A car leasing company addresses many of the pain points associated with traditional car ownership. Clients enjoy lower upfront costs, predictable monthly payments, access to the latest models, and the ease of avoiding the usual resale headaches. No wonder, then, that the global car leasing market is steadily expanding, with projections suggesting it could reach $1,014.8 billion by 2033.

With this momentum, both entrepreneurs and established players are turning their attention to starting a car leasing business. The potential is indeed substantial, but so are the challenges, from carving out a clear niche and shaping a solid business plan to navigating compliance and arranging insurance.

In this article, we’ll explore the key benefits and opportunities of starting a car leasing company and outline the foundations required to build and grow a viable venture.

What Is a Car Leasing Company?

A car leasing business gives customers the ability to use a vehicle for a fixed term in exchange for recurring monthly payments, without the commitment of full ownership (in certain contract structures, though, clients may also secure an option to purchase the vehicle at the end of the lease).

Rather than tying up capital in buying a car, clients are paying for its usage, covering depreciation, financing costs, and, in many cases, bundled services such as insurance or maintenance.

How Does a Car Leasing Business Operate?

From the operator’s perspective, leasing revolves around acquiring vehicles, structuring contracts, and maintaining financial performance over time. The core challenge lies in balancing customer demand with residual values, compliance, and operating costs, all while delivering a reliable experience that drives renewals and customer loyalty.

Behind the scenes, car lease company operators also manage vehicle financing, depreciation forecasting, insurance and credit arrangements, and service agreements to keep both profitability and customer satisfaction aligned.

Increasingly, specialized digital systems support all of these efforts by consolidating data flows, providing insights into fleet performance and loan management, and enabling automation that reduces manual overhead.

Why Is the Car Leasing Business Becoming Popular?

According to research by FinTech Futures, several factors explain the growing popularity of car leasing.

These include:

- Increasing preference for flexible mobility solutions. More people and businesses want the freedom to access cars without being locked into long-term ownership or tied down by resale risks.

- Advancements in vehicle technology. Leasing makes it easier to drive cars equipped with the latest EV features, connected systems, and safety tech that might otherwise be too expensive to buy.

Noteworthy is that electric and hybrid vehicles are gaining particular traction. Deloitte’s 2025 Global Automotive Consumer Study shows rising interest in full hybrids and range-extender technologies, which balance reduced fuel costs with lower emissions and fewer charging constraints.

- Growing corporate sector adoption. SMEs and large enterprises alike are leaning on car leasing for predictable fleet costs, bundled maintenance, and capital efficiency.

- Expansion of urbanization and ride-sharing services. In cities where owning a car is less practical, leasing supports both individuals and businesses tied to mobility-as-a-service platforms.

- Shift towards sustainable and environmentally friendly options. Government incentives and consumer awareness are accelerating the demand for leased EVs and hybrids, thus making sustainability a growth engine for the sector.

- Rising disposable income and consumer spending. As incomes rise, leasing gives people access to higher-end models that would be hard to justify through outright purchase.

- Digitalization and online platforms. The automotive industry’s shift toward digitization, combined with the rise in leasing platform adoption, is fueling market growth. By making contract management, loan servicing, and onboarding simpler and more transparent, these platforms speed up the process and create a more appealing experience for tech-savvy customers.

Why Start a Car Leasing Business? Key Benefits and Opportunities Explained

| Benefit | What you gain |

|---|---|

| Predictable revenue | Rather steady monthly income and improved financial forecasting |

| Market flexibility | Access to any segment or demographic, from niche audiences to broad markets |

| Sustainability impact | Integration of EVs and hybrids supports green mobility goals |

| Residual value gains | Opportunities to re-lease or resell vehicles for extra returns |

| Beyond-the-car revenue | Additional income from insurance, maintenance, or fleet management |

| Strategic partnerships | Collaboration with automakers, insurers, and fintechs enhances growth and ecosystem strength |

Launching a car leasing company can unlock opportunities that go well beyond simply putting vehicles on the road.

