Evolving needs and challenges continually shape the lending landscape. The global lending market has witnessed significant growth, surging from $7,887.89 billion in 2022 to $8,682.26 billion in 2023, marking a substantial compound annual growth rate (CAGR) of 10.1%.

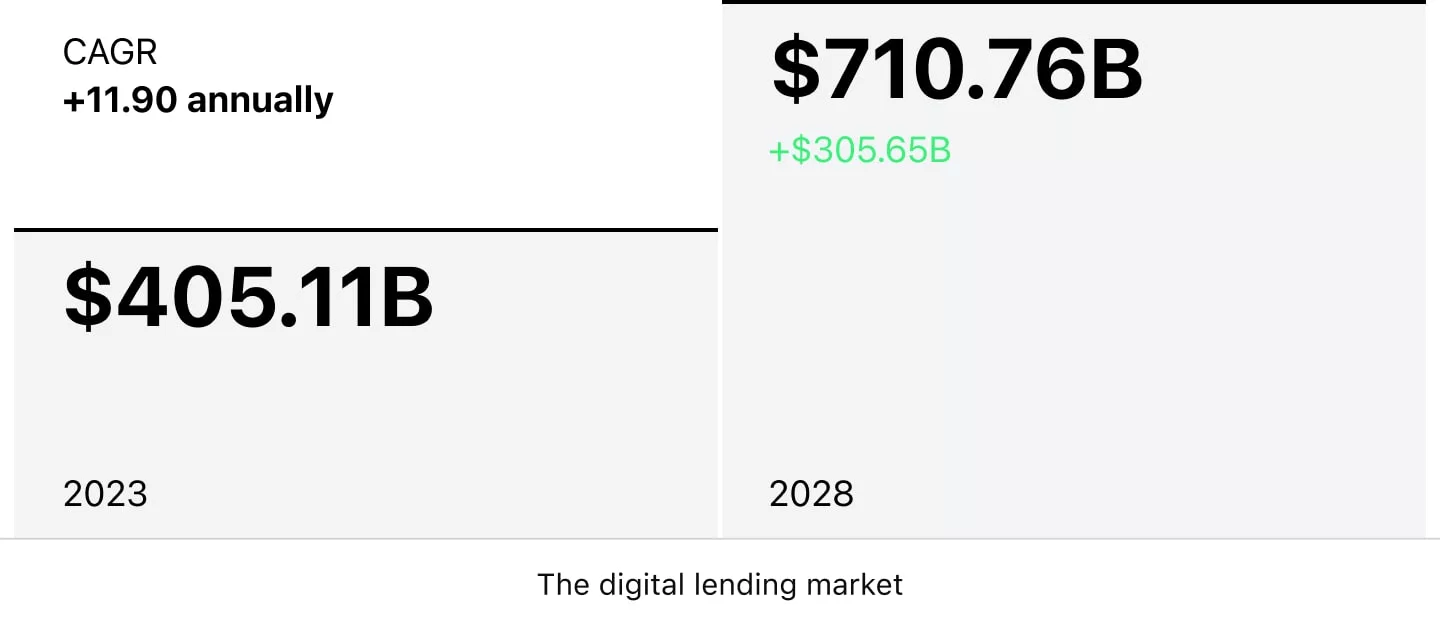

This surge isn’t just a numerical shift but a testament to the industry’s adaptability and response to the changing economic climate. During this period, the digital lending market is expected to grow from $405.11 billion in 2023 to an impressive $710.76 billion by 2028, with a notable CAGR of 11.90%. This expansion owes much to the challenges faced by SMEs during the COVID-19 pandemic, prompting a demand for innovative lending solutions.

Amidst this growth, the popularity of personal loans has soared. As of the second quarter of 2023, a striking 22.7 million Americans held personal loans, indicating an 8.1% increase from the previous year. This surge highlights a broader trend in which individuals extensively use personal loans for various needs, such as debt consolidation and reducing interest payments.

