Summary

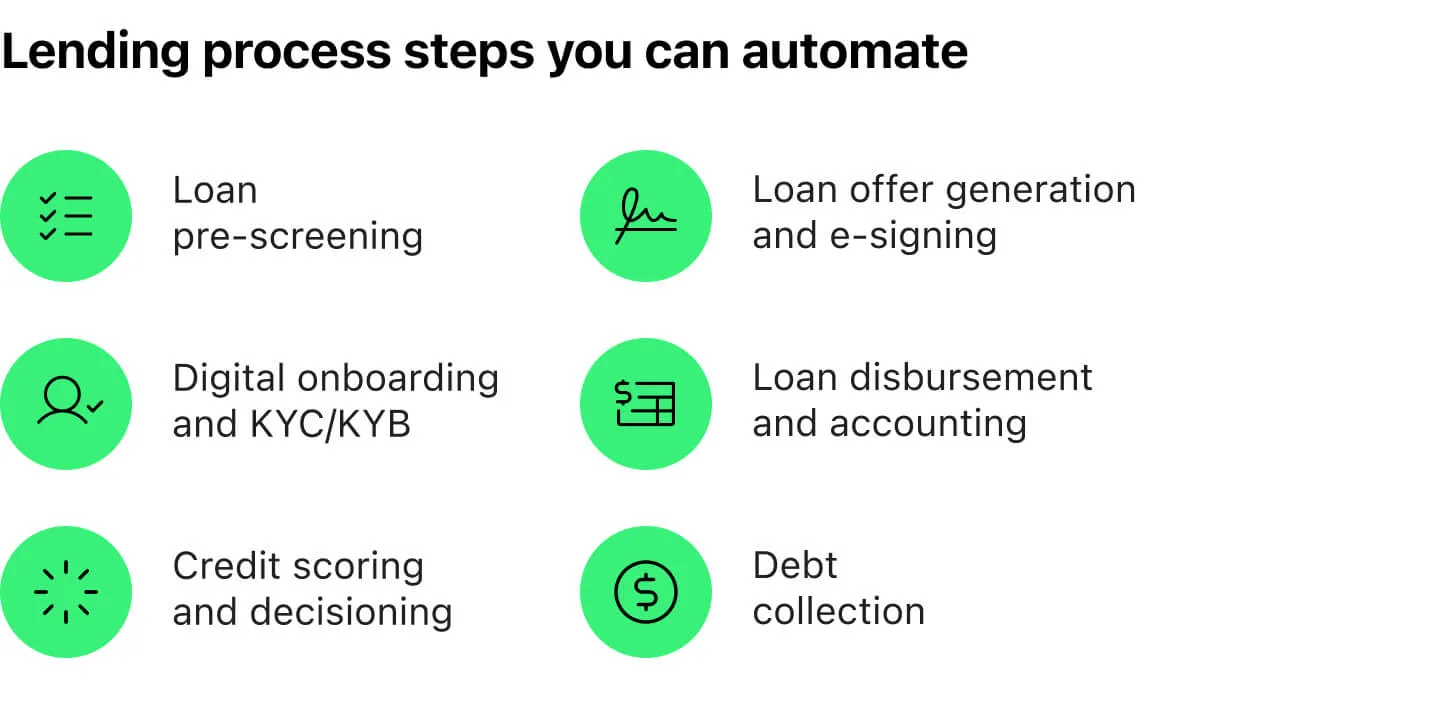

Automation is about transforming lending into a faster, more consistent, and scalable operation. In this guide, we break down six lending process steps that can be fully automated, from initial pre-screening to final debt collection. You’ll learn what each stage involves, how automation works in practice, and the benefits and challenges lenders should expect when implementing these solutions.

Most inefficiencies in lending are caused by broken processes. Whether it’s chasing documents, manually scoring applications, or reconciling disbursements at day’s end, traditional workflows introduce friction at every step. Automation solves this, but only when done deliberately. In this article, we map out six key stages where automation delivers the greatest ROI, along with practical tips for implementation based on real-world lending projects.

