WayFina success story

The ‘Grow Now, Pay Later’ initiative

changing agricultural finance

changing agricultural finance

WayFina is a supplier of fertilizers and agricultural products, primarily serving farmers and

small-to-medium enterprises (MSMEs) across African markets. Recognizing the financial constraints

that hinder many African farmers from accessing essential agricultural inputs, WayFina sought to

implement a "Grow Now, Pay Later" initiative. This program would allow farmers to acquire

fertilizers with deferred payments, settling costs post-harvest.

Challenge

Food insecurity and lack of automation

Traditionally, WayFina's business model required full prepayment for fertilizers, facilitated

through dealer networks. This approach limited accessibility for many farmers due to upfront

costs and logistical challenges. The company aimed to transition to a direct-to-farmer

distribution model with flexible payment terms to make fertilizers more affordable and

accessible. Implementing this change presented several challenges:

- Tight deadlines: The solution needed to be operational by December to align with Zambia's planting season.

- Regional specificity: Operating in Zambia required navigating limited digital infrastructure, the absence of traditional credit data, and the need to integrate with local service providers.

- Fraud concerns: The high-risk environment necessitated robust fraud detection systems tailored to the region. Operating in Zambia and the broader African region presents significant fraud risks, particularly in the lending sector. While specific data for Zambia is limited, insights from neighboring countries highlight the severity of the issue. For instance, in Nigeria, banks reported losses amounting to ₦6.03 billion (approximately $7.8 million) in the first half of 2023 due to fraudulent activities, with a notable portion stemming from loan fraud.

- Market research: Limited online information about local practices and data sources posed significant hurdles in planning and execution.

Based on machine learning algorithms, the solution allows each client to take an appropriate

level of risk and ensures that they do not pay excessive fees.

