Lending software in Bahrain

Under the hood

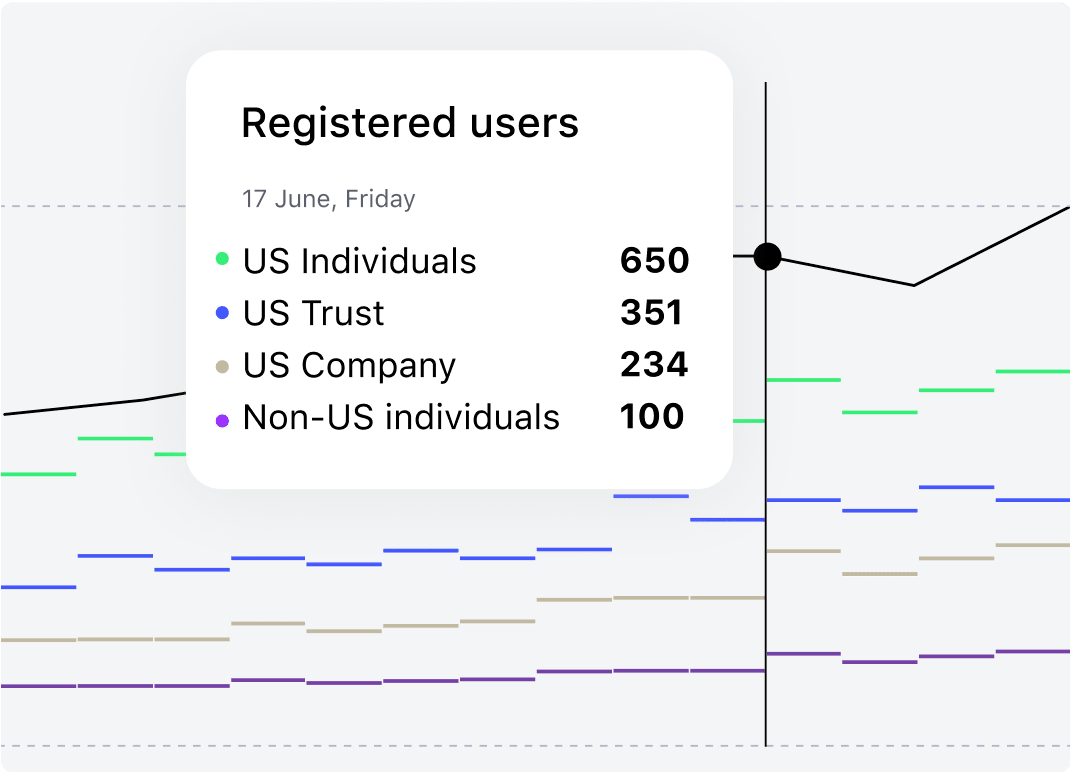

Credit scoring and KYC

Enrich your lending system with an AI-equipped risk management plugin. Experiment with onboarding using a multichannel module.

Automate each step of the lending management process to cut manual errors.

Automate each step of the lending management process to cut manual errors.