1. Loan Pre-Screening

Loan pre-screening is the first — and often most underestimated — opportunity to reduce inefficiencies in the lending process. At this stage, lenders evaluate whether an applicant meets the minimum eligibility criteria to move forward. It’s not about deep credit analysis yet; it’s about ensuring time isn’t wasted on applications that are clearly out of policy scope. Common filters include age, income level, citizenship, length of business operation, or even industry exclusions. While simple on the surface, this step plays a foundational role in maintaining underwriting capacity and optimizing funnel performance.

How to Automate Pre-Screening

Automating pre-screening brings instant wins. Rule-based engines can check incoming applications against configurable eligibility criteria in real time. With loan management software, credit teams can define and modify these rules via a no-code interface, eliminating the need to hard-code logic into the system or wait for developer resources. This flexibility is crucial—especially in dynamic lending environments where risk appetite may shift monthly or even weekly. The pre-screening engine can also tap into third-party data sources (like tax ID validators, business registries, or open banking feeds) to enhance decisioning without introducing friction for the borrower.

The benefits of automation here are immediate. Unqualified applicants are filtered out before they reach manual review, which significantly reduces the workload on underwriting teams. Decisions are delivered in seconds, enhancing the user experience by avoiding delayed rejections. Over time, data from rejected applications can be analyzed to understand patterns, optimize conversion rates, or identify segments that merit a different approach.

But getting it right takes more than just technology. One of the most common issues we see is a mismatch between pre-screening rules and the actual risk policy. Filters may be too restrictive, excluding potentially creditworthy borrowers, especially those with thin files or unconventional financial histories.

A smart pre-screening system should evolve. We advise clients to continuously compare rejected applications with downstream approval data.

Ivan KovalenkoCEO at HES FinTech

Ivan KovalenkoCEO at HES FinTech

Other common pitfalls include hard-coded rules that slow down policy updates, or a lack of clear rejection reasons, which can cause compliance issues in regulated markets. The key is to ensure that the pre-screening engine is both transparent and adaptable, providing a clear audit trail and empowering non-technical teams to maintain control.

When automation is implemented thoughtfully, this stage becomes a precision gate that protects underwriting resources, improves borrower satisfaction, and feeds valuable insights into the rest of the lending lifecycle.

2. Digital Onboarding & KYC/KYB

Once an applicant passes initial eligibility checks, the onboarding phase begins. With it, the complex task of collecting documents, verifying identity or business legitimacy, and ensuring compliance with Know Your Customer (KYC) or Know Your Business (KYB) regulations. This step is crucial for both regulatory alignment and fraud prevention. Yet, in many lending organizations, it remains fragmented, manual, and error-prone, creating bottlenecks just as a borrower is most engaged.

