Interest in starting a private lending business is growing, as businesses frequently require funding within timeframes that banks are often unable to meet. This gap is rooted in the structure of the banking industry itself.

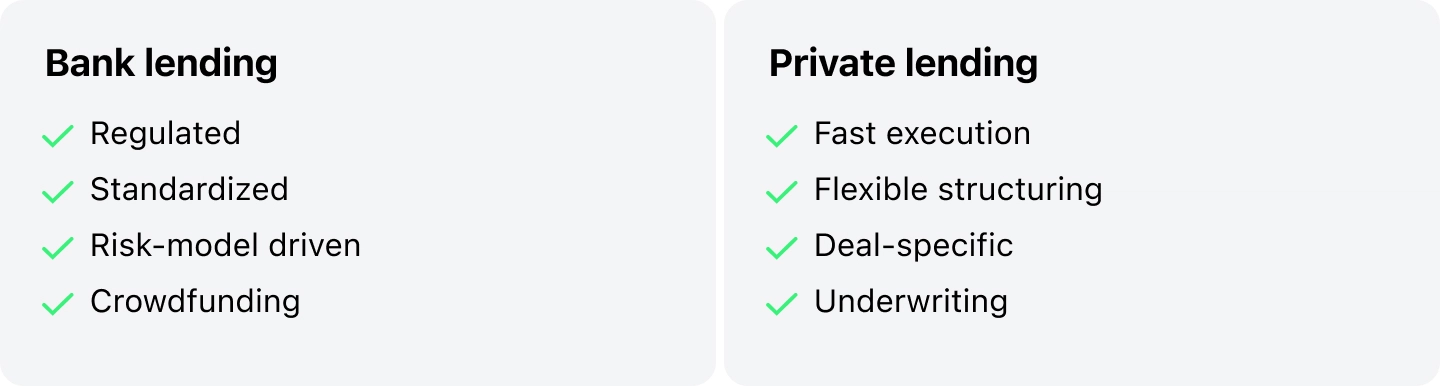

Banks operate within tightly regulated frameworks, are bound by capital and operational requirements, and rely on standardized credit and risk models. These constraints prioritize stability and compliance, often at the expense of speed and flexibility. As a result, lending decisions are driven largely by historical borrower data and predefined criteria, even when a transaction is commercially sound.

For these reasons, by 2026, private money lending has become a strong alternative to bank financing, providing faster decisions and loan terms that can be adjusted to fit the specific business realities.

However, the answer to the question 'How to start a private lending business' is not the easiest one. Below, we present a private money lending guide explaining all the intricacies and challenges.

Key Takeaways

- Private lending has emerged as a fast-growing alternative to traditional bank financing, driven by the need for speed, flexibility, and tailored loan structures.

- The principle of how to build a private lending business that is successful and scalable lies in clear loan structures, streamlined processes, and the right niche focus. Equally important is portfolio and risk diversification with spreading exposure across loan types, industries, and borrower profiles.

- Finally, the right private money lending software is a strategic game-changer. Such platforms make it possible to scale operations without losing control by automating all the steps, keeping transparency and compliance, and providing lenders with real-time visibility into portfolio performance.

How Does Private Money Lending Work

The private money lending business has been growing quickly in recent years and is now an essential part of the global finance market. According to research by Mordor Intelligence, the size of the global private credit market is estimated at USD 1.67 trillion in 2025 and is projected to grow to USD 2.9 trillion by 2030, with an annual growth rate of 11.62% over the 2025–2030 forecast period.