Solution

Bridging gaps in access to fertilizer

with flexible credit

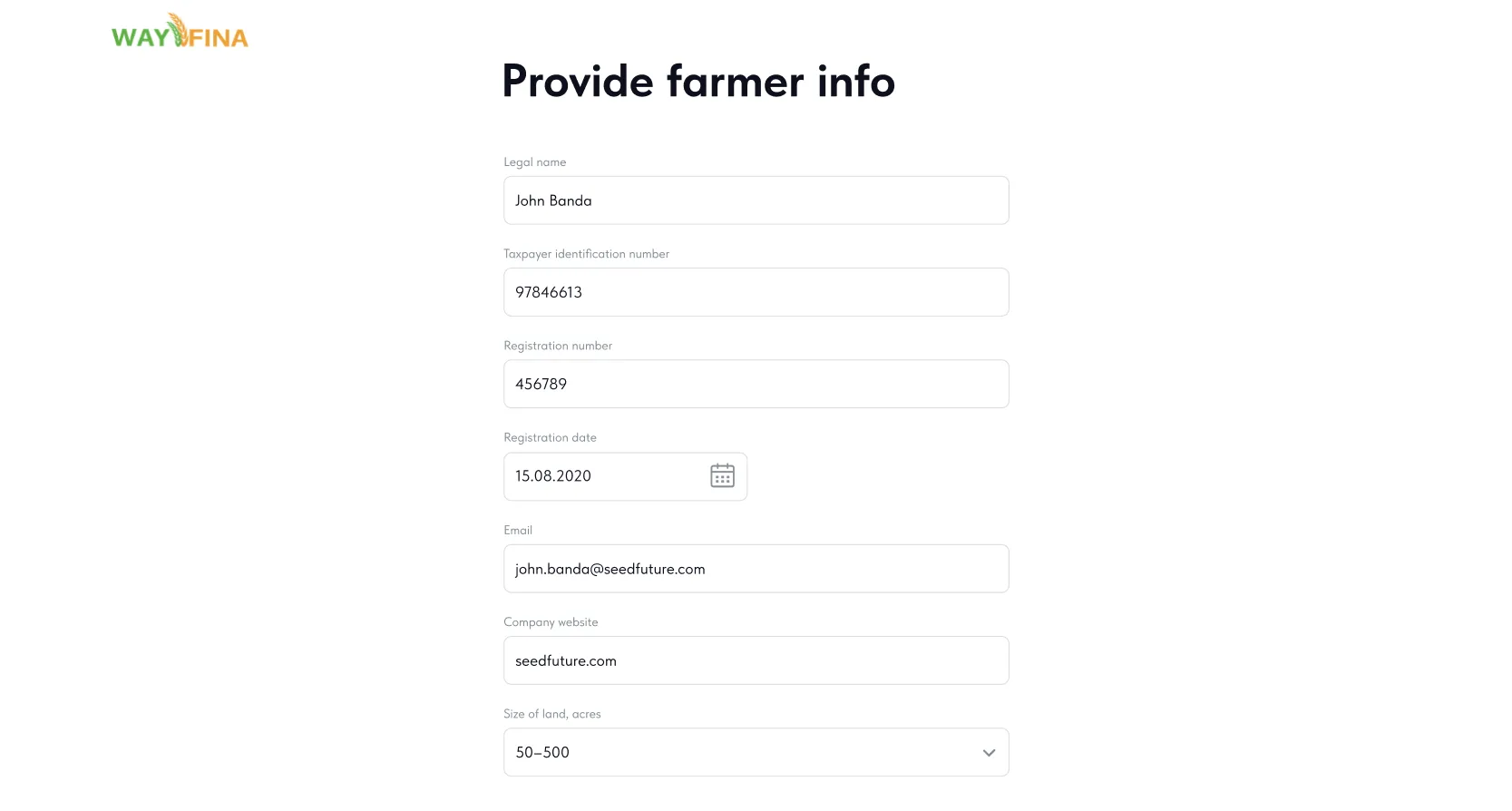

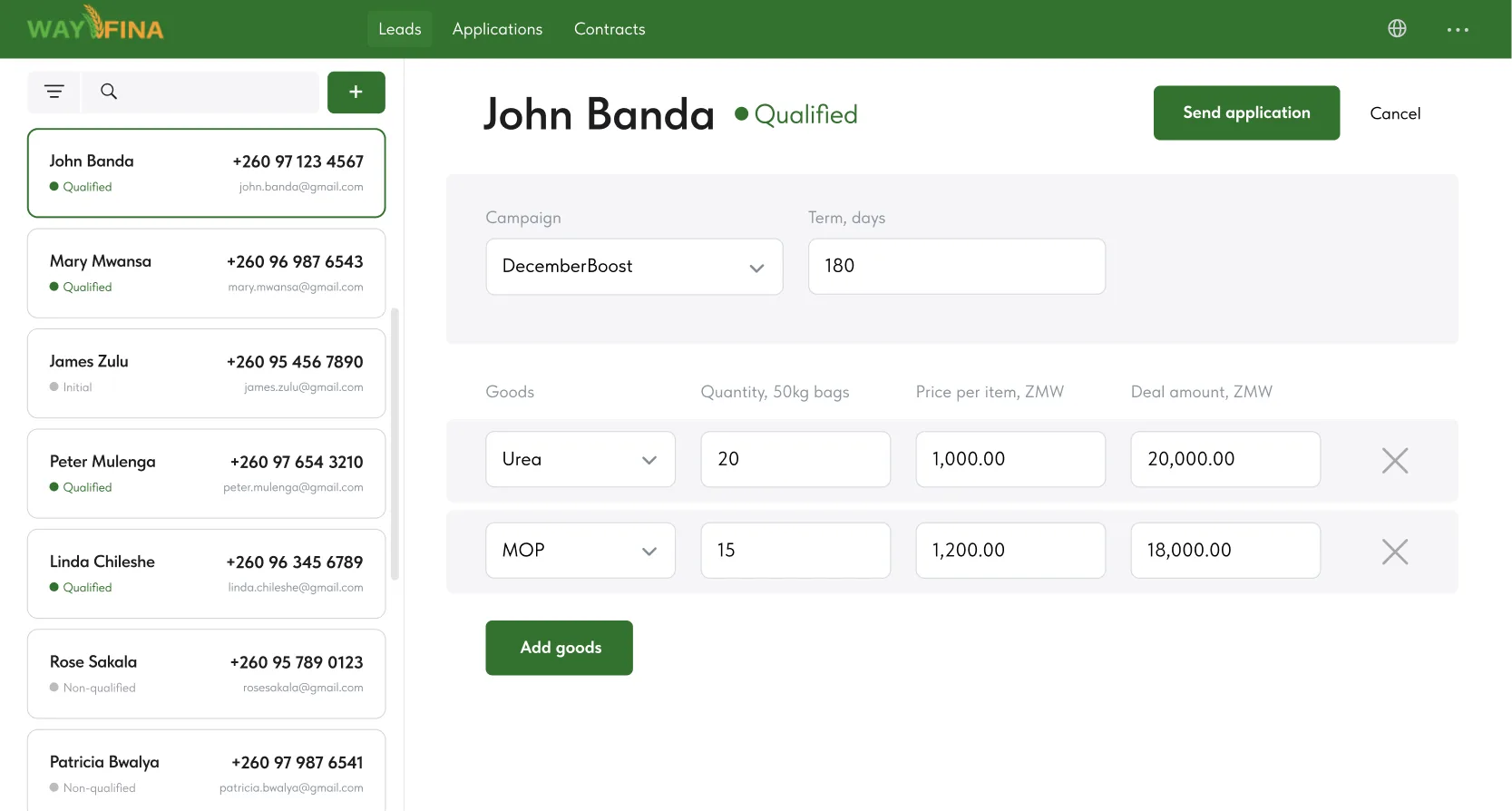

To address these challenges, WayFina partnered with HES FinTech to implement HES LoanBox, a

customizable lending platform tailored for the agricultural sector. This collaboration

facilitated the transition from a dealer-based prepayment system to a direct-to-farmer model,

significantly reducing costs and increasing accessibility. The "Grow Now, Pay Later" program was

integrated into the platform, offering farmers the flexibility to purchase fertilizers on credit

and repay after harvest.

The project is currently in its development stage, with the platform being customized to include

localized features such as integrations with regional payment systems and alternative data

sources.

Advanced AI-driven risk models are being developed to analyze non-traditional data and assess

creditworthiness responsibly, ensuring inclusive and sustainable financing. Robust fraud

detection

capabilities are also being implemented to handle the anticipated higher fraud risks in the

region.

Despite tight deadlines, the project is on track for deployment by December to align with the

planting season.

Impact

How flexible financing fuels Zambia's

agricultural growth

The implementation of HES LoanBox is poised to revolutionize agricultural finance and food

security in Zambia. By enabling farmers to access fertilizers without upfront payments, the

program directly addresses one of the region's most pressing challenges. This increased

accessibility is expected to lead to higher crop yields, strengthening food security and

reducing reliance on imports. In a region where droughts frequently exacerbate food shortages,

this initiative provides critical support to local communities.

Beyond its impact on food security, the solution empowers farmers and MSMEs, the backbone of

Zambia's agricultural economy. By offering affordable financing options, HES LoanBox enables

farmers to optimize their operations, invest in better techniques, and improve their

livelihoods. This empowerment creates a ripple effect of economic growth, supporting local

economies and fostering regional development.

Future outlook

A new chapter in Zambian agriculture

While the project is set to launch in December, its transformative potential is already evident.

The success of this initiative in Zambia will serve as a blueprint for expanding the program

across other African countries, amplifying its impact on food security and business empowerment.

HES LoanBox has proven to be not just a software solution but a catalyst for meaningful change,

combining innovative technology with a localized understanding of market needs.

This partnership between WayFina and HES FinTech exemplifies the power of fintech solutions to

drive progress. By transforming agricultural finance, HES LoanBox is planting the seeds for a

more resilient agricultural sector, ensuring a brighter and more secure future for communities

across Africa.