However, this growth is not devoid of challenges. The economic environment, marred by inflationary pressures and the looming specter of a possible recession, has significantly influenced lending practices and consumer behavior. In response to these shifting conditions, lenders have had to adjust their strategies to stimulate loan growth by accommodating more subprime and near-prime customers.

The convergence of these factors underscores the need for lending businesses to pivot their strategies and embrace innovative approaches to meet evolving consumer demands and tackle new challenges effectively. As the industry continues to transform, the adoption of lending software emerges as a pivotal factor for success.

The Evolution of Lending Software

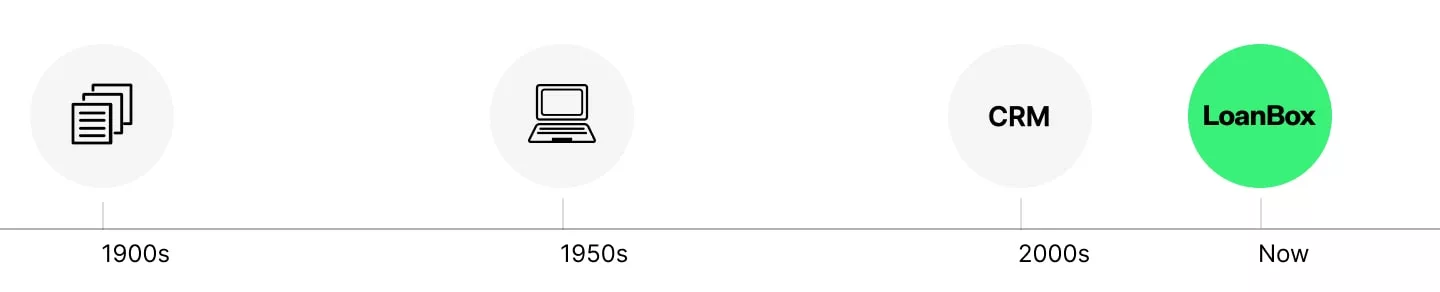

The history of lending technology is a testament to the industry’s quest for efficiency and precision. Each stage has propelled the industry forward, from labor-intensive manual processes to the introduction of Customer Relationship Management (CRM) systems.

Initially, manual procedures dominated the lending landscape, requiring extensive human involvement and being prone to errors. The advent of CRM systems marked a significant shift, streamlining operations and enhancing customer interactions. However, the demand for more sophisticated tools led to the emergence of automated lending software for small businesses.