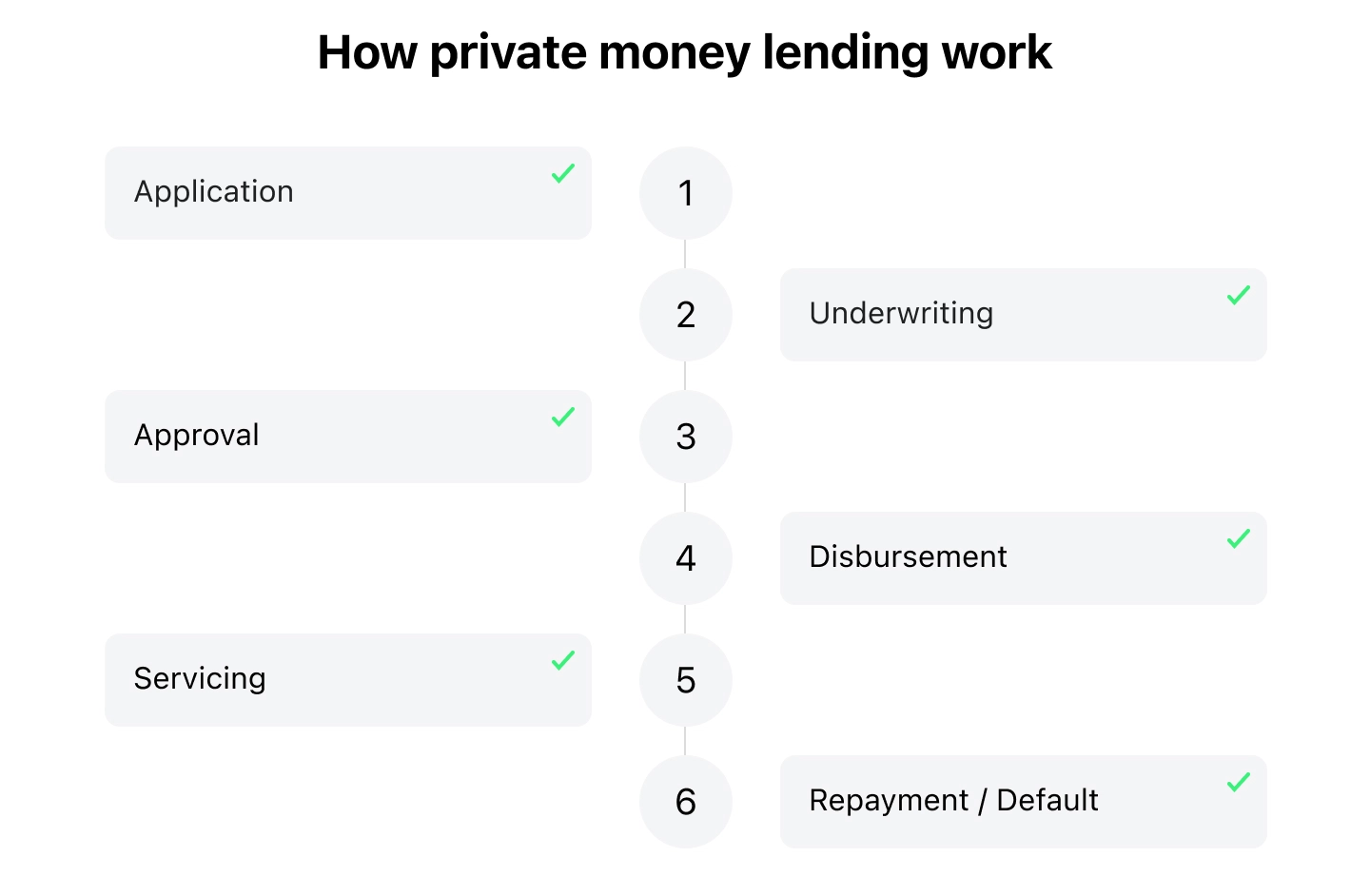

Private lending loans are traditionally used in the fields of real estate property, business operations, and short-term needs. They typically move through a clear, well-defined lifecycle that allows lenders to manage risk while keeping decision-making fast and efficient.

The private lending process begins with the borrower's application and underwriting stage, where the lender evaluates the loan purpose, borrower profile, and collateral. This is followed by due diligence and risk assessment, including asset valuation, credit checks, and legal verification. Next comes loan structuring and approval, with final loan size, interest rates, repayment schedules, and collateral conditions agreed, followed by documentation and funding.

