Idea Bank success story

A comprehensive POS lending platform for one of Poland’s top retail lending providers

HES FinTech introduced its fully functional POS Lending Platform to automate the processing of loan applications and build a better customer experience.

Founded in

2009

Markets

Poland, EU

Team size

740

Type

POS lending

HES LoanBox reduced the processing time for each new loan or leasing application by 5x.

Vladimir Pilipenko

CEO at IdeaFinance

Challenge

POS financing deals made easier

Idea Bank collaborates with more than 2.5 thousand retail chains and online stores nationwide

to offer consumer lending services. It required a comprehensive system to automate loan

application collection and processing for POS consumer financing deals.

Approach

Fast development of a configurable POS platform

In less than 3 months, the HES FinTech team gathered requirements, analyzed and documented

business processes, and performed customization and implementation of the solution. The system

was subsequently introduced to all Idea Bank’s partner retail sites.

3 months

time-to-market

2.5K

chain stores using the system

5x

faster application process

Result

Fast & automated loan application flow

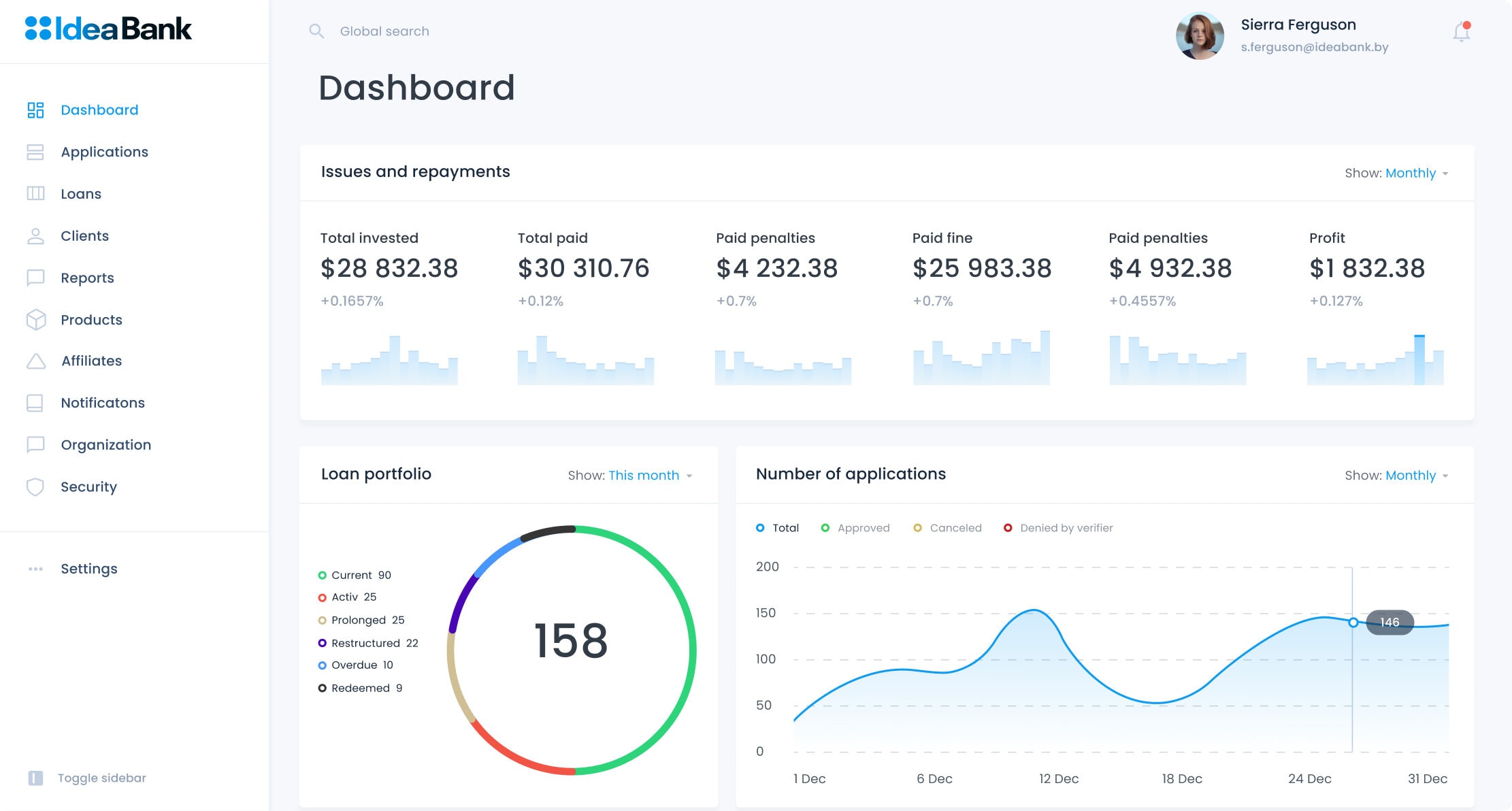

With the implementation of HES LoanBox, Idea Bank reduced application processing time by fivefold. The entire process was automated, requiring no additional checks by personnel, which led to significant operating cost reductions and gave Idea Bank a competitive advantage.

