Alternative finance is reshaping the financial landscape and taking over the world. As of 2022, the global alternative financing market was valued at USD 10.82 billion. It is projected to experience a compound annual growth rate (CAGR) of 20.2% from 2023 to 2030. Becoming a profitable niche for business, entrepreneurs choose to start a loan company and provide digital services for customers.

However, starting a loan company is a challenge with many unpredictable trials. Even if you think out your business plan, choose the niche, and find an investor, it doesn’t guarantee a risk-free path from a startup to an SME business. So, the HES team decided to ask one of our loyal clients about challenges on the way to success because who knows better how to start a loan business than an owner of such a company?

We are talking about starting a loan company, risky decisions on the way, and market expansion with Boris Batine, Co-Founder & CEO of the international micro-credit provider ID Finance and one of HES’s most valued partners.

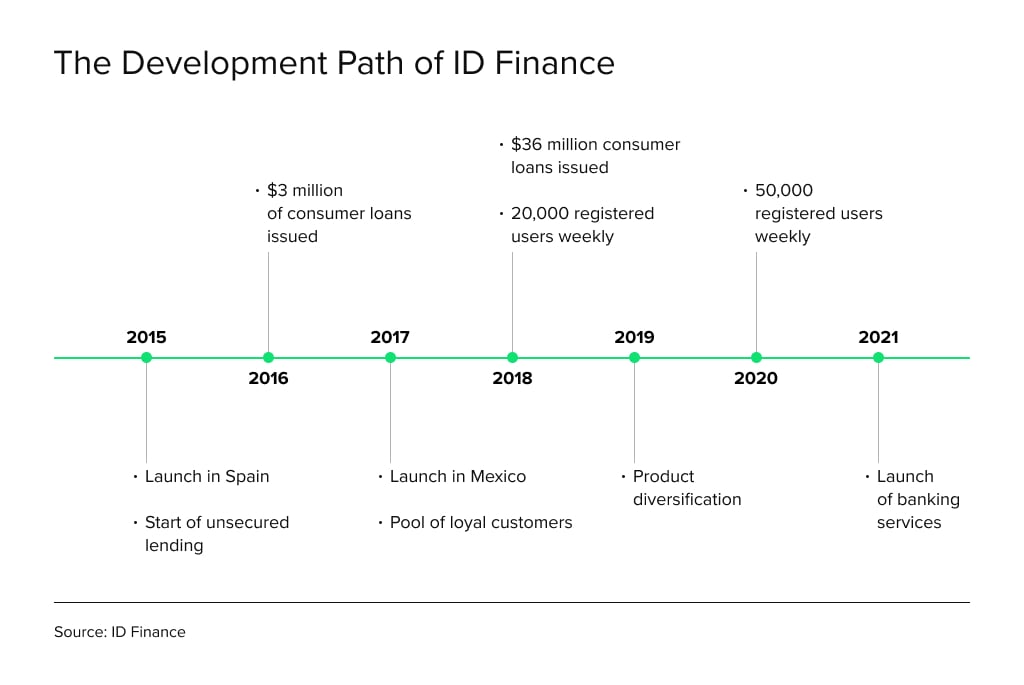

ID Finance is the holding behind MoneyMan and AmmoPay companies, as well as Plazo brands in Spain, Mexico, and Brazil. As of October 2019, the company reported 3 million users with over 40,000 new users joining each week. Based on the insights, the company has gained €60 million since 2015 including €5.8 million of equity and €54 million through debt.

About MoneyMan

MoneyMan is an online micro-credit lending business with more than 60,000 clients. It offers payday loans in Georgia, Poland, Kazakhstan, and Spain. Since 2012, MoneyMan has issued over 250,000 loans valued at over $50 million and attracted over $15 million in investments.

Unlike traditional micro-finance companies, MoneyMan offers digital lending services 24/7, so the company isn’t tied to the geography of its borrowers. The main advantages of the company are a fully automated loan approval and disbursement process and an innovative decision-making model called Scoring 5.0, which is based on Big Data and top-notch search technologies packed into lending management system.

Read also

How to Start a Loan Company like MoneyMan

It’s always easier to learn by considering good practices instead of studying a theory. So, we decided to ask some questions to Boris Batine about his lending experience with MoneyMan and the challenges of expanding business in Europe. Keep following the interview to find some advice on how to start a cash loan business and develop cash lending software.

How to find the right niche in money lending

MoneyMan quickly moved into leading positions in all of its countries of operation and has a growing ambition for steady expansion into new markets. What is your advice for finding the right niche in the money lending business in terms of geographical reach?

Boris Batine: When we were starting our lending business in Eastern Europe, this market was going through a period of rapid growth. It was fully controlled by commercial banks, but no one offered loans online, so the niche of online micro-lending was vacant. We saw how this business was booming in the UK and Western Europe and thought of adopting the all-new online model for our market.

