At HES FinTech, we’re continuously improving our core product, HES LoanBox, including more flexibility for both lenders and borrowers. The latest update introduces a series of new features: enhanced document management, flexible payment options, and notification template configuration.

All are designed to reduce manual work, boost efficiency, and give Back Office teams more control over documents, notifications, and payments—while enhancing the borrower experience at every stage.

Let’s take a closer look at what’s new.

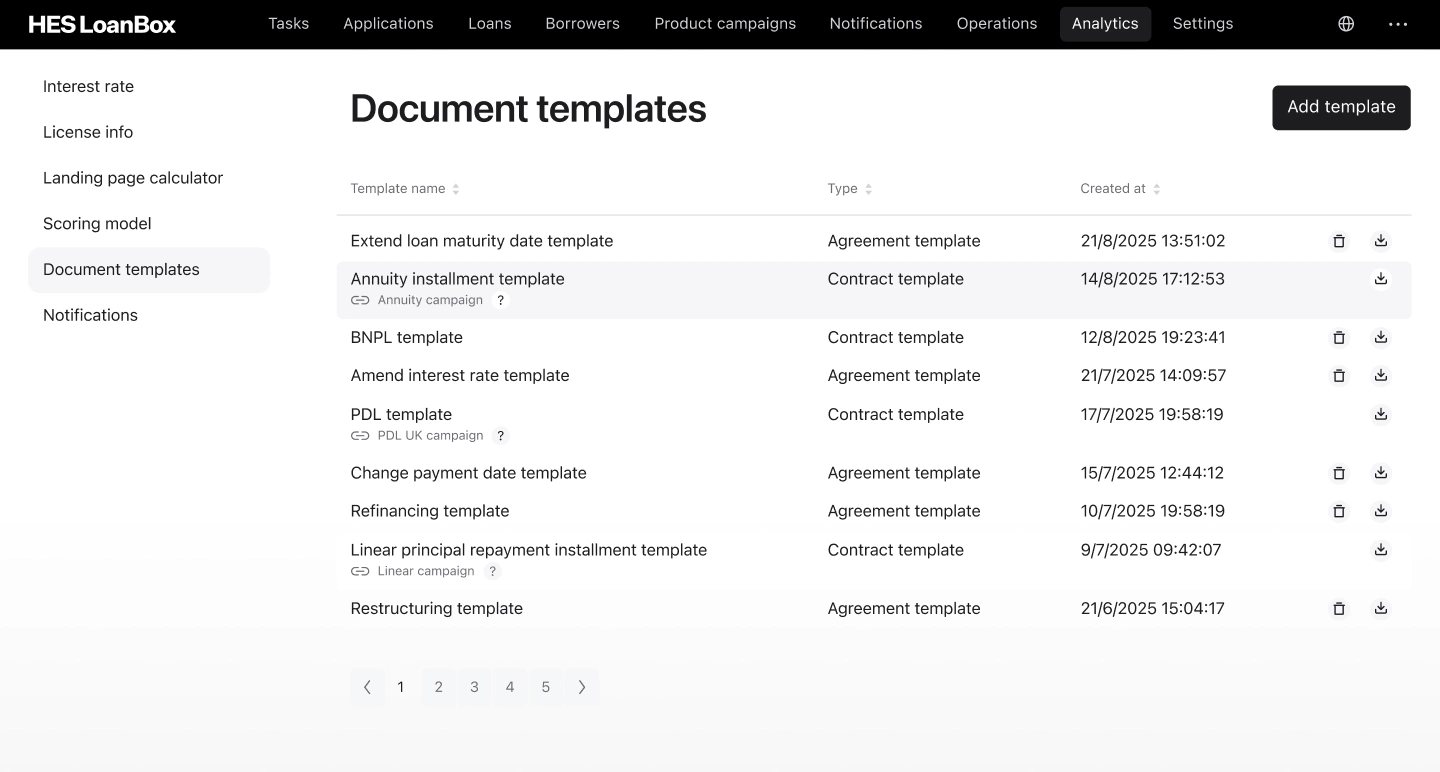

Enhanced Document Management

Expanding on the previously released major contract template functionality, Back Office users can configure additional agreement templates. They can manage templates using up to 30 placeholders—add new templates, download existing ones, or delete outdated versions. If a borrower adds a new template, the system automatically verifies its correctness and readiness for use.

