Loan workflow automation is a strategic imperative for lenders seeking to reduce time spent on tasks and increase focus on productivity. As far back as 2020, 73% of organizations surveyed said they were in the process of automation. But despite market growth for loan workflow automation software, which is projected to grow from $10.22 billion in 2024 to $12.35 billion in 2025 at a CAGR of 20.8%, organizations continue to fall victim to common pitfalls that cause massive losses in terms of time, money, and motivation.

Here’s our breakdown of the most common mistakes that can derail even the most well-intentioned automation project based on our hands-on experience developing custom lending platforms — and how to build a system that scales efficiently and securely.

The 7 Pitfalls of Loan Workflow Dystem Automation

To avoid falling into the same trap, learn how to set off on the loan management system workflow journey on the right foot with minimal mistakes and optimal results.

With over a decade of hands-on experience in developing custom lending solutions for banks, credit unions, and alternative lenders around the world, the HES FinTech team has seen both the successes and struggles of automation up close. Let us share our takeaways on the most common pitfalls that can derail even the best projects—and, more importantly, ideas on how to steer clear of them.

1. Poorly Defining the Loan Origination System Workflow

Before you automate anything, it’s important to get a good conceptual understanding of what you want to get out of the loan origination process and its automation. Lenders, driven by concerns of being outrun by their competitors, often rush into onboarding the latest technology without considering how it fits within their business model or workflow.

A vague or unclear workflow can result in:

- Endless software reiterations

- Delayed approval implementation time

- Team conflict as roles and responsibilities remain unclear

This is only the beginning. Such early-on errors within the loan application processing system accelerate inherent mistakes in the software, leading to inconsistencies or gaps in data validation, which leave the company open to fraud and hacks.

What to do instead: Prior to development, we recommend mapping out the process you want to achieve. Audit your current loan origination workflow, identify bottlenecks, management issues, and then focus on what you want to automate. Each stage, from application intake to approval and servicing, needs to be diagrammed, validated, and aligned with your KPIs. This approach ensures automation is driven by strategy, not just technology.

2. Making Silos Instead of Cross-System Integrations

Next on our list is perhaps one of the most damaging pitfalls, and that’s crafting your loan workflow automation into a series of silos. This ends up delivering a fragmented infrastructure that never does quite what it’s supposed to do. When your CRM, underwriting platform, loan management system workflow, and more aren’t properly aligned, the flow becomes a patchwork of isolated systems, and customers feel the friction.

- Borrower data needs to be re-entered at every location, increasing the risk of error

- Underwriters don’t get the information they need when they need it, leading to poor customer support

- Overall miscommunication between teams and with clients

Together, this creates a loan servicing system that’s disjointed and risks enlarging compliance gaps, and makes borrowers dissatisfied with the services.

What to do instead: It might come as no surprise, but solid communication and project management are a good start to crafting a truly integrated solution. Also, seek out platforms with RESTful APIs, prebuilt integrations (CRM, core banking, KYC), and event-driven architecture support to get your loan servicing system up and running smoothly. Avoid disconnected tools or those that force you into more isolated or manual workflows. This eliminates friction between departments and gives executives a single source of truth.

3. Automation Without a Proper Process

Everything runs smoothly until it doesn’t. A document is missing, or an input field is left incomplete. Without proper processes, the entire loan approval process can grind to a halt with stalled applications, frustrated borrowers and lost revenue, not to mention time, as a result. Without a proper process:

- Verification can remain incomplete

- Exceptions to the rules lead to higher drop-off rates

- Roadblocks in the process block its completion

Automation is only as good as the process behind it. If your workflow has gaps, technology will only make them more obvious.

Artem BritunHead of Business Analysis at HES FinTech

What to do instead: Audit and refine your loan processing workflow automation before digitizing it. Ensure your system has built-in configurable exception logic so it can handle outliers. For advanced setups, AI-assisted scoring can help flag irregular applications. and re-route cases for human attention so your staff are able to problem-solve quicker.