During the loan term, lenders ensure ongoing servicing, tracking repayments and risk, with collection if needed, and loan closure with collateral release upon successful repayment.

Due to this clear process, many businesses and individuals have turned to private lending loans as an alternative source of funding, especially when their credit history is incomplete or does not match bank standards and regulations.

How to Become a Private Lender

For private companies or entrepreneurs who are going to get into the private lending business it is pivotal to understand how to launch and develop it.

First, you need to secure your essentials: lending capital to provide loans, startup capital to cover business expenses like marketing, website development, or office costs, and at least a basic awareness of lending practices or guidance from an experienced partner or advisor.

Next, decide on your niche, whether to offer private money loans for real estate deals, or bridge loans, or to lend to small businesses or individuals or whatever else, so you know potential borrowers you will serve.

Set clear loan terms, including repayment schedules, interest rates, and collateral requirements, making sure that agreement is fully understood by borrowers. Follow local, state, and federal legal requirements, and consult a lawyer if needed to stay compliant.

Finally, build trust with borrowers through transparent communication, and use lending software to automate applications, approvals, repayments, reminders, and document management.

By combining these steps, you will know how to start a private lending company in an efficient and profitable way.

Types of Loans Offered by Private Business Lenders

Private lenders can offer different loan options to meet the needs of business owners. Each loan type serves a specific purpose and comes with its own terms, repayment rules, and risk level. The type of loan also determines who qualifies, what collateral is needed, how repayments are structured, and what legal or operational requirements apply. The most in-demand private lending loans:

1. Private Money Loans for Real Estate and Property

These are the core products in financing both residential and commercial properties. Such loans combine strong collateral protection with repeatable underwriting and servicing processes.

Asset-backed loans allow private money lenders to focus mainly on the value of the property instead of the borrower’s credit history. This makes approval easier and allows funding to be provided more quickly. Loan-to-value ratios (LVR), exit strategies, and potential recovery costs can be modeled in advance, making capital exposure more manageable.

From an operational standpoint, these loans require minimal ongoing management from the private money lender. Collateral inspections and valuation updates are periodic, defaults follow established legal procedures, and repayment behavior is generally stable compared to unsecured lending.

Demand remains strong, particularly among individual borrowers seeking fast closings, refinance solutions, or short-term capital outside traditional banking channels.

Examples of loans, including their estimated risk for private money lenders and current market demand:

Residential mortgages enable the acquisition of the single-family homes. Risk is relatively low if potential borrowers have strong credit and the property has solid value. Demand is steady because homeownership is always in demand. Risk arises from borrower default or falling property values, and can be reduced by proper credit checks, down payment requirements, and conservative LVR.

Fix-and-flip loans offer financing for purchasing and renovating properties to resell quickly. Risk is moderate to high due to renovation delays, cost overruns, or market fluctuations. Demand is high in active housing markets. Risk can be mitigated by reviewing detailed rehab budgets, monitoring progress with draw schedules, and lending to experienced flippers.

Rental property loans help buying properties intended for rental income. Risk is moderate because repayment depends on rental cash flow. Demand is strong in areas where there is a need for rental housing. Risks include rent decreases and can be reduced by verifying rental income projections, property management plans, and requiring sufficient equity.

Commercial real estate loans finance income-producing properties: retail spaces, office buildings, or multifamily complexes. Risk is quite low due to steady rental income but exists if tenants leave or market rents fall. Demand is consistent among investors. Risk can be reduced through tenant quality checks, debt service coverage ratios, and conservative loan-to-value limits.

2. Business and Commercial Loans

They provide capital to companies for operations, equipment, inventory, or short-term growth projects.

Private money lenders often favor this segment because the risk can be anchored to the business’s cash flow, contracts, or tangible assets rather than the owner’s personal credit history, allowing for faster decision-making and more flexible loan structures.

These loans demand active but manageable oversight, with monitoring focused on financial performance, receivables, and collateral, while protections such as liens or personal guarantees help limit losses.

