Commercial loan underwriting software has become a cornerstone of modern lending. Fintech businesses, banks, credit unions, and other financial institutions are turning to these platforms to handle the growing volume and complexity of business loan applications.

Given the convenience and multiple benefits of these systems, it’s no surprise that their adoption is accelerating. The global commercial loan software market is projected to reach $16.9 billion by 2034, which reflects how essential these tools have become in the underwriting process.

Still, with so many vendors and products available, finding the right underwriting platform for your business can be challenging.

To make the process easier and help you make an informed decision, we’ve evaluated the 10 best business loan underwriting platform solutions for 2026 and zeroed in on their key features, strengths, and weaknesses.

Read on for our picks and a practical guide to choosing the tool that best fits your team’s needs and goals.

What Is Commercial Loan Underwriting Software?

Commercial loan underwriting software is a platform that empowers financial institutions to assess, evaluate, and manage business loan applications with greater precision and efficiency.

Beyond replacing manual reviews and paperwork, it introduces automation, advanced data analysis, and smarter workflow management that reduces manual effort. The result is fewer errors in the lending process, improved consistency, and accelerated credit decisioning.

Typically, a leading automated commercial underwriting tool covers the full lending lifecycle and supports tasks such as:

- Loan origination and application intake – collecting borrower information and structuring applications for review

- Automated credit scoring and risk assessment – analyzing credit data to assess borrower reliability

- Document ingestion and data extraction – digitizing, organizing, and validating large volumes of loan documents

- Collateral and covenant management – tracking pledged assets and borrower obligations

- Regulatory compliance and audit trails – maintaining records and workflows in line with legal and industry requirements

- Portfolio monitoring and loan servicing – overseeing loan performance, repayments, and ongoing borrower relationships

