The pandemic feelably accelerated everything digital. The banks’ operational continuity, AI-based risk management, cloud infrastructure scaling, and more. However, such changes don’t seem to be temporary.

Rapid changes revolve around embedded finance as well.

Read also

What’s Embedded Finance?

We talk about embedded finance when the financial services are embedded within non-financial services. For example, banking services within ridesharing applications or insurance services in the moment of an online e-commerce transaction.

Pros and Cons of Embedded LendingEmbedded finance provides non-financial organizations with an opportunity to seamlessly integrate payment, lending, and insurance into their products and services. Along with the profitability increase, embedded finance substantially improves customer experience and customer loyalty.

Embedded Finance and Embedded Lending (BNPL): Market Value

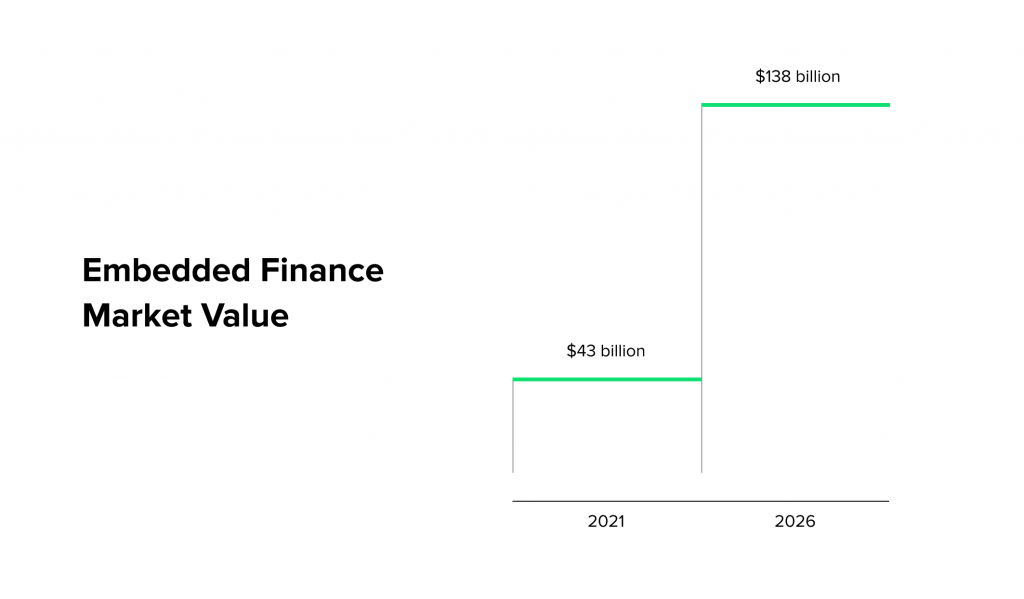

According to a study from Juniper Research, the value of the embedded finance market was $43 billion in 2021 and is highly likely to exceed $138 billion – in the other words, it will grow threefold by 2026. The market value implies the value of transaction revenue, insurance premiums, and licensing costs.

The reason for such stunning growth is the increasing availability of financial services APIs. Financial services vendors go for barrier-free integration to receive an additional revenue opportunity and develop a financial ecosystem that will potentially be beneficial to all parties involved.

In this article, HES FinTech, as an experienced money lender software provider, will focus on Embedded Lending and Buy Now Pay Later (BNPL) as a part of the Embedded Finance industry.

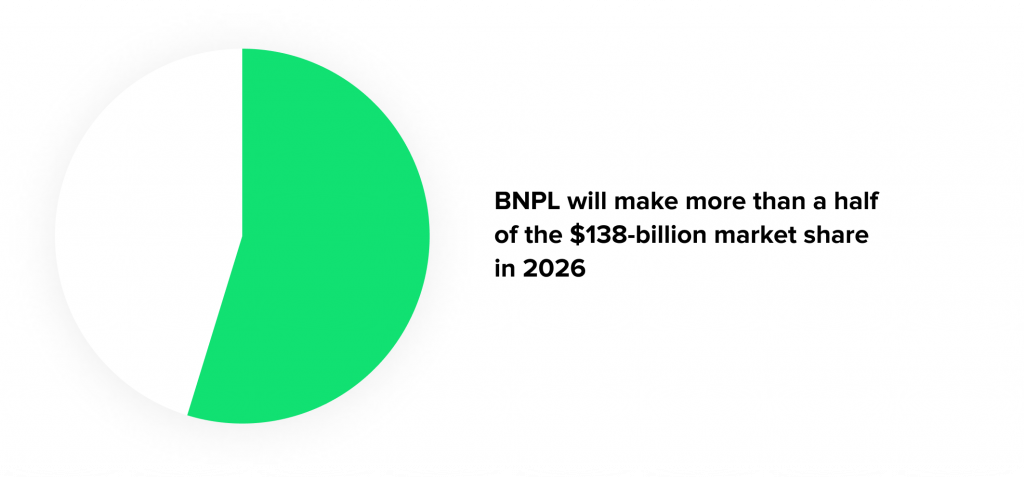

According to the same study by Juniper, the market value of Buy Now Pay Later services accounts for more than 50% of the embedded finance market in 2026.

