Business Analysis in lending software development is what helps business customers launch their digital lending platforms on time, on budget, and in full accordance with the specification. BA as a separate service can be a good starting point for the entire project cycle. It allows carefully estimating the project development process, the team, and the costs.

Also, BA-as-a-service results in ready technical documentation, use cases, and data flows. After that, businesses can easier select the financial software vendor and start the development right away or take their time.

BA services consist of 4 key elements:

- Technical Documentation - use cases, actors, supported devices and platforms, integrations, and most important information about the project.

- Technical Research - recommended technologies, programming languages, and frameworks.

- Industry Analysis - external factors that may impact the lending platform development and performance.

- Competition Analysis - reverse-engineering of competitors’ solutions for better understanding of the improvement potential, as well as figuring out goals and tasks.

Competitors’ auditing in BA helps business analysts learn more about customer’s domain and market, about the digital lending platform type, and the business model of competitors, both direct and indirect.

We define the assessment criteria and analyze the competing systems according to their features, advantages and drawbacks, technical aspects, marketing positioning, and entire user journeys.

Careful analysis of existing solutions during the BA helps to formulate the unique proposition and understand the competitive advantage of the planned system. It also significantly helps in drawing documentation.

Gone are the times where business analysis used to be translators between software developers and businesses. Business analysis today is more about the digital architecture of the business.

Read also

BA-as-a-Service: Discovery Phase VS Analysis Phase

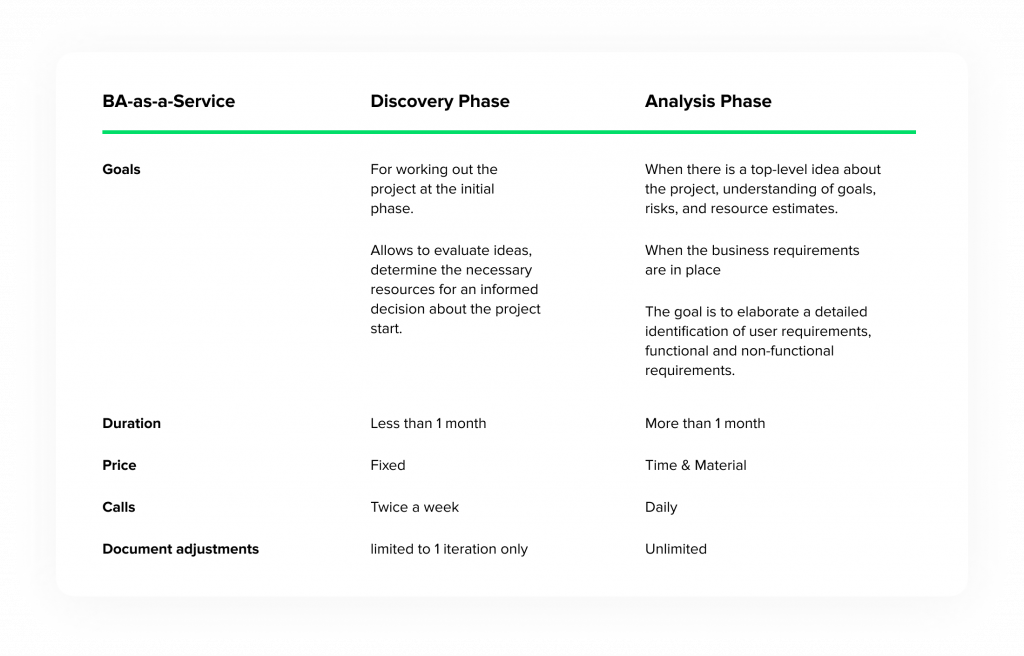

Business-Analysis-as-a-Service at HES FinTech consists of 2 phases:

1) Discovery Phase

The Discovery phase is relatively short, as a rule, it takes under 1 month. It is suitable for planning out the project at its initial phase. The discovery phase of BA helps to evaluate the idea, determine resources to help businesses make an informed decision about the start of the development.

