Installment loan software has been steadily gaining traction among fintech businesses. It streamlines how lenders issue, track, and manage credit while reducing administrative overhead and enhancing both the user experience and borrower accessibility.

The opportunities behind this technology are indeed vast, and that’s exactly why fintechs are racing to adopt it. Importantly, with the global loan servicing software market expected to reach $8.32 billion by 2033, the trend points to growing reliance on digital platforms that bring efficiency, flexibility, and compliance to modern lending processes. This growth is further fueled by regulatory demands for more transparent lending, the adoption of open banking APIs, and the need for real-time data sharing.

In this article, we’ll take a closer look at installment loan management software, the features that define it, and the business benefits that it brings. We’ll also share some actionable tips to help you choose a platform that fits your company’s goals, workflows, and growth ambitions.

What Is Installment Loan Software?

Installment loan software is a digital system that helps lenders automate and better manage the repayment process of installment-based loans.

It provides a unified platform that consolidates borrower information, payment histories, and compliance data into a single environment. Within it, lenders can configure loan products with varying terms, interest rates, and repayment schedules while maintaining accuracy, transparency, and full auditability throughout the lending process.

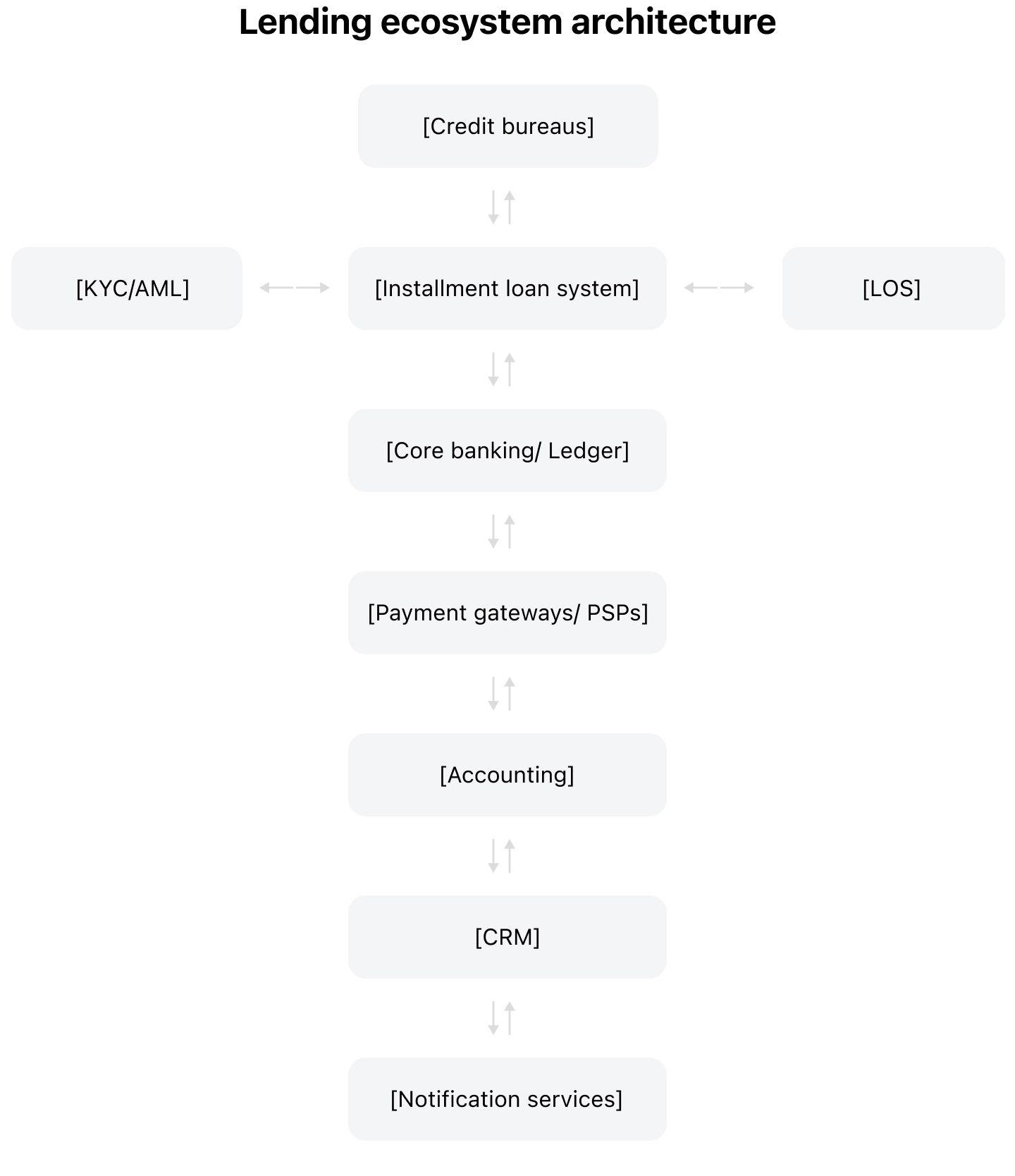

In addition, most modern installment loan platforms support API integrations with core banking, CRM, and accounting systems to enable streamlined workflows and unified financial reporting.

Installment Loan Systems vs Traditional Loan Management Software

While traditional loan management platforms oversee the overall lending process, from loan origination to servicing, installment loan systems are purpose-built to handle the unique dynamics of installment-based repayment.

They focus on scheduling and tracking recurring payments, recalculating balances after each installment, and ensuring borrowers stay on schedule through automated reminders and reporting.

Why Is Installment Loan Management Software Popular Among Fintechs?

According to a report by Stats N Data, the installment loan software market is expanding and becoming a key focus area for fintech companies due to several driving factors that are reshaping the way modern lenders operate and compete.

These include:

- rising demand for quick and convenient loan processing

- heightened competition among lenders to offer better terms

- an expanding consumer base seeking alternative financing methods like BNPL, microcredit, or peer-to-peer lending

- regulatory and compliance pressure (the need for compliance automation and the necessity to meet global standards like GDPR and PSD2).

What Are the Benefits From Installment Loan Management Software?

