In this article, we’ll explore 5 biggest trends reshaping lending in 2025—from AI to green finance trends—and how they’re creating a lending landscape that’s more inclusive, flexible, and customer-focused than ever.

The Continuing Rise of AI in Lending

Everyone and their dog is talking about AI these days. It’s already revolutionized the way loans are assessed, approved, and managed—delivering enhanced decision-making, faster approval times, and improved repayment outcomes for companies willing to embrace it.

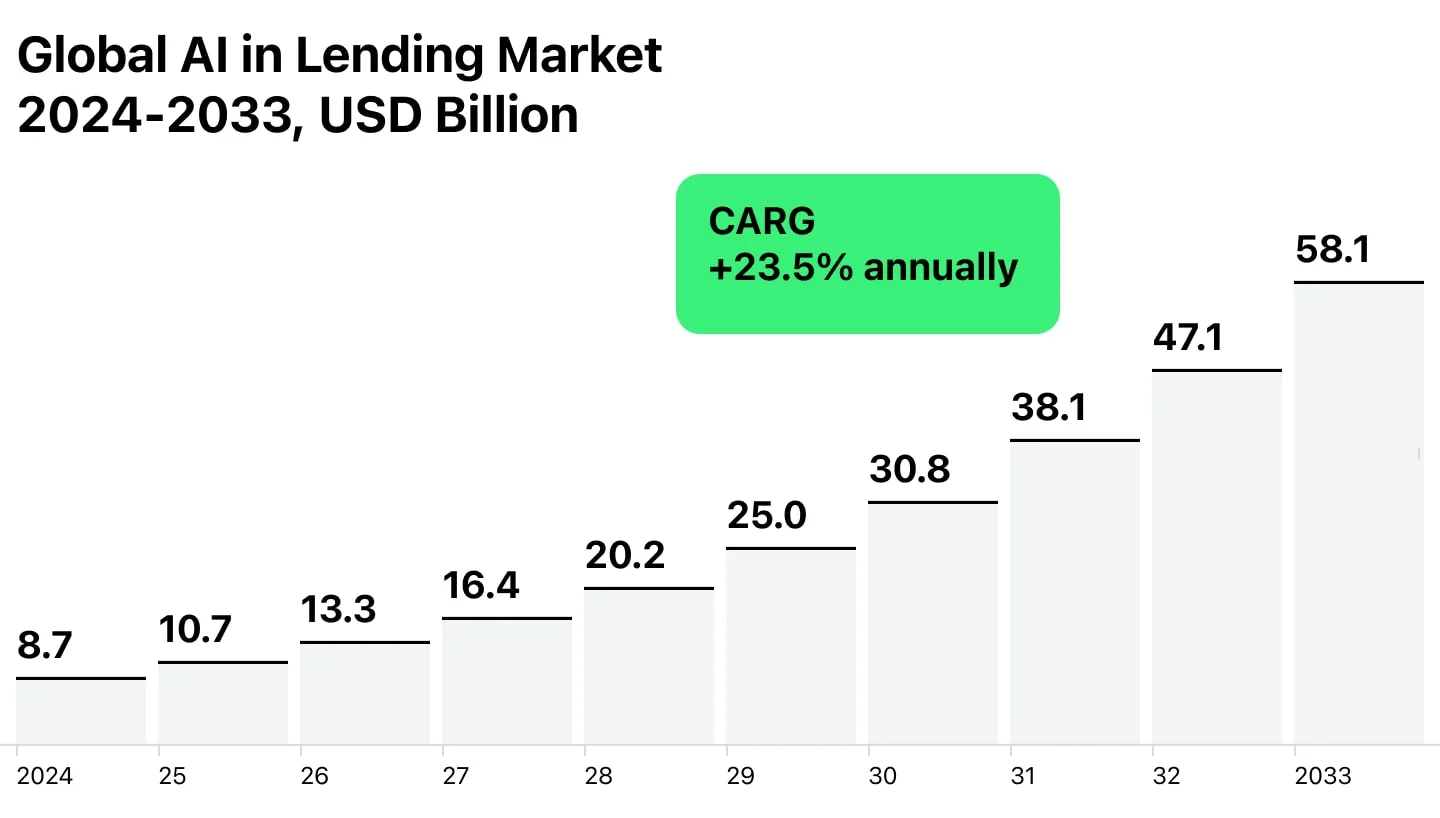

And the news? AI isn’t going anywhere. Its adoption in lending is only set to grow, transforming the industry even further.

