The global pandemic set in motion an acceleration of digitization across many industries, from e-commerce to services to finance and more, fundamentally changing how the world does business. As we move into the fourth quarter of 2021, it’s clear that many of these advances are here to stay, which leaves many asking how precisely has this affected the economy as a whole, and, more specifically, the banking and lending sector? Today, we’ll take a look at some of the latest market trends for banking and finance, and what these could mean for the future of the sector in Canada.

Read also

The Canadian Economic Landscape Today

As we said at the beginning, digitization, and its capabilities to deliver no matter what, the location has been growing for some time, causing a worldwide shift in how things are done. Increasingly, financial service providers have been seeking to onboard fintech to support their operations whether as standalone features, such as a fintech app, or an integrated solution, such as a credit checker for insurance, automated lending software, or point-of-service software.

When the coronavirus crisis began, the shift to digital came full circle, and such service became a lifeline to ensure safety while continuing life in the new normal. Digitization had deep-reaching effects that drove traditional providers to upgrade their services and downgrade their physical offices while new providers were entering the market. Here are some of the most important changes defining the industry in Canada today

Debt increases

Since 2007, debt in Canada has increased two-fold, doubling from $1 trillion to $2 trillion in just 15 years. In 2020, credit market debt also rose by 1.6%. Meanwhile, income for Canadians fell by 3.1, furthering the debt gap and indicating a dip in the economy. This situation has driven the Canadian government to look more closely at developing a long-term solution against rising debt, instead of viewing it as a reaction to COVID.

Inequality across states and age groups

Additionally, debt is unevenly spread across Canada, creating regional inequality. Nova Scotia is one of the hardest-hit regions in terms of credit. Its debt-to-GDP ratio stands at 106%, indicating high levels of debt. Meanwhile, areas such as Alberta show the lowest at 66.1%. Similarly, we are also seeing a discrepancy in various age groups, with younger consumers harder hit by the pandemic with job losses and increases to educational fees. This was particularly impactful to those just entering the higher education stage and job market.

For government structure and businesses exploring the lending arena, it’s essential to take into account lending and earning potential for Canadians and businesses is not equally disrupted and may impact any solutions rolled out.

Businesses are more hesitant to take on credit

Growing debt following major COVID lockdowns, combined with uncertainty for what the future may hold in terms of government policy and consumer demand, has left businesses hesitant to take on additional debt. Over 40% of companies suggested that they simply couldn’t afford to take on additional debt, which may lead to industry stagnation, business closures, or simply a more frugal future. Simply, for many businesses, now is the time to invest smartly.

Borrowers are becoming savvier

In the past, taking out a loan may have meant going to the bank and meeting with a manager who would make the decision of whether or not a person was creditworthy. That has long since changed. In today’s lending market, borrowers hold increasing power to make their own lending decisions, and the market is providing them with a wider variety of choices—leading to a savvier consumer.

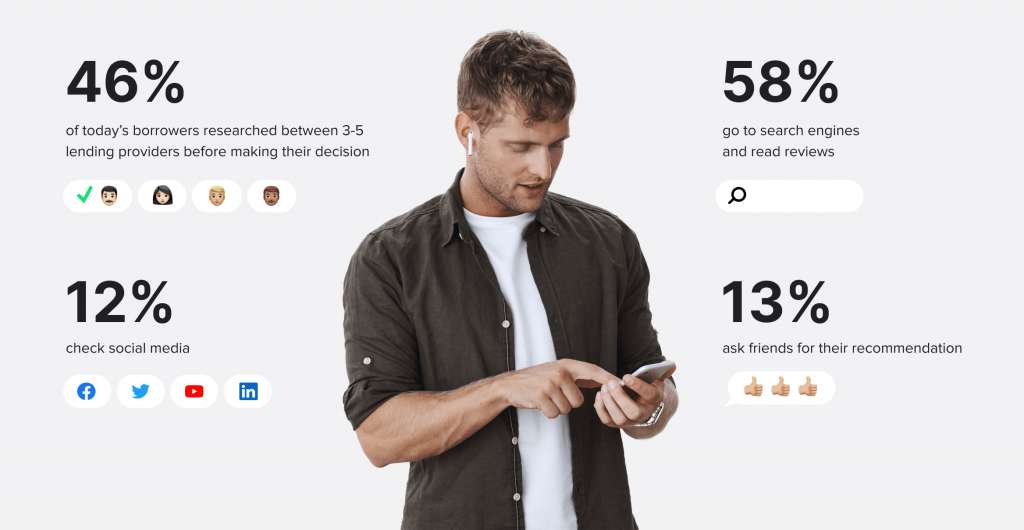

When it comes to lending, 46% of today’s borrowers researched between 3-5 lending providers before making their decision. Where did they do so? Online. Over 58% based their decision on an internet search (including reviews), meanwhile just 13% asked their friends, and 12% checked social media. Making the web a powerful platform for lending providers.

Move towards less credit and more savings

Alongside the drive to seek more convenient services, Canadian financial consumers are also less likely to lend than in previous years. In 2020, only 25% surveyed were open to lending, compared to 30% the previous year. In addition, there is a reduction in investment and borrowing for household consumption, exports, imports, and non-residential businesses, indicating a bearish market mindset. However, there is one exception to the lending rule. Canadians were more likely to invest in housing during the pandemic than in other areas, sprouting growth in this industry area.

At the same time, like in the US, savings grew. On average, Canadians spent around $4,000 less due to the pandemic, which went directly to savings accounts, with an average of $5,000 per person being saved or $180 billion total.