Installment loan software provides a wide range of business and operational advantages that enable fintechs to stay agile, competitive, and efficient.

| Benefit | What it means for fintechs |

|---|---|

| Greater operational efficiency | Businesses streamline loan servicing, reduce manual overhead, and free teams for more important work |

| Enhanced borrower experience | Lenders deliver faster approvals and build stronger customer loyalty |

| Significant cost savings | Fintechs manage to cut operating expenses and increase long-term profitability |

| Data-driven performance insights | Decision-makers are able to optimize credit strategies using accurate real-time data |

| Smarter and faster underwriting decisions | Lenders accelerate approvals while improving credit risk accuracy |

Let’s explore some of the most impactful ones.

1. Greater Operational Efficiency

Installment loan systems deliver end-to-end loan automation that eliminates manual data entry and minimizes human error.

Tasks like payment processing, document verification, borrower communication, and collections follow-ups are handled through preconfigured workflows and rule-based triggers, which substantially accelerates day-to-day servicing and standardizes processes across departments.

Thanks to this, teams spend less time on repetitive administrative work and manage to devote more time to building stronger borrower relationships and strategically managing portfolio growth.

2. Enhanced Borrower Experience

Installment loan management software allows lenders to offer their customers convenient digital onboarding, transparent account tracking, and proactive communications via email, SMS, or in-app notifications. Besides, it connects credit checks, underwriting, and document signing into one continuous flow, thereby delivering faster approvals and a more intuitive borrowing journey.

As a result, borrowers feel more informed and in control while fintechs benefit from stronger engagement, higher satisfaction rates, and improved customer retention that compounds over time.

3. Significant Cost Savings

Beyond operational convenience, installment loan software produces tangible cost savings across the lending cycle.

By consolidating loan servicing, origination, and collections under one digital system, lenders manage to cut overhead costs associated with manual supervision and redundant tools.

Plus, automation reduces staffing needs and error-correction expenses while centralized workflows improve productivity at scale.

4. Data-Driven Performance Insights

Installment loan platforms help transform raw data into actionable business intelligence.

Modern solutions often come with integrated analytics and customizable dashboards or allow easy integration with third-party analytics tools so as to help reveal patterns in repayment behavior, delinquency trends, and product performance.

With these insights, decision-makers are able to fine-tune their pricing models, improve credit risk assessment, and even uncover new lending opportunities.