For instance, at HES FinTech, we use modular architectures and combine them with AI functionality, ensuring automation remains transparent and controllable at every step.

4. Forgetting About Regulatory Compliance

Compliance is a crucial part of any loan process, yet it sometimes gets overlooked among the more glamorous digital loan workflow. But staying aligned with regulatory requirements isn’t an added extra, it’s an essential. Your loan management system process flow needs to account for the latest legal and data privacy standards. Otherwise, that tech upgrade becomes a liability, risking:

- Costly fines and regulatory penalties

- Delays in the approval and allocation process

- Breaches of trust and data protection

So whether you’re ensuring you’re meeting the latest KYC/KYB, AML, data protection requirements such as GDPR (EU) or local equivalents, or local lending laws, non-compliance can lead to bigger problems down the line.

What to do instead: These allow you to automatically flag missing disclosures, ensure identity protocols are followed, and align your flow with the latest regulations, which can change quite often depending on your jurisdiction.

Integrate compliance monitoring into your automation layer, instead of making it an added extra. Such modules will automatically verify borrower data against current AML/KYC rules and maintain complete audit logs for regulators.

5. Focusing Too Much on the Tech and Not Enough on the Users

How often have you opened an app that just felt wrong, and then closed it immediately? This isn’t the feeling you want to give your borrowers. Automation shouldn’t seem depersonalized or too “techy.” Instead, it should be the seamless, professional experience you get in a bank or other lending facility. When borrowers encounter friction in the loan application process, they often end up abandoning it, leading to:

- High drop-off rates

- Poorer brand perception

- Lost connections when it matters most

UX matters when it comes to how borrowers interact with your brand. When borrowing, they want to ensure that the provider is reputable, and nothing says that more than a system that works, and works well.

Improved UX can reduce loan abandonment rates by 15–25%, directly increasing funded loans.