This new capability helps cover the entire lending process, ensuring all agreements are up-to-date, compliant, and comprehensive. It may also positively impact key customer metrics, such as customer effort score, Customer satisfaction, and Customer retention.

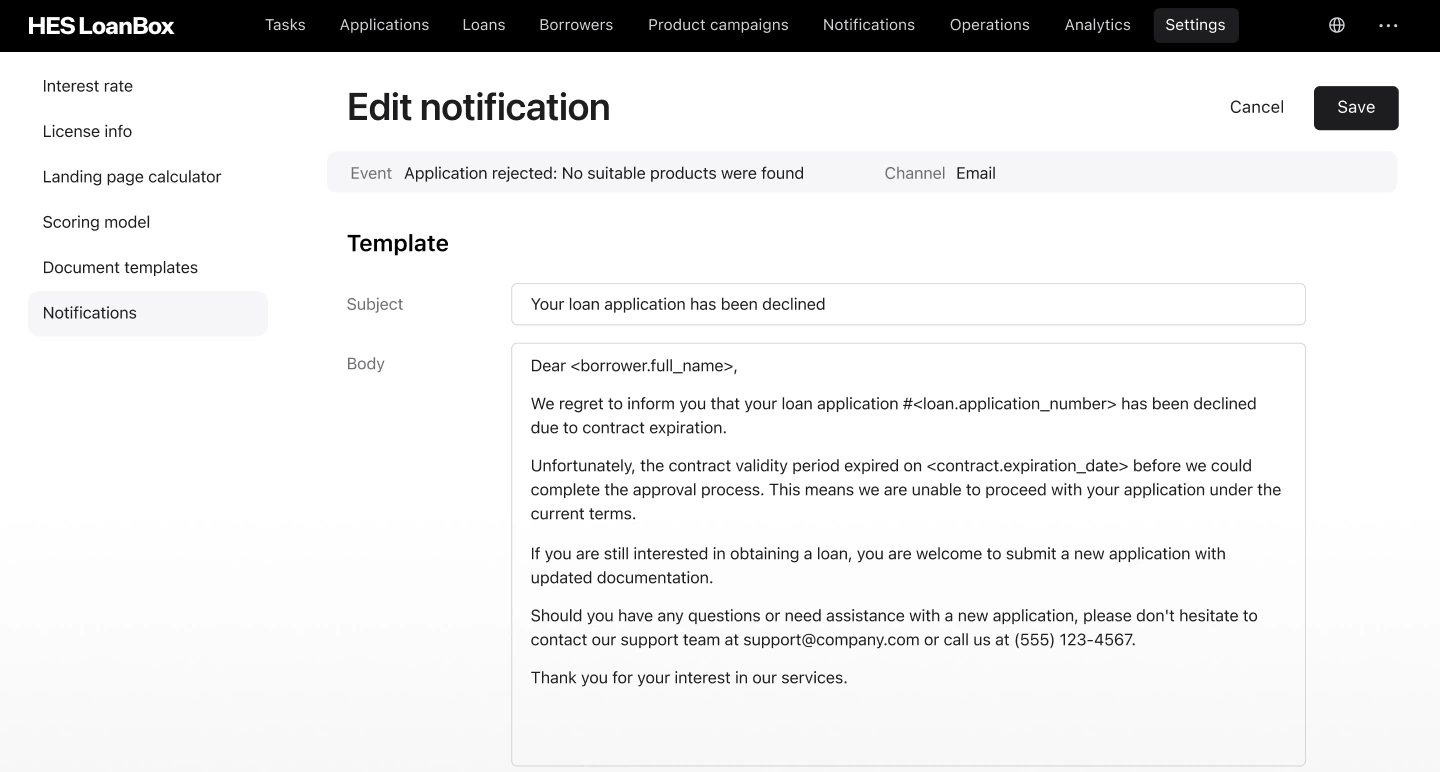

Notification Templates

With the latest update, HES LoanBox users can now manage SMS and email templates directly within the application. They can quickly adjust the text and tone of notifications based on the borrower’s case, making communication strategies more flexible and contextual.