Automating Onboarding Effectively

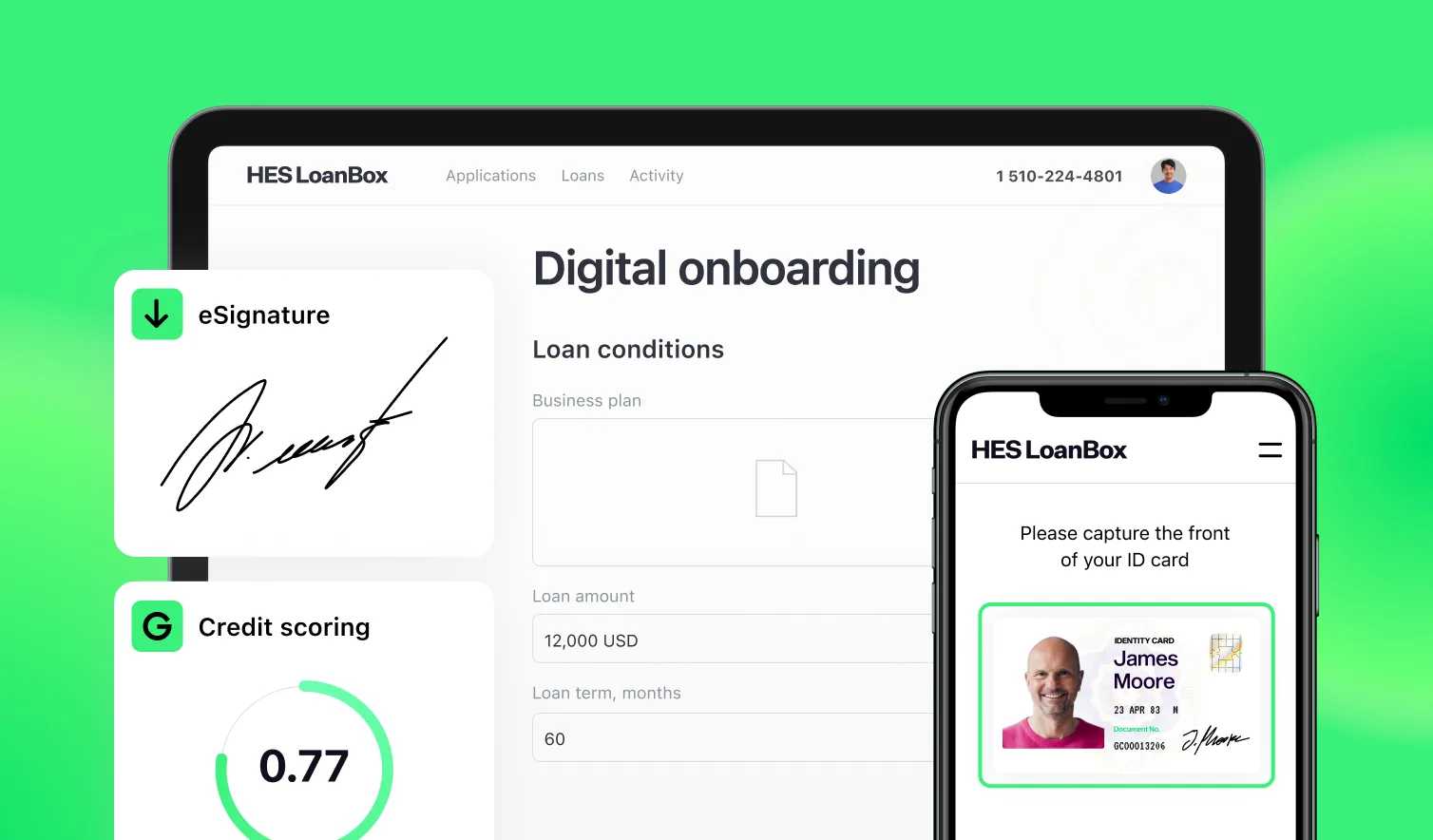

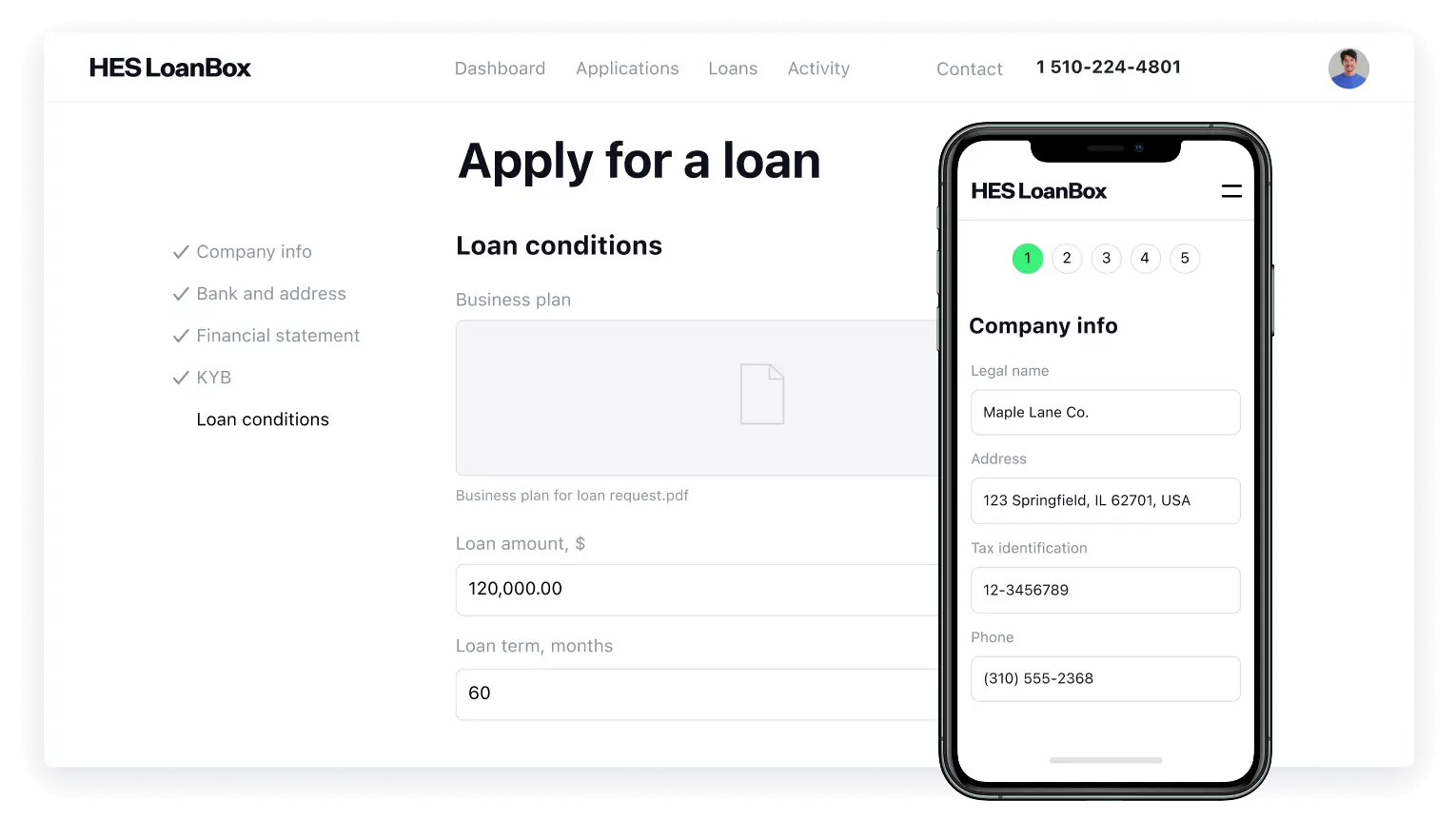

Automating onboarding is one of the most impactful steps lenders can take to improve speed, compliance, and user experience. With modern lending platforms like HES LoanBox, digital onboarding combines a seamless user interface with deep integrations into third-party systems, like credit bureaus, government registries, biometric identity providers, and e-signature tools. Applicants can upload documents directly through mobile or desktop interfaces, while the system performs real-time validation, detects incomplete submissions, and prompts the user to correct issues without agent intervention.

Biometric verification adds another layer of security and regulatory robustness. E-signature capabilities ensure that disclosures, consents, and agreements are signed electronically in full compliance with local and international laws. The result is a streamlined experience that can take minutes, not days, and works as smoothly for a sole proprietor applying from their smartphone as it does for a mid-sized business submitting more complex documentation.

Still, successful onboarding automation hinges on more than just plugging in APIs. Poorly implemented flows can backfire—resulting in failed verifications, repeated document requests, or applicant drop-offs due to unclear instructions.

We’ve seen onboarding processes that looked digital on paper but still relied on email attachments and manual data entry. True automation means creating a guided, responsive flow that adapts to each applicant’s profile, with as few back-and-forths as possible.

Anton LippertHead of Project Management at HES FinTech

Anton LippertHead of Project Management at HES FinTech

A common pitfall is underestimating the UX side of compliance. Legal requirements often vary by region and customer type, which means onboarding flows must be flexible enough to change depending on loan product, geography, or business size. One-size-fits-all forms rarely suffice, especially in multi-market deployments.

