The HES FinTech team has spent the last several months building a completely new product that is bound to change the way lenders approach debt recovery.

The debt recovery industry is at a turning point: what worked five years ago no longer does. Both customers’ expectations towards fintech products and technical advancements are raising the bar for businesses. Companies that have collection stage in the workflow are now feeling the pressure from multiple directions:

1. Inefficient outreach: Agents waste 80% of their time chasing low-propensity debtors or dialing incorrect numbers.

2. Generic approaches: ‘One-size-fits-all’ strategies fail to engage modern borrowers, leading to ignored calls and low conversion rates.

3. The data gap: Most lenders sit on a goldmine of behavioral data but lack the tools to turn it into applicable recovery strategies.

4. Compliance risks: Manual decision-making leads to human error and possible regulatory breaches.

5. Growing operating expenses: When agents spend the majority of their time on unproductive calls and manual administrative tasks, labor costs quickly erode recovery margins. High employee turnover, recurring training expenses, and the growing volume of delinquent accounts aggravate these problems.

Seeing that traditional collection models are failing and accumulating our vast expertise in building lending solutions and new tech capabilities, we have come up with the HES Collection Engine. It’s a leading-edge solution that helps lenders address all the problems mentioned above and move from reactive collections to intelligent, data-driven recovery strategies.

What Tasks You Can Solve With the HES Collection Agent

The HES Collection Agent is designed to address the most frequent operational and coordination challenges of modern debt collection.