For those exploring how to start an auto leasing company, the strategic advantages are worth a closer look.

1. Predictable and Recurring Revenue Streams

Instead of depending on one-off car sales that can fluctuate with demand cycles, a car leasing business owner benefits from long-term contracts that guarantee consistent monthly cash flow.

This predictability makes financial forecasting more reliable, lowers exposure to market volatility, and creates the kind of consistent revenue profile that investors really value.

2. Vast Opportunities Across Market Segments

A car leasing company opens up a wealth of possibilities and gives you the flexibility to target any segment or demographic. From urban commuters and small business fleets to corporate or specialized mobility services, the model can be adapted to meet diverse customer needs.

On top of this, you can start with a small fleet focusing on a niche audience and gradually expand into broader markets, all while experimenting with innovative offerings such as event rentals, luxury fleets, or eco-focused mobility solutions.

3. Contribution to Sustainability Agendas

Sustainability has been a boardroom priority and car leasing companies are well-positioned to support it. By offering electric or hybrid fleets, a car leasing company can allow its clients to cut emissions without shouldering the cost of full ownership.

Besides, PwC notes that some businesses are already experimenting with leasing charging boxes, and future iterations may even include renewable add-ons like solar panel leasing, all of which can make decarbonization more accessible.

4. Attractive Residual Value Economics

Compared to outright sales, a leased vehicle doesn’t exit the balance sheet once it leaves the lot. After the first contract ends, the same car can either be re-leased or strategically sold in the secondary market, depending on residual value analytics.

In other words, the ability to extend the revenue lifecycle transforms vehicles from depreciating assets into financial instruments with multiple value-extraction points, thus boosting overall asset efficiency.

5. Beyond-the-Car Revenue

Leasing opens the door to services that go far beyond the car itself.

Maintenance packages, insurance coverage, roadside support, or charging subscriptions can all be bundled into a single contract, thereby creating additional income streams.

Plus, over time, businesses can branch into fleet management platforms, usage-based insurance, or even MaaS integrations, gradually evolving from a vehicle lessor into a mobility solutions provider.

6. Strategic Partnerships and Ecosystem Growth

If you have an ambitious business idea that goes beyond just “how to start a car leasing company”, you can leverage partnerships to accelerate growth and service innovation.

Collaborating with automakers, insurers, fintech firms, or charging infrastructure providers allows operators to expand offerings while sharing operational risks.

Done thoughtfully, these alliances create a sticky ecosystem where customers receive end-to-end solutions, and your business builds defensibility that makes it harder to displace in the market.

How to Start a Car Leasing Company?

If you’ve been wondering how to start a car leasing business, it’s worth being aware of the key building blocks behind it.

Below, we’ll walk through the essential things to focus on before and while launching your leasing venture.

1. Research the Market and Define Your Niche

Every successful leasing venture begins with thorough research as this is a vital step for anyone exploring how to start a leasing company for cars.

The process involves carefully studying industry trends to identify where demand is growing, analyzing competitors to uncover their unique selling points, and benchmarking prices to understand what customers are willing to pay.

Once you have a clear picture of the landscape, the next step is choosing a niche that matches your ambitions and goals.