To get onboarding right, lenders must combine four elements: seamless UI, reliable third-party data sources, flexible configuration for compliance rules, and a real-time overview for back-office teams to track each applicant’s progress. When these elements work together, onboarding becomes a competitive differentiator.

3. Credit Scoring & Decisioning

Credit scoring sits at the heart of any lending business. It’s where a lender answers the most critical question: “Can we trust this borrower to repay?” Yet despite its centrality, scoring and decisioning are often tangled in legacy systems, hard-coded rules, and opaque models that fail to evolve with borrower behavior or data availability.

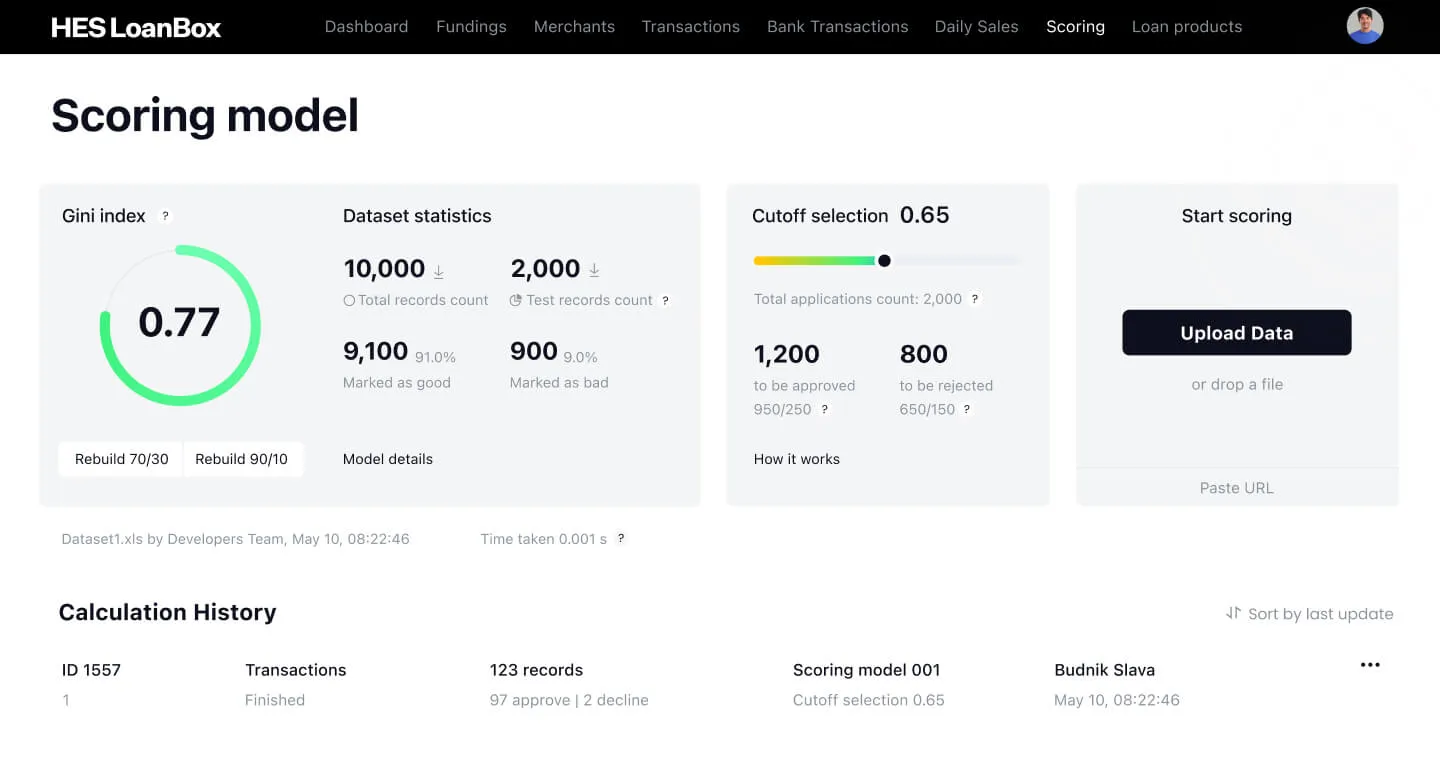

Modern credit scoring automation replaces these bottlenecks with fast, data-driven, and explainable decisions. With a platform like HES LoanBox, lenders can combine AI and machine learning models with deterministic business rules to build a layered scoring approach—one that balances statistical insight with regulatory transparency. Scores can incorporate traditional data sources (such as credit bureau reports or banking transaction histories) alongside alternative data streams like utility bills, telecom usage, ecommerce behavior, or social signals—especially valuable in underbanked or emerging markets.