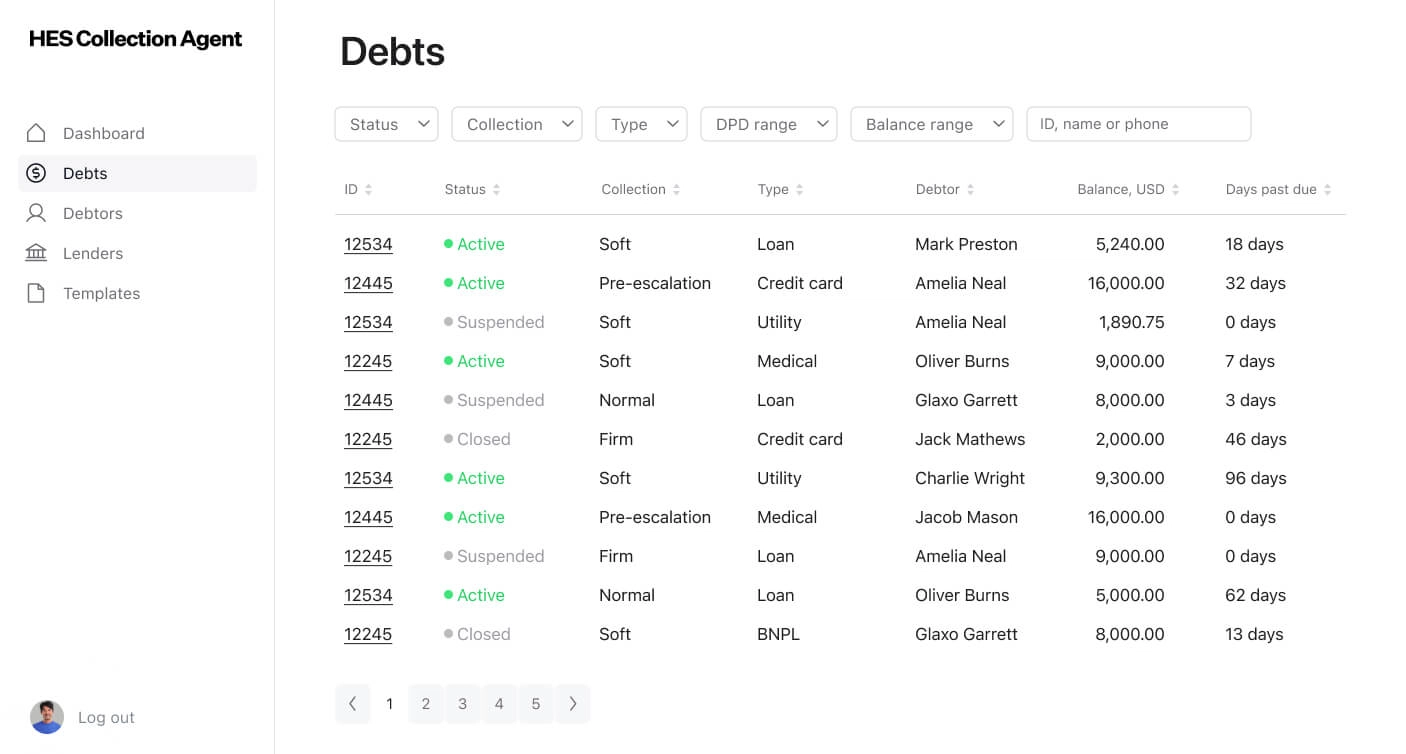

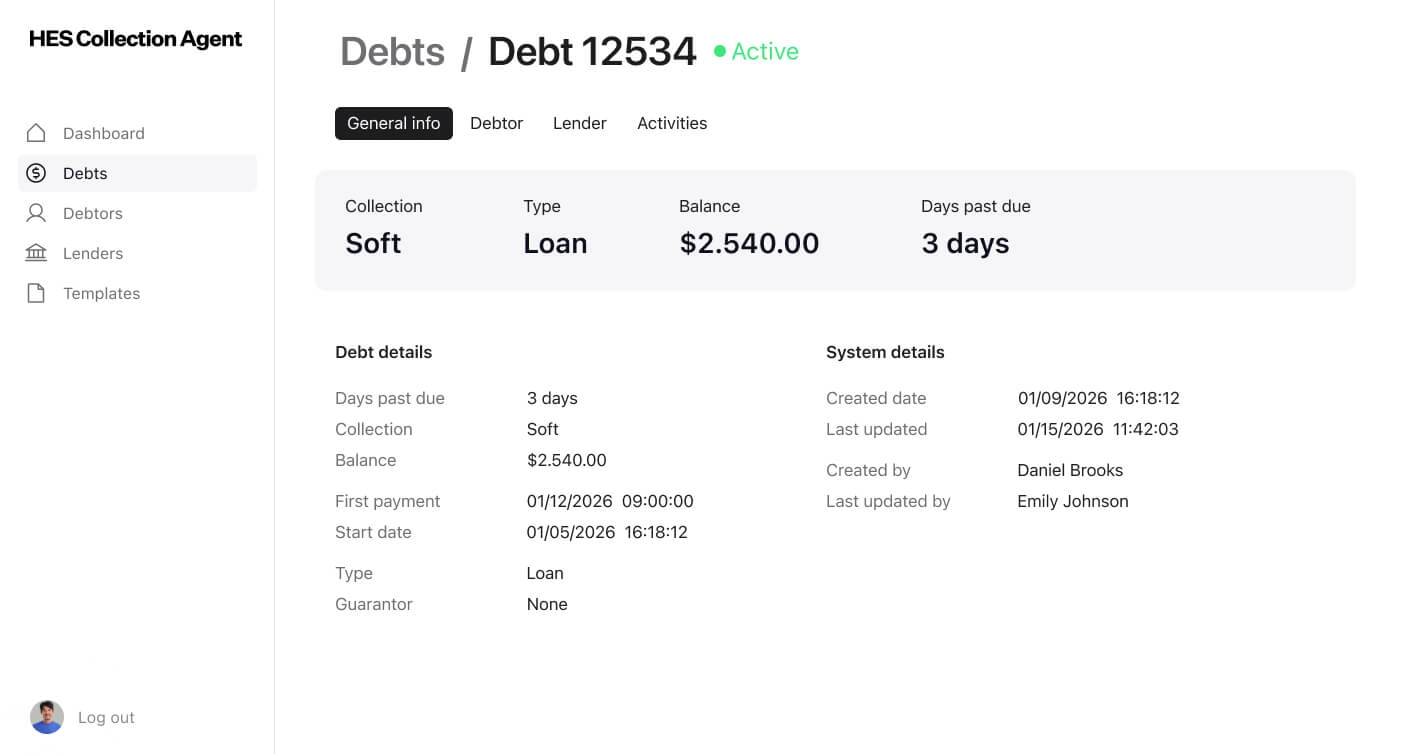

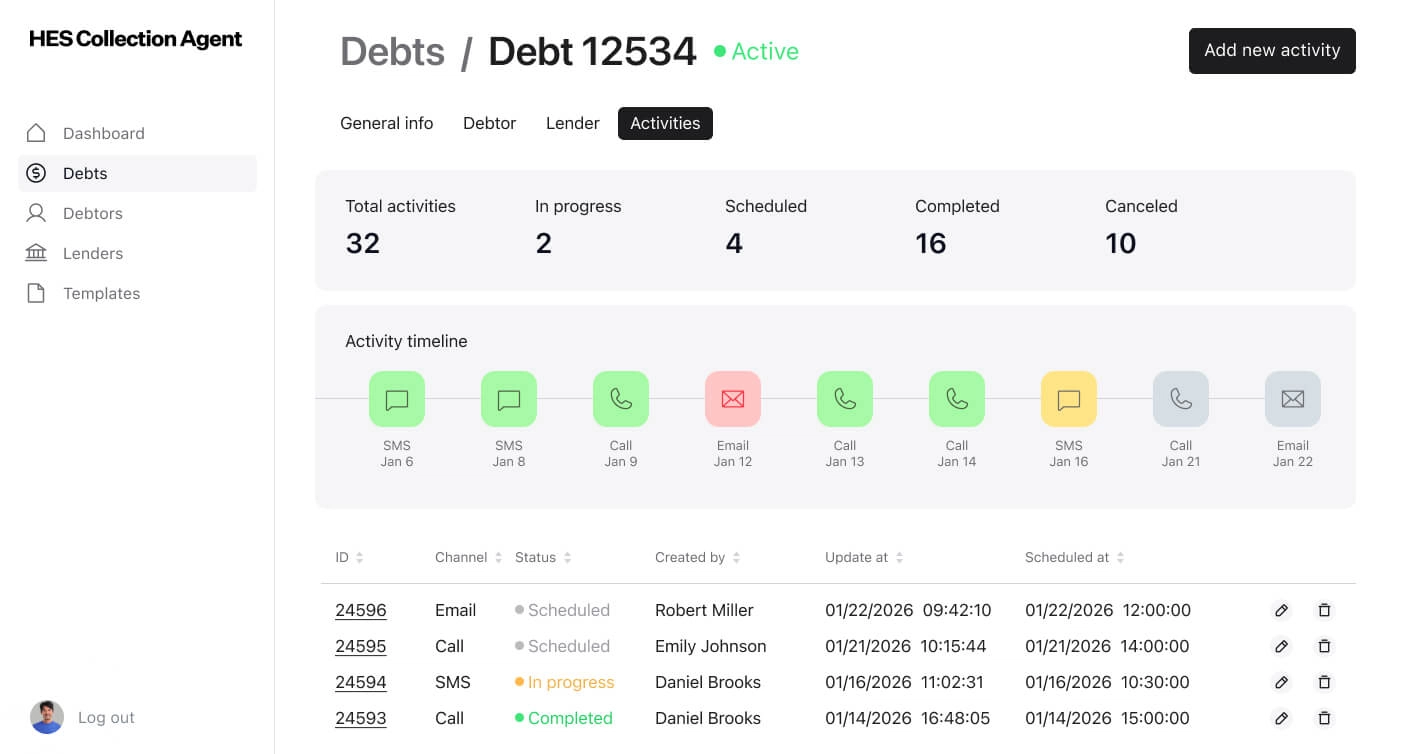

- Control the entire collection lifecycle

The tool enables strategic orchestration by centralizing collection workflows from early-stage delinquency to legal and agency management within a single, comprehensive platform. - Create seamless, transparent workflows

All borrower interactions, payment plans, and other activities performed with the tool are centralized in one view, which eliminates data silos. - Automate at scale

Routine workflows and task assignments are automated, allowing your team to focus only on complex cases that call for human intervention.

Core Capabilities of the HES Collection Agent

The software brings structure and intelligence to every stage of the collection process. It combines AI-powered decisioning, automation, and real-time insights to help teams act faster, focus on the right cases, and stay fully in control, all while being compliant and agile.

