The way your clients borrow is changing. The COVID-19 pandemic proved that no person or business is immune to volatility. For borrowers, this meant an increase in both personal loans and business credit as a means to stay afloat during the crisis or even capitalize on new market opportunities. For lending providers, this meant adapting and learning how they can optimize their performance without significantly increasing their risk during these troubling times. And the best place to start is at the beginning with loan origination software.

Loan origination software is the first step in the loan management process. Getting it right sets the tone, and risk level, for the entire loan funnel. Encompassing client onboarding, decision-making, document management, reporting, and more, it is an essential tool that any lending provider should have.

Read also

3 Reasons to Transform Your Loan Origination System

In 2020, the digital lending sphere was estimated to grow by 11% CAGR, showing an increase in demand not only for lending but for efficient digital services. Here's why you need to place updating your credit union or bank loan origination software in the first place:

Customer service

We said it before, and we'll say it again, the demand for seamless digital services is increasing. Clients expect simplicity, speed of service, personalization, and control in loan origination processes. By undergoing digital transformation you get a chance to meet clients’ expectations in full. For example, your borrowers can create and manage a feature-rich personal account. It allows:

- Creating and managing loan applications

- Tracking active and past loans

- Extending loans or rolling them over

- Monitoring payment schedules

- Setting notifications and more.

Risk management

Origination software isn't all about creating a seamless onboarding process (although that is part of it). It's also about ensuring minimal risk to your organization. Whether that's checking your client's ID for KYC or AML, managing data according to national and international regulations, analyzing your client's credit score, or something, it's vital you get your loan origination process right at the start. This helps avoid risks further down the line.

Process optimization

How your business functions are important. Alongside providing stellar service to your clients, keeping your staff satisfied is important too. It's been scientifically proven that satisfied staff performs better. While in the current market environment, your team is likely experiencing increased stress as it is, setting out clean and efficient digital processes can help streamline their work and increase your overall efficiency.

5 Steps to Upgrade Your Loan Origination System

Compelling as these reasons are, transforming your current loan origination cycle is no easy feat. Nor is it something that should be taken lightly. At the same time, there's no reason to let the fear of development take over. To help start you off on the right track, here are our top five tips for optimizing your loan origination system process and transforming your business.

1. Organization-wide approach

Your client should be at the center of your business. By focusing on their needs and delivering value, you set yourself up to be more successful. That said, of course, the value should not affect profitability or efficiency. For all these reasons, when choosing to upgrade loans origination software, it's vital that you approach it as an organization-wide initiative. Focus on improvements to the overall service rather than an isolated technology upgrade. By integrating your loan origination software into wider development, you will discover tangible results that deliver value across your entire loan pipeline.

2. Simplicity and speed

Don't create roadblocks where they don't need to be. When your clients come to you, they expect a seamless service that takes account of their needs and answers to their application as soon as possible. According to research by Forrester, 66% of potential clients say that their time is the most valuable thing when it comes to onboarding. That's just one reason why it's essential to initiate an efficient mortgage loan origination process that allows you to deliver simplicity and security all in one go. This software can be stand-alone or integrated with your current tools, allowing you to automate routine processes and deliver greater efficiency for your team.

3. Data management

Poor data and data management is estimated to cost businesses an average of $14.2 million annually. With Big Data growing as a trend, it's vital that you manage your customers' data efficiently. Not only does this keep you in line with regulations such as KYC, AML, and GDPR (EU), it helps you manage your business better. Empowered by properly gathered and stored data, you can adjust your business model to meet your client's needs, target marketing campaigns, and predict loan risk more efficiently.

4. Choose a reliable partner

Quality, reliability, and ability – these are the key traits to look out for when choosing an IT services partner. Whether you're seeking a solution to optimize your mortgage origination process or create an entirely new system for personal loans, then you need the right hands on deck. Your loan origination software vendor will not only provide you with the technical elements of your new solution but help guide you in its use to ensure maximum efficiency.

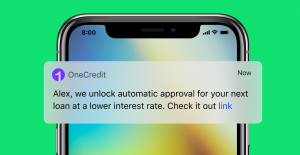

5. Analytics focused

The modern world is data-driven. From ordering your coffee in the morning to checking your Facebook feed to the business decisions you make – data is everywhere. But why is it so important in the loan origination software business? By focusing on the data collected from your customers, you are better able to access the level of risk of loan repayments. It's time to stop treating clients as stereotypical groups and high time to use data to assess the real risk, not the perceived one.

Read also

Should You Upgrade Lending?

Budget, time, resources. These are all elements to consider when deciding if now is the right time to upgrade your loan origination processes. By accessing the current capabilities of your business and its potential for growth, you will be better equipped to make the decision about how and when to upgrade.

Update your loan origination software – contact our team to launch a project.