ID Finance success story

A consumer lending platform for one of the fast-growing fintechs in Europe

Learn how MoneyMan launched a microfinance lending

business in 7 countries with HES Fintech.

HES FinTech has been our reliable technology partner since 2012. I believe much of

our success is due to the well-architected HES LoanBox solution.

Boris Batine

Co-Founder at ID Finance and CEO at MoneyMan

Client overview

MoneyMan

MoneyMan, part of the ID Finance Group, started in 2012 as a short-term

online lending service. Over the years, MoneyMan has played a crucial role in reshaping the

lending landscape, particularly in markets with limited access to traditional financial

services. As a key brand within ID Finance, a fintech company founded in 2015, MoneyMan operates

in multiple countries including Spain, Mexico, and Brazil, addressing a massive demand for

accessible credit.

Its focus on emerging markets made the company a major player in

providing financial solutions to millions of people who lack access to traditional banking

services. Through cutting-edge AI-driven risk management systems and advanced digital solutions,

ID Finance processes loan applications in real time and offers accessible credit products to

millions of customers across its markets.

Challenge

360-degree microfinance lending automation

MoneyMan, an innovative online lender, required a fully-fledged,

flexible solution to automate the

entire microfinance lending process and operating procedures. The system had to be capable of

running high-performance scoring models in real time.

Approach

A winning combo of top-notch features and enhanced security

HES FinTech provided a tailored lending platform to ID Finance,

addressing their need for automation, scalability, and advanced risk management. HES LoanBox was

built to support ID Finance’s ambitious growth plans, enabling them to:

