A loan tracking system has become an indispensable tool for financial institutions and fintech businesses. It helps them monitor loan performance, track repayments in real time, and maintain compliance across expanding portfolios, all while enhancing accuracy and operational control.

In this article, we’ll take a closer look at the key features and advantages of such solutions and share some practical tips to help you choose the right one for your business.

What Is a Loan Tracking System?

A loan tracking system is a digital platform that enables lenders to manage and monitor loans after they’ve been issued. It serves as a centralized hub where borrower data, payment schedules, interest details, and compliance records are brought together into one unified view.

With such a system in place, financial businesses can keep their data accurate, current, and easily accessible across teams. This, in turn, streamlines internal workflows and builds a solid foundation for agile lending operations.

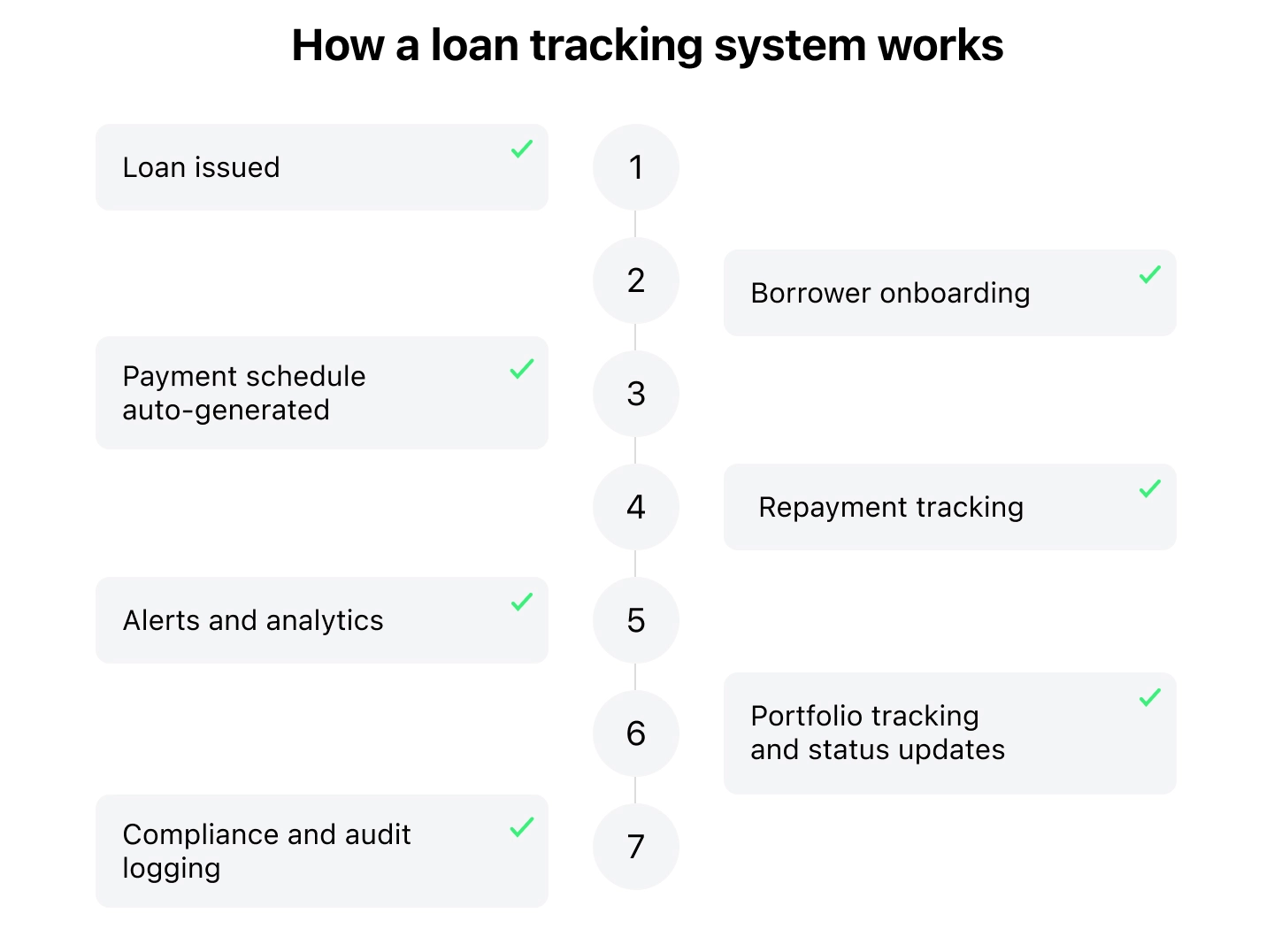

In practice, a loan tracking system works by continuously updating loan data across the entire loan lifecycle, from disbursement to final repayment.

