Think you know your borrowers? Think again. In recent years, we’ve been observing massive shifts in consumer borrower behavior, heralding in a new generation of lending consumers—the empowered borrower.

Tech-savvy, market-aware, and knowledgeable about their lending wants and needs, this upcoming generation expects more from their providers—and not just better rates. As the Fintech segment of the lending industry continues to grow—rising from 5% in 2013 to 38% in 2018, eclipsing banks (28% in 2018)—it’s clear that empowered borrowers are looking away from traditional providers for their services, but why? And what can lending companies learn that will help them retain and gain empowered borrowers in the future?

Read also

Who is the Empowered Borrower?

Borrowing and lending have been a part of finance since the very beginning, while it may seem that the rules of lending have been well-established and are unamendable—the lending provider sets the rules and rates—this is all set to change, and soon. Empowered borrowers are keen market researchers who investigate their perspectives before making a decision about where to borrow and how much.

According to research by PwC, Millennials and Gen Z (18–34-year-olds) are more likely than any previous generation to research loan types and review loan documents before signing, showing diligence to the process. Digital natives, this generation is adept at online research and as such expects lending providers to keep up with both lending trends and services. While non-millennials, those over 35, remain slightly ahead in terms of comparing loan products — 40% of non-millennials vs. 37% of millennials — the younger generation is more focused on customer service and financial education.

What this means is that the next generation of lenders and the one that will follow, those under 17 at the moment, are set to be the most informed and tech-savvy generation of lenders yet. So how can companies keep up and exceed the expectations of empowered borrowers?

What Does the Empowered Borrower Want or Top 5 Needs for Companies

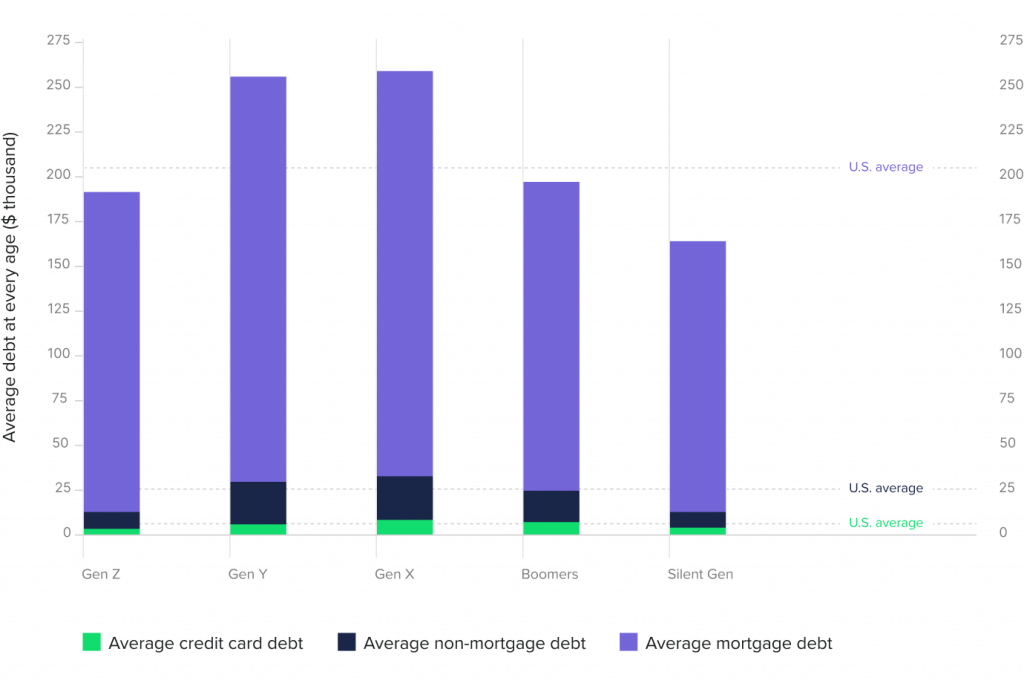

According to data from Experian’s State of Credit 2021, we can see that borrowers from the Gen Z and Millennial generations are reassessing how they borrow and how much they can afford. Considering lenders, they are less likely to take out a loan than Gen X, but does that mean they’re moving away from lending altogether? No. Statistics show that both generations are still borrowing and not insignificant amounts either—millennials still borrow over the national US average for non-mortgage debt and mortgage debt, while Gen Z are lower on both accounts. So, then what can providers do to access this changing market, and what are the empowered generation seeking?