Digitizing Scoring and Decisioning Processes

Automation enables scores to be calculated instantly and decisions to be made within seconds, even with multiple layers of risk segmentation and custom criteria. Borrowers don’t wait for manual review unless necessary, and credit officers can review decisions with a full digital trail. Business users can test and refine scoring strategies through champion-challenger models, continuously improving outcomes without deep tech involvement.

But powerful automation also demands accountability. The EU AI Act and similar regulations globally now classify automated credit scoring as a “high-risk” activity. That means lenders must be able to explain how decisions are made—not just to internal stakeholders, but to regulators and borrowers.

The most common implementation risk is relying entirely on “black box” models. While ML can uncover subtle risk signals, it should enhance the institution’s credit policy, not replace it. Lenders must maintain visibility and control, especially when using third-party models or credit scores that might not reflect their portfolio strategy.

Another challenge is fragmented logic. In many older systems, scoring rules, rejection criteria, and pricing logic live in separate modules or even spreadsheets. This creates inconsistencies and slows down updates. An effective decisioning engine should consolidate all of these into a single, auditable flow with the ability to trigger different outcomes (auto-approval, manual review, conditional offer) based on defined thresholds.

4. Loan Offer Generation & E-Signing

The longer it takes to present loan terms and secure acceptance, the greater the risk of drop-off, especially in competitive markets. Automating the generation of loan offers and the signing process allows lenders to respond instantly — with personalized, compliant proposals that convert faster and reduce operational overhead.

Bringing Automation to Offer Generation

In a fully automated lending flow, loan offers are generated based on the borrower’s risk profile, eligibility criteria, and product configuration. Systems like HES LoanBox dynamically calculate loan amounts, interest rates, fees, and repayment schedules. This ensures that offers are not only compliant, but also tailored to both business goals and customer expectations.

The offer generation module automatically pulls data from the scoring and underwriting phase to prefill contract templates. It then uses configurable business logic to calculate repayment terms, add grace periods or fees where applicable, and produce fully formatted documents ready for signing. Borrowers receive the offer via mobile or desktop, review the terms, and complete the process using an e-signature tool integrated directly into the platform.

This level of automation delivers two major advantages. First, it dramatically shortens the “time to yes” from hours or days to mere minutes. Second, it minimizes manual errors and rework associated with inconsistent templates, manual inputs, or unclear terms. “We’ve seen clients cut their approval-to-disbursement window by over 70% simply by automating offer generation,” says Artem Britun, Head of Business Analysis at HES FinTech. “But even more importantly, it reduced friction at the most sensitive point in the customer journey.”

Another key consideration is ensuring that the e-signature process meets local legal and regulatory standards. It’s not enough to “go digital ”— it must be verifiable, timestamped, and legally enforceable. Integration with trusted providers (like PandaDoc, Adobe Sign, or regional equivalents) is essential, along with a clear audit trail.

At this stage, speed, clarity, and compliance converge. A well-automated offer and signing flow builds trust with the borrower, reduces abandonment, and accelerates revenue realization, all while keeping the legal team at ease.

5. Loan Disbursement & Accounting

Once a borrower accepts the offer, the lender’s promise becomes real: the money must move, and the system must account for it. In a manual environment, this final step is often the most error-prone — requiring back-office teams to toggle between banking portals, ERP systems, and spreadsheets. Delays or mistakes at this stage expose the business to reconciliation issues, compliance risk, and cash flow blind spots.

