Getting a loan is like signing a serious contract. The parties are anticipating the signing procedure. However, the true value of the agreement isn't in its announcement, but in the diligent, long-term execution of its terms. It requires discipline from stakeholders to respect their obligations. The process may be facilitated with tools like loan servicing software. It's designed to assist borrowers in managing their payments and help lenders efficiently maintain their customers’ accounts, making that long-term commitment smoother for every party involved.

The loan servicing software market size is expected to grow. In 2029, it will reach $5.38 billion compared to $2.51 billion in 2024. The reasons for such a significant increase are the rising demands for automation and regulatory compliance, customers’ expectations for flawless service, and the pressing need for scalable solutions among financial institutions. The latter ones have been looking for technological solutions to optimize their workflows for several years already. According to McKinsey, 35% of small and medium-sized organizations planned to use fintech for lending in 2022.

Loan servicing software allows banks, lenders, credit investors, and other financial institutions to accelerate their routine tasks, increase the efficiency of the staff, and bring customers improved services. In this article, we focus on the main features of this software and its benefits for financial companies.

What is Loan Servicing Software?

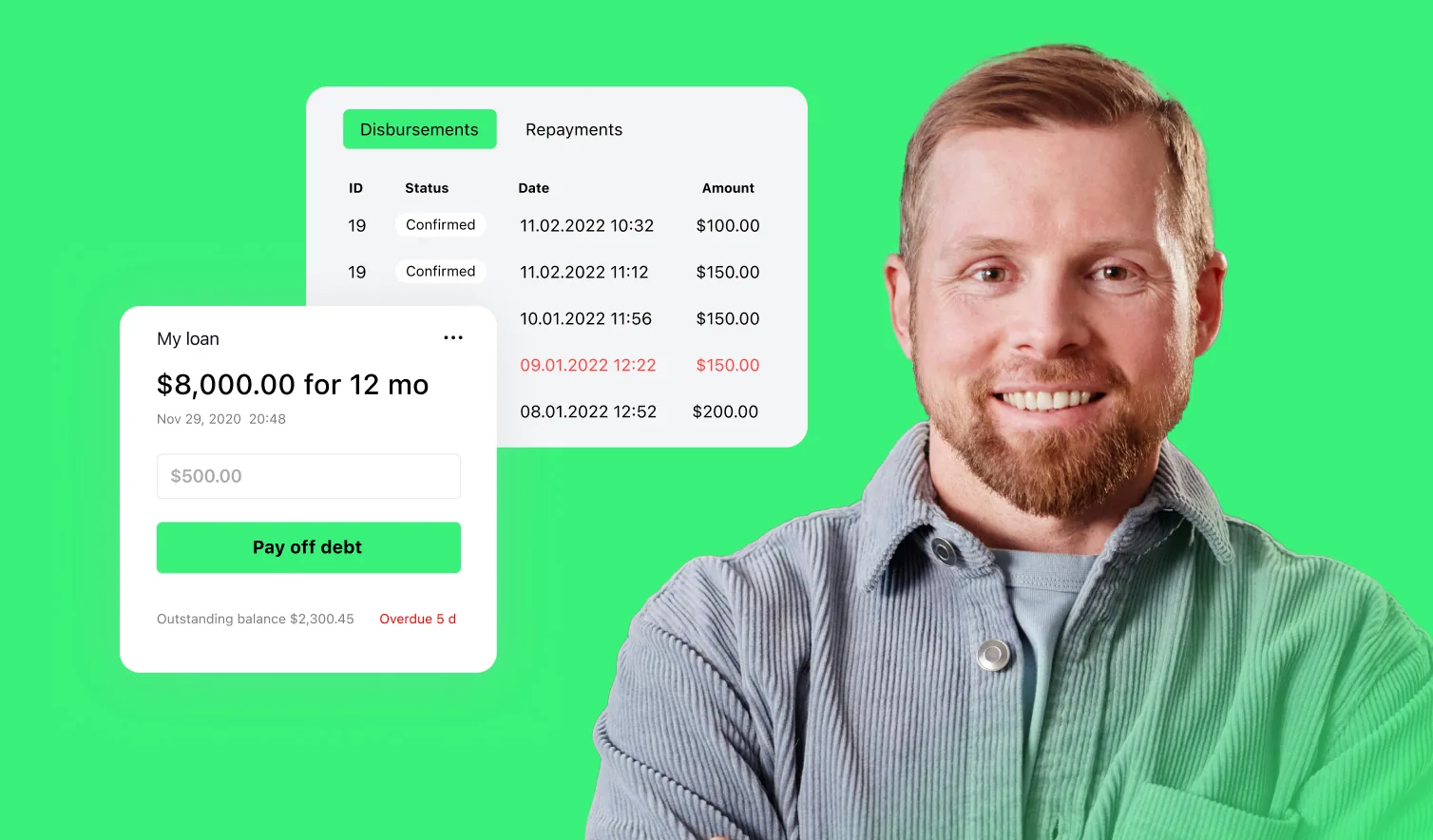

It is a platform that automates and manages loan repayment processes. It handles the operations that happen after disbursement, such as tracking payments, keeping and managing account records, reporting on compliance, and communicating with customers.

Instead of using loan servicing software, banks and financial systems might rely on manual data entry that involves working with spreadsheets, general accounting software (e.g., QuickBooks), physical documents, and a lot of human labor. Any serious lending business understands that the risks of a manual approach are too high. First, manual work involves high risks of errors and low operational speed. Second, the processes are not streamlined and lack organization.

Loan Origination vs. Loan Servicing vs. Loan Management

There are different types of loan software. Some of them address only a part of the lending cycle, like origination, servicing, collection, etc., and some tackle the entire cycle, like loan management software.

- Loan origination: It covers the initial phase, which is the loan application, evaluation and approval, and funding.

- Loan servicing: This is the actual topic of our overview. The software assists with managing payments, updates, and customer interactions. The main purpose of this phase is to make sure the repayments happen and any appearing issues are timely resolved.

- Loan management: This type of software combines the two phases described above, as well as loan origination, compliance, reporting, loan collection, and portfolio performance.

Important note:

When is it better to utilize the first and the second tools separately or to implement an end-to-end loan management solution?

Smaller lenders, credit unions, community banks, and specialty finance companies might want a single system for everything. It allows them to avoid the complexity and cost of integrating two separate systems. Besides, their load volume is typically manageable enough for an all-in-one product.