In my opinion, the next wave of AI adoption in lending will likely center around predictive analytics and advanced customer insights. These innovations promise to make borrowing more accessible, efficient, and customer-centric than ever before.

As we explore the trends shaping the future of lending, it’s clear that all of them are, in one way or another, connected to AI. For now, take a look at the statistics below, which represent the projected global AI in lending market size for the forecast period from 2024 to 2033.

Open Banking and API

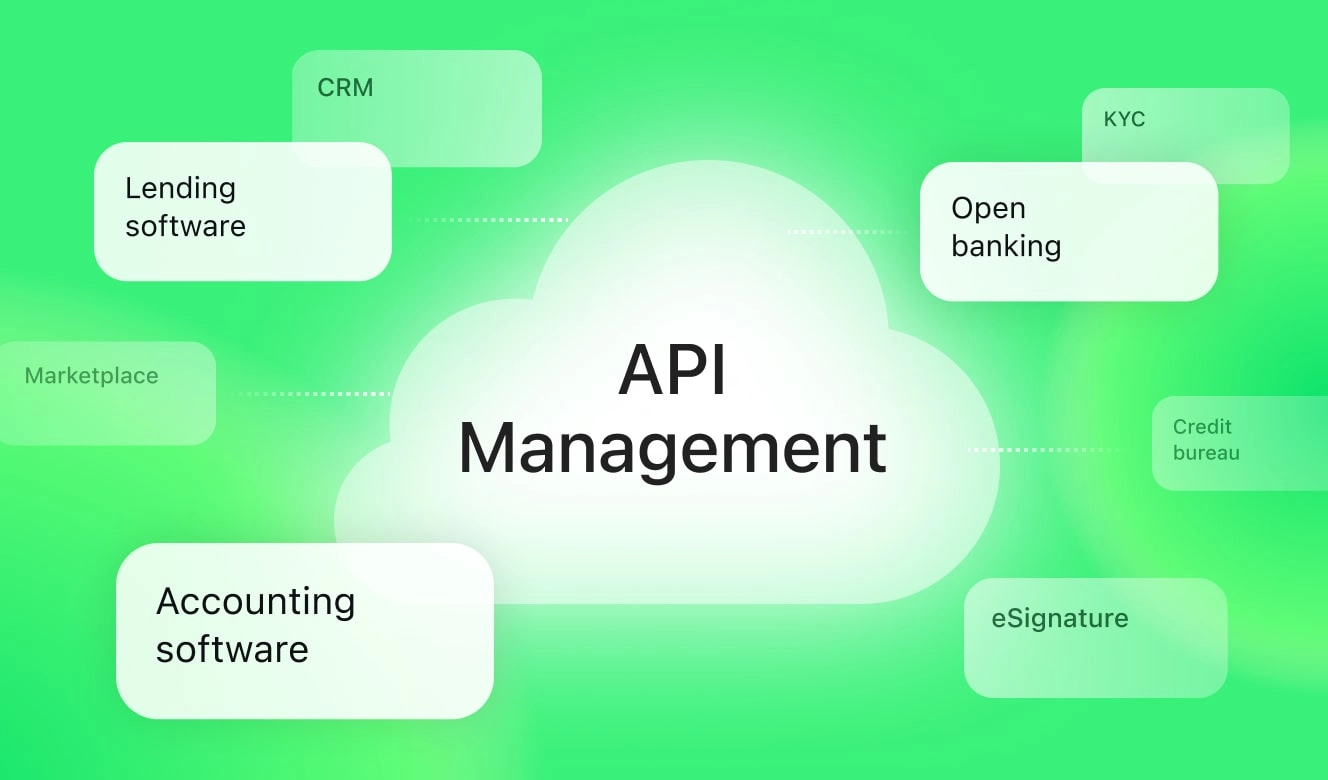

An API (Application Programming Interface) is a set of rules and protocols that allow different software systems to communicate and share data in a structured and efficient way.

