Choosing lending software as a service that truly fits your specific digital lending needs is not a simple task. If a company chooses the wrong software for its business, it can be a costly mistake, but unfortunately, many businesses make it.

Capterra’s 2024 Tech Trends report shows that 60% of buyers regret a purchase made in the past year or two. This number shows that many companies don’t think long-term when buying. Selecting the right lending software is no different.

Whether you're still weighing the options between opting for a SaaS lending platform or building your own lending platform or unsure which software model best corresponds to your strategy, this article is for you. We’ll walk you through approaches and help you figure out which option truly fits your business, not just for today, but for the road ahead. By the end, you'll have a clearer understanding of which path is the most suitable option given your aims and budget.

SaaS Lending Software: Ready-Made, Cost-Efficient, but Constrained

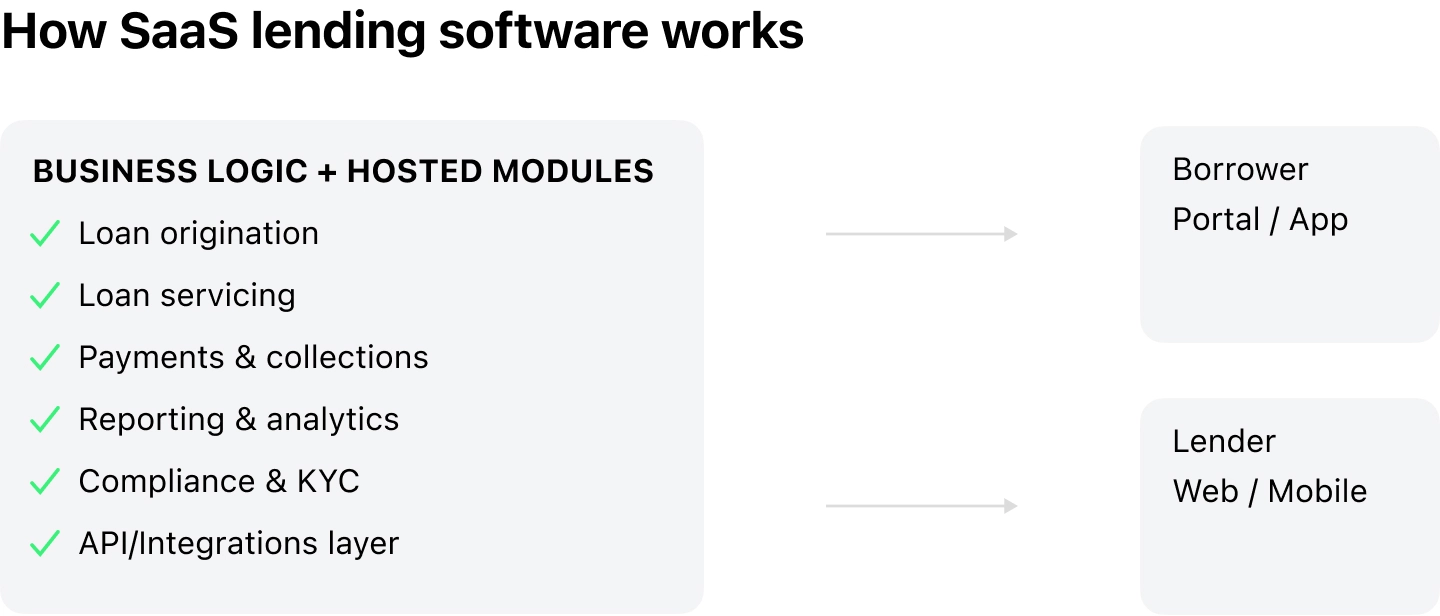

Typically, SaaS is a cloud-based online platform that provides users with access to software via the internet, eliminating the need for local installation or maintenance. It simplifies and automates the loan process. The majority of platforms assist in launching and managing loans, reviewing information about borrowers, and handling transactions. Moreover, smart analytics and reporting features help customers analyze data. It’s useful for small and medium-sized lenders, microfinance institutions, credit unions, online loan marketplaces, and startups that want to launch quickly without investing much in tech infrastructure.