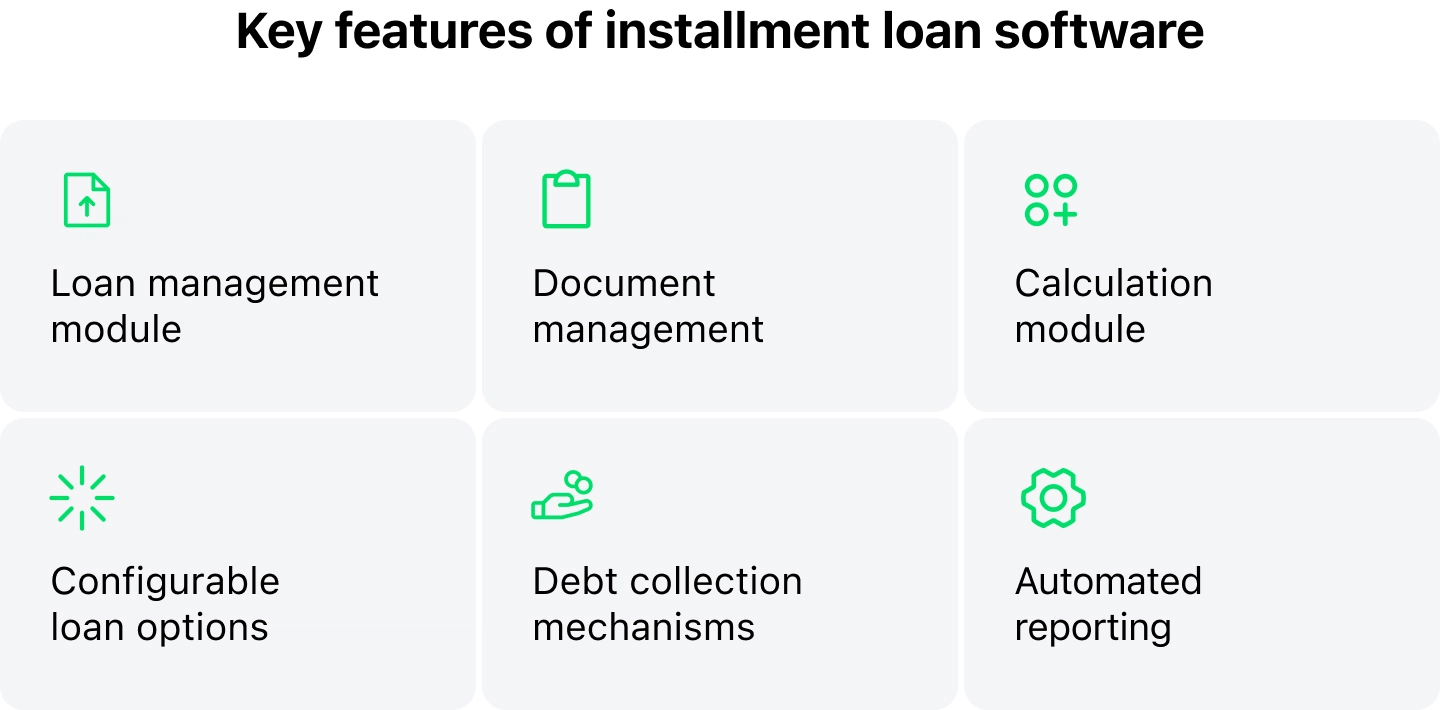

Key Features of Installment Loan Software

Installment loan platforms come with a range of features and functionalities that facilitate lending processes, reduce risk, and enhance the borrower experience.

Below, we’ll take a closer look at the key features that make these platforms essential for efficient installment lending.

1. Loan Management Module

The loan management module tracks every installment loan through its full lifecycle, from origination and disbursement to repayment, renewal, and closure, thus giving lenders real-time visibility into balances, interest accrual, and borrower activity.

Besides, automated alerts and workflow triggers help teams stay on top of key events like missed payments or renewal opportunities, which, in turn, supports accuracy, transparency, and scalability across thousands of concurrent loan accounts.

2. Document Management

Installment loan platforms automate the generation, storage, and verification of essential files such as loan agreements, disclosures, and identification documents. They reduce compliance risks and make audits straightforward by keeping all records centralized and easily traceable.