The benefits include higher yields, the ability to customize terms, access to borrowers overlooked by traditional banks, and the opportunity to carve out specialized niches such as service providers, startups, or seasonal businesses.

The challenges lie in unpredictable cash flow, more hands-on underwriting, higher default potential if revenues fall short, and sometimes complex legal or regulatory requirements. When approached carefully, this type of lending can deliver strong returns, provided the lender maintains disciplined risk controls and focuses on segments where they have expertise.

Examples of loans including their estimated risk for private money lenders and current market demand:

Small business loans provide businesses with operational expense, working capital, or expansion. Risk is moderate to high because repayment depends on business performance rather than hard collateral. Demand is strong, especially among startups and growing businesses. Private lenders reduce risk by carefully reviewing financial statements, requiring personal guarantee and setting shorter terms for lons.

Bridge loans cover immediate financing gaps, often until a longer-term loan or other funding is secured. Risk is moderate due to reliance on a timely exit strategy. Demand is high for businesses and investors needing fast access to funds. Risk can be mitigated by verifying exit plans, limiting loan terms, and maintaining adequate equity or collateral.

Mezzanine loans fill gaps between senior debt and equity in business or real estate projects. Risk is high because repayment is secondary to senior debt, making default more impactful. Demand is moderate, mainly among growing companies or developers seeking leveraged funding. Risk can be reduced by structuring clear terms, requiring equity stakes, and carefully assessing the borrower’s cash flow and financial health.

3. Consumer Loans

A broad category of loans intended for personal, non-business purposes. Present various types of support for everyday needs, emergencies, or large expenses to meet individual requirements. They can be short-term or long-term and may be secured, backed by collateral such as a car or home, or unsecured, with no collateral, like credit cards or personal loans.

Private money lenders are drawn to this segment because repayment terms are usually predictable, documentation is standardized, and loans can be issued quickly without complex procedures. Managing these loans is relatively straightforward, requiring regular monitoring of payments and, in some cases, collateral such as cars or other assets to reduce risk.

The main benefits include consistent demand from borrowers who may not qualify for traditional bank financing, the ability to establish repeatable lending practices, and potential for portfolio growth with moderate effort.

Challenges include higher default risk for unsecured loans, difficulty in verifying borrower income in certain situations, and regulatory limits on interest rates that can restrict flexibility. When approached carefully, personal and consumer lending can provide steady returns for private lenders while allowing them to serve a wide range of individual needs.

Examples of loans including their estimated risk for private money lenders and current market demand:

Payday loans are provided for personal, non-business purposes. They are very short-term, high-interest, and are typically repaid with the borrower’s next paycheck. Loans are small in amount, designed for urgent cash needs, and often heavily regulated. Risk and demand vary depending on the borrower’s income, collateral, and repayment ability. Risk can be mitigated through credit checks, loan limits, and clear repayment terms.

Student loans cover tuition, books, and other education-related expenses. Risk is moderate because repayment depends on the borrower’s future income and ability to find employment. Demand is steady, especially among students without access to traditional funding. Risk can be mitigated through enrollment verification, income assessment, and structured repayment plans.

Auto loans support purchasing vehicles. Risk is relatively low because the car serves as collateral, though depreciation and potential default create some exposure. Demand is high due to widespread vehicle ownership. Risk can be reduced through credit checks, proper loan-to-value ratios, and repossession clauses.

Healthcare loans cover medical procedures, treatments, or emergency health expenses. Risk is moderate to high because repayment depends on the borrower’s income rather than collateral. Demand is strong, particularly for urgent or uninsured care. Risk can be reduced through income verification, loan size limits, and structured repayment schedules.

What Are the Legal Requirements for Private Business Lender

Do you need a license to be a private lender? Not always. Legal obligations depend on where you operate and the types of loans you plan to offer. In some regions, a license is required, while in others it applies only to specific loan types.

For instance, you may need to get a consumer lending license for personal loans, or a commercial lending license for loans made to businesses, or a mortgage lender license if you issue residential real estate loans. The exact requirements depend on what you are lending, who you are lending to, and the jurisdiction in which the transaction takes place.