Tip 1: try to get there first

Being a pioneer in the market always gives you a competitive advantage. But if you cannot be first, be smart. Carve your own niche by adopting an existing solution into new markets and expanding to neighboring locations.

Then, if you get a customer asking for a loan that is outside your expertise, don’t broker such clients. Refer them to other reputable private loan originators. Thus, the customer will get a decent level of service, and you will start building a community of companies that can send referrals to each other.

Tip 2: do your homework

Having a lot of solid planning and making sure you have what it takes to grow is the basis when you think about how to start a loan company. Altogether, we spent about a year analyzing the market environment, handling legal issues, and building our lending platform. In order to run a good online money lending business, make sure that the country’s population is actively using online banking and bank credit cards. The system of state law should allow making loans online, conducting remote authorization, and processing personal data. It should also have an effective system of debt collection.

How to build an international lending business

You started your business by expanding to relatively close markets of Kazakhstan and Georgia. Why have you changed this strategy and looked at Spain as your next destination?

Boris Batine: My partner Alexander Dunaev and I have always thought of MoneyMan as an international business. After our first success, we made a shot at markets of culturally close neighboring countries. Then we looked at the situation from the other end and tried to expand into distant markets with larger cultural differences using the knowledge we had gained.

The Spanish market has all the qualifying factors which I mentioned above. Individuals carry out 55% of their bank transactions via the Internet, this includes 11% of transactions via mobile apps, plus all non-banking lending is done completely online. This is a huge contrast to Eastern Europe, where online takes not more than 10% of the whole MFI loan portfolio. In Spain, if you need a small sum of money for immediate financial needs, instead of going to a bank, you will borrow a quick payday loan via the Internet.

Above all, the Spanish legal system is straightforward and transparent. The online lending market is not controlled by any central banks or other state authorities. The work of companies that operate in the financial market is regulated by acts on consumer and data protection and anti-money laundering. These laws regulate all lending activities and personal data management. It turns out that this is enough for the market to work well.

Tip 3: strive for transparency in your business

Dealing with finances is hard for most people. So making the work of your company clear and transparent will give you a competitive advantage. Not pretending something you are not will increase your trustworthiness, attract more clients, and boost their loyalty.

Have you experienced any cultural shocks and challenges in entering the new market?

Boris Batine: Actually, it is quite the contrary. Although online loan rates in Spain are approximately the same as in other countries, Spaniards don’t view charging interest on payday loans as immoral usury. They seem to have the right attitude for lending as a business, and this helps us a lot.

The average loan size stands at around € 300. It is twice more as we used to. We financed our first loan in June 2015, so it is too soon to speak of bad debt. We have planned our annual level of overdue debt outstanding for more than 90 days at a maximum of 8%. For comparison, it is 14% for our first countries. Spaniards value their credit history and live up to their income. They borrow as much as they need but not as much as they can get.

Looking for unique software for lending?

Creating a money lender business from scratch: does it worth it?

Expanding to a relatively new market is risky because you appear in an unknown business environment. Is it difficult to register an MFI in a new country? Is it better to start a loan company from scratch?

Boris Batine: If you decide to start a loan company from scratch, note that it’s never fast. In Spain, it usually takes up to 4 months. We wanted to save some time, so we bought a small dummy company, which cost us € 5,000. Legal services cost about € 1,500 per month. Registering a new company would have saved us around € 500-1,000, but we would have lost time.

Opening a bank account was extremely challenging for us. Most Spanish banks treat online lenders as competitors and refuse to open and maintain their accounts or set out prohibitive tariffs and service conditions. What I know about cross-cultural business behavior is that such a troubled relationship between banks and alternative lenders does not exist outside Spain. The cost of corporate services in Spanish banks is about two times higher than that in any other country we worked in before. We were lucky to open an account with Catalunya Caixa (and two reserve accounts in smaller banks in case Catalunya Caixa decides to shut off our air supply) through the connections of our country manager in Spain.

In addition, Spanish taxpayers are required to keep all their docflows in electronic format. We have chosen to outsource the accounting of our Spanish office to a local agency.

How to allocate the budget for international expansion

Let’s finish talking about your expansion experience in Spain. How did you go about staffing and getting office space? How much money did it take?

Boris Batine: As soon as we registered the company, we started looking for a country manager. We quickly found the right candidate through LinkedIn — it was only the fifth interview we had done. But we also relied on the Page Personnel recruitment agency to help us source skilled candidates for key positions. By the way, their services in Spain are about 40% cheaper than we expected from our previous experience. It took more than 50 interviews to find the right people for some positions, but we never hired out of sheer desperation.

The pay level in all locations is almost equal. Yet, the rent on commercial property in Spain is still cheaper. For example, we are renting a 120 sqm office in the heart of Barcelona for €1,200 per month. At the moment, MoneyMan Spain has seven employees assigned to key functions, such as marketing and finance, legal support, customer service, and debt recovery. Our Spanish office has a total monthly overhead of €25,000.