Think of an API as a contract between two systems: one system offers certain functionalities or data, and the other system can use them, provided it follows the defined rules. For example, if a lending platform wants to access a credit bureau’s data to check a borrower’s credit score, the API defines what data the platform can request, how to request it, and how the credit bureau will respond.

Here is how it works in lending. For example, when a lending platform needs to check a borrower’s credit score, it uses an API to securely and quickly communicate with a credit bureau. The API sends the request, gets the data, and returns it to the lending platform—all without you having to know the technical details behind the scenes.

How APIs Transform Lending

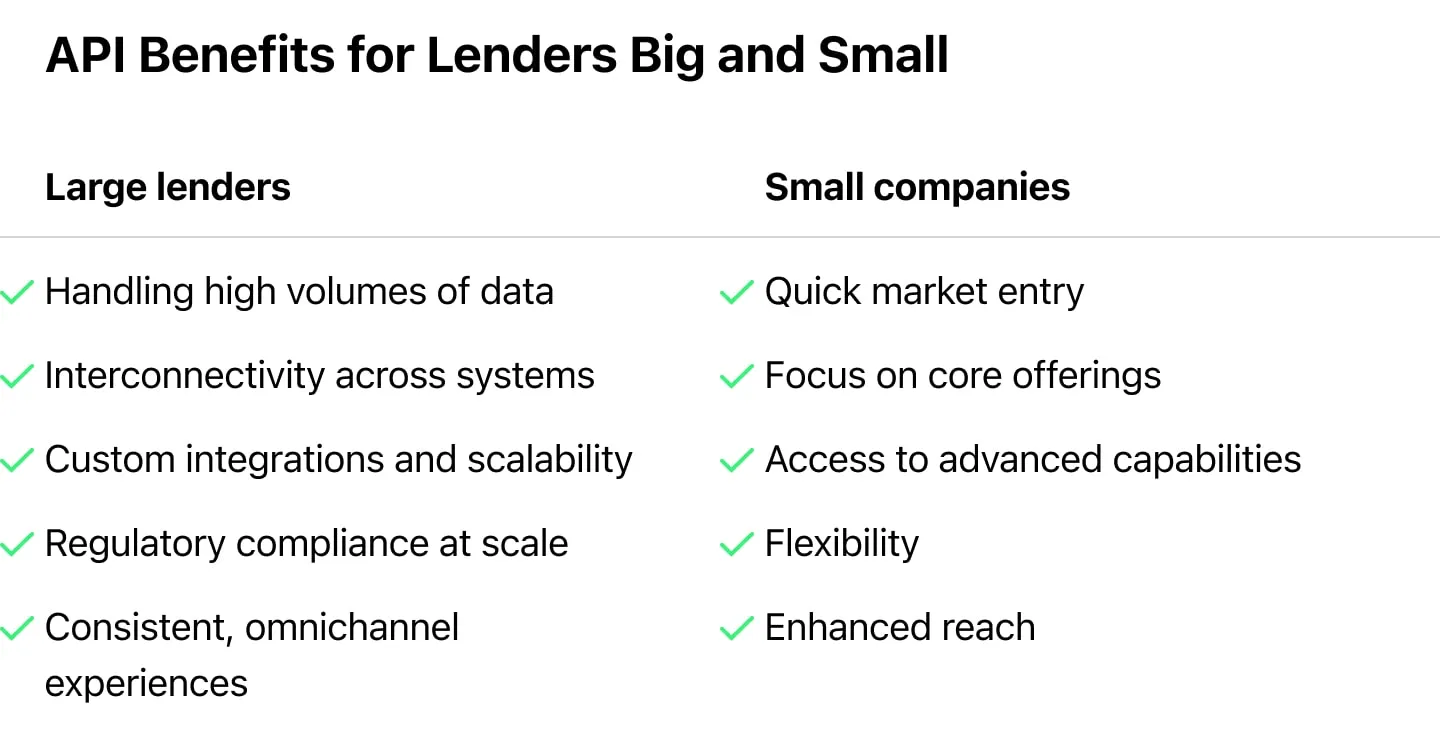

Now let’s talk about its benefits. Firstly, APIs enable seamless interconnectivity between various systems, such as lending platforms, credit bureaus, and payment gateways. This streamlined communication allows lenders to access, verify, and process data in real time, significantly improving decision-making speed and accuracy.

These systems elevate the customer experience. Borrowers no longer need to input large amounts of information manually, as APIs handle these tasks behind the scenes. Long approval times become a thing of the past, paving the way for a smooth and seamless customer journey.

Learn More About API Management in Finance

Lastly, API-based lending solutions provide scalability by supporting modular upgrades. Platforms can easily integrate new features or connect with third-party tools without disrupting existing infrastructure. This adaptability ensures that lenders can quickly respond to evolving market demands and maintain a competitive edge.

For a more in-depth discussion, we partnered with TPIsoftware for a webinar exploring the transformative power of APIs in lending. The session covered key topics such as API management strategies, zero downtime, API orchestration, advanced security measures, and how these technologies are shaping the future of lending.