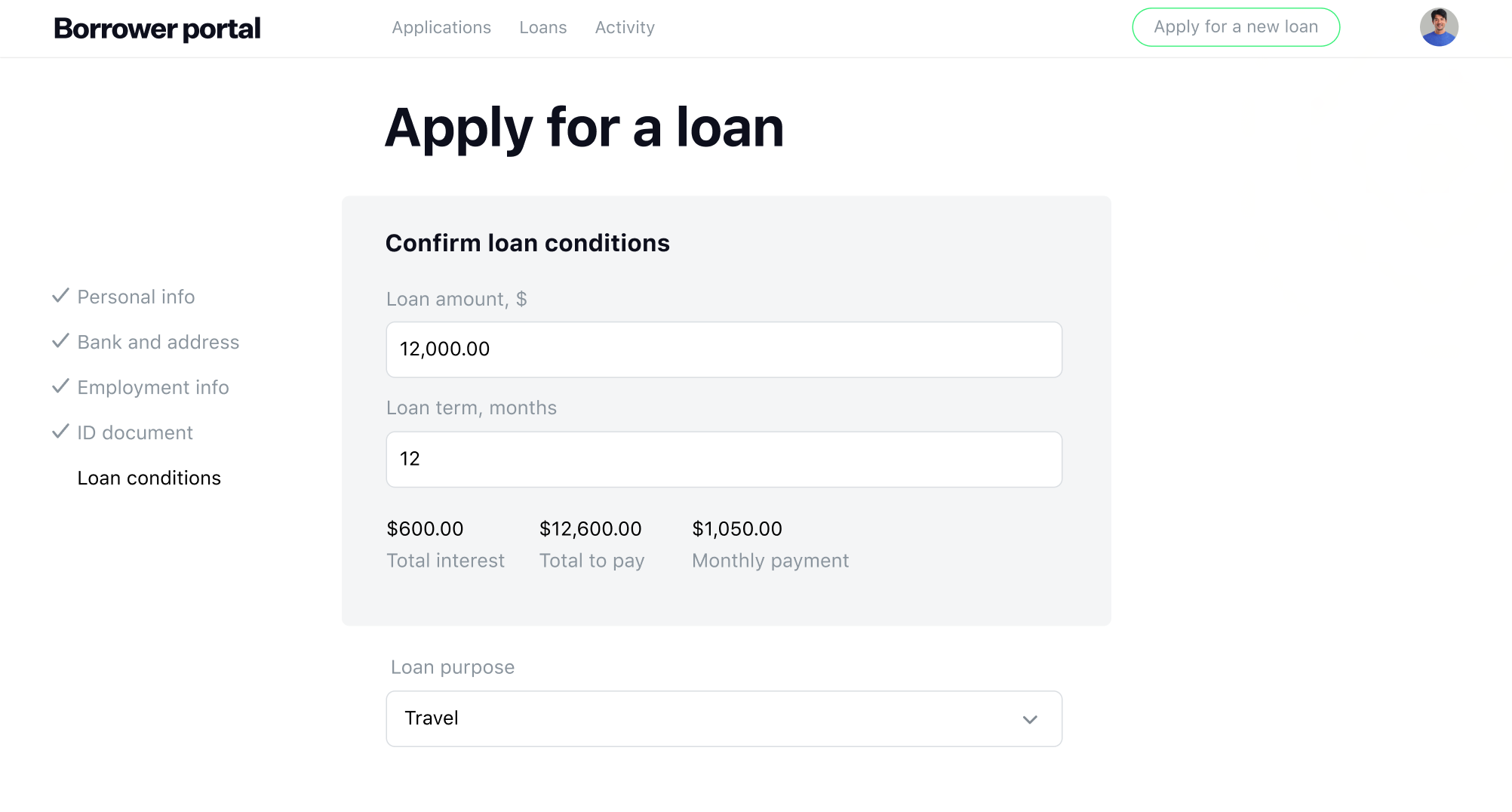

What to do instead: Treat UX/UI as part of your strategy for the automated loan origination process. Improved user experience in different elements of loan origination software, like borrower portals, underwriting dashboards, and admin panels is an opportunity to reduce abandonment rates and directly increase adoption and funded loans.

At HES FinTech, we treat UX/UI as a core part of automation—not an afterthought. Every borrower journey, underwriter tool, and admin panel is designed to feel intuitive, efficient, and aligned with the task at hand. From the first click to final repayment, every screen is designed to reduce confusion and help users complete their tasks confidently, without calling for help or dropping off midway.