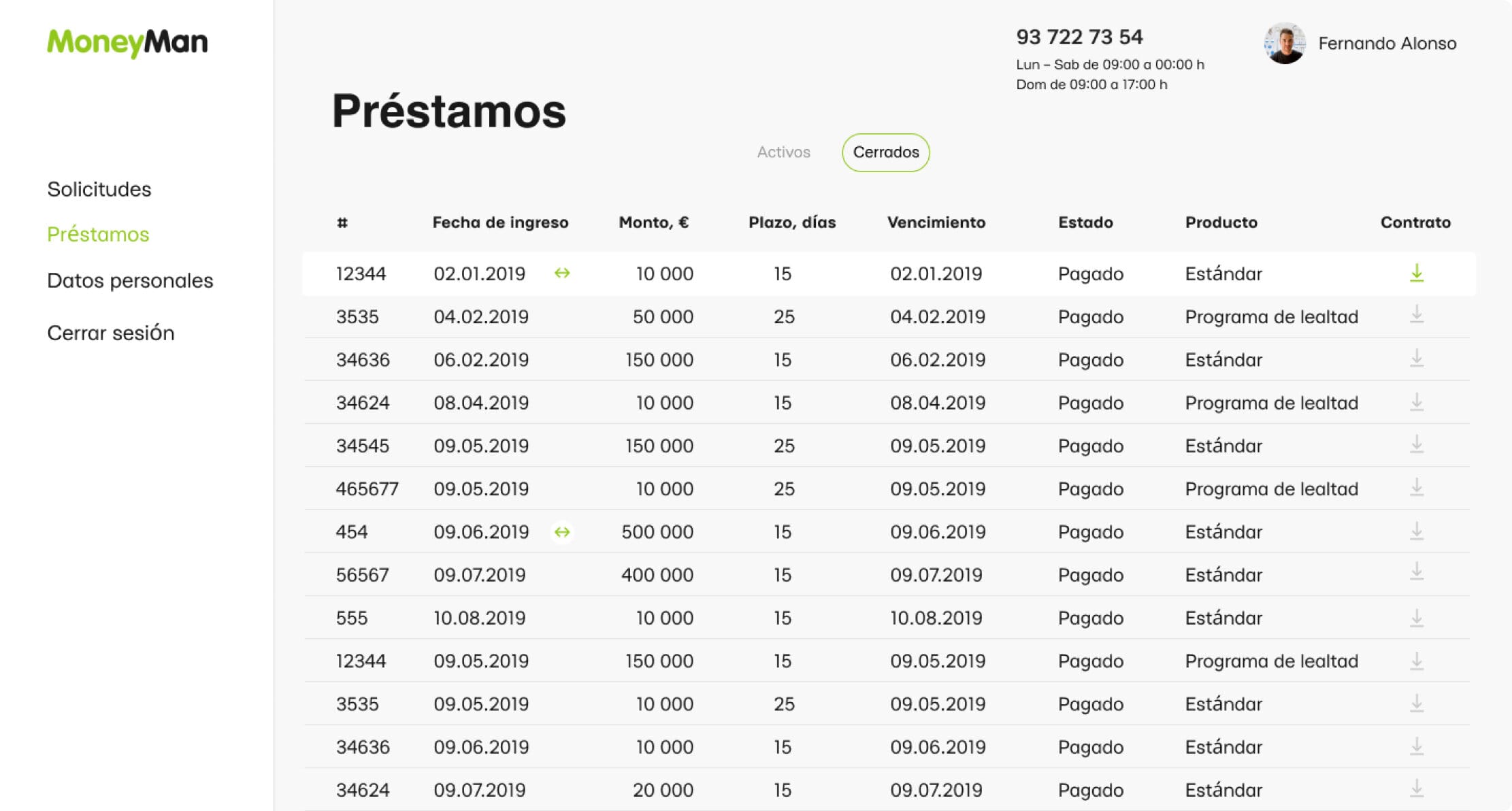

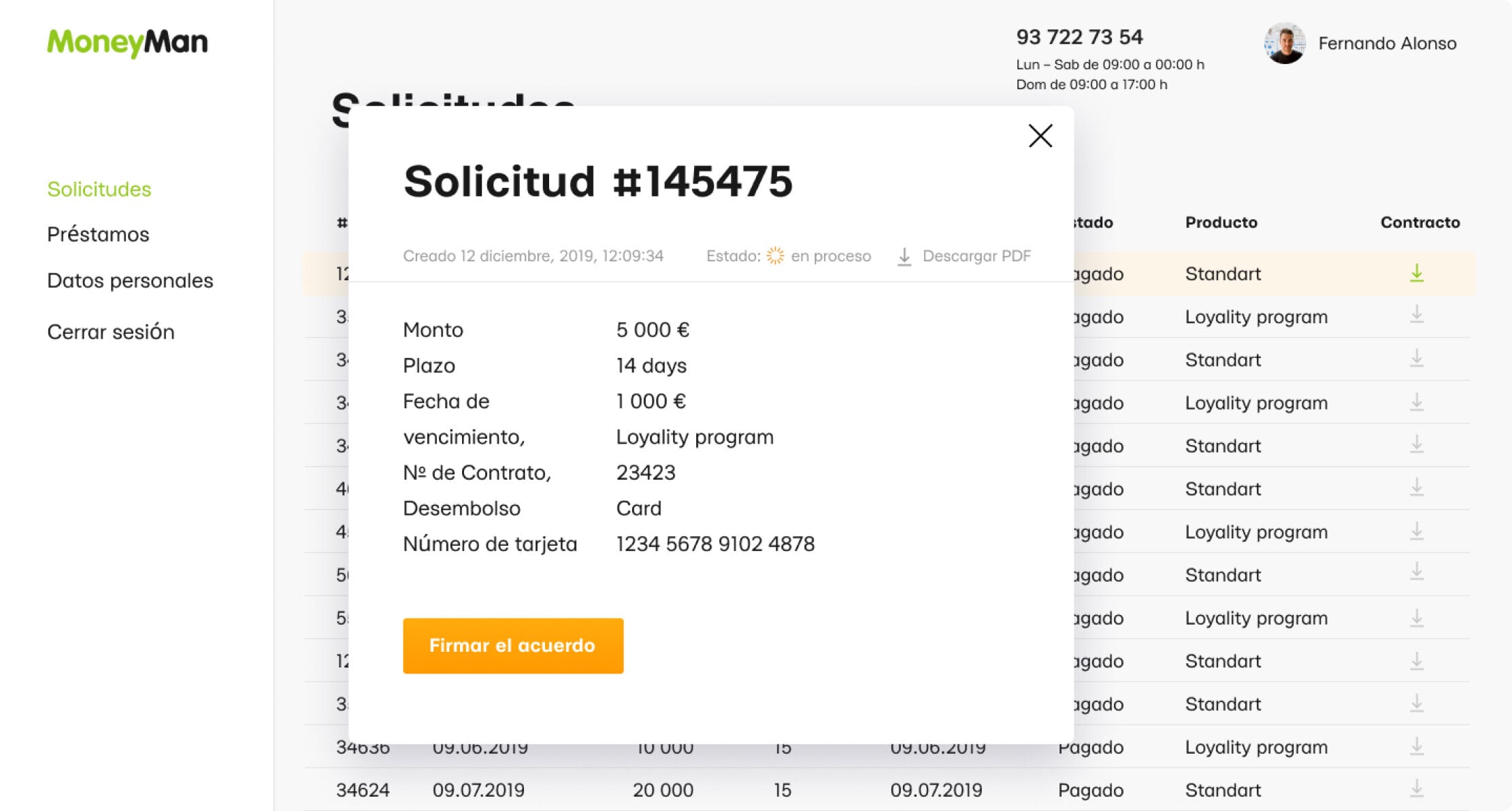

- Automate loan approvals: HES FinTech’s platform streamlined the loan approval process, reducing the time it takes for MoneyMan and other ID Finance brands to make credit decisions. This allowed ID Finance to handle thousands of applications daily with minimal manual intervention.

- Advanced risk scoring: Leveraging AI-based analytics, the platform integrated with ID Finance's proprietary risk models to assess loan applications accurately, improving both approval rates and portfolio health in risky markets.

- Scalability: As ID Finance expanded into new markets, the solution provided by HES FinTech easily scaled to meet increased demand. This ensured that MoneyMan’s operations could continue to grow without disruptions.

- Real-time data processing: HES LoanBox integrates real-time data processing capabilities, allowing ID Finance to process applications and monitor loan portfolios efficiently across multiple countries.

- Regulatory compliance: HES FinTech helped ID Finance stay compliant with various local regulations, ensuring that their operations were legally sound across multiple jurisdictions.

3 months

Time-to-market

400K

Loans issued via the platform

20-30%

Year-over-year business growth

Result

Technically equipped lending business operating worldwide

By 2024, ID Finance reached over 3 million users globally, with 40,000

new customers joining weekly. The fintech firm needed a scalable, flexible solution to keep up

with this rapid growth—one that ensures secure, efficient loan processing and risk management in

emerging markets, where data is often less structured.

HES FinTech and ID Finance have a long-standing collaboration that began in 2011, when Boris

Batine and Alexandr Dunaev shared their vision of launching the first online payday loan (PDL)

platform. Within just three months, HES LoanBox was developed to support the core logic,

workflows, and all business processes essential for the company's operations.