Top 9 Commercial Loan Underwriting Software

1. HES LoanBox by HES FinTech

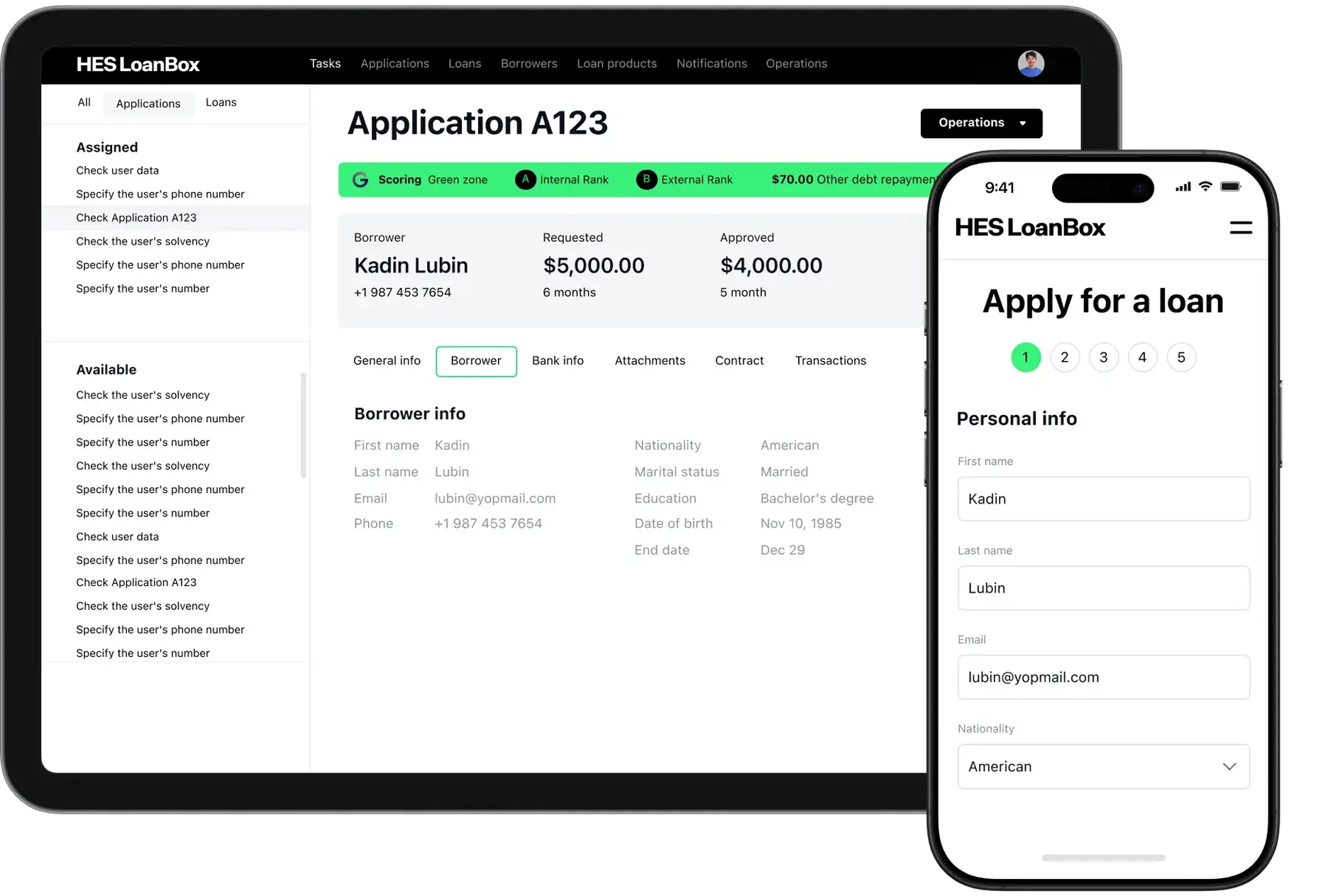

HES FinTech offers white-label commercial loan software built on over 20 modular components covering the entire lifecycle, from loan origination to repayment and collections.

The HES LoanBox platform is designed for a wide range of lenders, from fintech firms and non-bank institutions to large banks, and can be configured to fit different business models and regulatory environments across multiple regions.

Its sophisticated features such as automated loan processing and decisioning, AI-powered underwriting, role-based access, and robust reporting with BI integrations streamline operations, reduce risks, and provide actionable insights for more efficient underwriting.

Key Features and Functionalities:

- AI-based credit scoring and transparent AI credit decisioning accelerate risk evaluation, shorten decision times, and ensure explainable outcomes for regulatory compliance.

- Flexible integration options and robust API management allow businesses to easily connect with banks, payment providers, CRMs, and other systems while maintaining complete control over data flows.

- Comprehensive fraud prevention and security enhance protection through KYB/AML checks, biometric verification, OWASP-compliant infrastructure, and ISO 27001 certified development.

- E-signature and paperless workflows streamline document signing, approval processes, and eliminate physical office visits.

- Highly configurable workflows and product engine adapt the platform to businesses' unique lending processes with quick product creation and rule-based automation.

- Dedicated borrower portal offers clients full transparency, self-service capabilities, and a smoother loan experience throughout the entire lifecycle.

- Agent dashboard with task management quickly onboards team members, manages leads, extends tailored offers, and tracks performance metrics.

- Unified back-office platform includes task management dashboard, automated decision-making, calculation engine, scoring system, user roles management, and advanced BI tools.

- Multi-region compliance support ensures adherence to GDPR, CCPA, PIPEDA, UK DPA, and other regional regulations.

- Code Development License option provides full source code access for maximum flexibility, security, and zero vendor lock-in as your business scales.

Pros:

- Rapid deployment (≈3 months) with out-of-the-box functionality and minimal disruption

- Highly customizable to fit diverse lending models across consumer and commercial lending

- Strong automation capabilities (up to 90%) minimize manual intervention and operational costs

- Robust advanced reporting and analytics with BI integrations enable data-driven decisions

- Scalable modular architecture supports varied loan volumes and quick product creation without system overhauls

- Enterprise-grade security with ISO 27001 certification and GDPR compliance built-in

- Flexible deployment options: cloud, on-premise, or hybrid based on your security requirements

- No vendor lock-in: Code Development License available for complete ownership and control

Cons:

- Initial setup may require technical expertise for optimal configuration of advanced features

- Advanced reporting and BI tools may have a learning curve for new users

- Integration with certain legacy or regional systems may require additional customization

Overall rating: 4.8/5

👉 Explore HES LoanBox Solution

2. Flinks

Flinks provides a secure platform that gathers, standardizes, and enriches borrowers' financial statements and banking data, making it easy for lenders to interpret and act on.