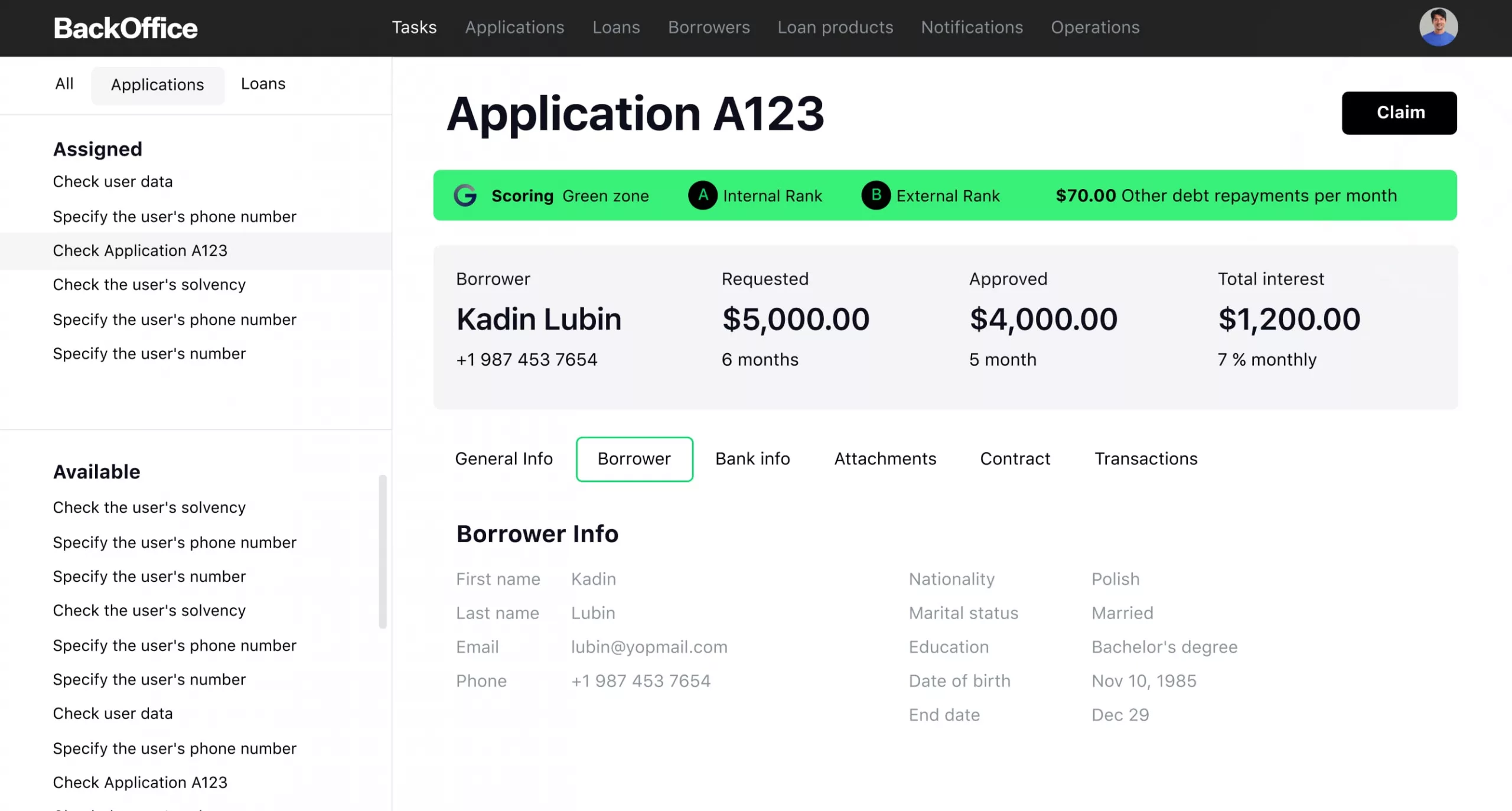

Today’s automated systems, exemplified by lending software vendors like HES LoanBox, embody the pinnacle of lending technology. They seamlessly merge Software-as-a-Service (SaaS) capabilities with the power of Artificial Intelligence (AI). This integration empowers lending institutions to assess loan portfolios, automate debt collection, and gain invaluable data-driven insights swiftly and accurately.