The Future of Canadian Finance for Businesses & Consumers

Despite the effects of the pandemic—increases in savings, rise in debt, changes in consumer behavior—now, as we enter Q4 of 2021 and beyond, the Canadian economy is starting to show some signs of recovery, a light at the end of a very long tunnel. The country’s resilience in times of challenges is indeed forging a path to a more sustainable future. Here are some of the trends we can expect to see in coming years that will drive the future of the Canadian lending and banking sectors.

Accelerated drive to digital

If you don’t have a digital strategy for your business, now is the time to get one in place before it’s too late. Digital is inevitably increasing across all industries, without exception. In the banking sector alone, 78% of providers are already digitally equipped, aiming to meet consumer demand for more accessible online services. And the results show it pays off. Even before the pandemic, digital industries grew in productivity by 22.1%, compared to 6.1% in non-digital sectors.

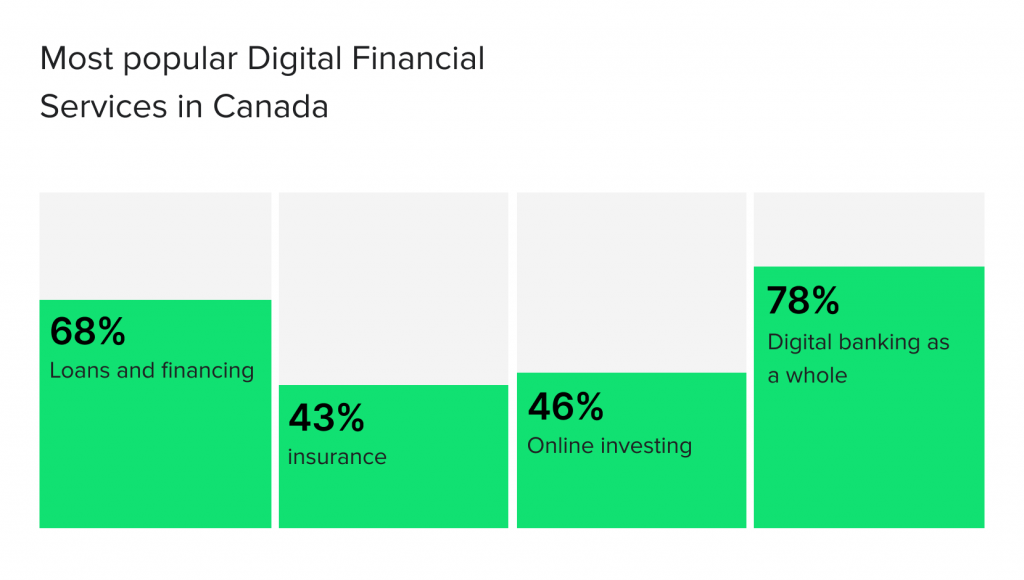

Customers want services that work for them. For example, 43% said they’d like to buy insurance online, 46% are interested in online investing, 78% want their banking needs to be serviced online. In comparison, 68% seek loans and finances on a digital platform. And these are just some of the statistics backing the demand for more inclusive digital services.

According to Markets and Markets research, North American is expected to have the largest market share of the digital lending software market in 2018-2023. It is explained by the high presence of digital lending vendors, and the early adoption of digital financial services in general. The financial institutions are monetizing this opportunity as they transform their legacy systems to automated digital lending platforms, improve their loan portfolios and enhance the customer experience with the help of automation. This transformation has also increased the demand for an advanced loan management system in Canada, as businesses seek to optimize their lending operations and improve efficiency in a competitive market.

Responsible lending

Since the pandemic hit, one message has rung loud and clear—there are no guarantees. This sentiment has spawned a rise in financial caution in the form of savings, cautious investments, and increased care taken when it comes to lending. That’s why it’s reasonable to expect a drive towards more responsible lending in the future. What this means is loan providers will need to take care to ensure the services they offer are appropriate to their consumers. But how can providers do so effectively? The answer lies in technology. Advanced tools, such as credit software, help companies more accurately establish risk and potential and allow them to offer tailored loans to meet consumer demand.

Automation and speed

A rise in digital has also meant a rise in demand for getting services as and when we need them. Speed of service is now as expected as accuracy, creating challenges for financial service providers. Increasingly we are set to see the onboarding of software and tools, more so than we are already seeing, that will aim to deliver faster and more efficient services. For example, this may be in the form of automation software designed to make form-filling quicker or loan origination software or management tools added to the lending process to automate it for both the consumer and client. All of which are designed to deliver accuracy, alongside the speed needed to keep up with a rapidly changing market.

Personalization

Over the past year and a half, we have observed the inequalities in society more acutely than ever before. Income and debt discrepancies existed across states, while those of younger generations found themselves disproportionately affected by the pandemic. Due to this and other factors, it’s likely that in the coming years, the trend for personalization will continue to grow as consumers demand financial services that are tailored to meet their actual needs. The latest offerings will need to account for the real market, not general statistics, and focus on the potential consumer as an individual, not a target group.

Intelligent personalization services will drive financial services into the future by allowing providers to offer more tailored services, and such technology is set to grow in usage across both traditional and challenger providers.

Read also

What’s Next for Canadian Financial Providers?

With an increase in vaccine uptake and hopes for a lockdown-free future, businesses and consumers alike are taking cautious steps into the future. As we move forward, we are seeing market opportunities for growth and development for financial services and providers seeking to answer the changing needs of society.

Today’s consumers demand easy-to-use digital services that meet their needs, no matter where they are—at home, at work, or somewhere else—, while businesses are looking to integrate technology into their main offerings. Getting ahead of the game and succeeding in a post-pandemic world is all about flexibility, consumer focus, and accessibility of services, and onboarding the right service is at the heart of any digital transformation.

Need a solution to meet lending demand? Contact HES FinTech for a free live demo tour.