Key Loan Servicing Software Features

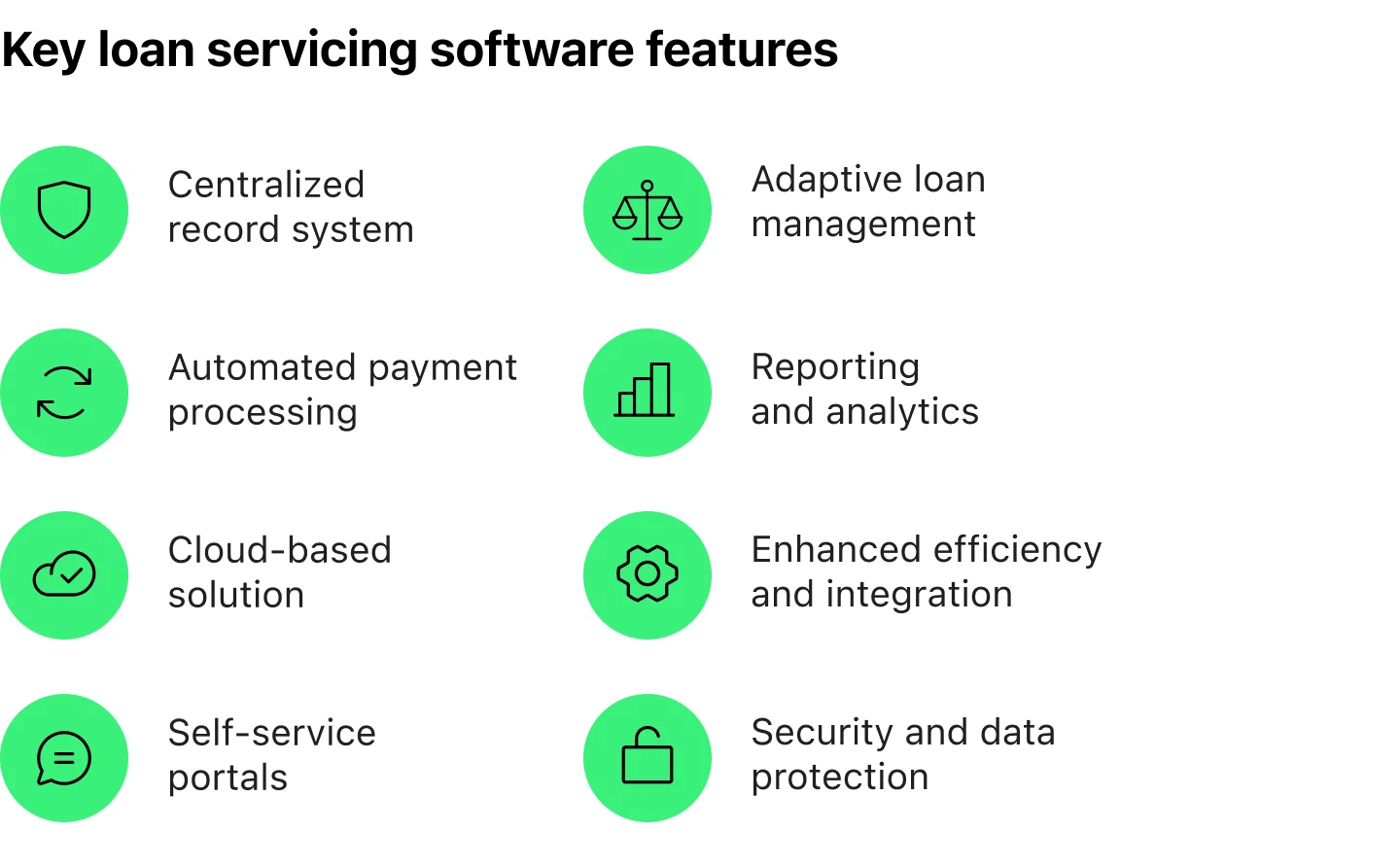

1. Centralized Record System

Loan servicing software is supposed to work as an information hub. It contains the data about a customer, their payment history, loan terms and conditions, and interaction logs. Such an approach allows every stakeholder to have the same information and easily refer to loan portfolios if necessary.

2. Automated Payment Processing

With this feature, debit payments happen automatically from borrower accounts. It reduces the cases of missed payment, and the lender receives a continuous cash flow. Besides, if the borrower fails to make the regular payment, the system reminds them with a notification. The payment methods may include ACH transfers, credit and debit cards, and wire transfers.

3. Cloud-Based Solution

Cloud technologies allow for more convenient and faster work with data, as it is accessible to all authorized users. Besides, while the provider secures the underlying infrastructure, the lender manages user access and its own data, ensuring privacy and control.

4. Self-Service Portals for Customers

Borrowers access online portals if they need to check their loan statements and balances. They can download the required tax documents without spending extra time in customer support. On the one hand, borrowers are happy with the convenience of the service. On the other hand, the staff is not overloaded with calls, requests, and routine operations.

5. Adaptive Loan Management

It happens sometimes that borrowers overcome temporary difficulties and need special payment conditions. With loan servicing software, lenders can easily optimize loan terms for such customers, create customizable repayment plans, adjust interest rates, or suspend payments for a certain period. It increases customer satisfaction and retains clients.

6. Reporting and Analytics Dashboards

The software not only automates processes, but it also provides food for thought. Lenders may analyze the portfolio health and track such metrics as delinquency rates, default rates, profitability, etc. This “drill down” helps to follow trends, identify risks, and proactively take measures. As a result, borrowers receive more competitive loan products and a better-tailored service.

7. Enhanced Efficiency and Integration

Ideally, loan servicing software should run based on ‘if-this-then-that’ rules. For example, if a borrower misses a payment, the system sends a notification and labels an account in the CRM. Therefore, every detail is taken into consideration and handled.

This automation is enforced with seamless integration with core banking systems and payment gateways. It allows for the real-time exchange of data, such as transaction updates and balance information, and creates an operational workflow without data silos and with reduced error potential.

