 65% of retail banking execs see them as partners instead of competitors. Through partnerships and acquisitions, banks will form strategic alliances with fintech to offer Banking as a Service (BaaS) or Lending as a-Service (LaaS). That’s logical – while fintechs have innovative ideas, the challenge lies in the implementation of the appropriate technology and choosing a digital transformation strategy. A dedicated technological partner provides synergy and agility that result in a coherent integration with current systems and products.

Many industry executives would agree that legacy systems represent the biggest hurdle on the way to embrace transformation. These systems are too complex (if not clumsy), and it takes a lot of effort and programmer wizardry to keep them up to date. Examples of such systems include network infrastructure, hardware, operating systems, ERP, and CRMs.

What’s more, employees are quite unenthusiastic to adopt a new platform because cumbersome or not, they got used to the current system. It’s just a basic human reaction to the unknown. One thing is certain — the limitations of legacy systems result in high costs associated with issues with cybersecurity, maintenance, low level of integration with modern cloud and other SaaS platforms. Switching to digital requires a lightweight system — most often a microservice system — that won’t replace, but supplement the current one. For lenders, it’s especially vital during the process of customer onboarding. When submitting a loan application, borrowers want a quick response, but old systems just can’t provide the level of convenience that customers expect.

Read also

Wrapping it Up

Just like any industry, banking has its ups and downs. However, there is no doubt that in the decades to come the biggest banks will evolve into technology companies in their own right. The success of such technology revolutionaries like Amazon and Apple serves as proof of what can be achieved if companies adopt the customer-centric approach. The digital bank of tomorrow will embed financial transparency at the core of its business, and that answers the question of why investments in digital transformation are so important today.

Are you interested in going digital? Contact us to discuss the digital transformation of your business.