Green Financing

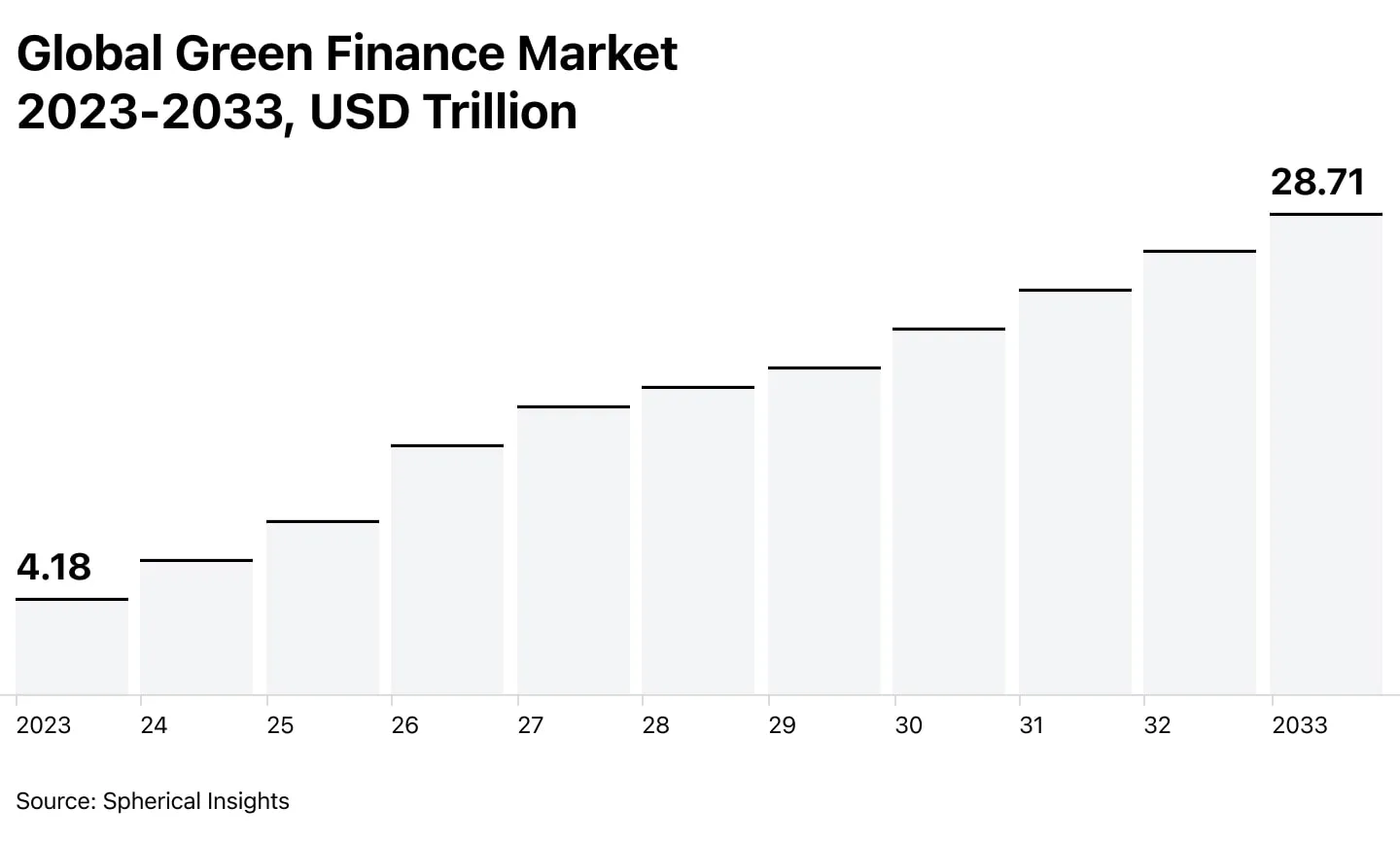

The global green finance market is expected to reach USD 28.71T by 2033, at a CAGR of 21.25% during the forecast period 2023 to 2033.