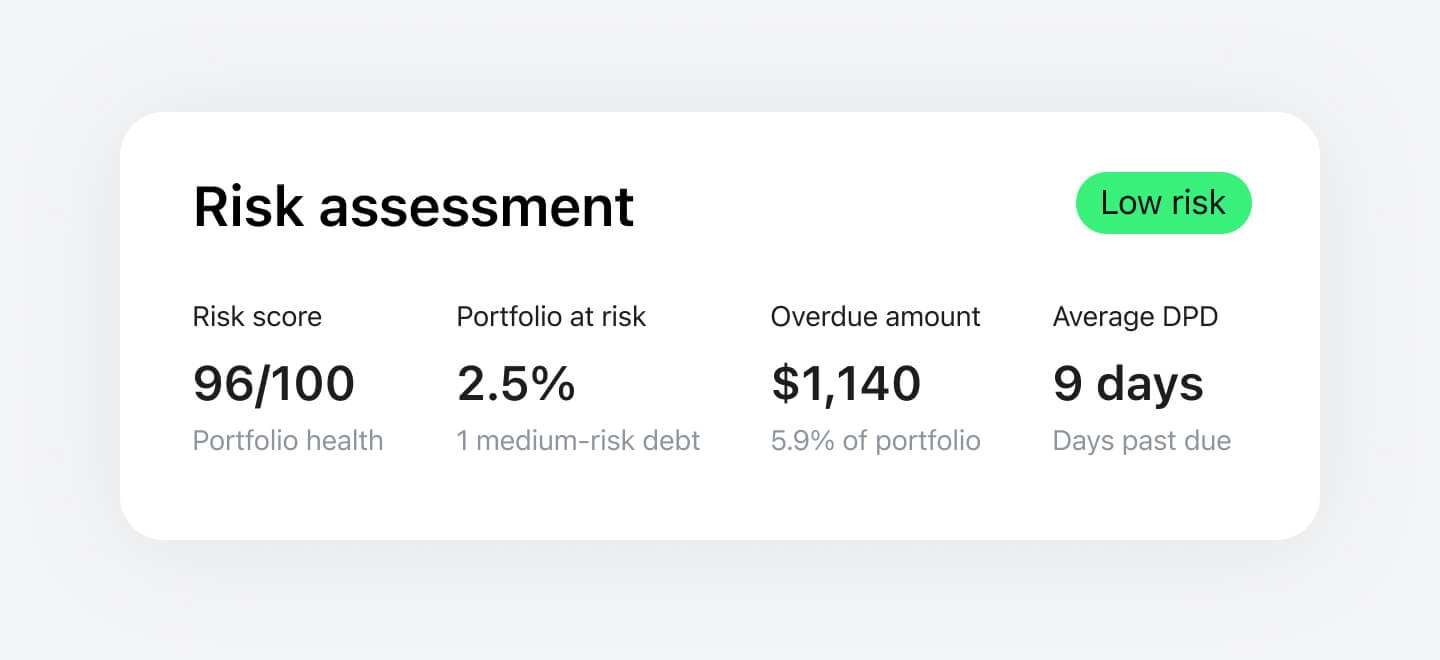

1. AI Engine for Smart Segmentation and Prioritization

Turn borrower data into precise recovery decisions

At the core of the HES Collection Agent is an AI-driven engine that replaces one-size-fits-all collection strategies with intelligent, risk-based prioritization. Our engine analyzes historical, behavioral, and transactional borrower data and, on this basis, calculates propensity-to-pay scores that predict who is most likely to repay.

Where regulations allow, we enrich your existing data with behavioral and digital insights to build a 360-degree debtor profile. Thus, separate the ‘Can't Pay’ (hardship cases) are automatically separated from the ‘Won't Pay’ (strategic defaulters). Collection resources are focused where they deliver the highest return, while maintaining fair and customer-oriented treatment.