It’s a popular choice for businesses, especially for tools like customer relationship management (CRM) systems or team collaboration apps. For example, SaaS lending software like nCino or Mambu allows financial companies to digitize the loan process, making it faster, more transparent, and more comfortable for clients. It seems that everyone is happy with how things turned out.

Benefits of a SaaS Lending Platform

- It is ready to use; you don’t need to build anything from scratch.

- You don’t have big upfront costs. You pay a subscription fee, which is usually much cheaper than developing your own software.

- You can start using it almost immediately.

- Most platforms support integrations with payment and KYC services, tools for managing loans, checking borrower info, handling payments, and generating reports.

- These platforms are used by many organizations from different spheres, so they’re proven and reliable.

- You have automatic updates from the provider, and sometimes updates can break integrations or require regression testing.

- If your lending process is fairly standard, SaaS can handle growth without much hassle.

At the same time, you need to accept some built-in limitations.

Limitations of SaaS Lending Software

- You are not able to change how it looks or works to fit your exact needs because it is not supposed to be customized.

- You have to stick with one provider. Switching to another service later can be a pain, especially if your data is hard to move.

- You don’t always know where your data is stored or how it’s protected. Data location and compliance options depend on the vendor’s hosting model.

- If lots of people are using it at once, it can slow down.

- If your industry is highly regulated or specialized, SaaS may lack the compliance or tools you need.

- Connecting it to your existing tools or software can be tricky because it doesn’t play nice with old systems.

- The company might update things or remove features without asking you.

- Extra costs sneak in: Want more features or better support? You might have to pay more.

- You might face a risk of downtime if their servers go down.

- You’re using the same system as other customers, which can be risky if something goes wrong because shared space means shared risk.

Using SaaS lending software can feel like the perfect solution. It’s easy to access online, so you don’t need to install anything or manage servers. The provider takes care of updates and maintenance, which saves time and money upfront. But as your business grows, you might start to notice some limits.

The platform might not be able to adapt to new needs, custom features become difficult to add, and scaling turns expensive. Moreover, SaaS usually follows standard security and compliance practices, which might not be enough for high-risk or specialized industries that require more control over data storage, privacy, or compliance features than the platform typically offers.

Custom Lending Software: Tailored, Growth-Ready, but Complex

In comparison with SaaS, which is a pre-built solution that anyone can use, custom software is developed from zero for the particular goals and demands of the clients. It can be adapted to specific workflows, regulations, and demands of organizations. Yes, developing such software is similar to constructing your own house from the ground up.

Benefits that Custom Lending Software Brings

- It’s built specifically for your business, so it fits your processes and goals.

- You can adjust and scale it as your business grows—no need to switch platforms or start over.

- You have more control over how your data is stored, managed, and protected, which is important if you deal with strict legal or industry rules.

- It supports unique workflows, so if your lending process isn’t standard, the software can be tailored to match.

- It integrates well with your existing systems and tools, making your operations more efficient.

- While it costs more upfront, you avoid ongoing license fees and expensive workarounds later.

- You can build features that help you stand out from competitors and offer a better experience to your clients.

Possible Bottlenecks of Custom Lending Software

- It takes time and money to build. You’re starting from scratch, so development can be slow and expensive.

- Your team needs to be involved throughout the process—planning, testing, and making decisions—which can be time-consuming.

- You’re responsible for keeping it running. That means handling updates, fixing bugs, and staying compliant with regulations.

- You’ll need a reliable tech team, either in-house or outsourced, and that’s never cheap.

- There’s a risk of poor-quality code, especially with fast or low-cost development options that rely heavily on AI.

- You might get locked into working with one vendor, which can make switching or upgrading harder later.

- If it’s built too tightly around your current processes, it might be difficult to adapt as your business changes.

- It takes longer to launch compared to ready-made solutions, so you might miss opportunities while it’s still being developed.

Custom lending software offers a tailored solution that aligns with your business processes, scales with growth, and gives you more control over data management and security. It's an ideal option for companies with unique workflows or strict compliance needs. It integrates smoothly with existing tools and can deliver a competitive edge through custom features.

However, building a solution from scratch requires significant upfront investment, time, and resources, along with ongoing maintenance and a skilled tech team. Potential risks include vendor lock-in, poor code quality from rushed development, and limited flexibility if the software is too tightly aligned with current processes. All these factors present in a custom solution can possibly delay market entry compared to off-the-shelf alternatives.