Besides tracking at all steps of the lending flow, the system generates alerts, compiles analytics, checks portfolio statuses, and ensures that servicing activities remain compliant with internal policies and regulatory requirements.

Manual Tracking vs. Loan Tracking System

| Aspect | Manual tracking | Loan tracking system |

|---|---|---|

| Accuracy | Prone to errors | Automated and reliable |

| Compliance | Hard to maintain | Built-in audit trails |

| Efficiency | Time-consuming | Real-time updates |

| Scaling | Difficult | Easily scalable |

| Transparency | Limited | Full borrower visibility |

How Is a Loan Tracking System Advancing?

As the financial sector advances, loan tracking systems are evolving in parallel.

According to a report by FinTech Futures, recent trends highlight significant progress in AI and machine learning, cloud-based architectures, advanced data analytics, and business intelligence tools, all of which contribute to smarter and more personalized loan products.

Accenture’s study The Age of AI: Banking’s New Reality further emphasizes the growing influence of AI in lending and highlights that AI-powered solutions make loan processing and tracking more accurate, reduce manual errors, provide real-time updates, and substantially speed up the decision-making process.

What Benefits Does a Loan Tracking System Bring to Financial Businesses?

| Benefit | How it works |

|---|---|

| Greater operational efficiency | Automates repayment tracking and updates, reducing manual workloads and minimizing human error |

| Near-real-time portfolio visibility | Provides continuous access to live loan performance data, enabling faster and more informed decision-making |

| Enhanced compliance and audit readiness | Maintains centralized and time-stamped records that streamline audits and support regulatory compliance |

| Deeper tracking insights and forecasting | Helps collect and organize loan data, making it ready for building predictive models and shaping effective strategies |

Loan software for tracking loans delivers a range of advantages that go well beyond basic operational convenience.

Let’s explore some of the most impactful ones.

1. Greater Operational Efficiency

Modern loan tracking software automates essential tracking tasks such as repayment monitoring, schedule updates, and balance reconciliation. It removes the need for fragmented spreadsheet tracking by consolidating all loan details into a single real-time dashboard.

As a result, financial teams can instantly access borrower statuses, identify missed or partial payments, and keep portfolio records accurate with minimal effort, freeing time to focus on more strategic and high-impact tasks.

2. Real-Time Portfolio Visibility

Tools for real-time loan performance tracking provide lenders with a live snapshot of their entire loan portfolio.

With real-time updates on repayments, outstanding balances, and delinquencies, decision-makers can monitor overall performance and detect emerging trends or issues before they escalate.

3. Enhanced Compliance and Audit Readiness

Loan payment tracking software maintains complete time-stamped histories of every transaction, communication, and adjustment as well as keeps all data audit-ready at any point.

Essentially, built-in automated alerts and data validation mechanisms help detect missing documents, data inconsistencies, and anomalous entries, which helps maintain structured, accurate, and compliant records.

Together, time stamps and validation tools enable systematic monitoring, support regulatory audits, and reduce the risk of compliance violations, ensuring that all activity is both properly documented and traceable.

4. Better Customer Experience

With a specialized loan tracking system, customers can view their repayment progress, upcoming installments, and transaction histories through self-service dashboards.

By giving customers this clarity and control, businesses benefit from fewer support inquiries, more timely repayments, and deeper trust, which translates into smoother operations and stronger customer relationships.

5. Deeper Tracking Insights and Forecasting

Thanks to integrated analytics and dashboards, financial businesses are able to identify early warning signs such as repayment delays or high-risk borrower segments and act proactively.

What’s more, with the help of specialized predictive modeling tools, lenders can turn the data collected from loan tracking systems into actionable insights that improve forecast accuracy, strengthen risk management, and help refine overall lending strategies.

What Are the Key Features of a Loan Tracking Solution?