2. The ‘Next Best Action’ Engine

Deliver the right message at the exact moment it matters

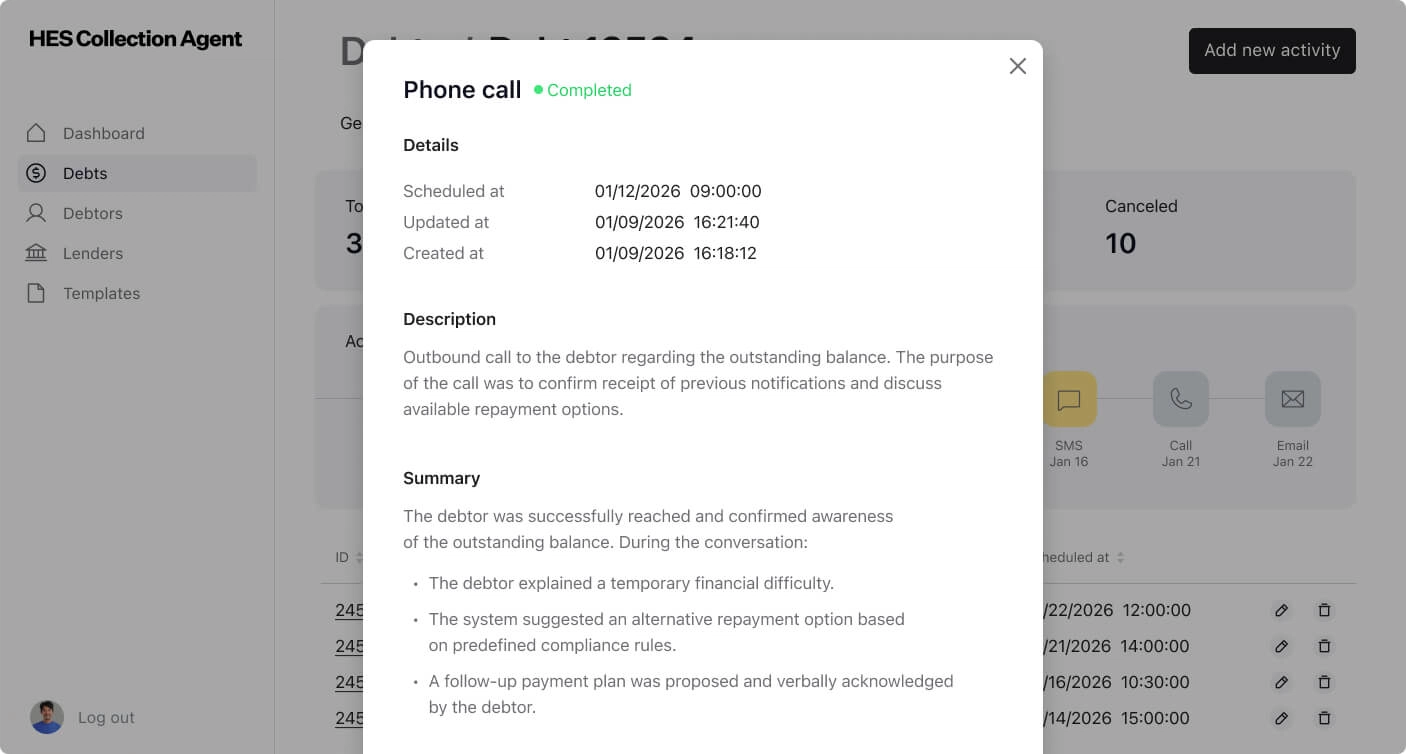

The platform’s adaptive decisioning engine determines the next step for each borrower relying on real-time behavior. It dynamically selects the best channel, timing, and contact frequency across email, SMS, push, and voice to prevent communication fatigue and increase engagement.

If interaction patterns change, the system instantly adjusts by switching channels, tone, or strategy.