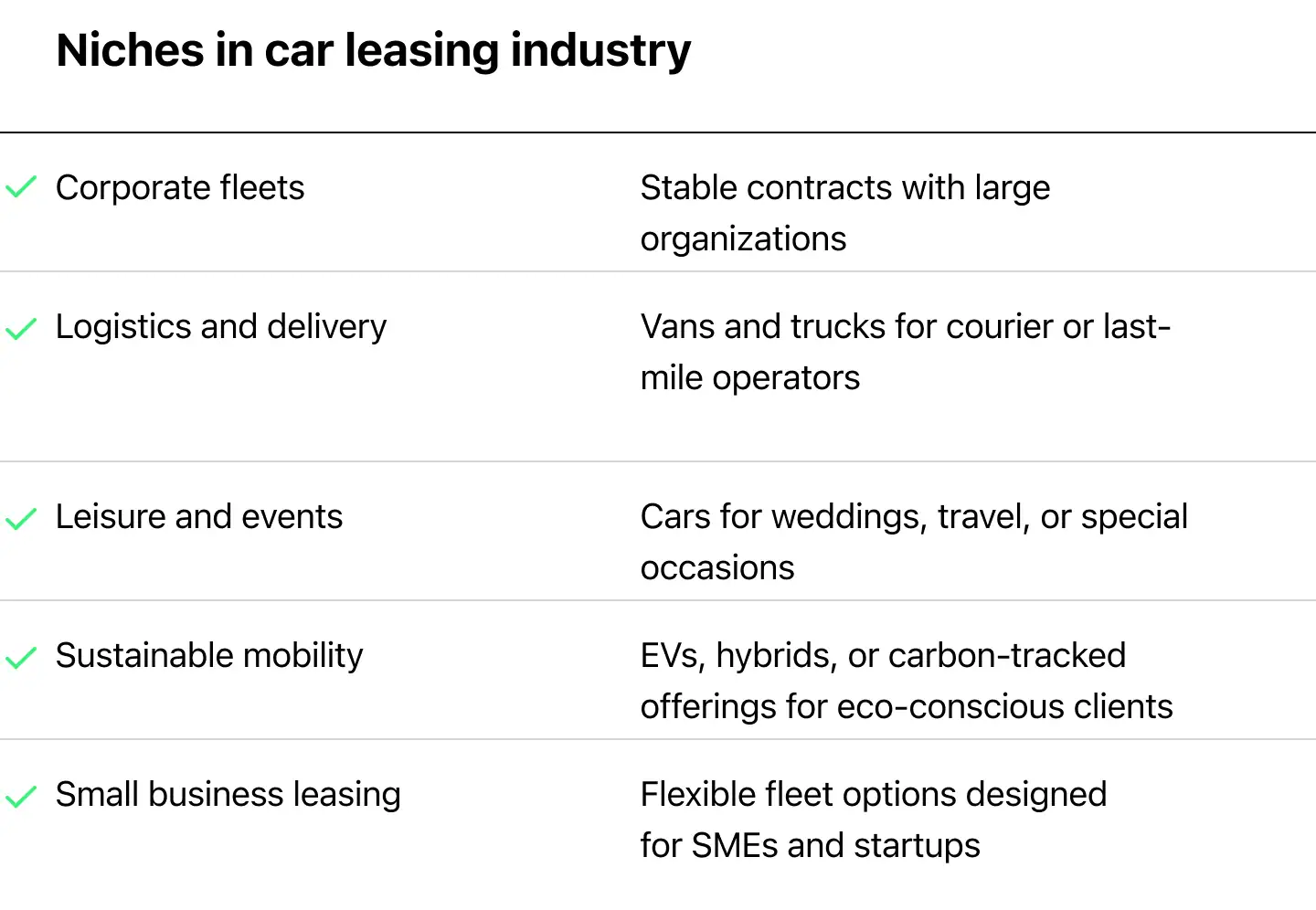

Some popular directions include:

- Corporate fleets—stable contracts with large organizations

- Logistics and delivery—vans and trucks for courier or last-mile operators

- Leisure and events—cars for weddings, travel, or special occasions

- Sustainable mobility—EVs, hybrids, or carbon-tracked offerings for eco-conscious clients

- Small business leasing—flexible fleet options designed for SMEs and startups

Of course, the possibilities are not limited to these examples. You can combine categories, create hybrid models, or experiment with entirely new formats to align market demand with your business vision.

2. Create a Solid Business Plan for Your Car Leasing Company

Before diving into operations, it’s necessary to outline in your business plan how the company will function financially and strategically. This blueprint should serve as a foundation for decision-making, clarify your strengths, highlight potential risks, and set out the long-term vision.