Weighing Up the Two Options

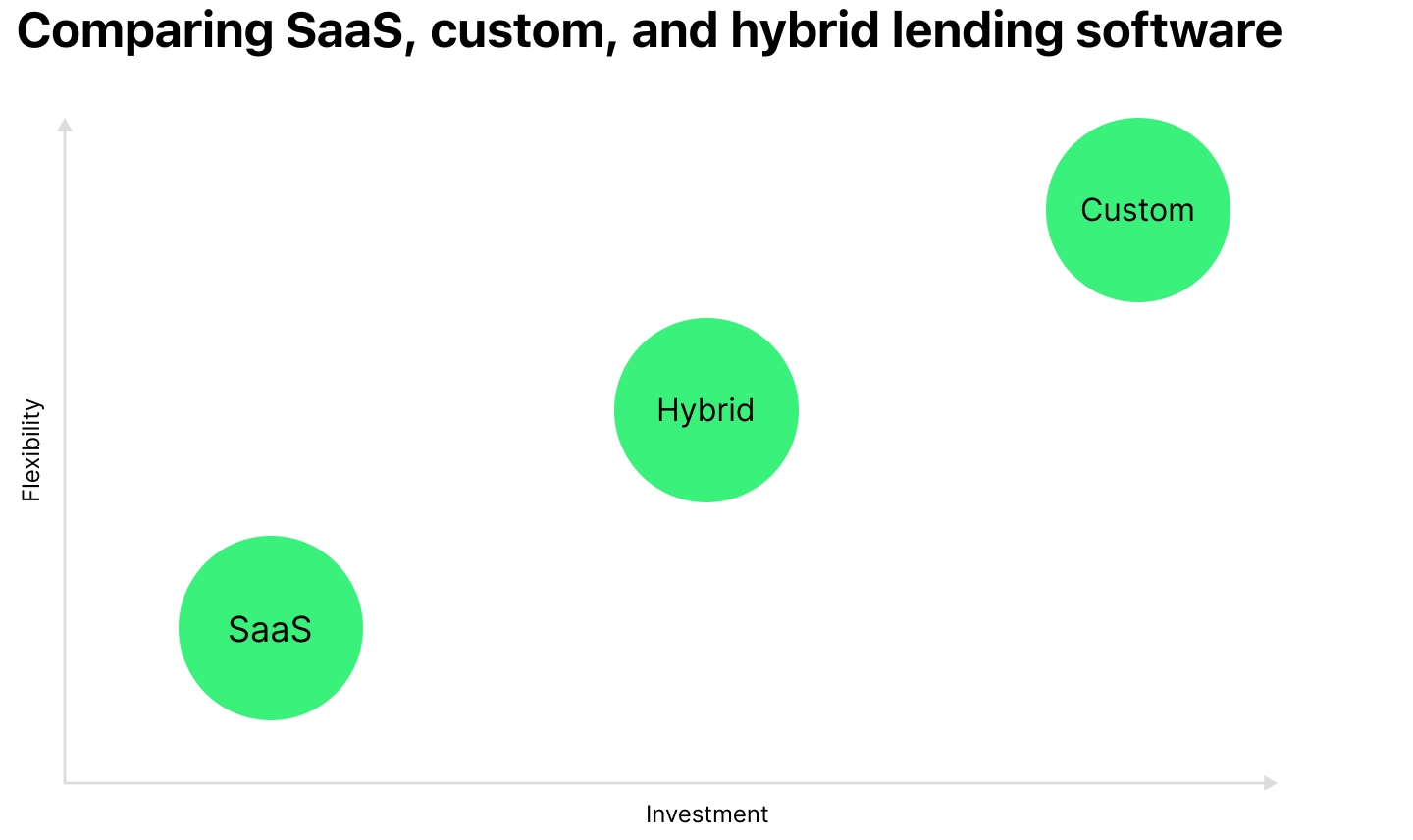

Choosing between a SaaS lending platform and a custom solution depends on your business needs, how much you can spend, and your long-term plans. As we’ve already seen, SaaS is great for getting started quickly and keeping costs low. At the same time, custom software gives you more control and can be elaborated exactly for your business.