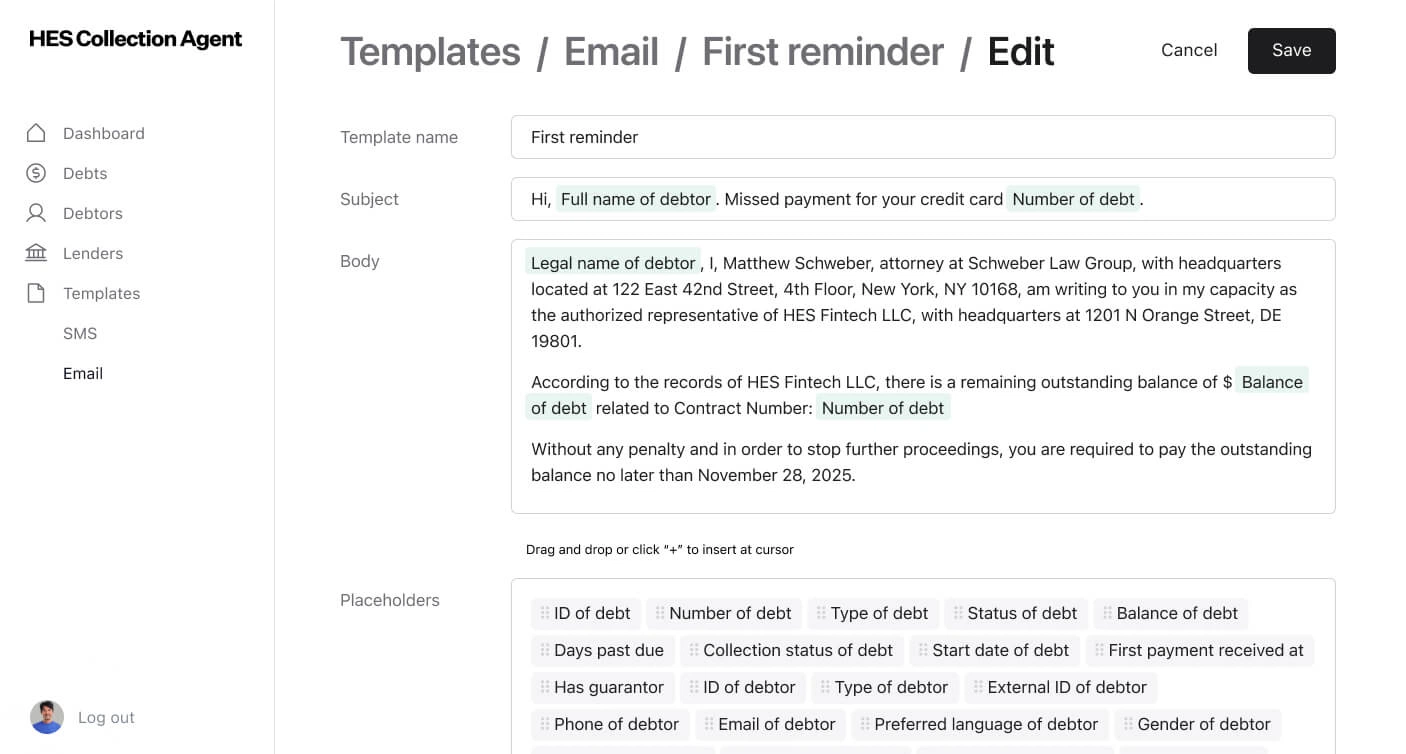

3. Control and Optimization

Achieve full visibility and precision in every interaction

The HES Collection Agent gives businesses complete control over their collection strategies, but without slowing down execution. With pre-approved message templates, it’s easy to secure brand consistency and meet regulatory standards within every interaction.

Strategic orchestration makes sure that every engagement follows clearly defined rules earlier set by the user. It ensures the right message reaches the right borrower at the optimal time.

4. Operational Efficiency

Automate the routine and elevate your team’s impact

By automating data processing, segmentation, task assignment, and follow-ups, the HES Collection Agent cuts manual effort and operating costs, as well as processing time.

The system automatically handles the digital nudges and reminders, so that your staff can focus on high-value cases that need retention or difficult negotiations.

Automated promise-to-pay monitoring tracks borrower commitments in real time. If a payment fails, the strategy automatically adapts, switching to ‘Soft Pressure’ or ‘Retention’ modes without human input.