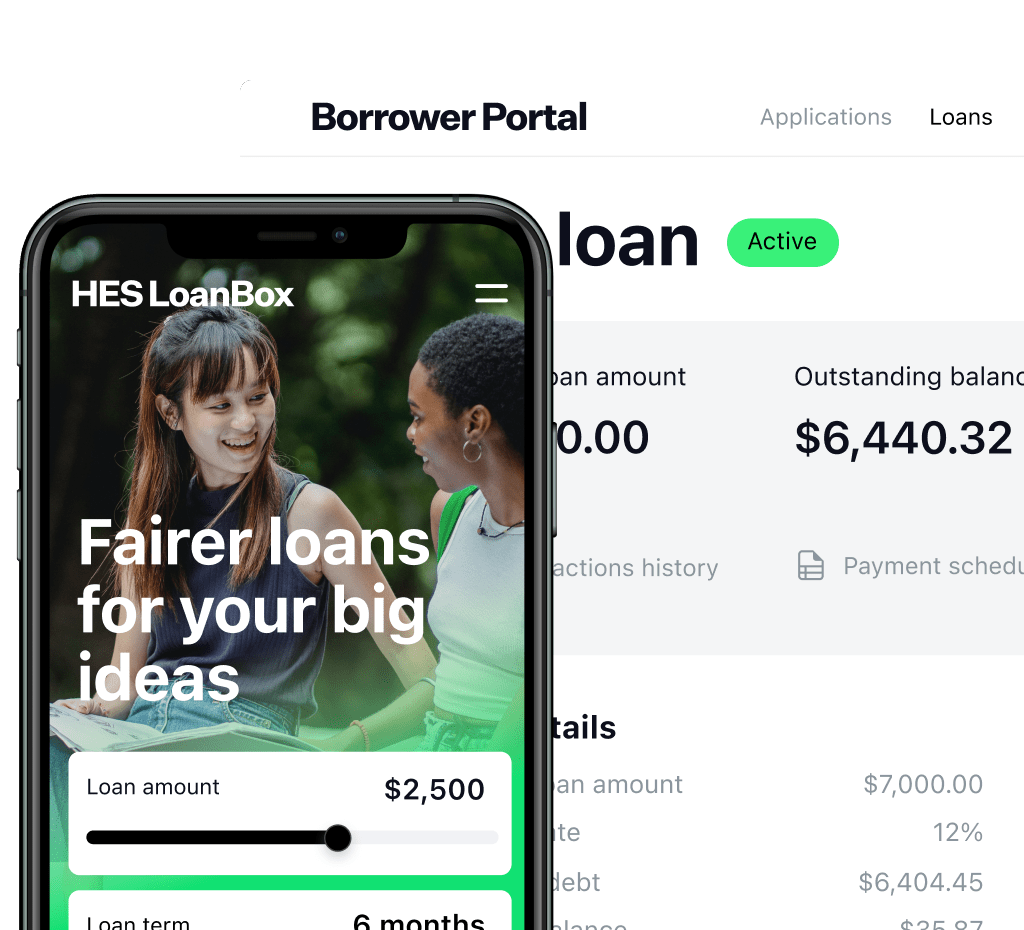

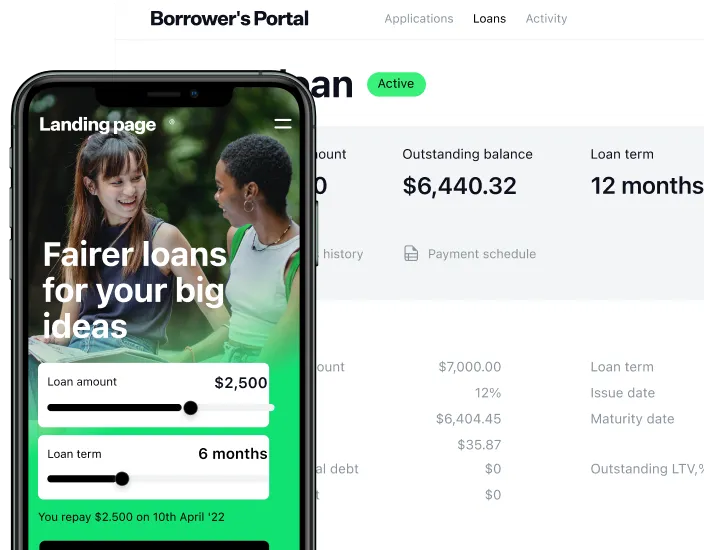

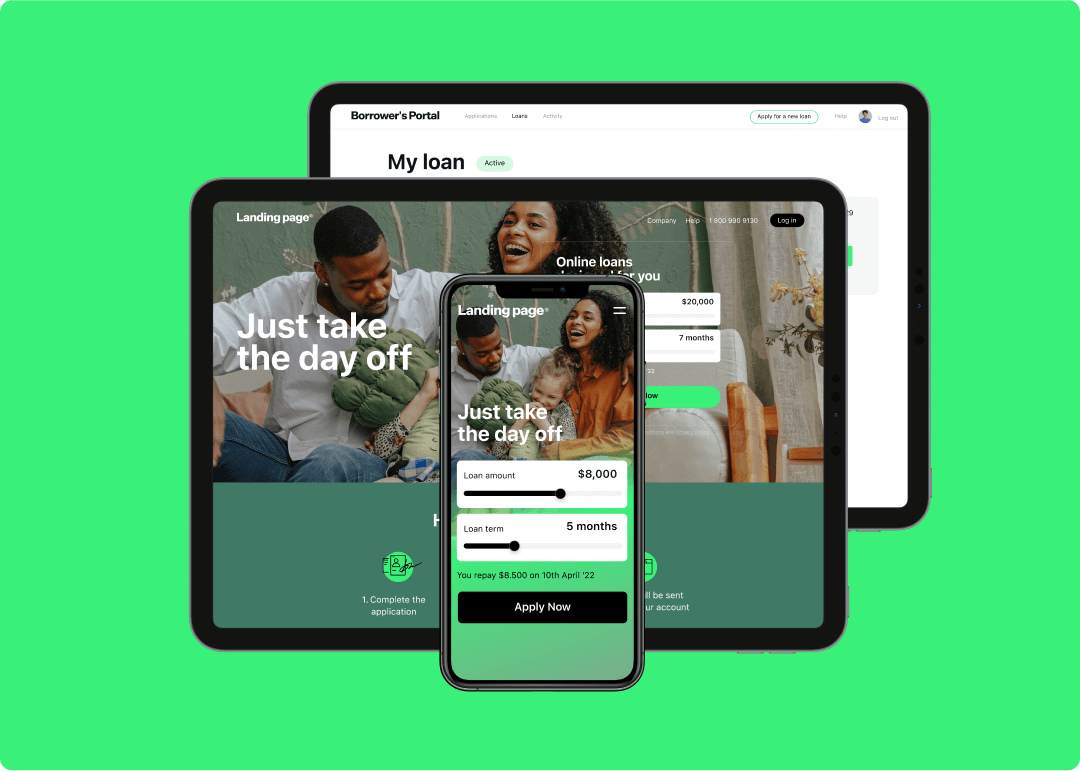