Embedding Automation into Loan Disbursement

Automating disbursement and accounting solves both the operational and reputational risk. In a well-orchestrated system like ours, once an offer is signed, the platform automatically triggers the disbursement workflow. Funds are transferred to the borrower through integrated banking APIs — whether through traditional bank rails, mobile wallets, or instant payment providers. At the same time, the platform updates all related internal records: the general ledger, loan balance, accruals, and transactional history.

Accounting is often overlooked in early-stage lending automation. Many teams automate disbursement but still rely on manual data entry or end-of-day uploads to sync loan data with finance systems. This creates discrepancies, makes audits painful, and limits visibility into real-time portfolio performance.

We’ve seen clients spending hours reconciling balances manually. The real value comes when every transaction is automatically journaled and linked to the appropriate customer and product line.

Artem BritunHead of Business Analysis at HES FinTech

Artem BritunHead of Business Analysis at HES FinTech

Successful automation requires more than just connecting to a bank. It means ensuring every disbursement is validated, every transaction is logged with full traceability, and every accounting entry complies with internal policies and external standards. This is particularly important in regulated markets or when working with cross-border transactions, multi-currency portfolios, or tiered funding structures.

Disbursement is the moment your loan product becomes tangible. Automating it ensures control, transparency, and audit-readiness from the first transaction onward. When properly integrated with accounting, it forms the backbone of a scalable, resilient lending operation.

6. Debt Collection

No matter how strong your scoring model or underwriting discipline, every loan portfolio will include delinquencies. The question is not whether borrowers will miss payments — but how quickly and effectively you respond when they do. Debt collection has long been viewed as a cost center, plagued by manual call centers, rigid scripts, and reactive strategies. But today, AI-powered automation is transforming collections into a strategic, data-driven function that drives recovery rates without compromising borrower relationships.