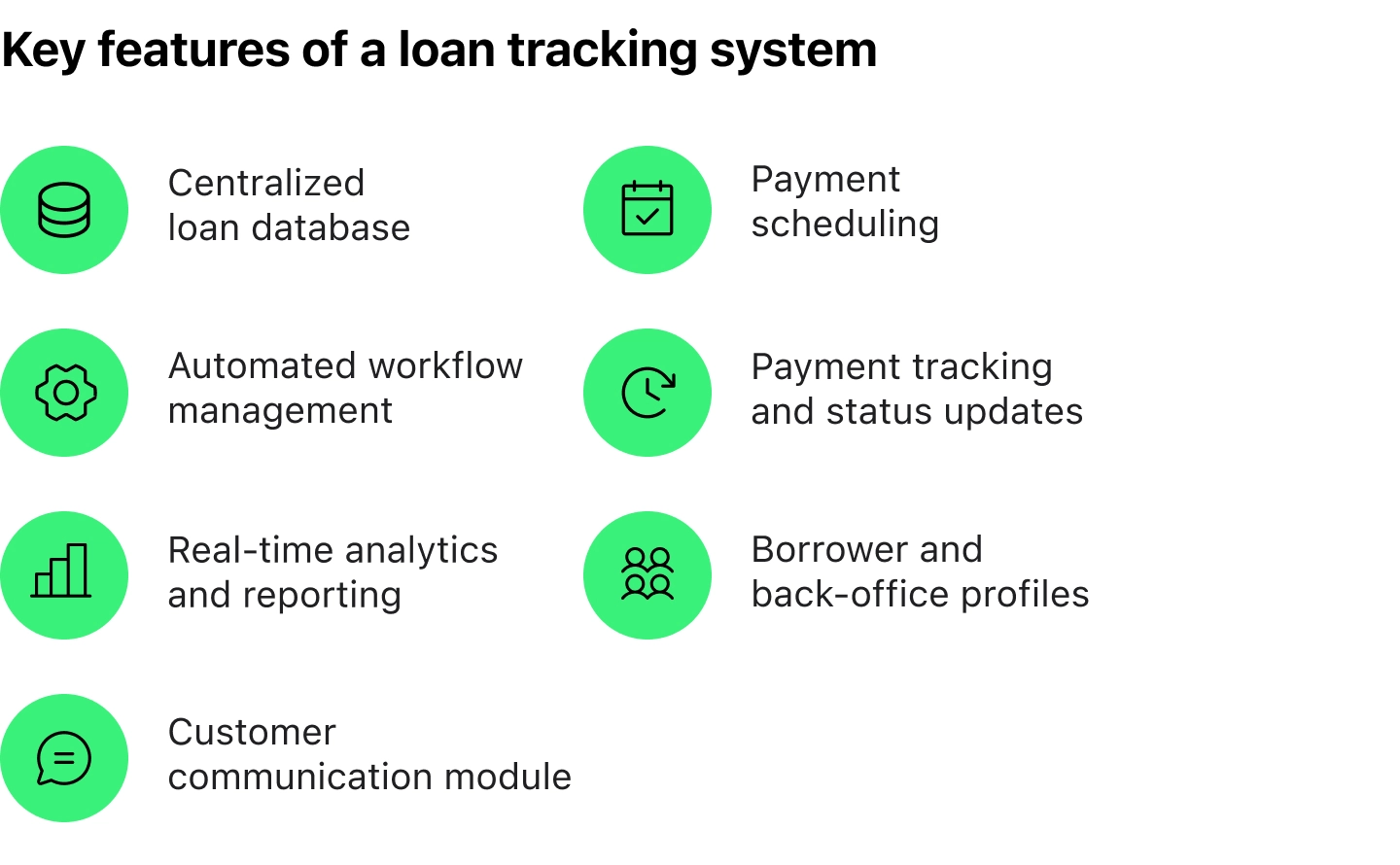

While every loan tracking system has its unique capabilities, most share a core set of features that help simplify oversight, maintain accuracy, and enable smarter tracking across all loan portfolios.

Here are some of the most essential features to look out for.

1. Centralized Loan Database

A core feature of any loan tracking software is a unified repository for all loan-related information.

By storing borrower details, repayment schedules, and contract documents in one place, teams can quickly access accurate data without sifting through spreadsheets or multiple platforms.

2. Automated Workflow Management

A tracking software platform takes over repetitive and time-consuming tasks such as payment monitoring, installment reminders, and loan status updates. It helps keep every step of the loan cycle on schedule and removes the risk of missed deadlines or manual oversight.