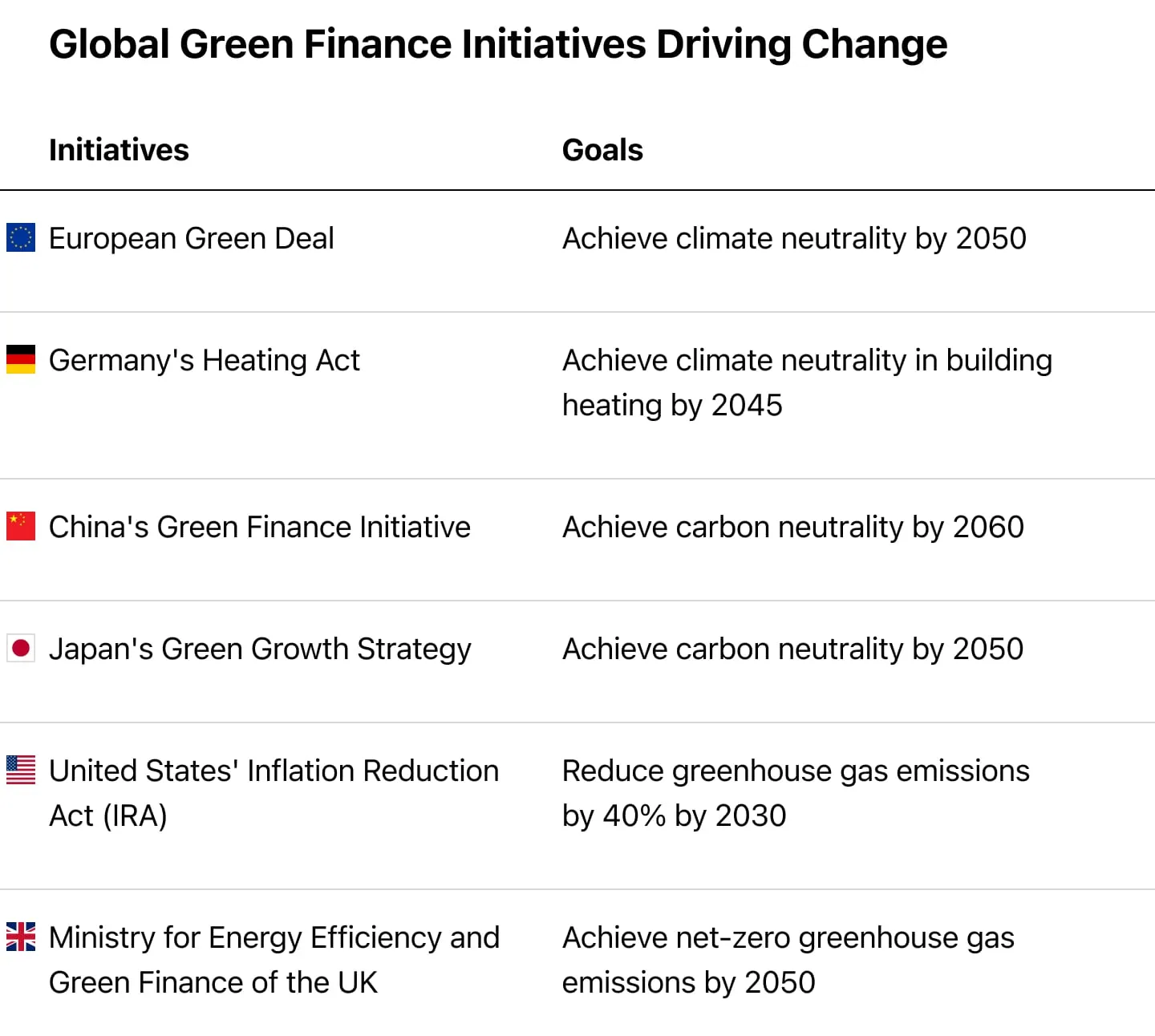

Green finance involves financial products and services designed to support environmentally friendly initiatives, such as renewable energy, energy efficiency, and sustainable infrastructure. Governments worldwide are implementing policies and regulations to accelerate this transition, creating significant opportunities for lenders.

Sustainable Solutions Made Possible Through Financing

Green financing is transforming how individuals and businesses adopt eco-friendly solutions, addressing one of the biggest challenges: the high upfront costs of technologies like solar panels, battery storage, and low-carbon heat pumps. These costs can be daunting, but lenders are stepping in with innovative financing solutions to bridge the gap and enable this critical transition.

Lenders offering tailored green finance products can position themselves as leaders in a rapidly evolving market. Flexible financing solutions that allow borrowers to spread installation costs over time make green technologies more accessible, enabling a wider customer base to participate in the sustainability movement.

Here’s how this win-win model works:

- Lenders provide loans tailored to green solutions with manageable repayment terms, helping customers overcome the barrier of high initial investments.

- Borrowers experience immediate benefits, such as reduced utility bills and improved cash flow, as green solutions typically lower long-term energy costs.

- Lenders gain a competitive edge by offering innovative products that cater to growing demand, aligning with global sustainability goals and demonstrating leadership in green finance.

This approach enables businesses and households to adopt eco-friendly solutions without a heavy financial burden, driving both environmental sustainability and economic growth. At the same time, it allows lenders to diversify their portfolios, align with ESG (Environmental, Social, and Governance) principles, and attract customers who prioritize sustainability.

As the demand for sustainable financing continues to grow, this is an opportunity for forward-thinking lenders to cement their market position and unlock long-term value.

Learn More

The Role of Alternative Data in Personalization

The lending industry can no longer afford a one-size-fits-all approach. Personalized offerings attract new customers and help to build long-term relationships. Moreover, tailored products can improve repayment rates, as borrowers are more likely to meet terms that align with their capabilities and circumstances.

As the name of this section suggests, alternative data plays the main role and basically makes personalization possible.