This stage implies one or several Q&A sessions with domain experts and decision-makers to set business goals, define the project scope, learn more about the target audience, competitors, and the market niche.

Also, it allows planning out the project deadlines, milestones, and collaboration workflow, as well as consider possible constraints - organizational, financial, or technical.

As a result, customers receive a number of documents: a context diagram, a vision and scope document, technical documentation, a list of integrations, a project plan, and project evaluation according to the WBS model.

The costs of the discovery phase are usually fixed, and the phase does not require much of the customer’s involvement - a few calls per week are usually enough. They help stay on the same page and get updates about the progress.

2) Analysis Phase

This phase is more profound and is a great deal for businesses, who already have a top-level idea about their project, understand goals and risks and have a rough estimate of the needed resources. The Analysis phase requires ready documentation with business requirements and key business processes to be covered by the system.

The Analysis phase is aimed at elaborating user requirements, functional, and non-functional requirements in detail and gathering them in the software requirements specification. In addition, the specification contains restrictions, frameworks, rules and standards, integration requirements. This document allows moving the project development process right away.

In addition to all of the documents listed for the Discovery phase, and a thorough software requirements specification, this BA phase provides businesses with prototypes of user interfaces and design guidelines.

The Analysis phase may take several months to complete and requires the active involvement of the customer’s technical team. The costs are based on the Time & Material basis and a detailed report on the working hours and tasks performed.

Here is a comparison table:

BA-as-a-Service in Lending Software Development: Use Cases

BAaaS at HES FinTech can be used for:

Automating processes

Digital lending helps automate even the most important manual processes. Business analysis helps visualizes and structure them to drive automation at a bank or financial institution. For planning out business processes in BA, business process modeling or BPM or flow diagrams are used most often.

Starting a new project

The development of a new product always takes a lot of resources invested into financial business software analysis.

For this purpose, the BA services can play 2 roles:

- be the initial part of the project with banks and financial organizations (after signing a contract)

- A separate service is ordered before making a decision about the software vendor and signing a contract for the platform development with them.

For creating a basic idea of the product, a product vision board can be used. It assists in creating a high-level description of the lending platform and considers various product aspects, like business goals, value proposition, key features, the description of the market, and the users). It can be extended to include other major aspects of BA in financial software development: competition, cost factors, channels, revenue streams.

Enhancing the current digital lending platform

BA can help determine the ways of improving user experience with the product or work on boosting other metrics, such as conversion rate. For such cases, data analytics can be used. It helps identify faults in UI/UX, detect misused or unnecessary features, reveal dead ends in customer journeys.

The team carries out software product analysis with the help of certain tools and databases. We can extract data, study it, reveal patterns, and use the resulting insights to improve the system’s usability and prioritize improvements.

It is a good idea to start with BA before adding new features to the application o redesign the lending platform.

For adding personalization and increase customer engagement

Receiving tailored services is one of the most reliable ways to boost customer satisfaction and retainment. More lending businesses are striving to diversify their digital offerings and personalize the to segments of target audience, build individual communication channels and even go for separate digital products for certain demographic groups. Business Analysis can help understand the opportunities and challenges of such changes and get ready for development.

Business analysts create empathy maps for in-depth study of the target audience. It takes into consideration a lot of behavioral factors, like user needs, motivations, capabilities to create requirements for digital lending system development.

Read also

- Determine the business objectives and desired outcomes of their digital projects

- Plan requirements documentation and resources

- Get ready for the project to start

- Measure project success.

To sum it all up

Business-Analysis-as-a-Service involves HES FinTech’s Architects, Managers, and Business Analysts to help customers:

The toolkit for BA in software engineering, as well as techniques, and deliverables may vary, but the ones used at our company are based on our 10+ years of experience and fit the lending industry best.

We are ready to accompany your business during research, discovery, development, and post-launch iterations. Contact us to learn more about Business Analysis and Consulting for loan management software development.