8. Security and Data Protection

The software developers employ special security measures like data encryption, role-based access control, and iterative penetration testing. Also, the solution should be compliant with such data protection protocols and standards as SOC 2, ISO 27001, and GDPR. Borrowers’ financial and personal data is highly sensitive, as well as the information of the lending institution. These protections help prevent cyberattacks and ensure ongoing regulatory compliance.

Benefits of Using Loan Servicing Software

The above-mentioned features work well for both lenders and borrowers. In this table, we have summarized what each party gains by leveraging this type of software. A more detailed explanation of the advantages comes next.

| Loan servicing software functionality | Benefits for lenders | Benefits for borrowers |

|---|---|---|

| Centralized record system |

|

|

| Automated payment processing |

|

|

| Cloud-based solution |

|

|

| Self-service portals |

|

|

| Adaptive loan management |

|

|

| Reporting and analytics |

|

|

| Enhanced efficiency and integration |

|

|

| Security and data protection |

|

|

Improved Operational Efficiency

An employee will spend many hours manually generating, for example, 500 payment reminder emails. The software will do it immediately after the due date of the payment. It optimizes the process and saves costs.

Enhanced Risk Management

The program scans accounts and identifies those borrowers who have begun making late payments. Employees may proactively offer them special payment plans to prevent default and keep the portfolio's delinquency rate low. This minimizes losses and results in the overall health of the lender’s entire loan portfolio.

Lower Default Rates

This benefit logically comes from the previous one. Predictive maintenance of risk allows for reducing missed and late payments. Besides, automatically reminding borrowers of timely payments helps them stay on track.

Scalability Potential

If loan servicing software is built on a cloud infrastructure with a flexible architecture, it grows with the demands of the business. Unlike a human employee who gets overwhelmed, the software effortlessly handles a surge in loans. This is powered by robust database scaling and secure APIs that ensure everything keeps running smoothly, without costly delays or the need to constantly hire more staff.

Stronger Security and Regulatory Compliance

Security measures behind the software encrypt all sensitive data, like social security and bank account numbers, using industry-standard AES-256. Another measure is the tokenization of the information. Critical client data is replaced with unique tokens to minimize risk even in the event of a system breach. This robust protection is essential for avoiding devastating regulatory fines for non-compliance with GDPR, CCPA, and the SEC.

More importantly, such measures reduce the risk of reputational damage. Multi-factor authentication adds a critical layer, ensuring that only authorized users have access to borrower accounts and loan management systems.

Excellent Borrower Experience

In case your software provides self-service portals and the possibility to ask for flexible terms, it adds up convenience and transparency for customers. They become loyal and are more likely to return for future business.

Single Source of Truth

Loan servicing software contains all loan data. Therefore, the participants have the same information and can rely on reporting and analytics insights. It helps to make better-informed business decisions. For example, a lender may analyze which of the loan products is the most profitable or which geographic region has the highest default rate and adjust the lending strategy accordingly.

Revenue Lift and Improved ROI

A combination of all the benefits of applying loan servicing software will eventually lead a business to a revenue lift. It happens because automated collection of payments and timely interaction with borrowers reduce overdue debts. Besides, cutting operating costs and minimizing losses while increasing the collection of payments results in an increase in ROI from software implementation.

How to Choose an Appropriate Loan Servicing Solution

When making a decision regarding the right loan servicing software, consider the following issues:

- What your specific business needs are and what types of loans you need to handle.

- Determine must-have features and separate them from nice-to-have ones.

- Evaluate software’s scalability and flexibility.

- Assess vendor’s reputation, user feedback, customer service, and compliance standards.

- Think of the integration with existing systems that you might need.

- Choose a solution with a user-friendly interface and mobile access.

- Check if the pricing model is affordable.

Conclusion

Borrowers expect lenders to provide them with fast and transparent loan processing and customized options for various types of clients. Businesses that appear inefficient fail to compete. Loan servicing software brings financial institutions enhanced security and productivity, increased speed of managing loans, and satisfied customers. At HES FinTech, we offer automated lending solutions that help our clients modernize their operations, comply with evolving regulations, and attract new clients.