Core Features of Automated Lending Software for Small Business

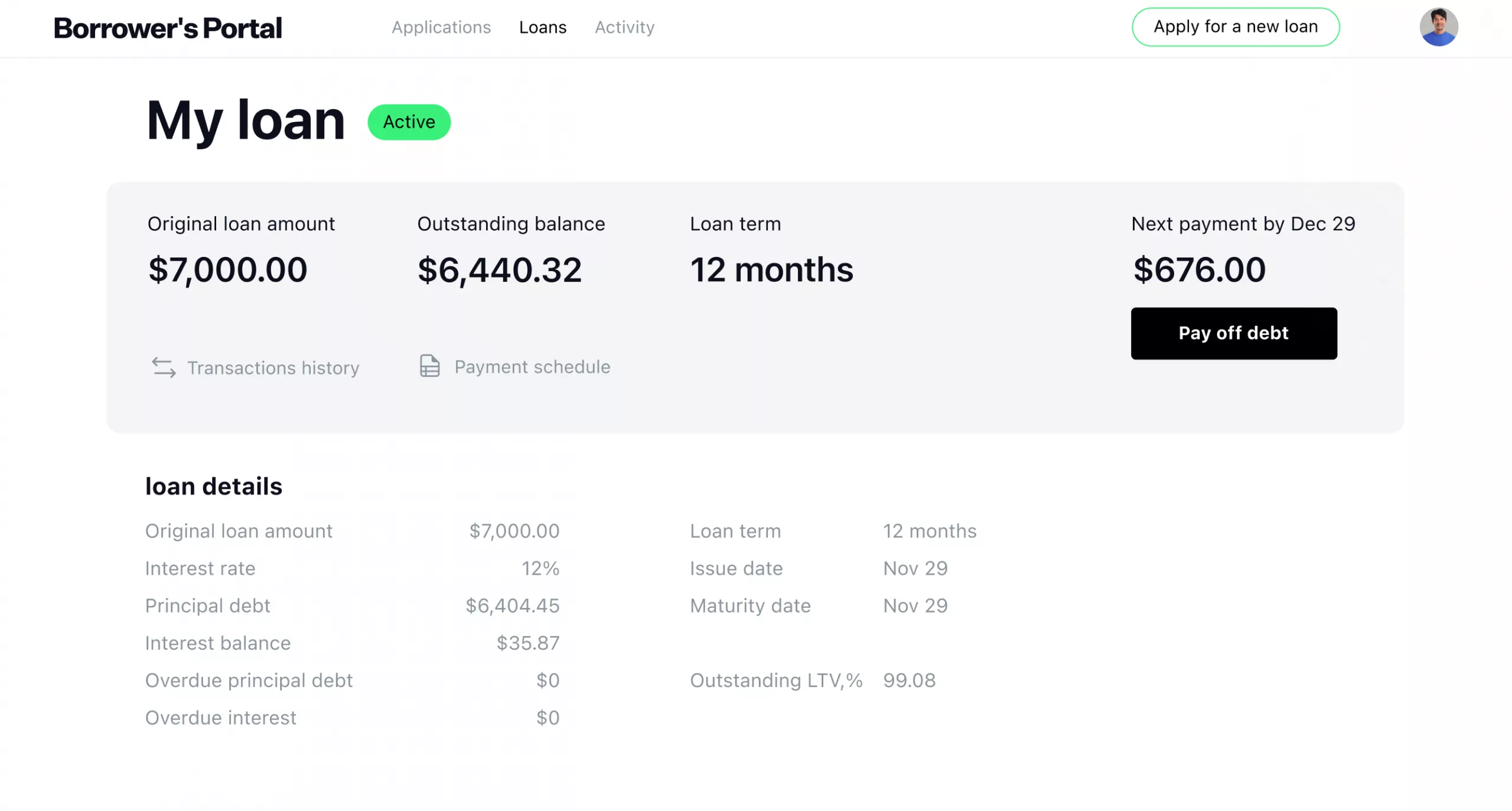

Automated lending software like HES LoanBox encapsulates a suite of transformative features that revolutionize lending practices, surpassing traditional CRM capabilities.

AI Integration for Intelligent Decision-Making

The integration of AI enables swift and accurate decision-making. Through sophisticated algorithms, HES LoanBox conducts AI-powered credit scoring, automating underwriting processes with smart preapprovals. This not only expedites loan assessments but also identifies potential delinquencies based on historical data patterns, enhancing risk assessment.

Automated Lending Decision and Data Analytics

Loan Management Software Features to Invest in at the MVP StageThe platform’s automation capabilities streamline various processes, from debt collection to risk management. With AI-driven debt collection tools, institutions can analyze accounts receivable, devising tailored collection strategies for better debt recovery rates. Additionally, robust data analytics enable smarter credit portfolio management by predicting defaults and offering valuable insights for risk assessment.