With the implementation of HES LoanBox, Idea Bank reduced application processing time by fivefold. The entire process was automated, requiring no additional checks by personnel, which led to significant operating cost reductions and gave Idea Bank a competitive advantage.

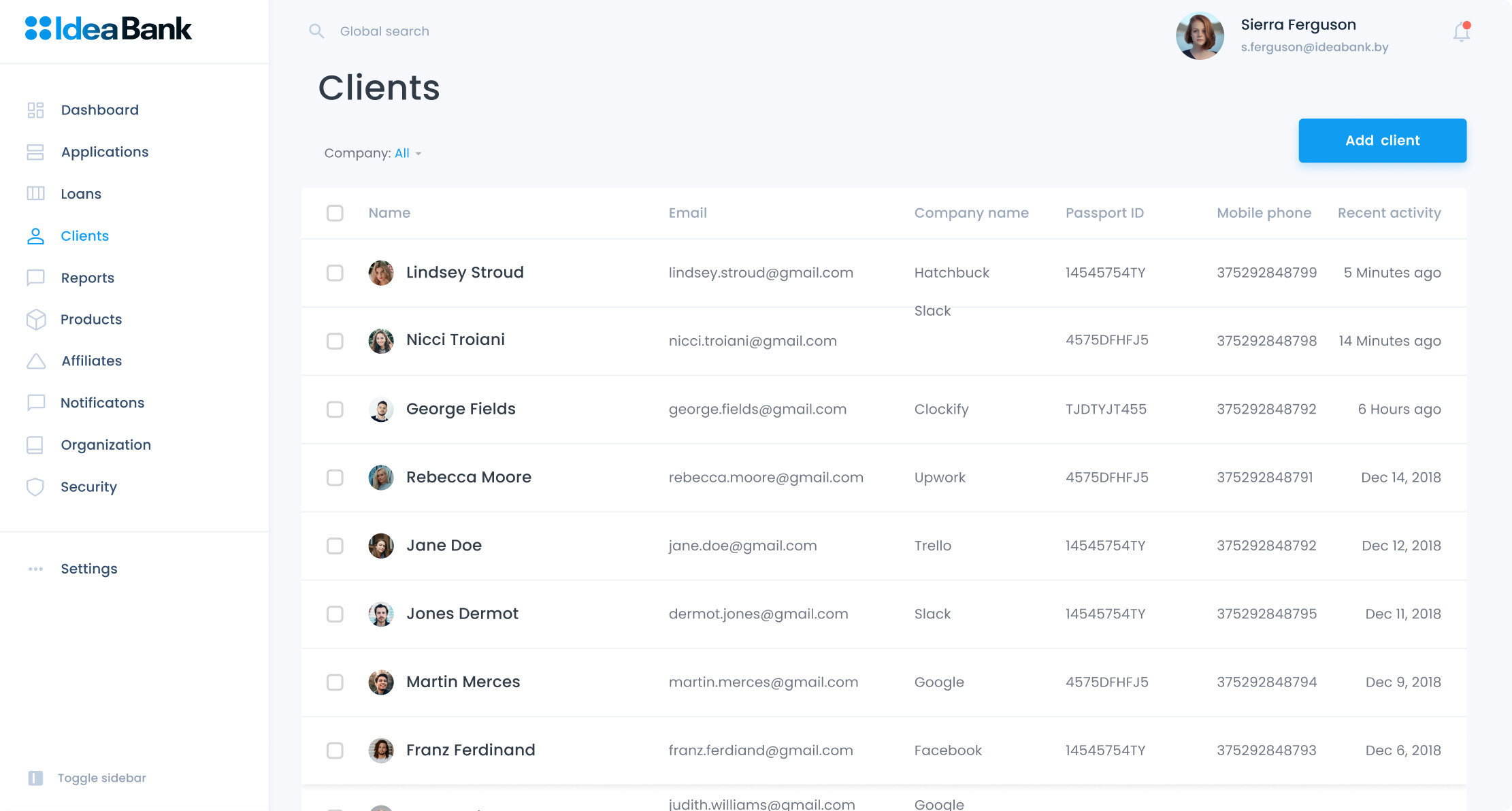

- Administrative interface for management of partners, POSs and system users.