The solution streamlines the commercial loan underwriting process with automated data collection and analysis, enabling faster loan approvals, even for borrowers with limited or no credit history.

Key Features and Functionalities:

- Advanced document fraud detection uses AI to flag and interpret tampered documents, thus speeding up reviews and reducing risk.

- Income and employment verification automates validation of earnings across all employment types, cutting processing time and lowering default risk.

- Data enrichment transforms raw banking data into actionable insights by aggregating employment, spending, and debt servicing information.

- Integrated reporting features make it possible to access detailed lending reports through the dashboard or API for CRM, LMS, or LOS.

Pros:

- Provides real-time financial data from 15,000+ institutions to connect from

- Data enrichment engine delivers deep borrower insights (over 6,000 attributes), enhancing risk models and decision accuracy

- Sophisticated fraud controls, including AI-backed document validation, minimize manual effort and onboarding risk

- Innovative payment handling improves conversion and borrower experience

Cons:

- Generating specific reports can sometimes be challenging and require careful setup to get the most accurate insights

- The reliance on bank screen-scraping may occasionally result in incomplete or slightly inconsistent data

- Some users have noted minor usability hurdles when navigating certain workflows

- While coverage of Canadian financial institutions is strong, the list of supported banks and credit unions is still somewhat limited

Overall rating: 4.4/5

3. LendingPad

LendingPad is a comprehensive lending solution that supports functions such as warehousing, audit, loan tracking, and third-party channel administration.

Its Lender Edition expands capabilities with features like automated underwriting, customized pricing and eligibility rules, real-time pipeline monitoring, and unlimited user management.

Key Features and Functionalities:

- Cross-department collaboration allows diverse teams to work together, improving communication and processing speed.

- Built-in compliance support tools help lenders stay aligned with regulatory requirements.

- Analytics and reporting features provide insights into loan pipelines, performance, and risk to support better decision making.

- Customizable workflows let lenders configure processes to match internal practices.

Pros:

- Dedicated servers and performance monitoring help maintain fast and reliable platform performance for uninterrupted lending operations

- Cloud accessibility enables users to access the platform from anywhere

- Flexible and customizable workflows let lenders grow without needing major system overhauls

- Insightful oversight provides actionable visibility into loan pipelines and team performance

Cons:

- Some aspects of the platform may feel unintuitive, especially for new users navigating complex workflows

- Repetitive data entry can be required for certain fields, which may slow down application processing

- Initial setup and configuration can be time-consuming due to workflow customization requirements

Overall rating: 4.7/5

4. Abrigo

Abrigo provides an integrated credit risk and loan management solution that optimizes the entire lending lifecycle, from underwriting to closing.

With one-time data entry, automated credit spreading, risk rating, and servicing, the platform minimizes delays, enforces consistent policy application, and improves team collaboration.

Key Features and Functionalities:

- CECL modeling streamlines compliance and delivers powerful reporting insights.

- Integrated financial crime solutions monitor for fraud, AML, and suspicious activity, protecting both the institution and its clients.

- ALM modeling helps aggregate data across multiple solutions to create a singular view of an institution's opportunities and risks.

- Comprehensive risk-rating methods identify problem loans early on.

Pros:

- Helps make informed decisions that capture the true cost of making a loan

- Built-in tools help institutions stay compliant with evolving regulations

- Risk- and target-based pricing scenarios, coupled with key benchmarks, help validate the loan-pricing strategy

- Access to expert support ensures guidance and troubleshooting when needed

Cons:

- New users may face a learning curve with some of the platform's advanced features

- Some workflows and navigation elements can feel unintuitive

- Customization of user roles and permissions is limited in certain areas

Overall rating: 4.6/5

5. MeridianLink

MeridianLink's solution offers a configurable loan origination platform.

With over 1,000 configuration points, hundreds of third-party integrations, a robust underwriting and pricing engine, and support for a full suite of loan products, the platform adapts to varied workflows while allowing for efficient and consistent loan processing.