Regulations differ region by region, so if you are planning to operate in several ones, make sure to do thorough research or speak with a legal advisor on local specifics. Before starting your private lending business, it is essential that you understand all licensing, compliance, and legal requirements to avoid unnecessary risks.

How Private Lending Software Improves Workflows

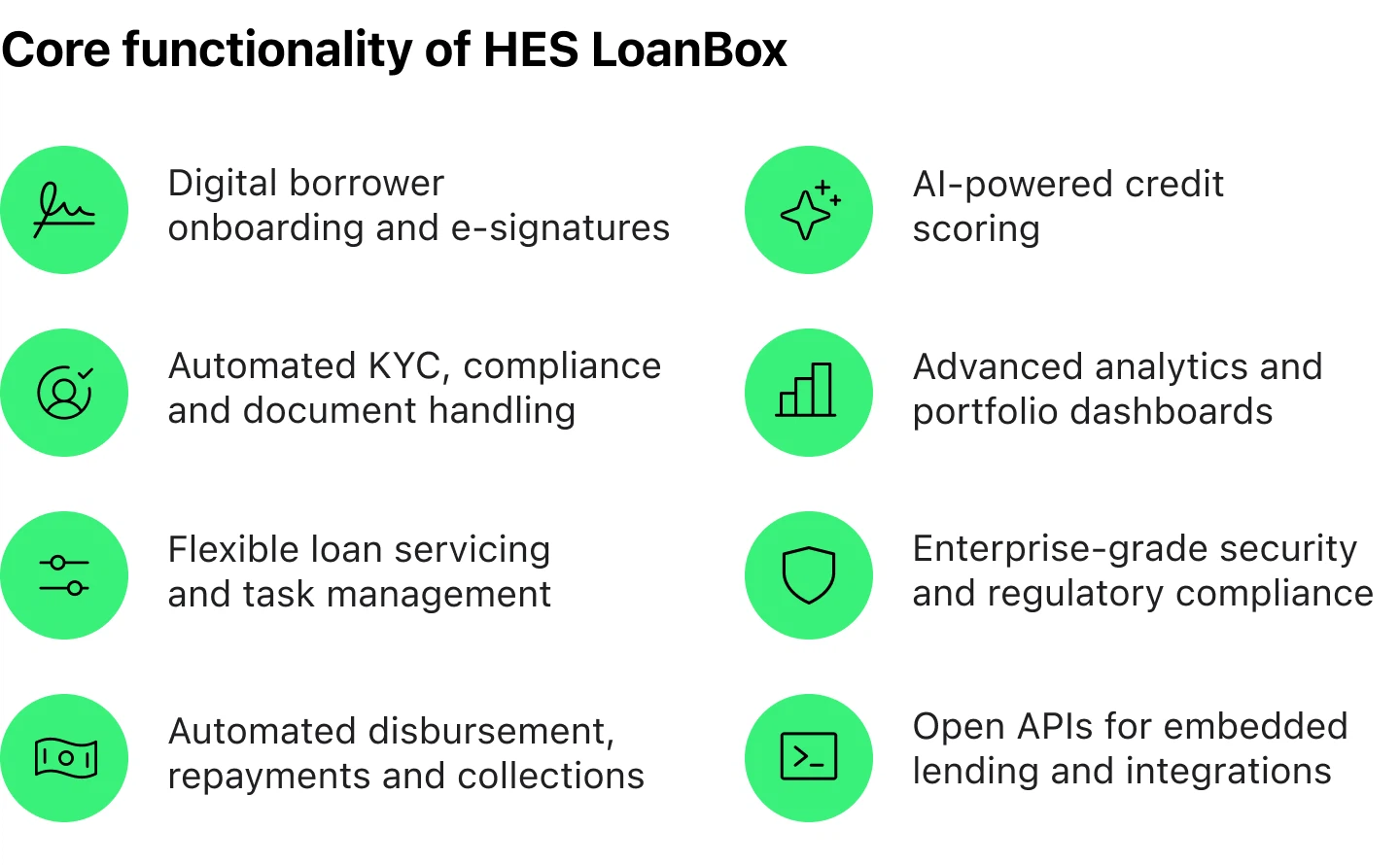

Lending software takes a lot of routine work off a lender’s plate. It helps handle loan applications by collecting borrower details, checking identities, and running basic credit checks automatically. Risk is reviewed during underwriting using set rules or automated decision tools.