For lenders, that means consistent loan tracking accuracy, faster response times, and a far more organized portfolio overview across all accounts.

3. Real-Time Analytics and Reporting

Modern loan tracking tools come equipped with advanced analytics and dynamic reporting tools that turn raw data into meaningful and vital insights.

They provide real-time visibility into portfolio performance, repayment trends, and risk exposure, thus enabling decision-makers to act on up-to-date information instead of relying on static monthly reports.

4. Customer Communication Module

Clear and continuous communication with borrowers is a crucial element of effective loan tracking.

A built-in communication module logs every reminder, notification, and inquiry in one place, which keeps both sides informed and accountable.

Plus, modern solutions support multi-channel communication via SMS, email, and in-app alerts, making it easier to stay connected, improve response rates, and build lasting customer trust.

5. Payment Scheduling

Payment scheduling tools give lenders full control over defining and managing repayment timelines for every loan. The system automatically calculates installment amounts, sets due dates, and adjusts schedules in real time when loan terms change. This helps ensure that both borrowers and internal teams can access up-to-date schedules at any moment and reduces confusion and missed payments.

Importantly, the feature also helps prevent delinquencies by keeping borrowers informed of upcoming obligations and providing full visibility into payment timelines and interest details.

6. Payment Tracking and Status Updates

A tracking software platform continuously monitors repayments as they happen. Each payment, whether full, partial, or missed, is instantly logged in the system and is reflected in the borrower’s balance.

With up-to-date information at their fingertips, teams can quickly address missed or irregular payments, stay on top of portfolio performance, and ensure that all records remain accurate and actionable.

7. Borrower and Back-Office Profiles

User-friendly dashboards bring clarity to both borrowers and internal teams.

Borrowers get access to intuitive interfaces showing loan balances, repayment histories, upcoming installments, and communication logs, all in one view.

Meanwhile, back-office dashboards help teams monitor overall portfolio performance, track risk exposure, and efficiently manage workloads through real-time visualizations.

Aspects to Consider When Choosing a Loan Tracking System for Your Business

With so many options on the market, choosing the best loan tracking system for your business can feel overwhelming. But once you know which aspects to prioritize, the process becomes far more straightforward.

Here are a few key areas that are worth paying close attention to.

1. Technology Architecture

It’s advisable to look for a platform that is built on a modern cloud-based infrastructure that supports open APIs and modular design, as this allows for flexibility, scalability, and easy integration with other tools.

Bonus points if it leverages AI or predictive analytics to help you spot any anomalies and potential payment risks early on.

2. Integration Capabilities

Your loan tracking system should work well with the rest of your tech stack. It should connect with your accounting software, payment gateways, CRM, as well as other tools and platforms.

The smoother those connections are, the less time your team spends on manual updates and reconciliations, and the more reliable and unified your loan data becomes.

3. User Experience

A good solution for tracking loans should feel intuitive, responsive, well-structured, and easy to navigate right from the start.

When dashboards are clear, borrower profiles are well organized, and notifications are customizable, your team will be able to work faster and make fewer mistakes.

4. Security Features

Prioritize systems that provide strong encryption, detailed access controls, and multi-factor or biometric authentication. Built-in KYC plugins and audit-friendly recordkeeping are major advantages, too.

Just as important, the system should stay aligned with changing financial regulations so as to save your team from manual compliance headaches.

5. Scalability

As your business grows and the number of active loans rises, your loan tracking platform needs to manage higher loan volumes without sacrificing accuracy or speed.

Thus, make sure to opt for a system that will be able to scale with your operations and ensure that tracking, reporting, and alerts remain reliable as your loan portfolio expands.

6. Vendor Reputation and Expertise

And of course, the technology is only as good as the team behind it.

A reliable vendor with real fintech experience and a proven track record can make all the difference, especially when you’re managing complex loan portfolios.

Therefore, take the time to thoroughly research and compare potential providers. The right partner should guide you through integration, customization, and future updates and stay by your side as your business grows.

Conclusion

A loan tracking system provides lenders with comprehensive operational insights, helps strengthen compliance, and creates a more transparent experience for borrowers.

When choosing the right solution for your business, consider factors like scalability, technology architecture, smooth integration, user-friendly design, and the reliability of the vendor, as these aspects will help you find a system that grows with your business and keeps your operations running without a hitch.