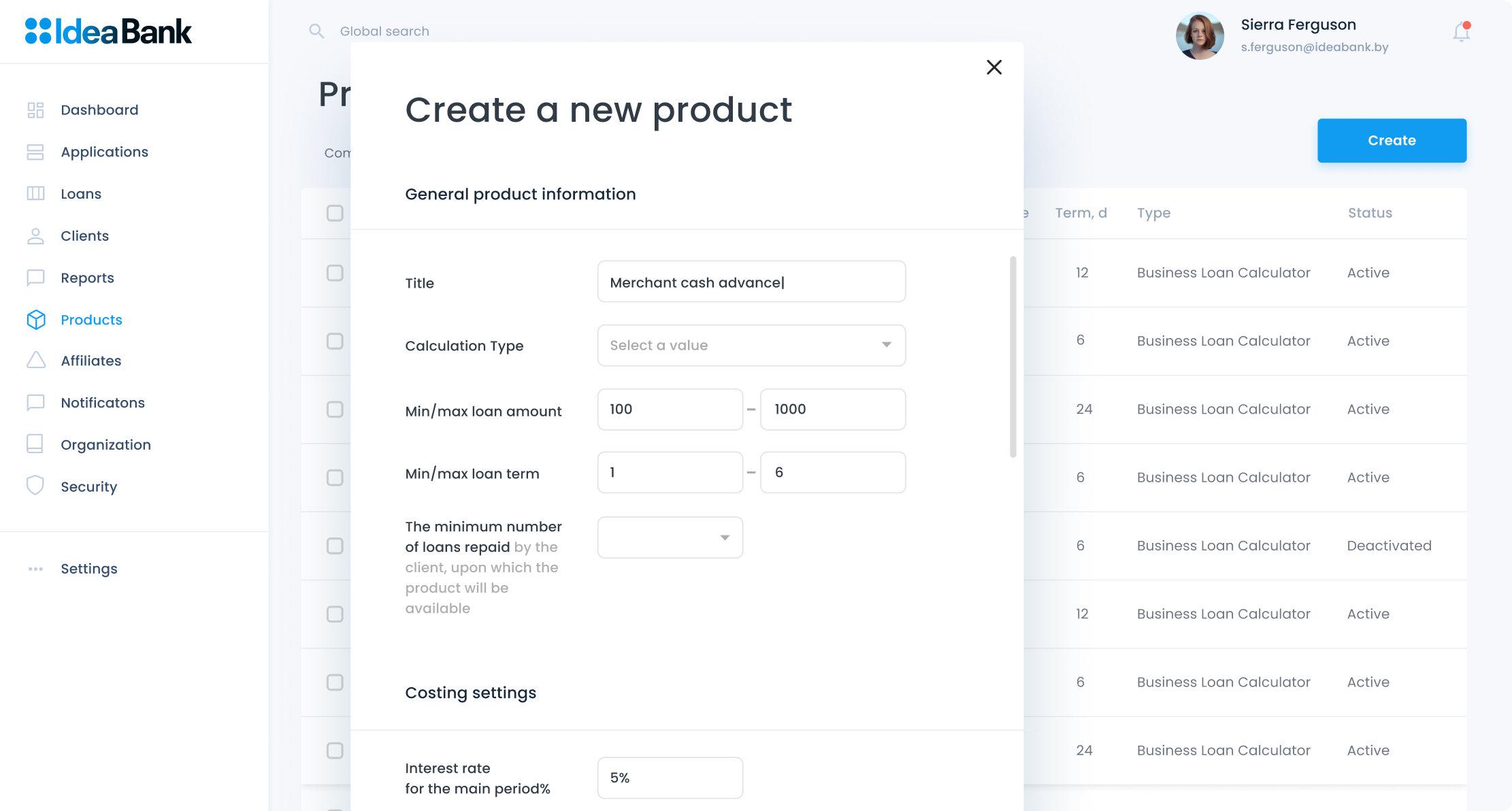

- Multiple loan product support.

- Multi-step application process. Template-based document generation.

- Manual and automated application processing and loan decisioning.

- Integration with the bank’s internal databases, credit bureaus and external data sources.