Moreover, maintaining audit readiness is easier with the software that organizes documents and ensures regulatory compliance, making reviews and inspections more transparent and efficient.

After a loan is issued, the system keeps everything on track. It sets up repayment schedules, calculates interest, and keeps an eye on late or missed payments. Reporting is also simpler, since required reports for regulators and internal teams can be created without digging through spreadsheets, while loan performance and risk stay easy to follow.

Loan documents like contracts and ID files are stored securely and can be pulled up quickly when needed. Borrowers receive automatic reminders and updates, so there’s less manual follow-up. From one dashboard, lenders can see all active loans, spot problem accounts early, and manage their portfolio more efficiently. Payments are processed through connected banking systems, making collections, early payoffs, and regular repayments run more smoothly.

For instance, HES LoanBox, a cloud-based lending platform that helps lenders manage every stage of a loan, from application and credit checks to servicing and collections, in one system. It supports loan origination, credit evaluation, servicing, risk management, and compliance. It is suitable for both individual lenders starting small and firms managing large portfolios, including those providing mixed loan types.

How to Start a Private Money Lending Business

Following these steps ensures that your private lending business is legal, efficient, scalable, and sustainable, while minimizing risk and improving borrower experience.

- Prepare the legal base by registering a legal entity, securing required licenses, and ensuring loan agreements and interest rates comply with applicable lending laws.

- Build a stable capital base by identifying where funds will come from, establishing clear lending limits, and keeping reserve funds in place to protect against possible loan losses.

- Define loan products by selecting loan types, setting interest rates, fees, and repayment schedules, and determining collateral requirements, loan limits, and LTV.

- Build lending operations by implementing private lending software for all automated applications, approvals, and tracking; providing borrower dashboards; integrating digital payments; securing document storage; and enabling automated borrower communications.

- Acquire and screen borrowers by defining target segments, evaluating income, credit, and collateral, performing KYC and AML checks, and building trust through transparent terms and contracts.

- Manage risk by diversifying the loan portfolio, requiring collateral or guarantees, monitoring repayments through software, and maintaining protection against defaults.

- Market and grow your private lending business by creating a professional website with clear offerings, leveraging SEO, social media, and online ads, providing tools like calculators and simple applications, networking with agents and consultants, and joining industry associations for credibility.

- Manage your portfolio by tracking all active loans from a central dashboard, monitoring borrower performance and risk, analyzing trends to adjust strategies, and collecting testimonials and referrals to build reputation.

- Ensure reporting and compliance by generating internal and investor reports, preparing regulatory filings, and maintaining detailed records of all transactions and loan agreements.

- Drive continuous improvement by reviewing loan performance regularly, updating private money lending software and processes for efficiency, and refining marketing, risk strategies, and loan products based on results.

Conclusion

If you’re thinking over how to get into private lending in 2026, start by planning carefully and understanding the business. Select a lending model and loan category that matches your available capital, expertise, and appetite for risk. Define repayment schedules, interest rates, and collateral, and ensure compliance with local legal requirements. Adopt private money lending software to manage applications, track payments, and organize documents efficiently.

Focus on marketing and networking activities to acquire borrowers and partners, following the stages of the customer lifecycle: generating leads, nurturing prospects, converting contracts, establishing partnerships and servicing, and maintaining ongoing client relationships.

When done with careful preparation, the right tools, and a well-structured strategy, private lending for business can become a rewarding and adaptable way to finance companies that are unable to secure funding through traditional banks.