Plus, with built-in e-signature capabilities, borrowers can securely sign documents from any device, which significantly reduces approval times and eliminates paper trails.

3. Calculation Module

The calculation module powers the financial logic behind lending operations. It allows lenders to configure credit lines, set installment structures, and manage variable interest models with precision.

The module can also automatically calculate repayment amounts, amortization schedules, and interest adjustments, even for complex products like cash advances or revolving credit.

4. Configurable Loan Options

Modern installment loan platforms, like HES LoanBox, feature flexible product configuration tools that let lenders design and launch new loan offerings in minutes. They can define repayment frequency, set amount limits, modify interest rates, or introduce promotional products without coding or vendor dependency.

Thanks to this feature, fintechs are able to innovate, better adapt their products to market shifts, and deliver a consistent and customized borrowing experience.

5. Debt Collection Mechanisms

Efficient debt collection is vital for maintaining healthy cash flow in installment lending.

The right software automates reminder sequences, triggers follow-ups, and categorizes borrowers based on delinquency stage or risk profile. It also empowers agents to access detailed borrower histories and communication logs in real time, enabling precise and compliant interventions that boost collection efficiency and support the overall health of the loan portfolio.

6. Automated Reporting

Automated reporting tools collect data across every stage of the installment loan lifecycle and convert it into actionable insights through interactive dashboards and easily exportable reports.

Using them, lenders gain instant visibility into KPIs such as delinquency rates, disbursement volumes, and repayment patterns, which, in turn, informs strategic planning and simplifies regulatory reporting through consistent and traceable data output.

What to Prioritize in Loan Software for Your Business

Choosing the right installment loan software is a complex task that requires careful consideration of multiple factors to make sure the platform will be able to address your business needs and support efficient operations.

Checklist for selecting the right installment loan software

- Integration capabilities

- Scalability and performance

- Security and compliance

- Customization and flexibility

- User experience for borrowers and staff

- Vendor expertise and support

Below, we elaborate on the key aspects to keep in mind when evaluating potential platforms.

1. Integration Сapabilities

When data flows automatically across systems, your teams spend less time on reconciliation and more time focusing on borrowers.

For this reason, prioritize solutions with robust APIs and prebuilt integrations for payment gateways, accounting software, credit bureaus, and other key platforms.

2. Scalability and Performance

It’s advisable to opt for a modular loan system as its design allows lenders to scale horizontally, that is, handle growing loan volumes, quicker launch new products, and expand to additional units without costly reengineering.

3. Security and Compliance

Financial data demands the highest level of protection. Thus, go for platforms that include end-to-end encryption, role-based access control, and automated KYC/AML verification.

Real-time audit logs and compliance dashboards are equally essential as they give your compliance officers instant visibility and keep your lending operations aligned with both internal policies and external regulations.

Importantly, make sure that the platform complies with recognized security standards and certifications such as SOC 2, PCI DSS, and ISO 27001 to guarantee robust data protection.

4. Customization and Flexibility

Your installment loan software should have a high degree of customization to make it possible for you to easily configure loan products, repayment schedules, and/or approval workflows.

Remember, the more adaptable and flexible the platform, the easier it becomes to experiment with new lending models and quickly adjust to market changes and demands.

5. User Experience for Borrowers and Staff

A well-designed interface benefits both borrowers and back-office teams.

Borrowers need to have clear visibility into their repayment schedules, account history, and remaining balances through an intuitive dashboard.

On the back-office side, analysts and servicing teams require dashboards that minimize clicks, simplify case management, and surface key data without manual digging, all of which directly reduce operational fatigue and errors.

6. Vendor Expertise and Support

Evaluate vendors based on their experience in the lending industry, a successful track record of implementing lending solutions, and the responsiveness of their technical support.

A partner with these strengths can make a real difference by helping you maximize system capabilities, optimize workflows, and turn technology investments into measurable business results.

Conclusion

Installment loan software helps fintech businesses optimize day-to-day operations, lower operational expenses, and deliver a better experience for borrowers.

When selecting the platform for your business, consider how well the system integrates with your existing tech stack, its capacity to scale as your operations grow, and its approach to compliance and data security. Also, pay attention to configurability and user experience, both for your team and your borrowers, as these factors will determine how much real value the software will bring you over time.