Key Features and Functionalities:

- A single loan origination platform centralizes all loan processes for efficiency and consistency.

- Web-based SaaS delivery with frequent updates ensures compliance and reliable performance.

- Smart decisioning leverages hundreds of data points and proprietary algorithms to support risk mitigation and automated credit decisions.

- Digital account opening expands reach by letting borrowers open accounts online, improving acquisition and onboarding.

- Data reporting functionalities deliver actionable insights to optimize lending operations and inform strategic decisions.

Pros:

- Robust underwriting and pricing engine streamlines decision making while reducing risk and errors

- Smart decisioning algorithms leverage extensive data points to accelerate approvals and improve accuracy

- Modular yet integrated, allowing institutions to connect other vendors' products into a single platform

Cons:

- New users may require time to get comfortable with the system

- Customization and integration can be complex, requiring extra technical support

- Full implementation may be challenging due to the platform's breadth of functionality

Overall rating: 4.8/5

6. Path

Calyx by Path is a cloud-native loan origination system designed for mortgage and commercial lending operations.

With customizable workflows, agile compliance tools, and scalable technology, it streamlines the underwriting process while helping lenders maintain high borrower satisfaction

Key Features and Functionalities:

- Advanced API access empowers smooth connections to other systems and enables data to move effortlessly where it's needed.

- Color-coded pipeline gives teams a clear visual sense of each loan's status.

- Agile compliance tools embed policy checks and rules directly into workflows, keeping audits and fee tracking organized and transparent.

- Built-in point-of-sale lets borrowers start their application through a secure and mobile-friendly portal.

Pros:

- Lets businesses customize fields and workflows on demand, giving teams control without waiting on developers

- An intuitive interface means teams pick it up quickly and focus on closing loans rather than extended training

- Built-in POS and compliance tools help reduce manual steps and keep deals moving

- Cloud performance and configurability combine for a platform that grows with lending needs

Cons:

- While the interface is clean, first-time users may need some time to understand the deeper customization options

- A few integrations may require manual adjustments when data mapping may not align perfectly, adding extra workload

- There's a library of tutorials, but some users wish for more hands-on onboarding or richer documentation

Overall rating: 3.8/5

7. FICS

Loan Producer® by FICS offers its Commercial Servicer product which is built for structured commercial or multifamily loans.

The platform's workflow flexibility and built-in compliance tools make underwriting smoother, more accurate, and easier to manage across teams.

Key Features and Functionalities:

- Unlimited user-defined status codes keep track of loans at every stage, from initial prospecting to post-closing.

- Document design tool helps generate custom documents tailored to your processes and policies.

- Compliance-ready platform automatically meets regulatory standards and promptly incorporates updates.

- Multiple user-friendly calculators support accurate calculations for loan scenarios and borrower assessments.

- Built-in tracking and reporting tools simplify the process of selling loans on the secondary market.

Pros:

- Lots of built-in innovative features make the solution convenient for all parties involved

- Built-in compliance and real-time updates minimize regulatory risks and keep teams aligned with current standards

- Centralized loan review gives clear visibility, improving underwriting accuracy and team collaboration

Cons:

- The interface can feel a bit dated compared to newer platforms

- Setup and customization may take time for new users

- Some advanced reporting features may require additional training to use effectively

- Integrations with third-party systems can be limited

Overall rating: 4.3/5

8. FUNDINGO

Fundingo takes the friction out of loan processing by bringing all data, workflows, and decisioning into one environment.

It's built to replace scattered spreadsheets and emails with an organized, automated system that helps lenders move faster while keeping accuracy and compliance intact.

Key Features and Functionalities:

- The centralized loan hub gives staff one reliable place to find and manage every detail of an application.

- The Offer Wizard and Pricing Matrix automatically generate borrower-specific pricing and term options aligned with lender policies.

- Credit and data integrations connect directly to third-party providers, allowing quick pulls of reports and statements.

- Intelligent routing directs applications to the most suitable underwriters, balancing risk profiles and team expertise.

- Application completeness checks scan submissions for missing items and request them from applicants without manual intervention.