With zero development costs for changes and no need for vendor support, lenders can achieve higher borrower engagement and timely repayments.

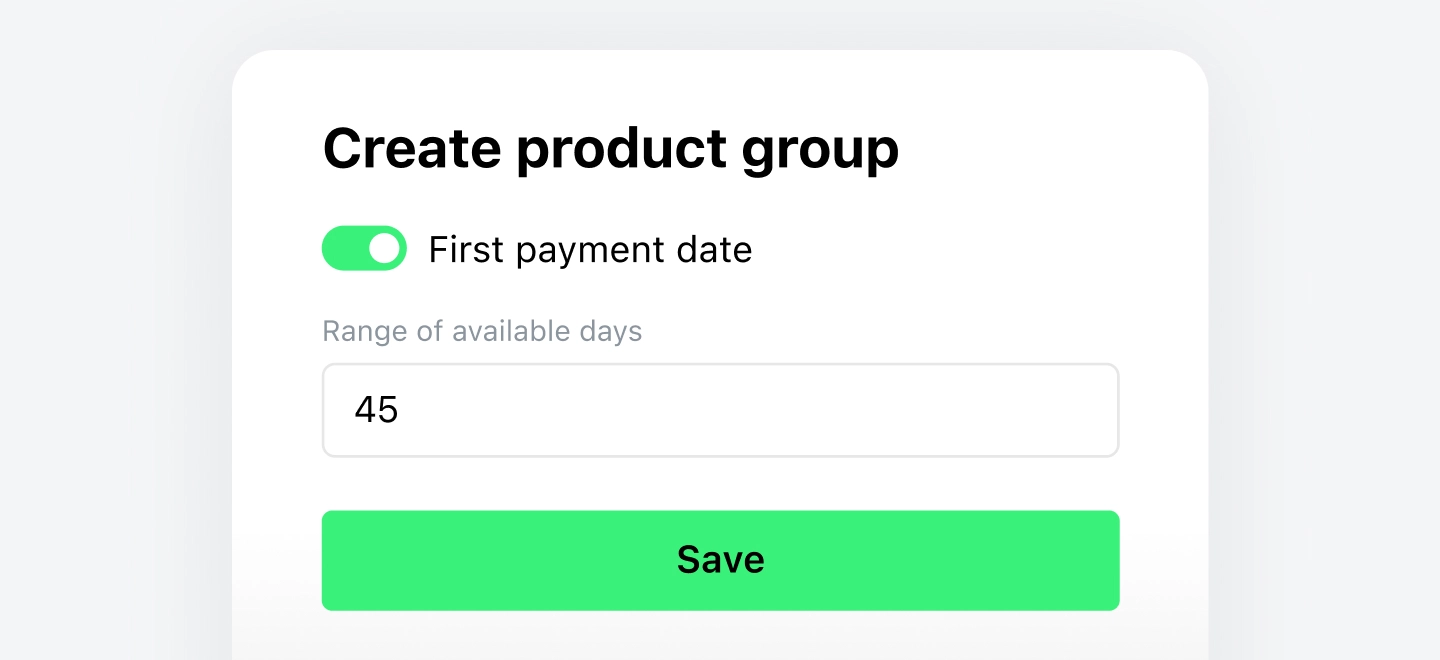

First Payment Date Management

Lenders can now choose whether borrowers can select their first repayment date during the application process on the borrower portal or let the system auto-calculate it. If some changes are needed after the application approval, the borrower can request the underwriter to update the repayment scheduling on their side.

