Changes in the banking software in the 2010s come at a rocket speed. New market players reinvent financial services and automate processes. A vast majority of banks would prefer to pause this tech revolution for a while to take their time, look around, evaluate their priorities and build their own digital strategy.

Although for many banks technology advancements are not much of a threat.

Fintechs are not likely to replace banking services in their integrity and one-stop-shop concept. However, next-generation banking is time-sensitive: the earlier you begin, the faster you can grow. In case, a good strategy for such a start is ready, of course. Incumbent banks, startups, and spinoffs need to take a fresh and balanced approach to their core banking and lending system challenges.

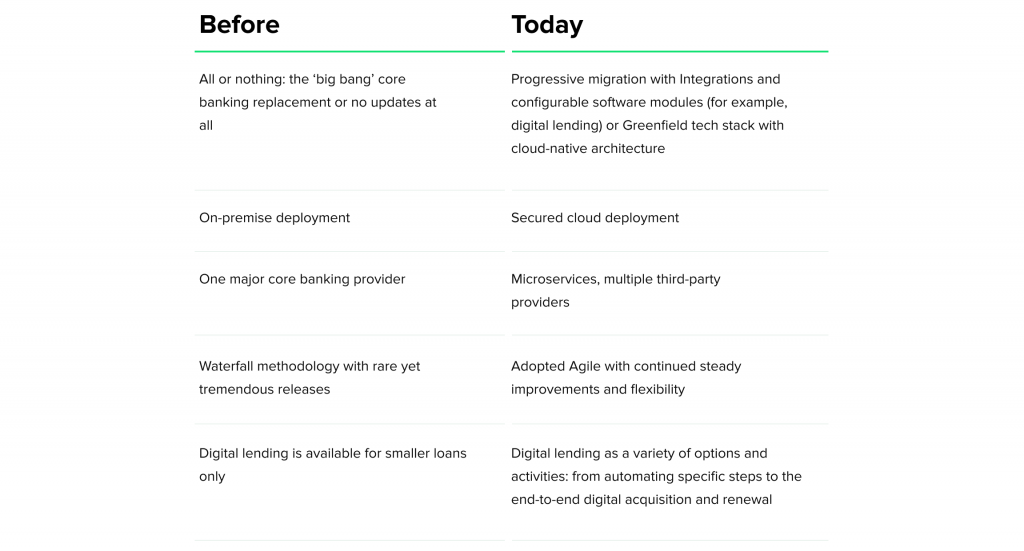

Full Core Banking Replacement vs Progressive Migration vs Greenfield Banking

The complete replacement option can be a result of an urgent need or some regulatory imperatives, but according to the McKinsey research, this option is risky. It takes extensive data migration, both automatic and manual, while the benefits from such a migration become noticeable only after the process is over, and the legacy system is ‘retired’. Also, banks tend to choose safer more traditional options demonstrating a certain level of mistrust to new-generation banking tech.

The progressive modernization takes less time and involves retaining the legacy platform and slowly minimizing its use. In this scenario, banks create updated new-gen architecture around the existing software. It looks safer in case this architecture meets the business goals for the next 5-8 years. Technically advanced banks use the key customer journeys: they take the most frequently used functionalities and reproduce them as stand-alone microservices. As the risk level is generally lower, banks still may not achieve their initial goals and have a long time to market.

In comparison to the previous two, greenfield banking is based on a new tech stack that enables to quickly launch new banking products, such as personalized loans, or new channels of interaction, such as mobile onboarding. This type of core banking update is usually cheaper than progressive modernization, while the existing customer base uses legacy software until the new tech is proven.

Read also

Why the Use of Legacy Banking Software Impedes Growth (even if it still works)?

- Technical debt requires a large investment in IT—to support the proper work of clunky systems full manual operational processes. This is why investment in bank loan software development or update means increased savings in the long run.

- In addition, a quick product launch is crucial in the competition of banks and fintechs. With monolithic architectures, insufficiently documented legacy code, and manual delivery fast launch of new financial products is hardly possible.

- Legacy software doesn’t allow build effective ecosystems and partnerships to work on the financial services of the future. Outdated bank architectures don’t support connectivity to third-party services. For example, for mortgage lending banks will be able to connect property-related third-party services to increase convenience and customer satisfaction.

On-premise VS Cloud-native

The new-generation banking is a cloud-native core banking platform that allows the integration of ready-made and custom solutions for loan management, as well as for investment, insurance, deposits, and payments.

Constructor-like components resemble a Lego set: they are independent and matching each other. The third-party services are deployed in the cloud, so they are scalable and easily accessible. In most cases, they meet all the bank’s security requirements as well.

One Financial Software Vendor VS Multiple Providers

Every microservice or module is dedicated to a specific end-to-end business process that is integrated into the core banking system. For example, HES Lending software provides loan origination and loan management from onboarding to underwriting and scoring, all the way to disbursements, payments, and collection. The development of new connectors is organized in a simple and seamless way using API.

Another outstanding thing about next-generation banking is elastic scaling. It allows growing from thousands to millions of customers by simply adding servers. It saves banks some time and investment on organizing a large infrastructure in advance. By the way, scaling down is just as easy.

Waterfall VS Agile

The waterfall development methodology is used less often these days. Agile is associated with CI/CD (continuous integration/continuous delivery) for small granular improvements, steadily adding new features, and step-by-step testing. It is the best approach for component-based software: banks can combine independent financial software components from different vendors, re-use, and choose best-for-purpose platforms with no vendor lock-in. The HES FinTech lending software is created exactly this way: an easily integrated platform with no charges per scaling and per user.

End-to-End Digital Lending: Complete Automation

HES software is based on a set of prebuilt components that can be adapted to the bank’s business needs, help update the loan management, or launch a new business line in a few months.

By breaking monolithic architecture into smaller microservices, you can take advantage of the modern technology for full-cycle loan management: from digital onboarding with KYC/AML to collection.

HES offers multi-channel loan applications, functional and convenient personal accounts for users, in-built CRM, user roles based on segregation of duties, credit scoring, product engine, calculation engine, reports and dashboards, advanced document management, integrations with payment providers, KYC, SMS, email, etc.

All that allows more flexibility, personalization, and efficacy in next-gen banking.

Read also

The Bottom Line

To sum it all up, to make use of digital transformation, banks need to choose software based on 5 cornerstones:

- Cloud-native - software ready for hybrid or multi-cloud environments: scalable and secure

- API-empowered - allowing digital banking to be more open to partnerships

- Configurable - adapted to the individual needs of a bank with easily adjusted business processes

- Component-based - able to address various customer needs and provide the launch of new banking products: deposits, loans, payment opportunities

- Supporting ecosystems - able to connect with other services for better customer experience.

According to a recent McKinsey banking industry report, the pandemic took away $3.7 trillion of revenues. However, the same report demonstrates a hopeful picture: if banks dwell on productivity and smart capital management, they have a high chance to help their ROE (return on equity) reach the pre-pandemic level by 2024.

Ready to try something new? Reach out to the HES team for a free digital banking and lending tour.