What is Alternative Data?

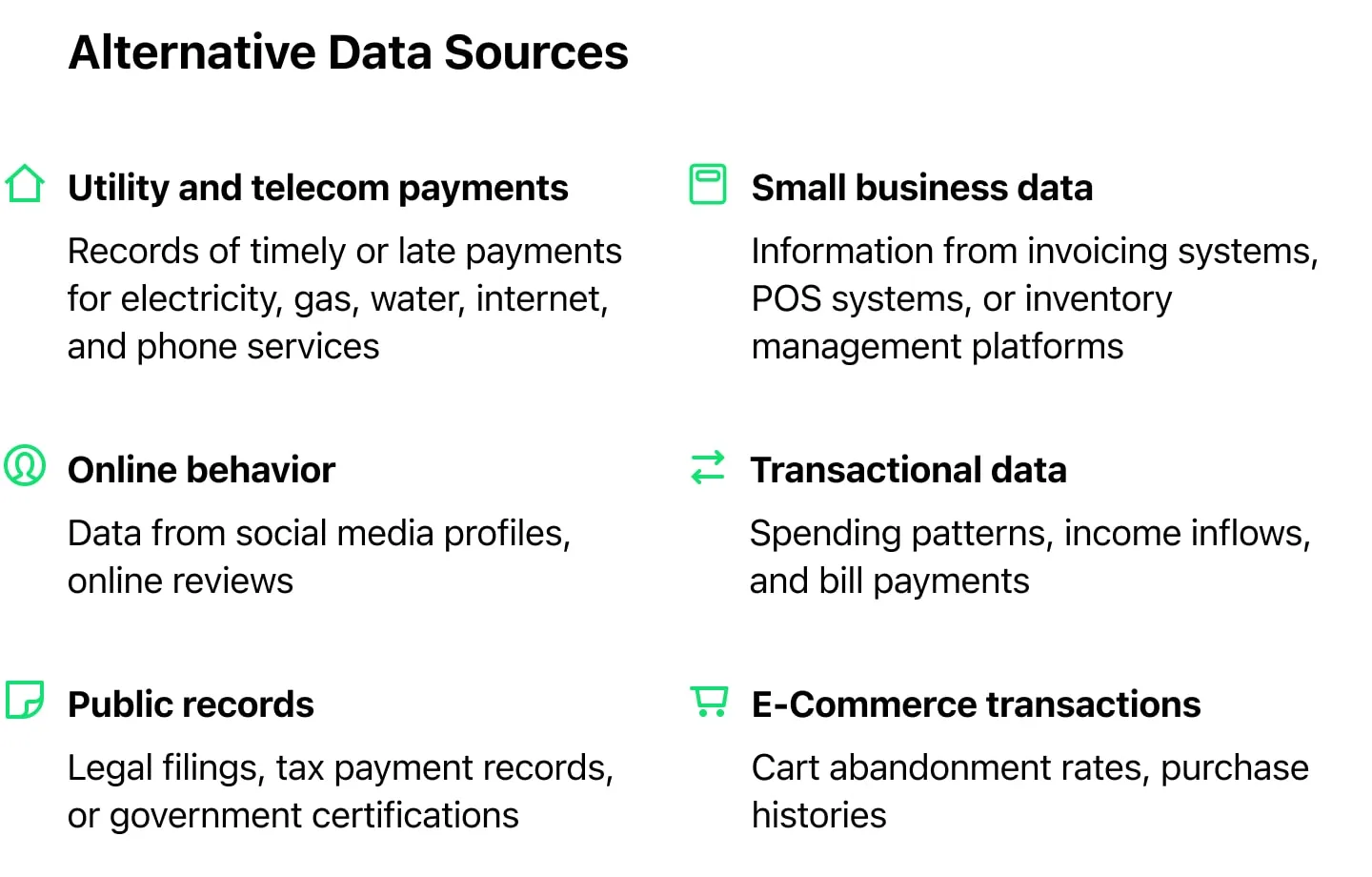

Alternative data is information that comes from non-traditional sources, giving lenders a deeper understanding of a borrower’s financial habits and creditworthiness. Unlike the usual credit scores and histories from bureaus, alternative data paints a fuller picture by looking at other aspects of a person’s or business’s behavior. It goes beyond the basics to help lenders see the bigger story behind the numbers.