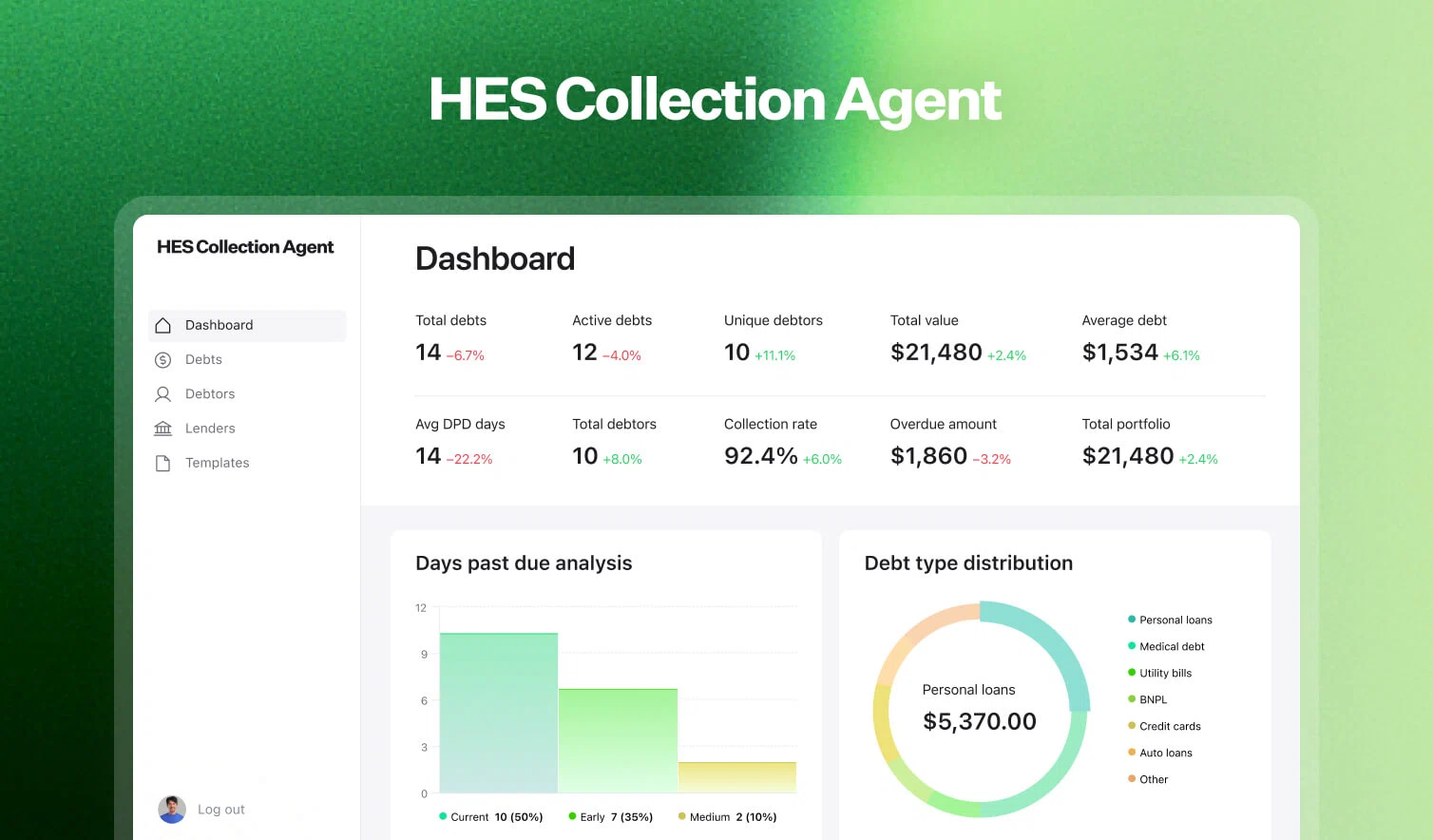

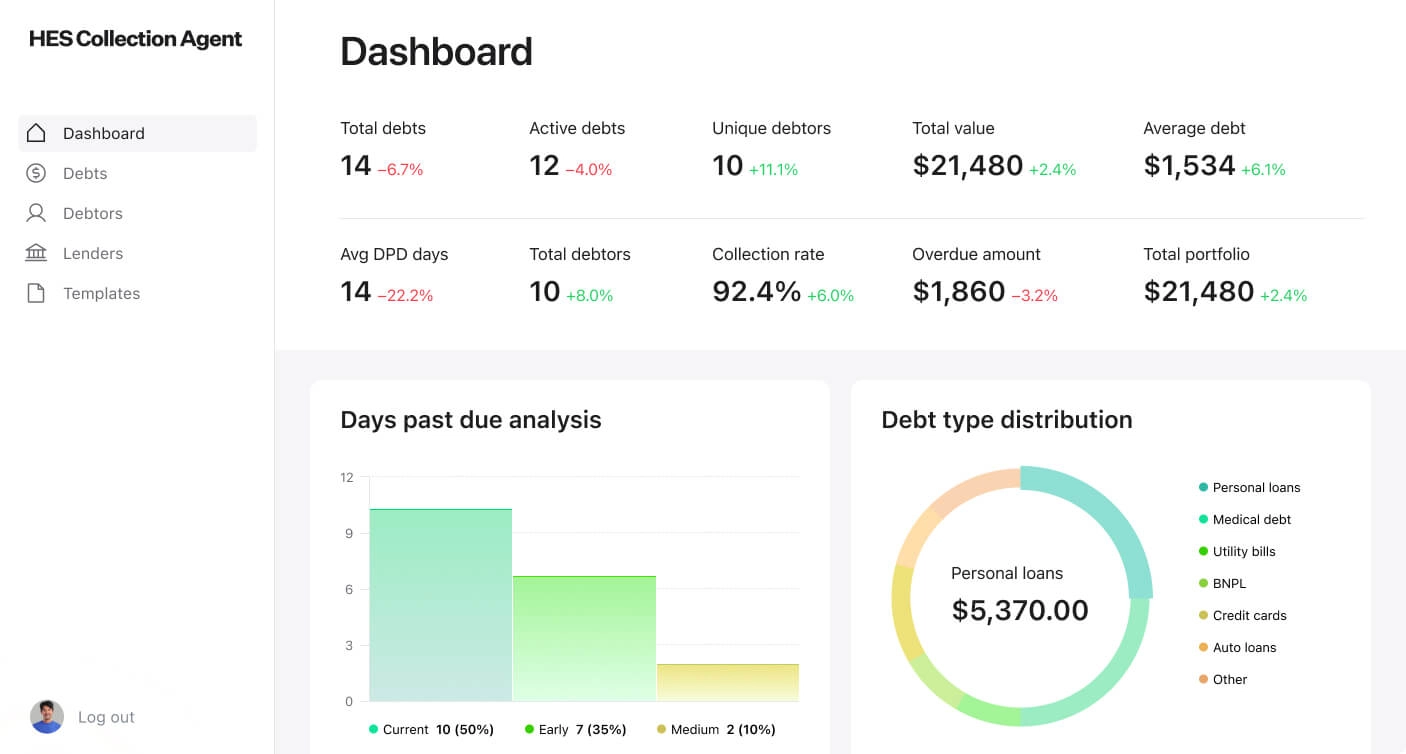

5. Portfolio Visibility

Get real-time insights into portfolio health and collection performance

The HES collection tool continuously monitors your collection portfolio, providing both portfolio-level metrics and detailed account-level insights.

Customers gain structured visibility into risk, exposure, and performance across all stages of delinquency. Accounts are automatically categorized by Days Past Due (DPD), so that teams are able to track portfolio distribution from current and early-stage delays through to higher-risk segments.

Thus, risk remains visible, priorities are clearly defined, and collection performance can be measured and optimized throughout the recovery lifecycle.

6. Security and Compliance

Get enterprise-grade protection built into every action

The HES Collection Agent is designed for regulated environments where compliance is mandatory.

All sensitive data is fully encrypted in transit and at rest, while every automated action is validated against configurable regulatory rules, including GDPR, FDCPA, and other region-specific laws. ISO/IEC 27001 certification ensures security protocols protect most sensitive data, both for your institution and for your borrowers.

Besides, the tool operates with up-to-date frameworks adhering local and international collection laws and regulations, such as timing, tone, channels, and frequency of communication.

7. Technical Agility

Integrate and adapt to changes fast, scale without disruption

Built on an API-first architecture, the HES Collection Agent connects effortlessly with your existing core banking, CRM, or accounting software via API or bulk data import, without the need for costly ‘rip-and-replace’ projects.

Configurable, no-code workflows allow teams to alter strategies, rules, and roles in minutes, without writing code. This helps your business adapt rapidly to market changes, legal updates, and portfolio shifts. For CTOs and product teams, this means faster time-to-value with minimal technical overhead.

Why Choose the HES Collection Agent

Our product combines artificial intelligence, automation, and regulatory precision to help lenders maximize recoveries while treating borrowers fairly. Bolstered with the in-built AI-powered decisioning and scoring engine and a standalone end-to-end loan management platform, the HES Collection Agent forms a complete ecosystem to cover the entire lending lifecycle.

Here are the results businesses can expect:

- 25% improvement in recoveries through smarter prioritization.

- 90% lower operational costs and 90% cut in processing time thanks to a drastic reduction in manual overhead.

- 50% higher response rate and more sustainable recovery results.