We are excited to introduce the Revolving Credit Line, a new loan type in HES LoanBox.

This lending option allows borrowers to draw from, repay, and reuse a credit limit without the need to reapply. Additionally, you can use this product to quickly launch credit cards or simply offer this type of credit without issuing a card.

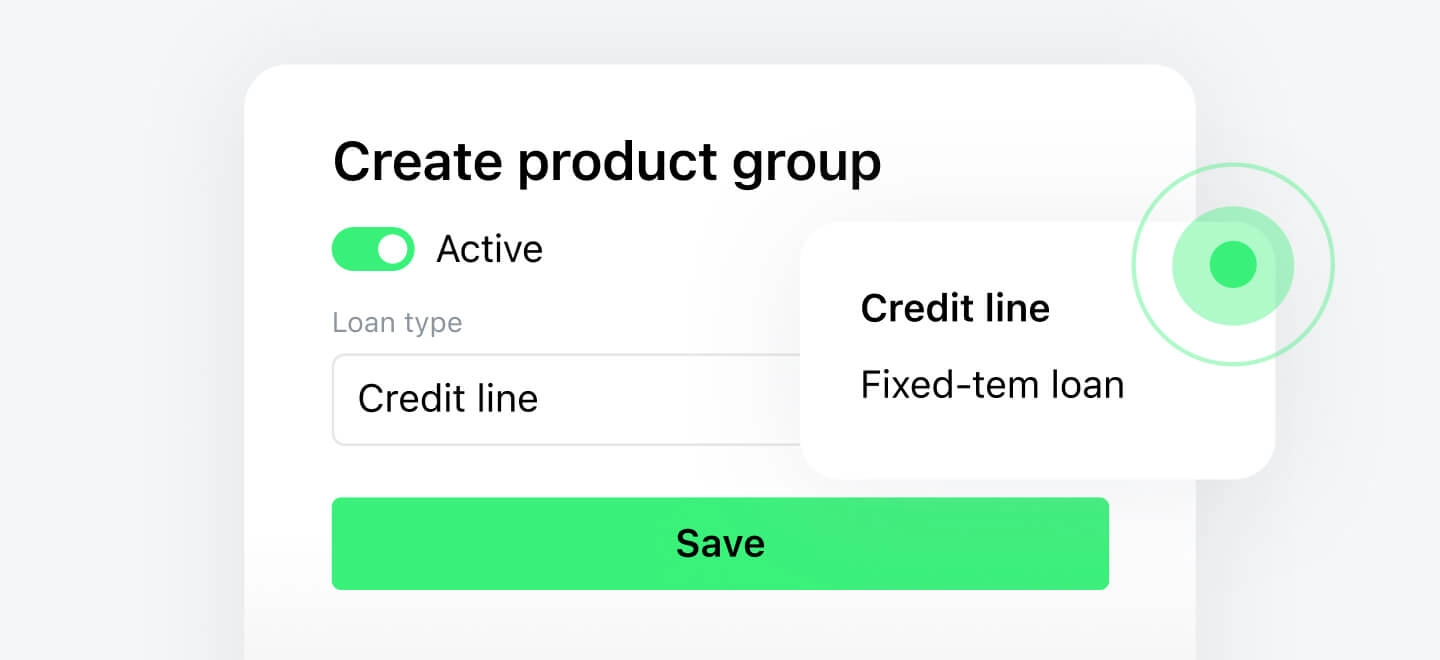

The Revolving Credit Line is now available in the same menu along with the fixed-term loan.