Transparency and trustworthiness

Forget the small print on the bottom of loan agreements, today’s lenders want clear documentation that shows exactly what they’re getting into—29% are likely to read loan documents. In addition, they actively seek out tried-and-trusted providers and referrals. When it comes to choosing a lending provider, POS (point-of-sales) remains top for all loan types, with existing banking relationships (the experience factor), traditional marketing channels, and friends and family coming in close. Meanwhile, we are also seeing a rising trend in social media influence, which is particularly relevant for younger generations of lenders.

Security and data protection

4.1 billion—that’s the number of data records compromised during the first half of 2019. $1,000 to $2,000—the cost on the black market for bank credentials to accounts with more than $20,000. The fact is data security and protection are key issues in finance, both now and in the past. Even in 2016, over 56% of businesses believed that maintaining data security was crucial. If we look to the next generation of borrowers, they are acutely aware of the risks of poor data security and are more likely to seek out providers that place security as a priority, not an afterthought.

Seamless digital experience

Next-generation borrowers are generation mobile. With over 6 billion mobile phone subscriptions worldwide, it’s no surprise that the empowered borrower wants a financial service that uses the same technology as they do. New consumers are demanding that their providers deliver a service that is accessible to them no matter what device they use. But not only that, savvy empowered borrowers utilize mobile apps to compare lending offerings, review affordability, and lock-in offer rates at the touch of a button. Armed with this knowledge they are often able to access better deals, meaning companies need to be competitive in their offerings.

Products that fit their needs

Personalized lending is the future. No longer is lending a top-down game. Instead, the market is becoming more client-focused with a greater emphasis placed upon the real needs of borrowers. In the post COVID world, where borrowers are naturally more cautious, they are seeking out loan products, through their networks—word-of-mouth referrals, POS, social media, and more—that meet their specific needs. This may mean seeking out preferential interest rates, low repayments, or benefits, but no matter the motivation, one thing is clear—borrowers are driving huge market changes.

Alternative methods of communication

With long-established processes, such as onboarding, KYC, and AML, forming the heart of the loan process, many lending providers become complacent in how these procedures are carried out, but it doesn’t have to be this way. Modern consumers are interested in alternative formats of communication and non-contact ways of getting the job done. Over 31% of respondents are interested in providers that automate the document collection process, with 13% (vs 9% in the 35+ segment) stating text or chat functionality is key. What this tells us is that empowered borrowers are actively seeking out services that cater to their needs and make their lives easier overall.

Read also

How HES Solutions Help Businesses Bridge the Gap to the Empowered Borrower

To address the demands of a tech-native generation, you need the right tools on hand. HES delivers smart, seamless lending solutions to businesses seeking to improve their market offers and address the future generation of lending consumers.

Back by the latest technology, HES clients can get the most up-to-date solutions out there, such as loan origination tools, management software, and more, designed specifically to meet enterprise needs and fast. But how should a company go about deciding which tech is right and which won’t work for them?

Know your borrowers—knowing your borrowers’ personas is the first key step in establishing a lending program that will work for empowered lenders. Talk to your clients to get to know their motivations and what’s holding them back from taking out a loan. This experience will deliver unrivaled insight to the next generation of borrowers.

Define your strategy—based on the knowledge you gained in the first step, now is the time to define the strategy. Drawing together market analytics, consumer data, stakeholders, and more, you can begin to formulate a strategy that will boost company growth and meet your clients’ needs.

Get the right technology on board—now it’s time to decide on a solution. Armed with a wealth of knowledge, you will be in a better place to discuss your particular consumer needs with the experts who will be able to advise the next steps in your financial management journey.

Looking for a reliable lending software vendor? Get in touch with HES FinTech.