The total cost of setting up a business in Spain made up €150,000, of which € 95,000-100,000 was spent on organizational arrangements over the first three months. The remainder was used as funds for lending.

Tip 4: multiple your budget

After you have calculated all the possible costs you need to cover during the first year, multiply this number by 2. You never can be sure that you took into account all the possible nuances and that no extra costs will appear during this time. So, budgeting for a business launch is exactly like when you are doing a house renovation. It’s a good idea to have a safety pillow.

How to build credit scoring and risk assessment process

Distinguishing bad borrowers among profitable customers is challenging. Constant failures in this complex task can lead to bankruptcy in a long-term period of time. What about risk assessment in MoneyMan? Did you have to make any changes to your existing credit-scoring model?

Boris Batine: If you already figured out the basics of how to start a lending business, innovative credit scoring is a must to keep growing your customer base and reducing non-performing loans. Since MoneyMan’s workflow process lacks face-to-face contact with the borrower, it is vital to have the risk assessment system run as smoothly as possible. We use probabilistic methods of credit scoring, which are based on stats and data sourced from different channels, including credit histories, mobile top-up data, and social profiles.

In Eastern Europe, our borrower verification workflow is built around a application form in loan origination software, which requests details of any previous loans. Of course, the borrower may not remember the exact opening and closing dates or other particulars, and the chance that loan documents will be at hand to look at is slim. But a hundred percent match is not necessary. The information about previous loans is impossible to fathom.

In Spain, we are taking advantage of the KYC service called Instantor. It identifies borrowers through their online banking accounts. The potential borrower logs in to their internet bank using the Instantor website, so the lender can see the data on their cash flows through bank accounts and credit/debit cards. Thanks to this service, we not only identify our clients but also get reliable information about their income and bank card usage. The pricing is set up as in a credit bureau — the more inquiries, the less the cost per inquiry.

Get a digital roadmap for your lending business

Want to get a ready-made digital roadmap for your lending business? Take a 5-minute quiz. Select the option that most accurately represents your situation. Once you complete the quiz, you will receive a finance digital transformation strategy tailored specifically for your lending company. It's free, and your answers are totally confidential.

Tip 5: use mission-critical software

You, as a business, need to focus on your company’s objectives and the requirements of your customers. It‘ll help you create the so-called minimum viable product with minimal functionality that will allow you to provide a great customer experience and go live in your first location. I recommend choosing the go-to-market software option that will allow you to quickly scale up and adapt to different market conditions.

HES FinTech and MoneyMan

Considering your collaboration with HES FinTech, was it a good decision for your business? What was the project scope?

Boris Batine: MoneyMan has a long-lasting story of strong business collaboration with HES since the launch of our company. In 2011 we came to HES FinTech with the idea of developing the first online PDL. The team needed 4 months to implement a solution that has no precedent for such a business in the country. Without going into detail about the project scope, HES developed the core logic, workflows, and all business processes. The platform was launched in 2012, and since this time, MoneyMan has grown into an international company - ID Finance that operates in 7 countries.

Read also

To Sum Up

Every business story is unique, so there is no one fits all business plan. However, every lender meets the same challenges when choosing a business niche, building a credit scoring process, expanding a company, and choosing a software vendor. Hopefully, this interview with Boris Batine gave you some insights on how to start a loan business, and here are just some main thoughts we want to highlight one more time.

- Find your niche. Even if you cannot be first, be smart. Think about what new and unique you can offer. For a start, it’s great to focus on one field and one market.

- Make deep research. Invest your time into studying and researching this niche to make sure you know the market, target audience, and legal requirements to start such a business. Don’t underestimate the importance of this step. The better you know all the details and possible pitfalls, the more chances you have.

- Choose the right software. Establish what minimal functionality you need in your software to provide your customers with high-quality services. Remember that you can add more features in the future when you need them.

- Develop your credit scoring algorithm. Depending on your needs, you can choose an AI-based scoring system or create any other way to evaluate your clients and reduce the number of overdue debts.

- Calculate your budget. Most startups fail because of a lack of investment. So when researching, calculate the approximate amount needed to start the business and keep it going for at least a year. A good practice is to double or triple this amount, so you’ll have the fund for unexpected costs.

- Keep the transparency. Explain the processes inside your company to the customers and make sure they understand what they are signing on. Keeping the work of your company clear and transparent will attract more loyal clients.

- Grow a community. If you get a customer that asks for a loan that is outside your expertise, refer them to other reputable private loan originators. Thus, you will stay in good relationships with both clients and colleagues that will help you develop business in the future.

Need software to launch a lending company? Get more inspiration by exploring our use cases, or get in touch with our team to ask about MoneyMan and other projects.