Pros:

- Teams appreciate the efficiency gains from consolidating information into one platform

- Automated offer generation and routing features cut down on repetitive tasks for underwriters

- Applicants benefit from a smoother experience with fewer delays caused by missing or incomplete data

- Strong integrations with outside data providers reduce verification bottlenecks.

Cons:

- The user interface, while functional, could be more intuitive in places

- Rolling out new features may take time, given the shared environment and update cycles

- Reporting options could be expanded for teams that want deeper customization

Overall rating: 4.5/5

9. nCino

nCino's commercial lending operating system unifies onboarding, loan origination, and compliance within a single workflow.

By bringing borrowers, front-line staff, and back-office teams onto one platform, nCino helps institutions reduce redundancies and accelerate credit decisioning.

Key Features and Functionalities:

- An integrated document repository can incorporate all the business's policies and provide a visual audit trail for auditors and teammates.

- The deal management features help access and manage overall deals of clients' loan and treasury products in real time.

- Automated workflow tools streamline approvals, documentation, and compliance checks, reducing bottlenecks in multi-step processes.

- Real-time reporting provides better portfolio management.

Pros:

- End-to-end workflow automation reduces duplication of effort and minimizes loan processing delays

- Automates pre-qualifications and credit approvals based on the institution's policy rules

- Strong compliance and audit-trail features support effective risk management

- Identifies parameters where a loan should be automatically approved, declined, or flagged for manual review

Cons:

- The approval process can become cumbersome when technical issues arise, as reported by some users

- Flexibility and customization are more limited compared to standalone systems, which can frustrate loan officers

- Expanding certain product modules can be slower than expected for specific industries

Overall rating: 4.3/5

| Platform | Key strengths |

| HES FinTech | AI-based credit scoring, flexible integration options, fraud prevention via KYB/AML, e-signature, highly configurable workflows, dedicated borrower portal, agent dashboard, and a unified back-office platform (with a task management dashboard, automated decision-making, calculation and product engines, scoring system, user roles management, and BI tools) |

| Flinks | Advanced document fraud detection, income/employment verification, data enrichment for actionable insights, integrated reporting via dashboard or API for CRM/LMS/LOS |

| LendingPad | Built-in compliance tools and updates, analytics and reporting, customizable workflows |

| Abrigo | CECL modeling, integrated financial crime solutions, ALM modeling, comprehensive risk rating methods |

| MeridianLink | Web-based SaaS delivery, smart decisioning with proprietary algorithms, digital account opening, data reporting functionalities |

| Path | Advanced API access, color-coded pipeline, agile compliance tools embedded in workflows, built-in point-of-sale for borrowers |

| FICS | User-defined status codes, document design tool, multiple user-friendly calculators, built-in tracking and reporting tools |

| FUNDINGO | Automated offer generation via Offer Wizard and Pricing Matrix, credit and data integrations, intelligent routing, application completeness checks |

| nCino | Integrated document repository, deal management features, automated workflow tools, real-time reporting |

Without further ado, let's explore the ten best commercial loan underwriting solutions of 2025 and dive into their key functionalities as well as pros and cons.

What Are the Benefits of Commercial Loan Underwriting Software?

The benefits of a commercial underwriting software solution extend far beyond process automation.

At its core, it enables financial institutions to transform a traditionally complex and error-prone process into a reliable, transparent, and data-driven practice.

By embedding structured workflows and intelligent automation, lenders achieve faster and more consistent credit decisions while strengthening risk management and regulatory compliance. Detailed audit trails enhance transparency and accountability, while scalability allows institutions to handle higher loan volumes without proportional increases in staffing.

Moreover, when artificial intelligence is layered on top, these advantages become even more significant. According to McKinsey, AI-driven underwriting can increase credit analyst productivity by 20% to as much as 60% and accelerate decision-making by around 30%, helping institutions serve clients more efficiently while keeping risks under control.

No single solution perfectly fits every lender. Yet, understanding some key considerations can help narrow the field and point you toward the most suitable platform.

Remember that the commercial loan underwriting software should complement and give a boost to your workflows, support your team's strengths, feel straightforward for borrowers to use, and adapt as your institution evolves.