| Factor | SaaS lending platform | Custom lending software |

|---|---|---|

| Time to launch | Fast: ready-to-use systems for SaaS loan management deploy in days/weeks | Slow: development cycle can take months |

| Total cost of ownership | Lower: subscription-based pricing, minimal upfront cost | Higher: significant initial investment + ongoing maintenance |

| Scalability | High: scales easily with vendor infrastructure | Moderate: depends on your architecture and resources |

| Data security | Vendor-managed security; shared responsibility | More control over data security and compliance |

| Flexibility | Limited customization; depends on vendor roadmap | Full flexibility to meet unique customer needs |

| Integrations | Pre-built integrations with common tools | Deep integration with internal systems and custom APIs |

Why Might Companies Choose a Wrong Lending Platform?

Imagine you are assembling furniture with a tool that’s not designed for the job. You might end up with something that’s unstable or not functional at all. Just as using the wrong tool can lead to frustration and wasted time, selecting the wrong software can cause inefficiencies and headaches for a business.

Common mistakes when choosing digital lending software include failing to check whether it can grow with your business, ignoring how well it integrates with other systems, and overlooking how easy it is for users to navigate. These issues can lead to slow processes, higher costs, and unhappy customers. To avoid this, it’s important to carefully review the software’s features, how well it fits with your current tools, and the kind of support the provider offers.

- Focusing on price, not the big picture

Selecting the cheapest option without considering long-term investments like maintenance, upgrades, and scalability can lead to higher expenses down the road. - Assuming it will work out-of-the-box

Overlooking the complexity of integrating with existing systems, workflows, and compliance requirements can cause delays and disruptions. - Underestimating customization needs

Standard features may seem sufficient initially, but as operations evolve, the lack of tailored workflows, reporting, and automation becomes a bottleneck. - Ignoring data security

Failing to assess how the software handles sensitive data can expose the business to compliance violations, breaches, and reputational damage. - Overlooking user experience

If the platform is difficult to navigate, adoption rates drop, training costs rise, and productivity suffers. - Not evaluating vendor support

Poor customer service, limited onboarding assistance, or slow response times can hinder implementation and troubleshooting. - Skipping scalability checks

A solution that works for a small team may not support future growth, leading to costly migrations or rebuilds. - Neglecting regulatory alignment

Especially in financial services, software must comply with local and international regulations. Missing this can result in legal and operational risks. - Failing to involve key stakeholders

Decisions made without input from IT, compliance, or end-users often miss critical requirements and lead to resistance or rework.

If a business chooses the wrong cloud lending software, the medium-term consequences can be significant. Operational inefficiencies may emerge due to integration gaps that delay workflows and increase manual effort. As the business grows, software that lacks scalability or customization can become a problem, needing upgrades that are sometimes quite costly or even complete platform replacements. User dissatisfaction—both internal and external—can rise if the interface is unintuitive or workflows are rigid, potentially harming customer retention and employee productivity. Neglecting security measures can lead to serious consequences, including regulatory breaches, financial penalties, and damage to the brand’s reputation.

Additionally, focusing on short-term savings rather than long-term value can lead to mounting maintenance costs and missed opportunities for innovation, ultimately slowing down digital transformation and competitive positioning.

Smart Middle Ground for Lending Software as a Service

However, not every lender fits neatly into the “SaaS or custom” category. That’s exactly where hybrid and modular platforms start to take on a key role.

If you find that a SaaS lending platform is too limited and custom software is too complex or expensive, hybrid or modular lending software might be the right fit. It gives you more flexibility than SaaS, without the full cost and development time of a custom solution.

The hybrid and modular approach gives lenders the best of both earlier discussed models, offering flexibility and scalability. This enables lenders to quickly adapt to market changes and customer needs while maintaining robust security and compliance.

Modular design ensures that lenders can customize their platforms to suit specific business requirements, enhancing their operational efficiency. This approach enables lenders to adapt and scale their platforms by integrating different modules to meet specific needs.