How It Works

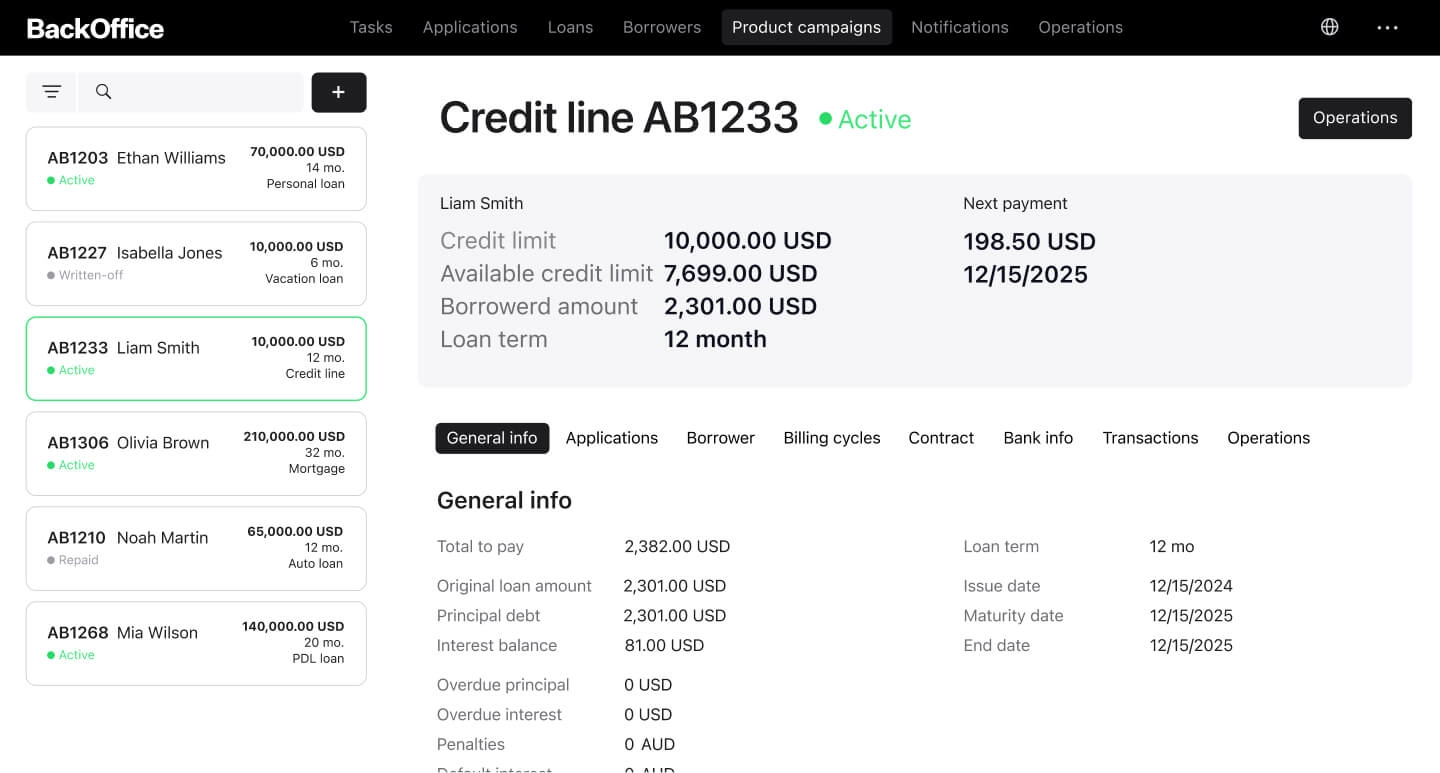

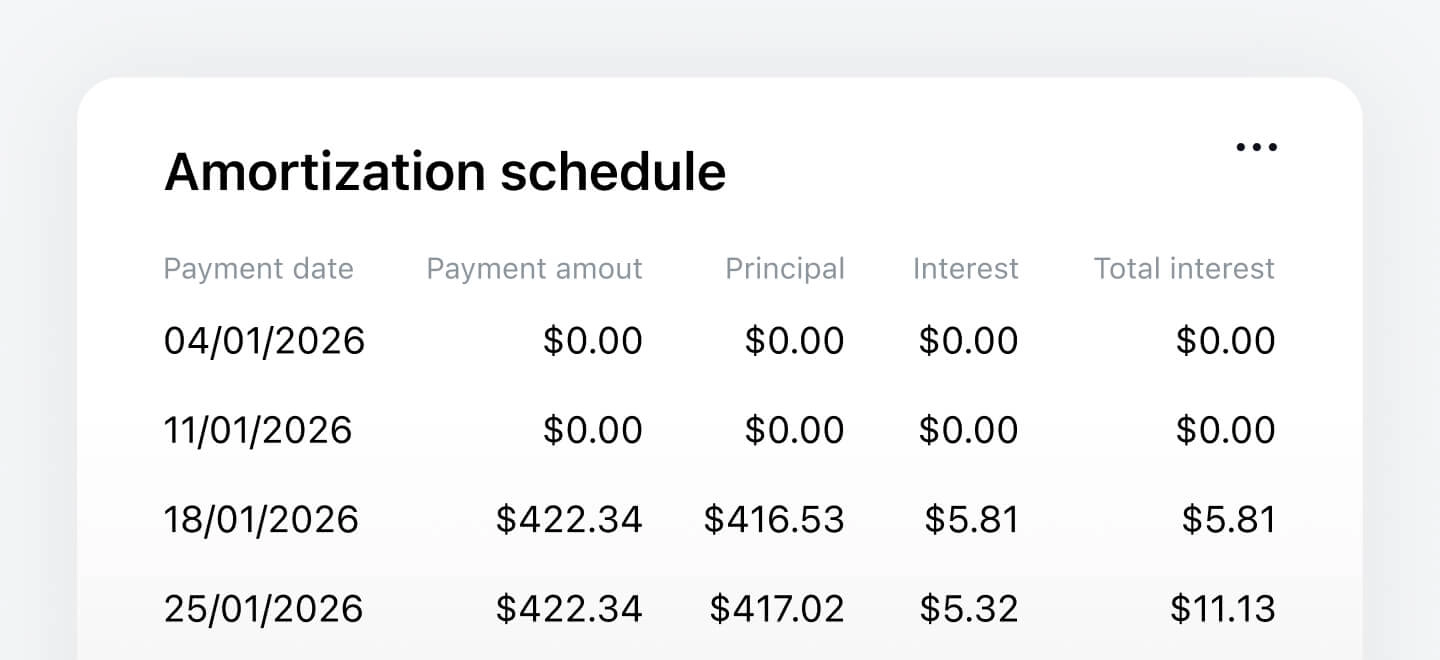

When a credit line is created, the borrower gains access to a reusable limit and can withdraw funds in portions. Interest is charged only on the part of the limit actually used, making this product highly cost-efficient compared to traditional term loans.

What It Means for Borrowers:

- Cost efficiency: Interest accrues only on the utilized amount, reducing expenses compared to term loans.

- Rapid access: Funds are available quickly for emergencies, seasonal needs, or opportunities.

- Cash flow stability: Borrowers can bridge income gaps and maintain operations without rigid repayment schedules.

- Flexible structure: Ability to draw funds in parts based on real needs.

What It Means for Lenders:

- Higher customer loyalty: Flexible repayment and a modern borrowing experience strengthen client relationships.

- Improved risk management: Adjustable credit limits and repayment structures help manage exposure.

- More stable revenue: Recurring interest and fees generate predictable income.

- Portfolio expansion: A competitive, high-demand lending product supports market growth.

- Operational control: Managers can initiate or approve credit lines directly from the back-office.

The Revolving Credit Line is a powerful addition to LoanBox’s product portfolio, combining reusable credit limits, selective interest accrual, and full Back-office control. We designed this feature to give borrowers greater flexibility and to equip lenders with new strategic opportunities to build smarter, more adaptable portfolios.

This is one of the advancements HES FinTech is making now to deliver the most easily customizable credit solution possible.

More updates are coming — keep an eye on HES LoanBox for the latest features designed to make lending even more flexible and efficient!