Where Automation Fits in Debt Collection

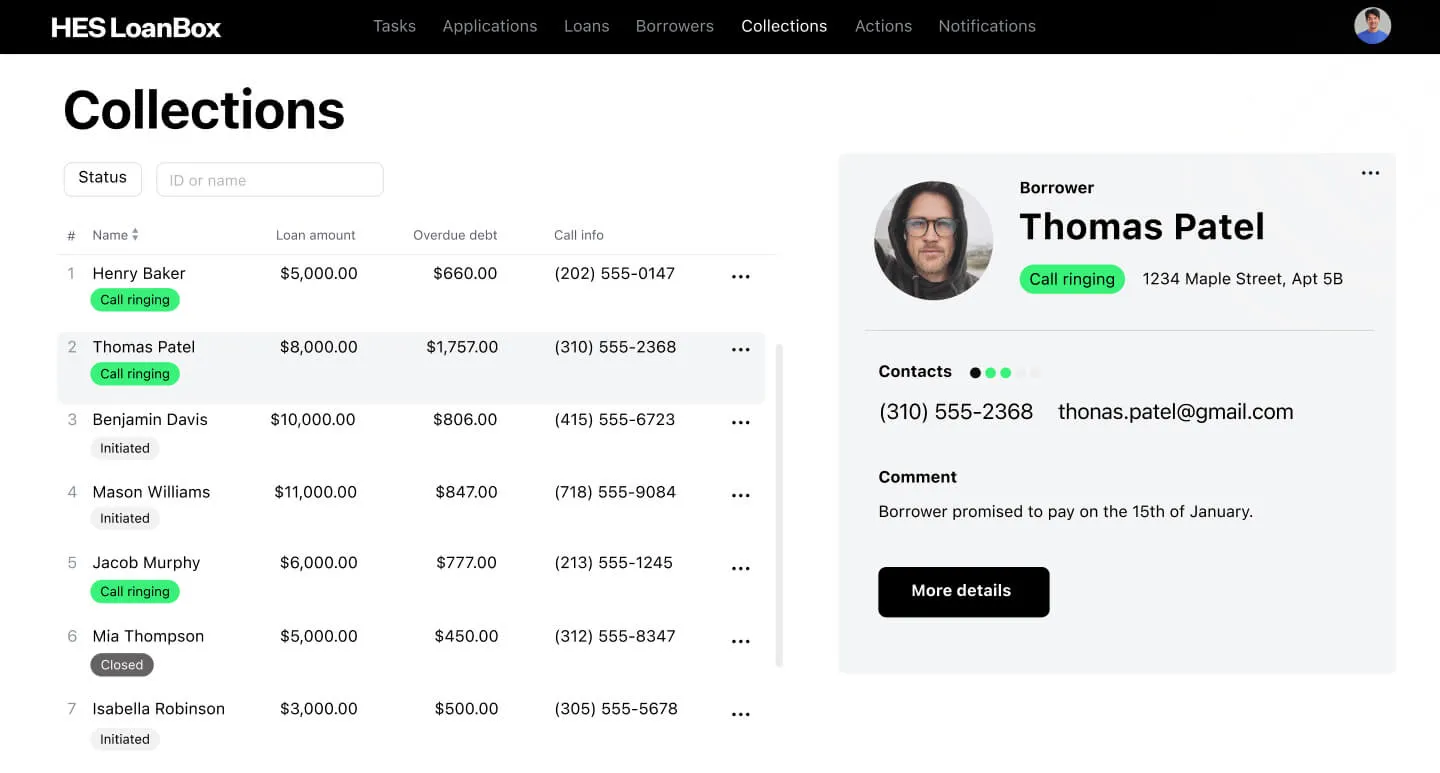

Automated debt collection begins with segmentation. Using behavioral and financial data, the system categorizes borrowers into risk groups based on payment history, transaction patterns, and even interaction preferences. Platforms like HES LoanBox allow lenders to design smart collection strategies that match the tone and timing of communication to each borrower segment. A borrower who simply forgot a payment may receive a polite SMS reminder and link to pay online, while a higher-risk case might trigger escalation workflows or agent assignment.

AI adds another layer of intelligence. By analyzing historical outcomes, machine learning models can predict the best time, tone, and channel to reach a borrower — or when to escalate.

We’ve built models that identify the tipping point between a nudge that works and one that backfires. This allows lenders to preserve the relationship while still enforcing repayment discipline.

Mark RudakML Product Owner at GiniMachine

Mark RudakML Product Owner at GiniMachine

One of the most frequent pitfalls we see is underestimating the flexibility required for collections. Many lenders adopt basic reminder flows but stop short of building strategy layers based on behavior. Others lack integration with payment providers, forcing borrowers to pay through disconnected channels — creating friction exactly when the goal is to ease repayment. A mature solution links each message to a frictionless payment experience, whether through embedded links, QR codes, or auto-debit features.

For in-house agents, automation also unlocks productivity. The system can assign cases based on workload, success rates, or borrower type. Agent workspaces surface context-rich borrower histories, recommended next steps, and even response templates — so teams can act quickly and consistently.

In the end, the best collection strategy is adaptive. With the right automation in place, lenders can reduce delinquency, recover more funds, and protect their brand, all while treating borrowers with empathy and precision.

Automate your lending business

Conclusion

Automating the lending process is a structural requirement for any lender looking to scale responsibly, serve customers faster, and control risk more effectively. From the earliest filter of loan pre-screening to the final stages of collections, automation unlocks efficiencies, improves consistency, and reduces the margin for error at every step.

As we’ve seen, each stage — from onboarding and scoring to disbursement and accounting — comes with its own operational and regulatory complexities. The real advantage lies in knowing how to implement automation thoughtfully: selecting the right integrations, ensuring auditability, tailoring the borrower experience, and enabling your internal teams to stay in control.

At HES FinTech, we’ve helped alternative lenders, MFIs, and embedded finance providers in 30+ countries move beyond fragmented tools and legacy workflows. Whether you’re fine-tuning a specific stage or redesigning your system end-to-end, HES LoanBox is built to support flexible, scalable, and compliant automation.

If you’re evaluating where to start or how to improve, let’s talk. Our team can help you assess your current workflow, identify automation gaps, and build a roadmap aligned with your risk appetite and growth strategy.