Benefits You Get With Modular Lending Software

- Quick setup

You can launch a custom loan origination system in just 3–4 months thanks to ready-made modules. - Smart automation

AI credit scoring, automated decisions, and KYC checks help minimize manual work and errors. - Simple and connected process

It is possible for borrowers to start an application on their phone and finish it on a computer without losing progress. - Easy connections

Works with over 100 APIs for payments, analytics, and reporting tools. - Made for you

Flexible workflows, document handling, and loan scenarios tailored to your business. - Strong security

Built-in KYC and fraud protection keep your operations safe. - Room to grow

Designed for companies interested in digital expansion of their businesses.

Bottlenecks You Might Face with Modular Lending Software

- While faster than fully custom builds, they may still require significant configuration and technical expertise.

- Over-reliance on pre-built modules can limit deep customization, and integration with legacy systems might be more complex than expected.

- Ongoing costs for licensing, updates, and vendor support can add up, and businesses may face limitations if the platform’s architecture doesn’t evolve with their needs.

Ideally, efficient modular lending software works like a SaaS product but with strong personalization options using AI mechanisms. It usually goes in the form of a white-label cloud-based lending platform, which is a ready-made tech solution with loan application forms, borrower portals, dashboards, and scoring tools that lets you fully customize the branding. This approach saves time, reduces costs, and lets you focus on growing your lending business instead of building software.

At HES FinTech, we use this approach as one of the most effective ways to address the diverse and specific needs of modern businesses, which often vary significantly in structure and operation. Our core product, HES LoanBox, is a modular cloud-based lending platform with personalization options and AI support for scoring. It offers functionality for each stage of loan cycle management:

- Hybrid flexibility

You get a ready-to-use core system that can be tailored to your needs without starting from scratch. - Modular design

You can pick and choose only the features you need, whether it’s underwriting, loan servicing, or debt collection. Add more as you grow. - Faster time to market

You can launch quickly with pre-built components, then customize as your business evolves. - Affordable scaling

You avoid the serious financial input related to full custom development while still getting a solution that fits you.

How to Choose the Right Lending Software for Your Business

If you follow this checklist for choosing lending software, you will most certainly have a clearer picture for making a grounded decision.

1. What’s your growth horizon?

- Are you planning to scale regionally or internationally?

- Are you interested in the platform that will progress with you?

2. How unique is your lending model?

- Do you offer standard loan products or niche services?

- Will you need your own workflows or scoring setup?

3. Do you have in-house IT?

- Can your team manage integrations and updates?

- Do you need a provider that handles everything?

4. What level of control do you need?

- Do you want full control over features and data?

- Or are you okay with a more standardized SaaS setup?

5. What’s your timeline for launching?

- Do you need a solution that can go live quickly?

- Can you afford a longer development cycle for deeper customization?

6. What regulatory requirements do you face?

- Are there specific compliance standards (e.g., GDPR, AML, local financial regulations) your software must meet?

- Does the provider offer built-in compliance tools or support?

7. How important is user experience?

- Do you need a mobile-first interface or multilingual support?

- Is the borrower journey smooth and intuitive across devices?

8. What reporting and analytics capabilities do you need?

- Do you require real-time dashboards, custom reports, or advanced analytics?

- Can the platform integrate with your BI tools?

9. What’s your budget beyond initial setup?

- Have you considered long-term costs like licensing, maintenance, and scaling?

- Are there hidden fees for support, upgrades, or additional modules?

10. How flexible is the vendor relationship?

- Can you switch vendors or self-manage the platform if needed?

- Is there a risk of vendor lock-in?

11. What level of customization will you need over time?

- Will your lending products or workflows evolve?

- Can the platform adapt without major redevelopment?

12. How well does it integrate with your ecosystem?

- Are there pre-built connectors, or will you need custom development?

- Does it support APIs for your CRM, payment gateways, and accounting tools?

Conclusion

Picking lending software is a decision that will shape how your business runs—not just today, but for years to come. A SaaS lending platform is quick to launch and affordable, great for standard lending needs, but it can be hard to customize and scale later. Custom-built software gives you more control and flexibility, but it takes more time and money to develop. Hybrid and modular solutions combine the speed and simplicity of SaaS with the adaptability of custom systems.

Whether you go with SaaS, a custom-built platform, or a modular solution, the key is to choose something that fits your company’s vision, goals, and strategy for growth. The right technology should support you where you’re headed, not just where you are now.

Just as important: choose a developer who understands your challenges, speaks your language, and stands by you when things get complicated.