7 Aspects to Look at When Choosing Commercial Underwriting Software for Your Business

What Matters Most in Commercial Loan Underwriting Software

| Aspect | Advice |

| Fit with workflows | Make sure the software sits naturally within your current processes to minimize operational disruptions |

| Cost and value | Look beyond the license fee and account for setup, training, and ongoing maintenance costs |

| Usability | Ensure that the software provides an intuitive experience for both your team and borrowers |

| Scalability | Check if the platform can handle growth in loan volumes and new products without strain |

| Integration | Verify seamless and robust connections with your banking, CRM, and reporting systems to prevent silos |

| Security and compliance | Opt for software that provides strong data protection and supports regulatory compliance |

| Vendor support | Make sure that the vendor provides proactive updates and offers responsive assistance |

Below, we'll look into the seven core aspects worth weighing when evaluating commercial underwriting software.

1. Fit with Existing Workflows

Start by asking how the platform will sit inside your current process. That first check often separates helpful tools from disruptive ones.

Software that allows subtle adjustments while still fitting into familiar routines can raise efficiency and accuracy without overwhelming staff. In other words, the closer the system aligns with your current lending processes, the more time it saves and the less frustration it creates.

2. Commercial Underwriting Software Price

The real price of loan management software goes beyond the licensing fee. Implementation, training, maintenance, and upgrades all shape the total cost of ownership.

That way, comparing platforms through the lens of long-term value, not just upfront expense, will help you avoid budget surprises, especially as loan volumes grow or business needs shift.

3. Team Acceptance and Usability

Small details like intuitive navigation, well-labeled reports, and clear dashboards often make the difference between a system that feels natural and one that feels like a burden.

That's why you need to make sure that the underwriting software boasts a user-friendly design, as this will directly impact how well your team performs.

4. Capacity to Grow

Lending needs rarely remain static. Increases in loan volume, expansion into new markets, or the introduction of additional products and features can strain a limited platform.

Therefore, choose a powerful tool that is built to expand and cope with higher throughput and new product types. This way, you'll save both money and headaches if/when your business scales.

5. Seamless Integration

As you know, underwriting platforms don't operate in isolation. They need to connect with core banking tools, CRMs, and reporting systems, often through robust API management to ensure trouble-free data flow and interoperability.

When integration is smooth, data flows where it needs to without constant intervention. Without it, you risk silos, manual workarounds, and slowdowns that quietly drain efficiency.

6. Security and Compliance

In lending, protecting sensitive data and meeting regulatory standards is mandatory.

Commercial credit underwriting software with strong encryption, audit trails, and compliance features reduces both legal risks and reputational concerns. With these safeguards in place, your team can focus on lending decisions instead of worrying about gaps in protection.

7. Vendor Support and Reputation

Implementing commercial underwriting software also means entering into a relationship with the vendor behind it, so make sure they bring both reliability and experience to the table.

A vendor that provides regular updates, responsive support, and a proven track record can turn inevitable setbacks into manageable events instead of business-stopping crises.

Which Commercial Underwriting Software Solution is the Best for Your Business?

The truth is, a perfect commercial loan underwriting solution that ticks every box may not exist.

What really matters, though, is identifying the factors that will have the greatest impact on your business, whether that's usability, workflow alignment, compliance support, integration, scalability, or long-term vendor reliability.

For most fintech businesses, all of these elements are likely essential for achieving efficient, accurate, and sustainable lending operations. So, the key is to select a solution that addresses as many of these priorities as possible.

The smartest approach is to collaborate with your key stakeholders, carefully weigh all priorities, and evaluate how each platform aligns with both your current processes and future growth plans.

Once you've shortlisted a solution and feel confident it fits your needs, engaging with the vendor is essential. Use this opportunity to ask detailed questions, explore possible customizations, understand the implementation roadmap, and confirm that the platform will integrate well with your existing infrastructure.

If you'd like to discuss how our commercial loan underwriting software can fit your business or learn more about its possibilities, contact our HES FinTech team.

![Top 9 Commercial Loan Underwriting Software [2026]](https://hesfintech.com/wp-content/uploads/2025/10/blog_Top-9-Commercial-Loan-Underwriting-Software-1.webp)