HES LoanBox continues to expand its loan restructuring capabilities. Alongside the existing loan term extension and changing rate, we are launching a new feature — Payment Holidays.

This update offers lenders a flexible way to support borrowers during temporary financial hardship, while maintaining portfolio stability and sustained revenue.

What Are Payment Holidays?

Payment holidays are a type of credit adjustment that lets borrowers pause repayments for an agreed period if they are facing financial turbulence without triggering defaults or harming their credit profile. During the payment holiday:

- The borrower is exempt from making payments;

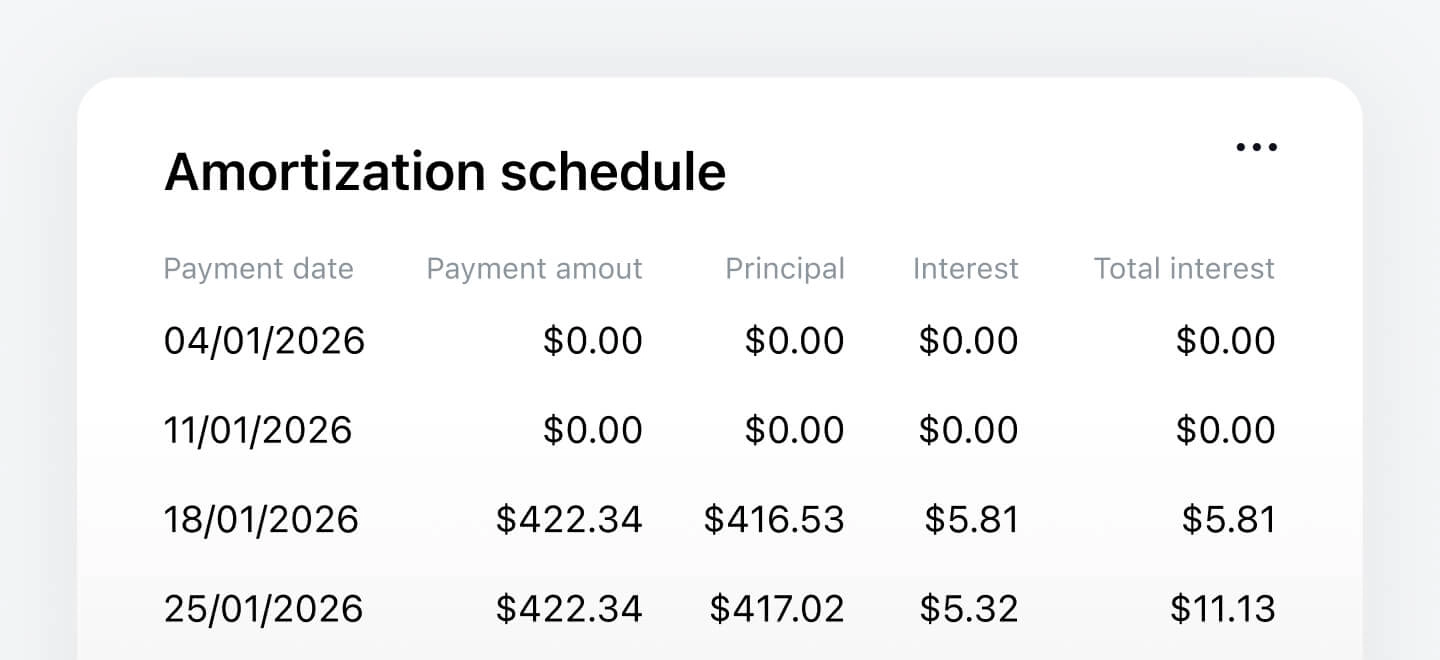

- The loan repayment plan is automatically recalculated;

- Interest continues to accrue and is added to the principal balance at the end of each payment period.

This feature assures transparency and regulatory clarity, and keeps the record accurate for both parties.

How It Works in HES LoanBox

The new loan restructuring option is fully embedded into existing HES LoanBox workflows:

Borrower-initiated requests

- Borrowers can request payment holidays through the borrower portal. This automatically creates a task for the back-office team to review.