Seamless Customer Experience

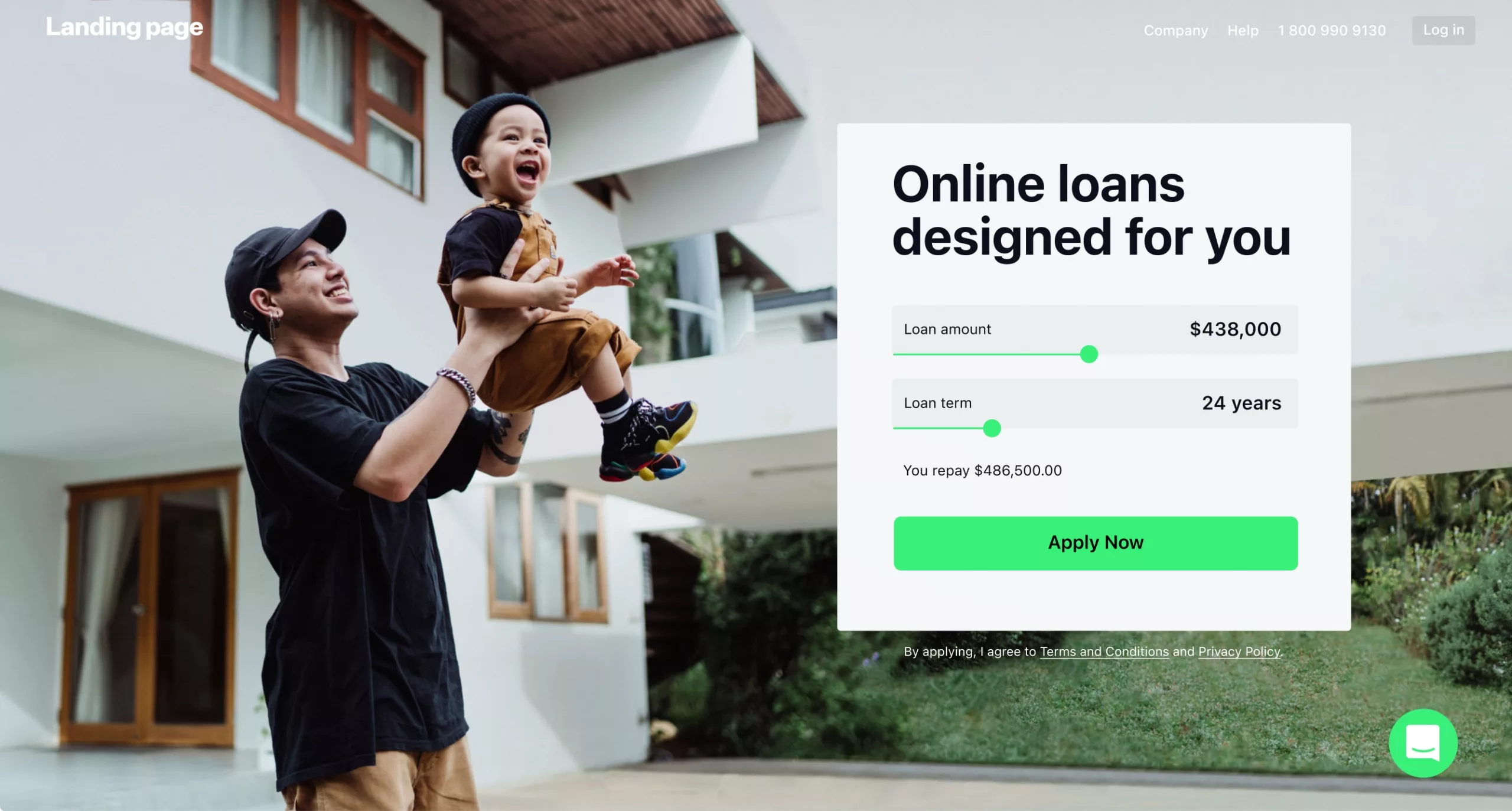

HES LoanBox offers configurable loans, allowing institutions to create new loan products effortlessly. Customizable loan terms, adjustable interest rates, and streamlined processes ensure a seamless customer journey, enhancing satisfaction and retention rates.