6. Limited Reporting and Analytics Capabilities

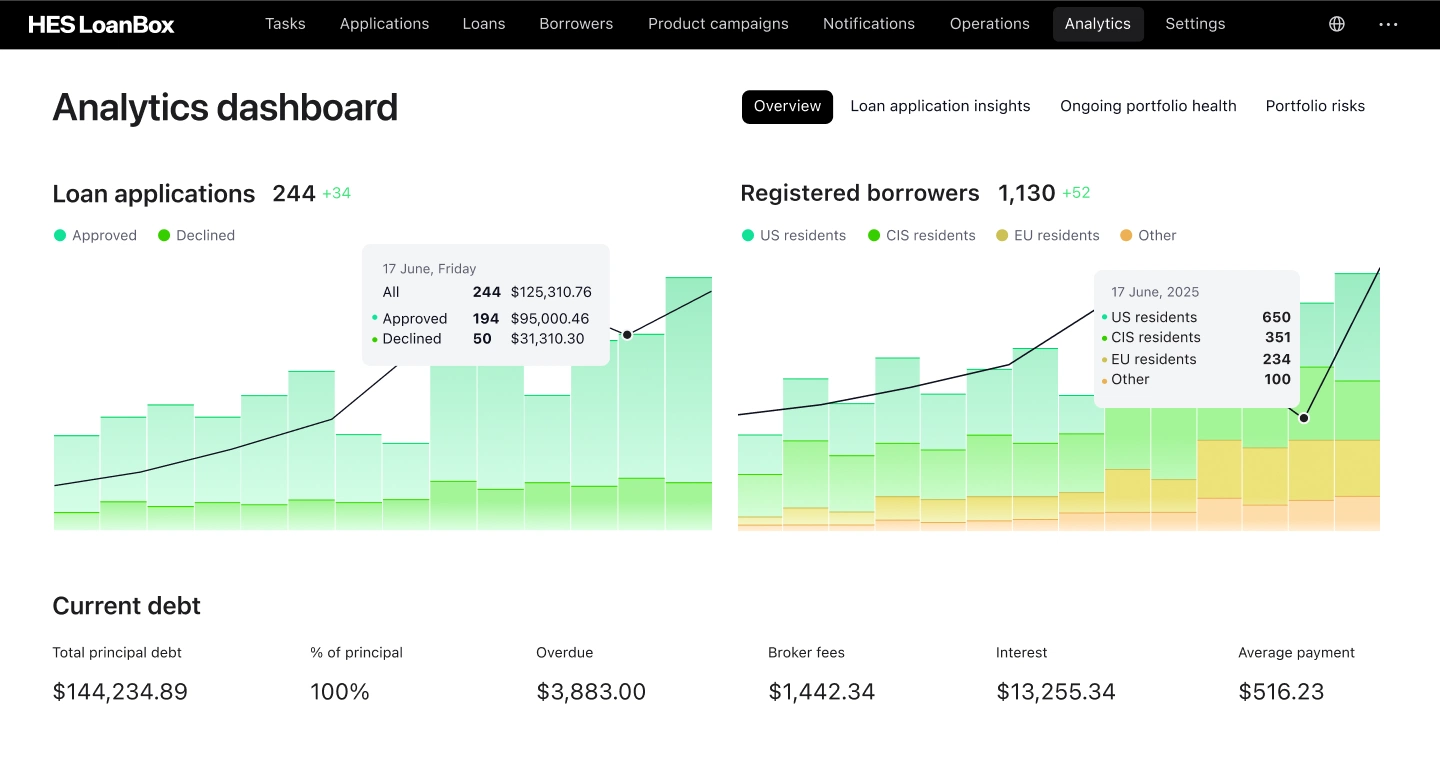

You can’t improve what you can’t see. Proper reporting and analytical tools help your loan automation process tick along as smoothly as a well-serviced engine, allowing you to visualize bottlenecks, performance, and growth opportunities. Forgetting to add this vital step leaves you blind:

- You can’t see where applicants are getting stuck

- You aren’t able to measure the efficiency of your tools

- You’re missing opportunities for growth

Often, this leads to afterthought solutions and installing tools that never quite give the data you were looking for, limiting your ability to undertake loan origination analytics and more.

What to do instead: Integrate KPIs, business intelligence and data visualization tools from the start. With real-time dashboards, customizable reports, and smart analytics, you’ll gain full visibility into your lending portfolio and the grounds for data-driven decisions on credit policies, performance optimization, and resource allocation.

7. Assuming Loan Automation Is a One-Size-Fits-All Task

Your business has unique selling points, its own branding, and design, so why should your automation process be exactly the same as your competitors? Copy-pasting from your competitor is not only a sure-fire way to confuse your borrower as to who’s who, but it also leaves you with much deeper problems in your loan workflow software:

- Rigid setups that don’t answer your audience’s needs

- Increased costs from adapting the software later

- Clumsy workaround solutions to align with goals

These result in frustrated teams, inefficient workflows and missed opportunities for development and customer interaction.