How Alternative Data Powers Personalization

Alternative data opens up new possibilities for understanding borrowers, enabling lenders to create financial products tailored to individual needs. It’s about going beyond surface-level numbers to get a clearer picture of someone’s unique situation. Here’s how it works:

For Underbanked Individuals

Traditional credit scoring often leaves out people with little or no credit history, like young adults or immigrants. But that doesn’t mean they’re financially unreliable. By looking at things like utility payments or rental history, consumer lending institutions can see how consistently someone handles their financial responsibilities. This allows them to offer loans with terms that make sense for that person’s actual behavior, not just their lack of credit history.

For Small Businesses

Small businesses with irregular cash flow can face challenges qualifying for loans under traditional criteria. But alternative data—like daily sales from a POS system or payment trends from invoicing tools—can reveal a business’s true financial health. With this information, lenders can design loans with repayment terms that match the ups and downs of the business’s cash flow, making the loan more manageable and less risky for both parties.

With alternative data, lenders can make smarter, more personalized decisions, helping more people and businesses get the support they need while managing risk more effectively.

The Rise of Embedded Finance Platforms

From e-commerce offering "Buy Now, Pay Later" options to ride-sharing apps providing insurance, embedded finance brings financial services directly to consumers when and where they need them most.

At its core, embedded finance integrates financial services—such as payments, lending, insurance, or investments—into the platforms of non-financial businesses. This integration happens through APIs, which allow businesses to embed these services into their existing products without building the infrastructure from scratch.

For example, instead of a business needing to redirect customers to a bank or financial institution for financing, it can offer lending solutions directly within its platform. This creates a more cohesive and convenient experience for users, while businesses benefit from increased customer retention and monetization opportunities.

Why Embedded Finance is Growing

The rise of embedded finance is driven by several key factors:

1. Shifting customer expectations

Modern consumers and businesses want financial services to be fast, simple, and seamlessly integrated into their daily interactions.

2. Technological advancements

The proliferation of APIs and advancements in cloud computing make it easier than ever to integrate financial services into non-financial platforms.

3. Expanding market opportunities

Embedded finance opens up new revenue streams for non-financial businesses while enabling financial institutions to reach customers they might not have otherwise accessed.

The Advantages of Embedded Finance Platforms

The rise of embedded finance is unlocking significant benefits for businesses and lenders alike.

For consumers, convenience reigns supreme. Financial services are delivered at the exact moment they’re needed, eliminating the hassle of navigating separate platforms or lengthy applications. Whether it’s securing a BNPL plan during an online purchase or applying for a business loan through an SME marketplace, embedded finance reduces friction and enhances the user experience.

For businesses, embedded finance opens new revenue streams. By partnering with financial providers, platforms can monetize their ecosystems without building complex financial infrastructures from scratch. Retailers, marketplaces, and apps can boost their bottom line while delivering added value to users.

For lenders, it’s a gateway to expanded reach. Embedding their services into third-party platforms allows lenders to tap into new customer segments with minimal marketing costs. Instead of chasing borrowers, they meet them at the point of need, whether it’s a shopping cart, a business dashboard, or a gig worker’s app.

Kickstart your lending in 3 months

Conclusion

One thing is clear: the future of lending is fast, driven by innovation, and there’s no slowing down. With AI and embedded finance becoming essential tools, and green finance creating new opportunities, the industry is evolving into something more dynamic and customer-focused. For lenders ready to adapt, the rewards are immense: better products, stronger relationships, and a future where lending is more accessible and impactful than ever.