Enhanced Security and Efficiency

HES LoanBox: Ready-to-Use Lending PlatformIncorporating KYC plugins and biometric authentication within HES LoanBox expedites borrower identification and ensures stringent security measures, reducing the risk of fraudulent activities. This not only enhances security but also accelerates the underwriting process, significantly reducing operational timelines.

Reporting and Decision-Making

SME lending software enables institutions to track KPIs through interactive reports and dashboards. This facilitates informed decision-making by providing comprehensive insights into lending operations, thus empowering executives and loan officers to make strategic choices effortlessly.

You could start lending in 3 months

Benefits Over Traditional CRM: Advantages of SME Lending Software

Automated lending software presents a paradigm shift from traditional CRM for lending, offering a multitude of advantages that significantly enhance lending operations:

Efficiency Amplification

Unlike traditional CRM systems that primarily focus on customer interactions, automated lending software integrates AI and automation across the lending lifecycle. This integration streamlines processes, from loan origination to debt collection, exponentially increasing operational efficiency.

Precision in Decision-Making

The AI-driven capabilities of automated lending software empower institutions with precise and data-driven decision-making. Through AI credit scoring and predictive analytics, these platforms mitigate risks by identifying potential defaults and enhancing portfolio management, a feat not achievable through conventional CRM systems.

Customer Experience Enhancement

Automated lending software goes beyond CRM by offering configurable loans and a seamless customer journey. Institutions can tailor loan products swiftly and adjust terms and rates according to customer needs, thereby delivering personalized experiences that foster customer satisfaction and loyalty.

Risk Management Fortification

While a traditional CRM system focuses on managing customer relationships, automated lending software prioritizes robust risk management. AI-powered tools assess risk factors, predict defaults, and provide insights crucial for maintaining healthy credit portfolios, reducing Non-Performing Loans (NPLs), and improving overall risk assessment accuracy.

Scalability and Adaptability

Automated lending software offers flexibility, unlike traditional CRM systems that may struggle with scalability. These systems can easily accommodate evolving industry needs, regulatory changes, and scaling operations, making them future-proof investments for financial institutions.

Case Study: Transforming Securities Management Through Automation

Challenge: Automating Securities Management

For over a decade, a client managed their fixed-income assets and liabilities using Excel spreadsheets. However, as their business expanded, the manual workload escalated, accompanied by a surge in human errors. Recognizing the need for change, they they turned to us to implement a cloud-based solution that could automate intricate calculations and reduce manual data input.

Approach: Customized Securities Servicing System

Understanding the scope, HES FinTech’s Business Analysis team identified the need for a tailor-made securities transaction management system. The project posed several challenges: automating complex interest calculations, enabling automatic payment issuance, generating real-time reports, and synchronizing interest rate adjustments based on the Central Bank of Iceland’s indicators. The system also had to handle multiple currencies and seamlessly scale with the client’s growth.

HES developers integrated the client’s accounting system with external services like CreditInfo and sourced rates such as EURIBOR, Stibor, and Nibor. Additionally, they established connections with the Central Bank of Iceland and commercial banks, hosting the system securely on the Amazon AWS cloud.

Results: Streamlined Operations and Enhanced Efficiency

Within six months, the client had a fully functional system for managing securities transactions. The intuitive interface streamlined data input, saving valuable time for employees. Automation significantly reduced error occurrences, elevating operational accuracy. The system continues to optimize the client’s expenses, operating reliably since its launch.

Post-implementation, ALM Securities sought assistance with onboarding. This partnership expanded, with HES providing ongoing technical support and system enhancements, solidifying a mutually beneficial collaboration.

Conclusion

The lending industry’s growth demands a shift. Automated lending software vendors, like HES LoanBox, surpass traditional methods. Success stories, such as HES FinTech’s automation of securities management, showcase technology’s transformative power.

For lending pros, automation isn’t just a choice—it’s the path to agility, risk reduction, and customer focus. It’s the driving force toward a future where innovation defines success in a rapidly evolving landscape.