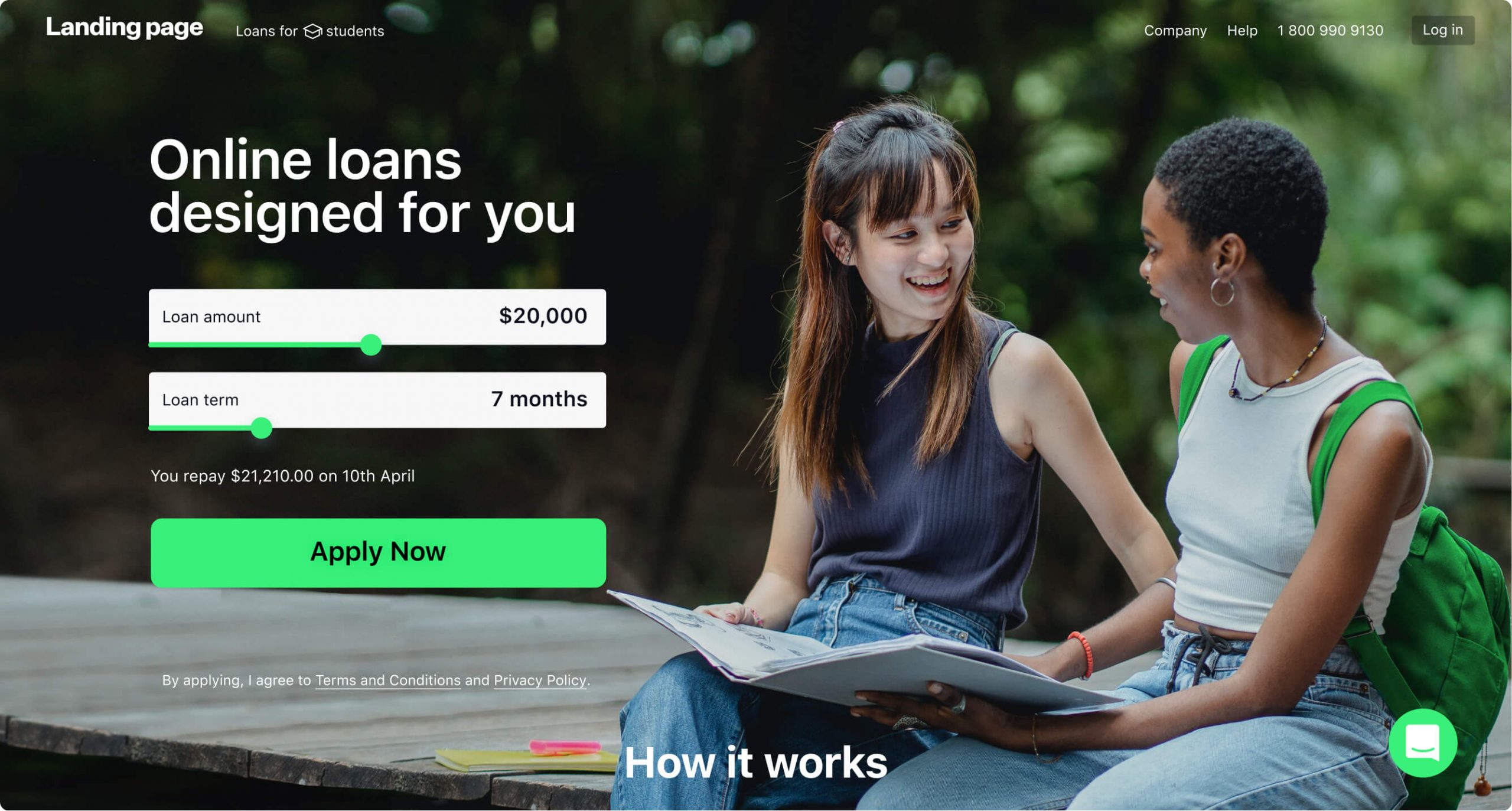

Origination module

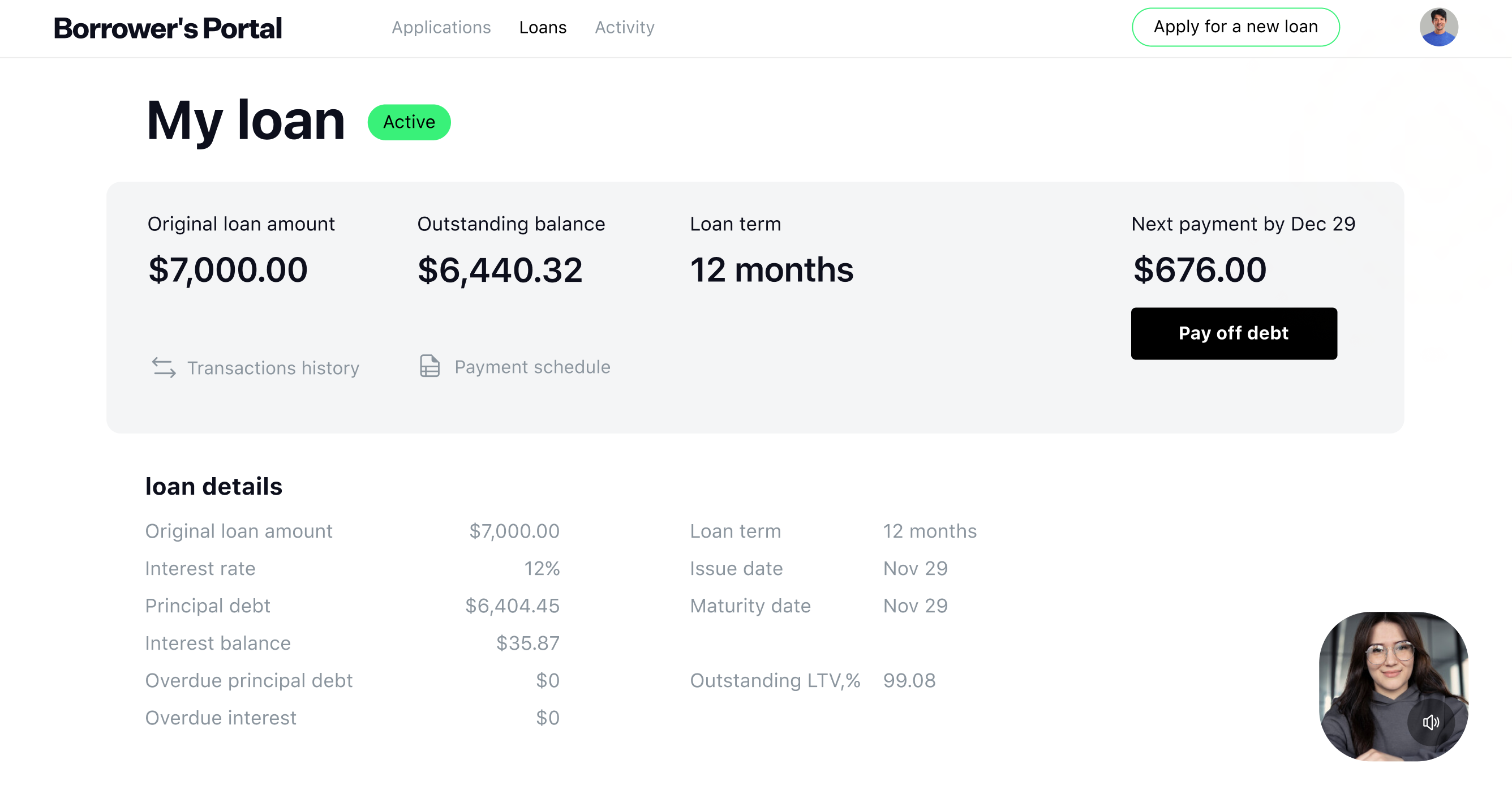

Automate customer onboarding and account opening across multiple

channels. Run a feature-rich customer portal and personal area.

channels. Run a feature-rich customer portal and personal area.