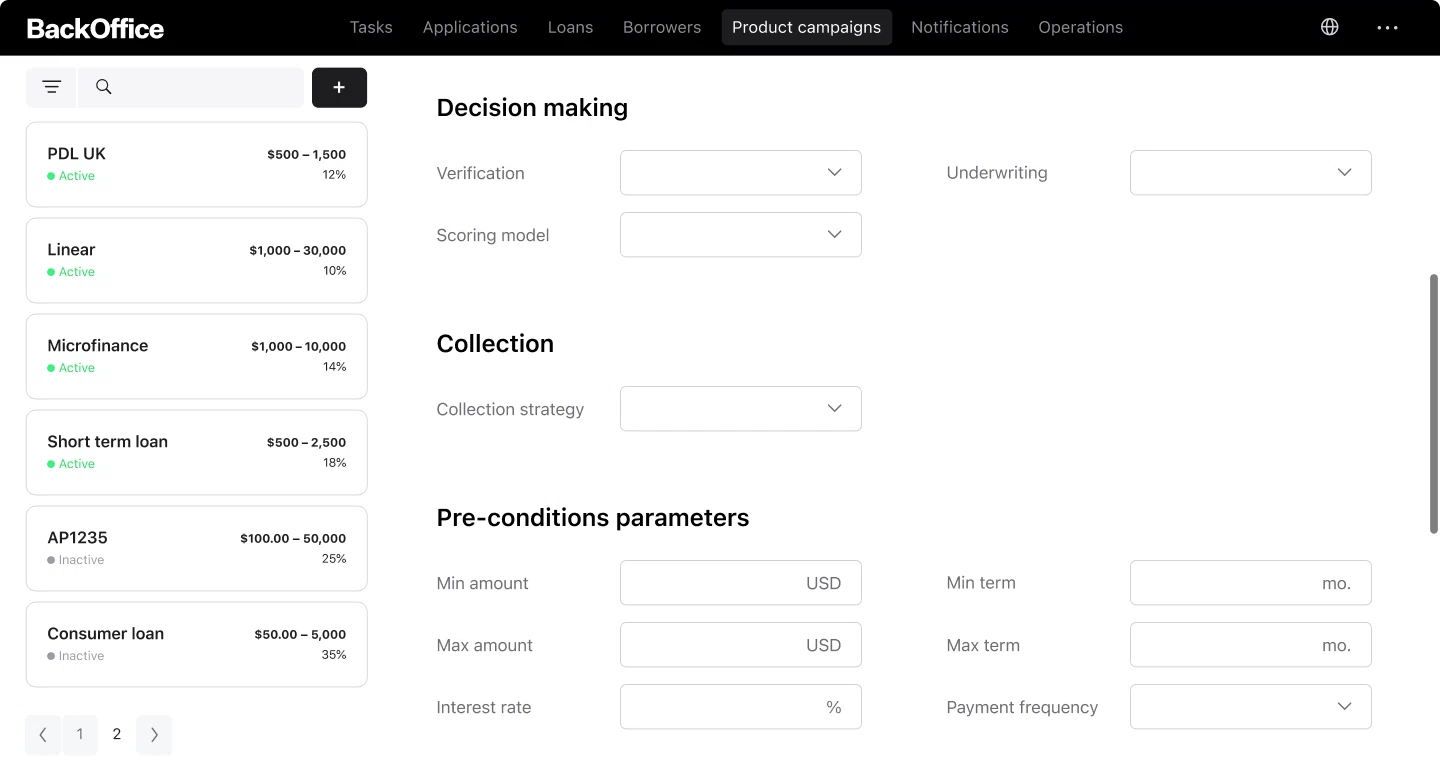

What to do instead: Look for lending software designed for scalability and configurability, not cookie-cutters. Whether it’s customizing approval criteria, risk scoring models, or UX flows, automation should support rapid deployment without sacrificing long-term adaptability.

What Is the Flow of the Loan Process? Next Steps

Knowing the challenges shouldn’t scare you into inaction. To avoid falling into these traps, take it back to basics and understand what you want to get out of automation before diving in headfirst.

Studies suggest that up to 70–80% of repetitive loan operations can be automated without compromising compliance or control. Successful automation lies not just on tech resources, but firstly, on understanding your processes, compliance landscape, and user expectations, and secondly, in aligning automation strategy with your business objectives.

If you’re aiming to invest in your lending management software the right way, our team is ready to help.