This simple yet impactful update gives lenders greater flexibility in setting up and personalizing loan products. Not only does it provide a seamless experience for both Back Office users and borrowers, but it also helps increase application completion rates, reduce delinquency, and improve customer retention.

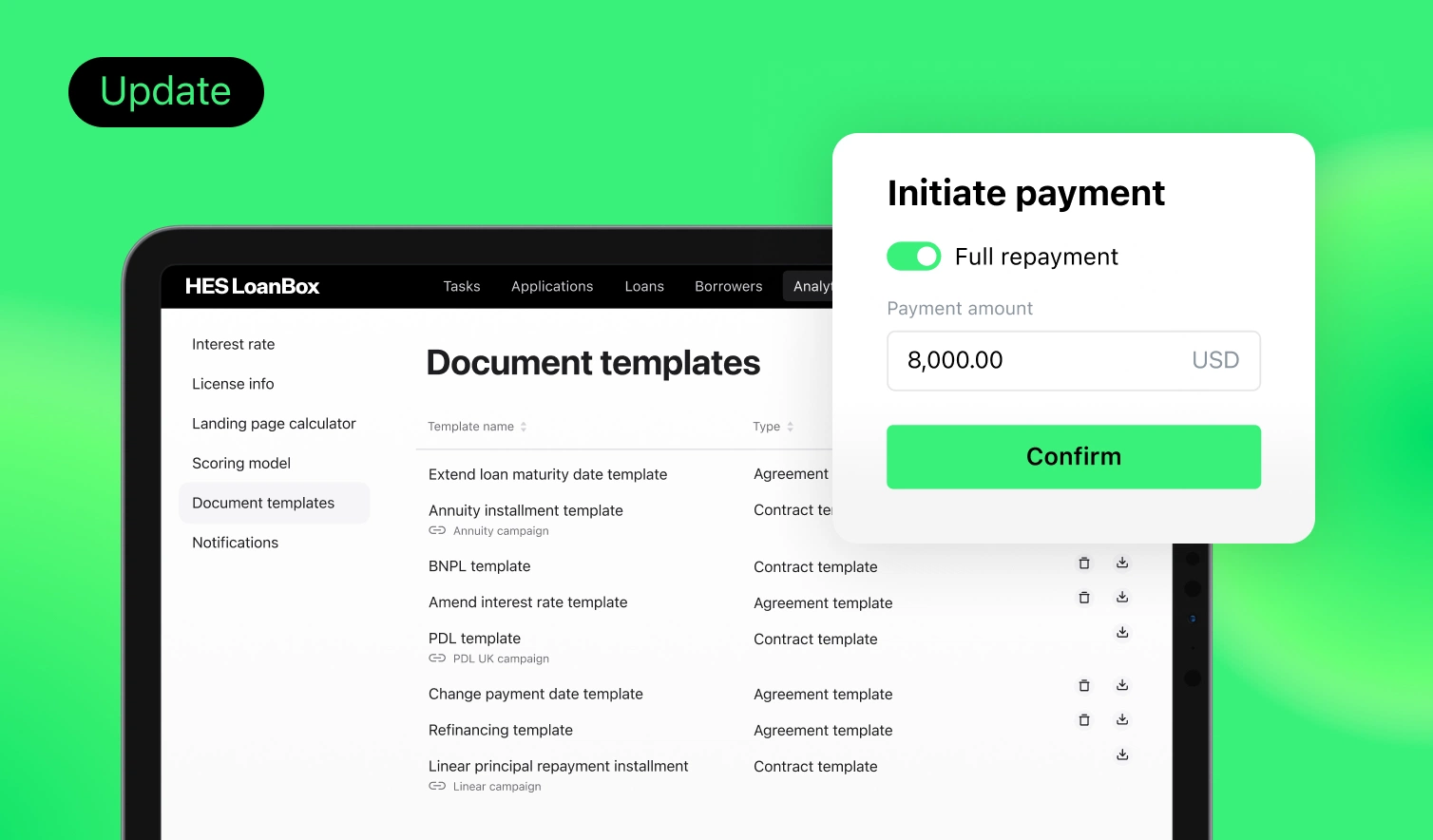

Payment Initiation from the Borrower Portal

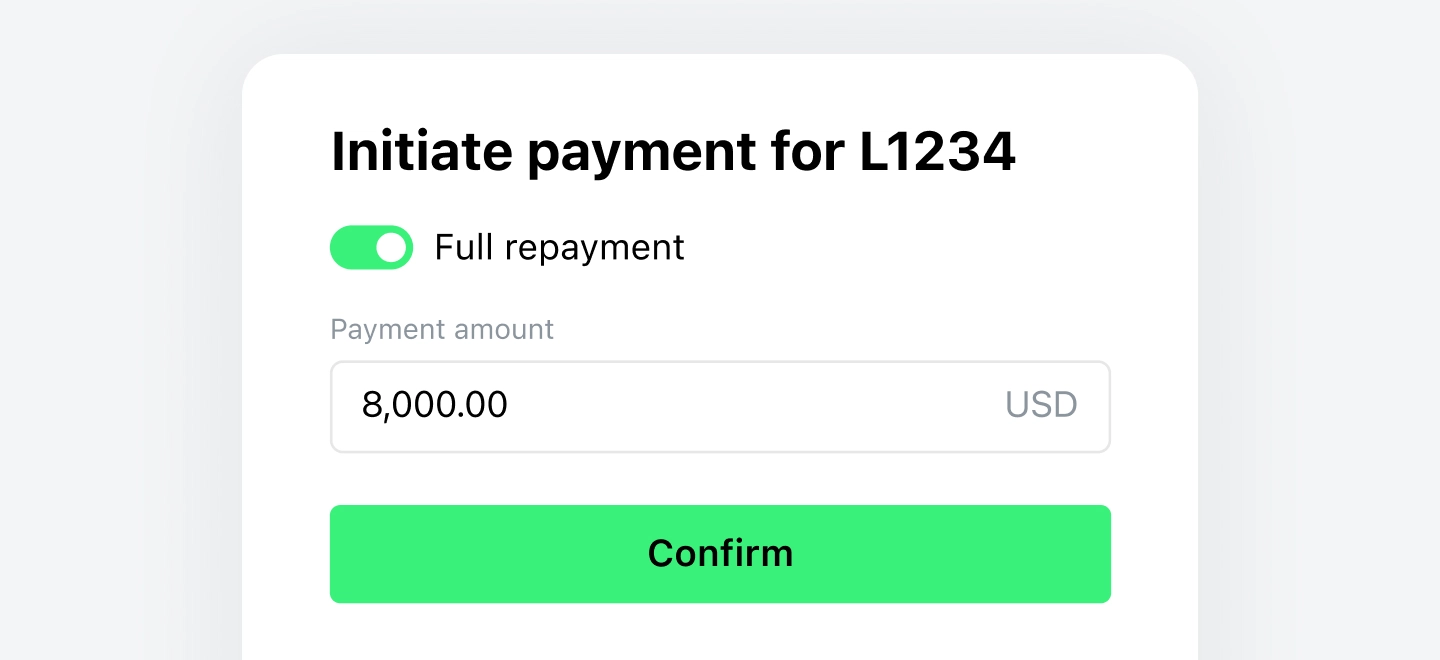

Borrowers now have more independence and can initiate payments directly from their HES LoanBox portal, whether it’s a full repayment or a partial payment.

If a transaction fails, borrowers can reinitiate it on their own, without involving the lenders’ support team. Also, this feature helps ensure payments stay on track with fewer failed or delayed transactions.

The Result: A More Adaptive Lending Experience

Each of these updates builds toward one shared goal: giving lenders and borrowers more flexibility, transparency, and control—without added complexity.

From automating document workflows to enabling real-time communication adjustments and borrower self-service payments, HES LoanBox continues to evolve as an all-in-one lending solution built for agility and growth.