100+ integrations

HES software can be integrated with any credit bureau, KYC/AML,

payment and notification providers, accounting systems, BI solutions.

payment and notification providers, accounting systems, BI solutions.

Product engine

Launch numerous unique product types and comply with the legislation changes.

Full configuration of the product, including repayment period, rates, penalties.

Full configuration of the product, including repayment period, rates, penalties.

and much more

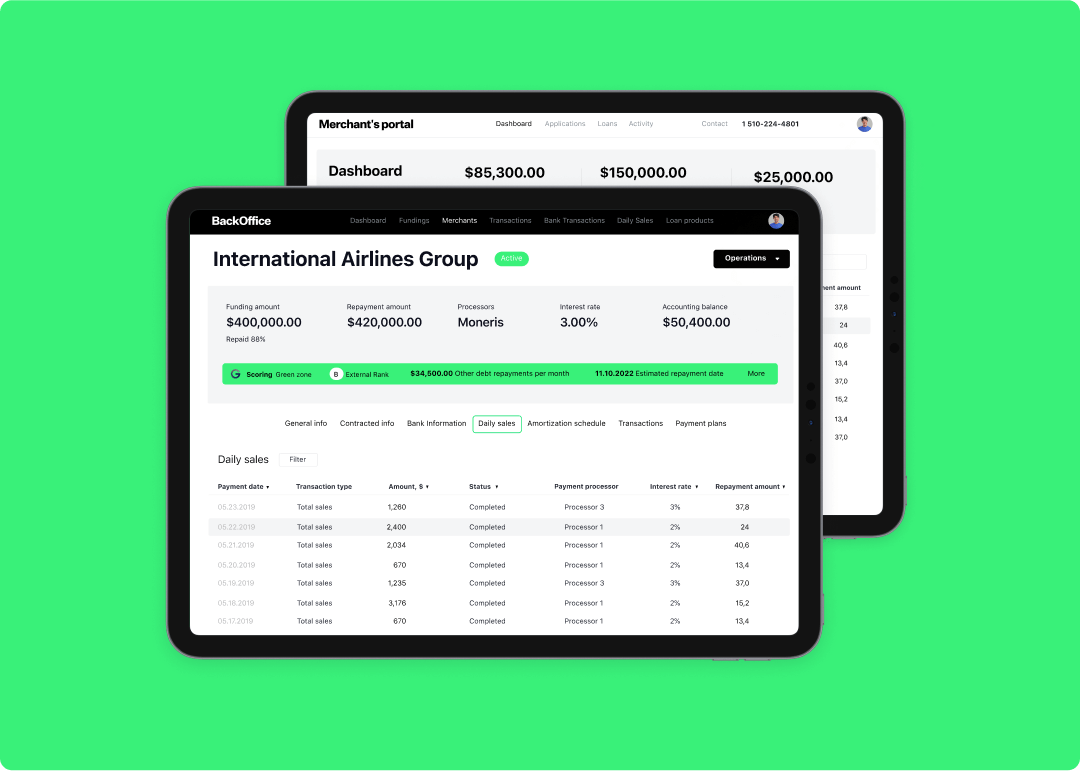

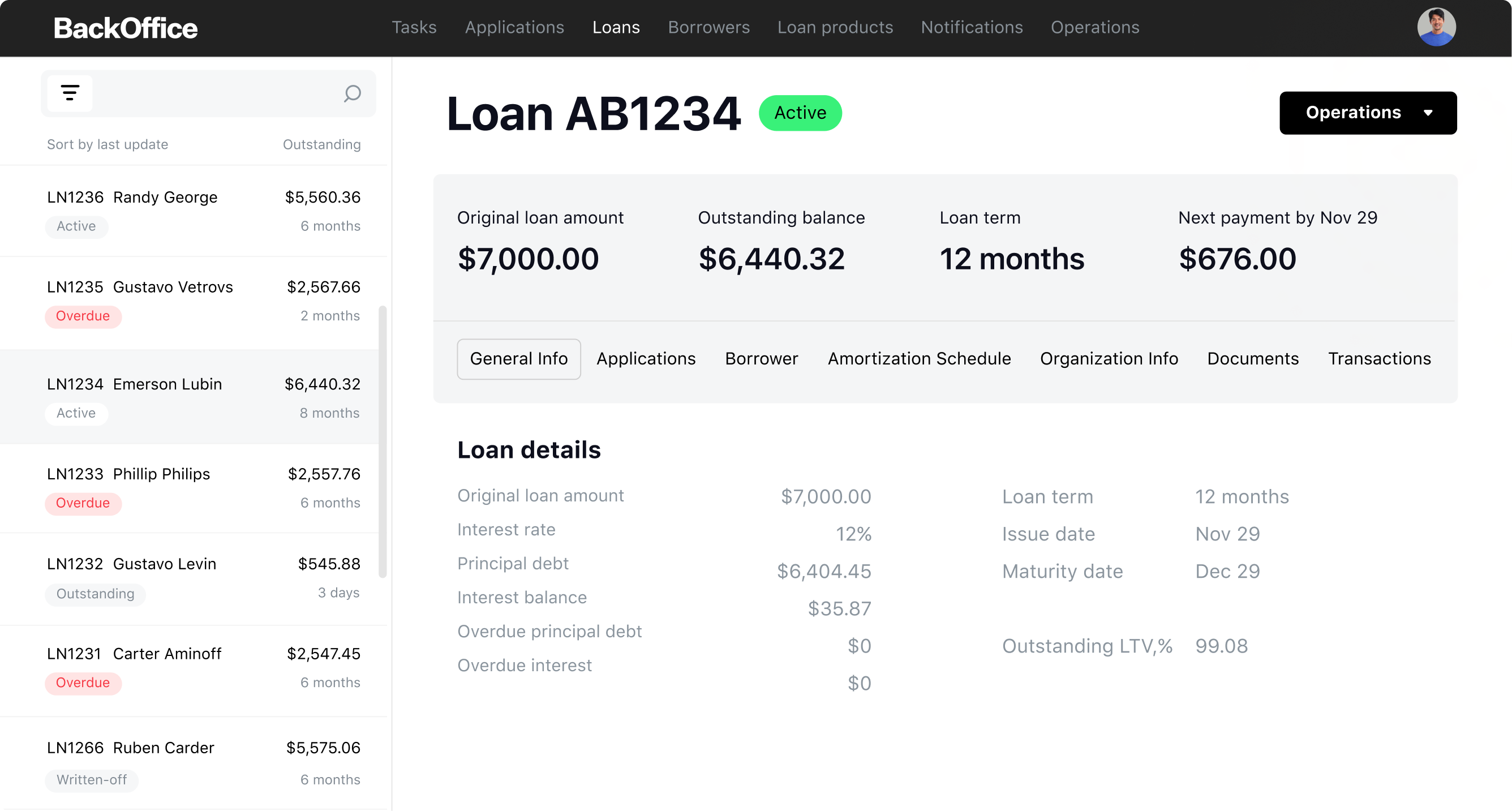

Debt collection

Automate and optimize collection operations.

Sophisticated and flexible soft, hard or legal collection features, pre-collection.