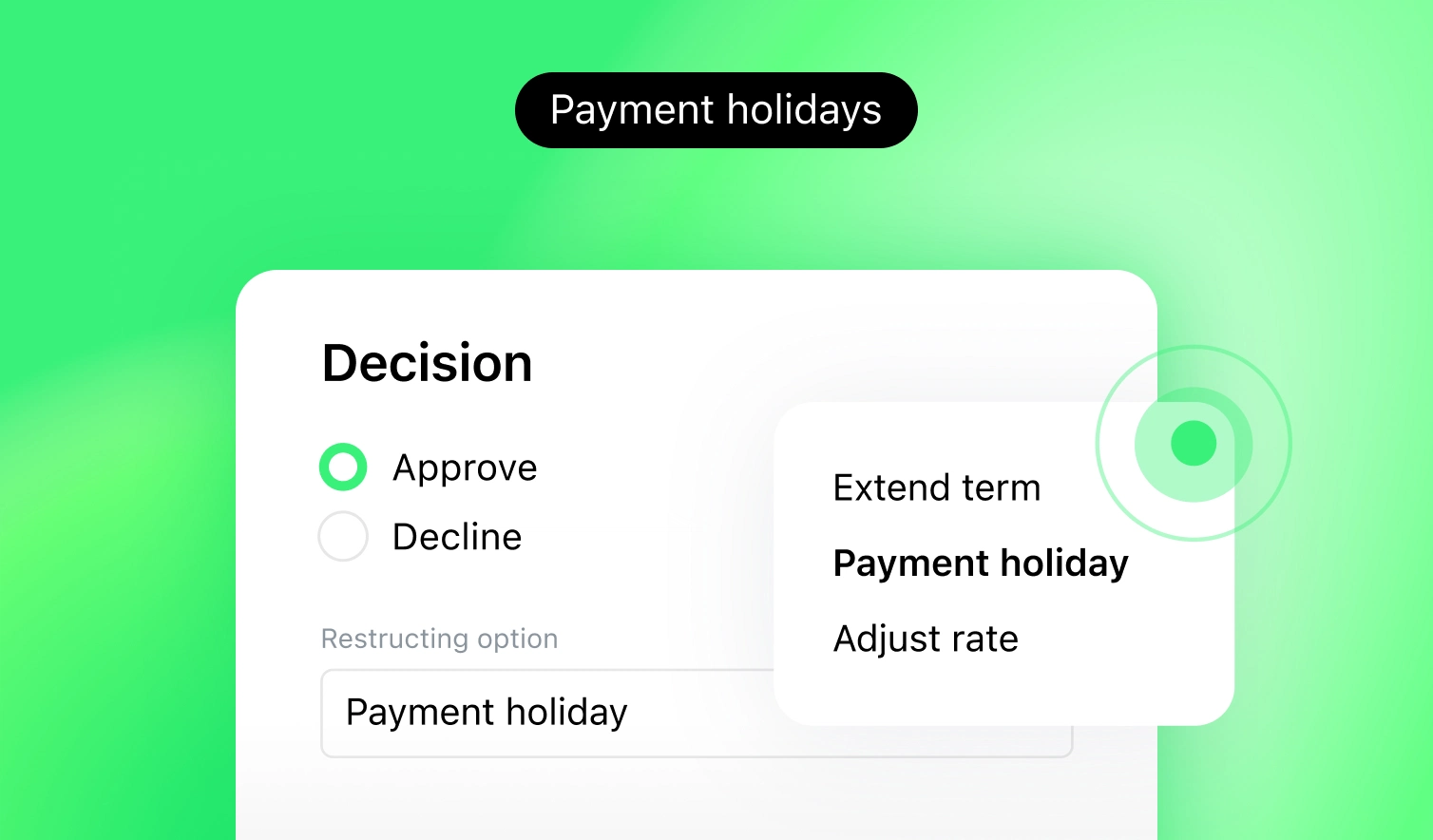

Back-office decision flow

- After reviewing the request, the back-office team decides if restructuring is suitable and, if approved, supplemental agreement is being formed and sent to the borrower.

- After sign-off, the payment holidays option is applied, and the loan schedule is restructured to ensure consistency across servicing, reporting, and accounting.

- For operational efficiency, payment holidays can also be applied directly from the back office to a specific loan, even if the borrower hasn’t requested it.

Benefits for Borrowers

- Instant financial relief

Payment holidays help borrowers handle short-term setbacks such as job loss, medical emergencies, or unexpected expenses without late fees or negative credit impact. - Flexibility during predictable hardship

For seasonal businesses or cyclical income streams, payment holidays provide room to reassign resources, recover, or focus on growth opportunities.

Benefits for Lenders

- Reduced non-performing loans

By supporting borrowers, lenders reduce the risk of defaults and avoid costly debt recovery procedures. - Stronger borrower relationships

Offering flexible repayment options builds trust, loyalty, and stronger long-term relationships with clients. - Sustainable portfolio performance

Rescheduled repayments extend revenue streams in a controlled way, protect portfolio health, and avoid aggressive collections.

A Smarter Approach to Loan Restructuring

With Payment Holidays, HES LoanBox helps lenders handle real financial challenges with accuracy, automation, and understanding, while supporting borrowers and keeping operations and finances on track.