The author of the paper adds that embedded lending at POS is a massive opportunity for banks and alternative lenders to win customers as the open API trend is developing. Financial services providers can leverage their current user database and partner with trusted non-financial brands to launch lucrative offers. According to Fintech Futures, the total addressable market of embedded finance will exceed $7 trillion in this decade – it literally means the finance becomes a natural part of the fabric.

What’s the Place of Banks in Embedded Finance and BNPL?

Perhaps, banking will always be needed, but it’s still a question of whether banks will be.

In one of his letters to JPMorgan shareholders, Jamie Dimon, the bank’s CEO said that it is clear that financial products – payments, deposits, and loans are leaving the traditional banking systems for neo-banking and non-banking.

However, banks can take a step to reinvent their business models. Instead of building and pushing out new lending products, they can offer embedded Buy Now Pay Later lending (along with payments and insurance) on a more affordable basis, with higher conversion, and at the optimum acquisition point.

Serving high-volume and low-cost customers, switching to online, and acting ‘behind the scenes’ can be a beneficial scenario for traditional banks.

How Does Buy Now Pay Later Work?

For retailers, BNPL consumer financing plans mean sales increase and avoiding high fees of credit cards. As seen in a study by BNPL provider Afterpay, 42% of Gen Z and 69% of Millennial consumers are more likely to buy when offered a BNPL option.

At the same time, consumers receive their purchased product or service immediately by signing up for installment payments free of interest.

Retailers don’t finance the purchase themselves, they seamlessly redirect consumers to a third-party financing institution. The lenders (banks or non-banking organizations) usually get access to very limited customer information but are able to make rapid decisions on the application. The details strongly depend on the national or regional legislation.

BNPL, traditional and cardless EMIs (equated monthly installments) have become more and more popular payment modes. Statistics registers growth of 290%, 125%, and 178%, respectively, most likely caused by the stressed income in households during the pandemic.

Looking for unique software for lending?

World-Renowned Cases of Successful BNPL Implementation

An initiative worth sharing is Uber Money in the US: opening debit and credit cards along with digital wallets for drivers and courier delivery employees working for Uber under a contract. They are able to find a loan section in the app and apply for 0%-interest loans and allocate a percentage of their earnings for loan repayment.

Another example is the Amazon Pay Later service launched in 2020 in India. Consumers can use a full-fledged BNPL model for purchases on Amazon India. The purchase amount is paid back either next month or EMIs over up to 12 months. The onboarding is extremely easy: just a single few-minute flow and a couple of eligibility criteria. Amazon offers this type of loan via Capital Float, a third-party lending platform, and via IDFC First Bank. The number of issued loans exceeded 1 million in less than a year.

2020 became an important year for BNPL partnerships: Samsung announced a partnership with Klarna. Embedded finance perfectly aligns with the tech giant’s strategy to demonstrate top-notch technology and convenient solutions. By the way, in 2021, Klarna’s revenue increased by 32% to $1.42 billion. The majority of its revenue is generated through the interchange and merchant fees.

Affirm, the next-generation BNPL market player from the US, generated Gross Merchandise Volume (GMV) $15.5 billion for the fiscal year 2022, representing an 87% increase.

Psss… Wanna start lending within 90 days?

What Businesses Should Know Before Entering the BNPL market

Quick adoption of Buy Now Pay Later technology is equally beneficial to consumers and merchants, but that doesn’t mean a completely smooth shift to embedded lending. The model is criticized because of its ability to encourage consumers to spend money on purchases they can’t really afford and get less protection than a traditional credit card provides.

For example, the UK authorities announced the regulation of BNPL schemes that makes the affordability checks on buyers obligatory. Regulation is the most prominent factor that may slow down the BNPL industry growth.

At the same time, two twin factors promoting its growth are opportunity and technology.

BNPL is not a brand-new concept: even Baby Boomers almost got used to traditional point-of-sale financing agreements that allow spreading costs. The ‘digital native’ generations are more open to technologies and are eager to learn more about new offers.

The development of a proprietary BNPL solution from scratch can be costly, however, businesses consider middleware or turn-key digital lending platforms that can be integrated into their existing product.

Read also

HES FinTech is there to consult you on the boldest ideas in fintech software development. Partnering with an experienced software vendor helps build technical capability faster and launch your product in months, not years.

Embedded finance embraces a lot of opportunities from peer-to-peer lending, BNPL partnerships, and brand collaborations that can be mutually beneficial.

Get a free live demo to check out how HES FinTech can help you with this. Remember about a $7 trillion embedded finance market value at stake, engage your tech and executive team, and start now.