Sophisticated and flexible soft, hard or legal collection features, pre-collection.

Document management

Security settings

Easy integrations

Success stories

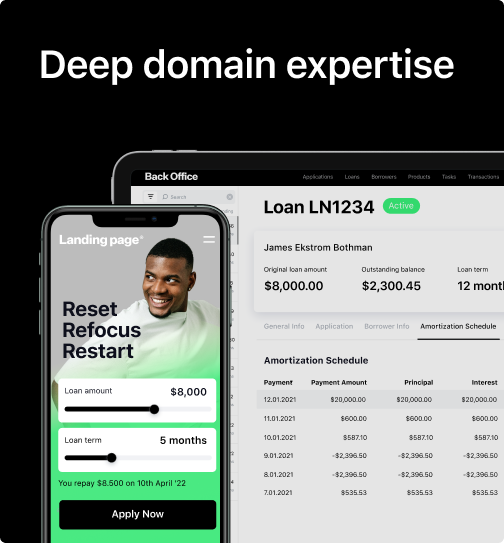

We cover the whole lending process, from loan origination to reporting. HES Fintech has been

transforming financial business demands into helpful features in Bahrain since 2012. Opt for digital lending solution tailored to your needs.

transforming financial business demands into helpful features in Bahrain since 2012. Opt for digital lending solution tailored to your needs.

For business lending in Bahrain

we suggest

Scalable end-to-end lending solution

3-4 months time-to-market

A few seconds for a loan decision

No additional charges per customer