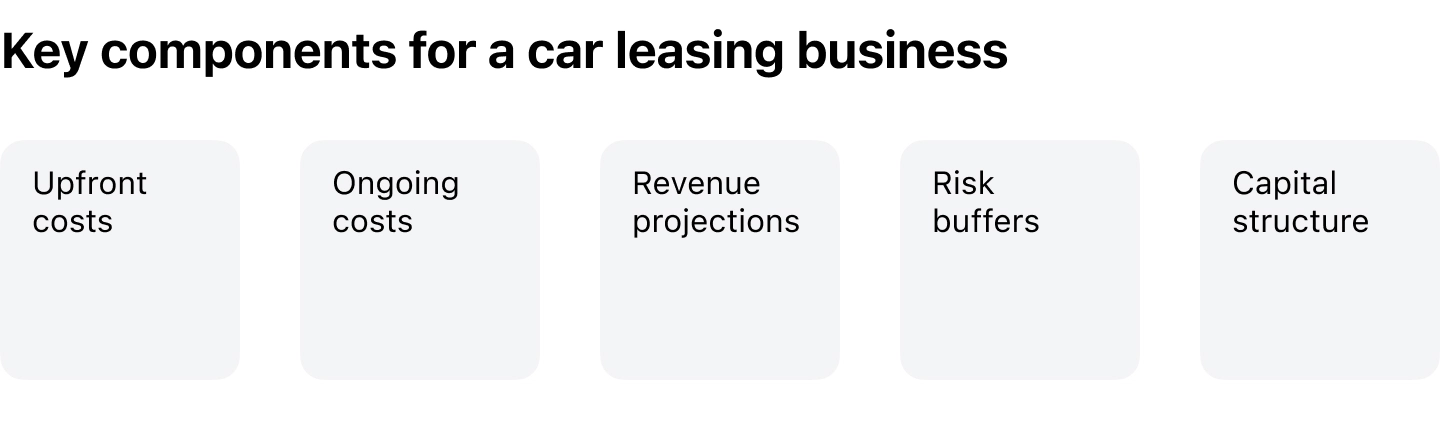

Importantly, your business plan should cover key financial and funding components.

- Upfront costs—vehicle purchases or financing, insurance, and setup expenses

- Ongoing costs—maintenance, staff, software, and regulatory compliance

- Revenue projections—lease rates, residual values, and service upsells

- Risk buffers—depreciation, defaults, and market fluctuations

- Capital structure—equity contributions, financing sources, and credit arrangements

When carefully prepared, a business plan functions as both an internal roadmap and a persuasive document that is capable of attracting capital, partnerships, and long-term commitments.

3. Register Your Business and Handle Legal Frameworks

The structure you choose for your leasing business determines taxes, liability, and growth flexibility.

Common options comprise:

- LLC (US) / Ltd (UK, EU) balances flexibility with liability protection;

- Corporation is suitable for scaling, attracting investors, and raising capital;

- Sole proprietorship is a simple setup, but bears personal liability risks;

- Partnership implies shared ownership and responsibilities among founders.

The decision should reflect your long-term ambitions, financial model, and appetite for risk. Once a structure is selected, the necessary documentation must be filed with the relevant state agency.

In addition to registration, it is important to create a strong brand identity. A distinct name, professional logo, and consistent visual presentation add credibility with both customers and financial institutions.

Then, when registration is complete, focus on legal frameworks. Remember that standardized lease agreements should set clear rules for payments, mileage, liability, and contract termination.

4. Acquire the Right Fleet

Your fleet is both your core asset and your biggest expense, so selecting vehicles must be both strategic and data-driven.

Instead of mirroring competitor lineups, study local demand patterns, driver preferences, and infrastructure readiness. For instance, the adoption of EVs depends on the density of charging stations, while logistics operators require durable vans that maximize uptime and minimize service interruptions.

In other words, evidence-based decisions like these help ensure higher utilization, strengthen your reputation for reliability, and set the stage for long-term profitability.

5. Build Your Tech Backbone

Modern leasing businesses operate on a digital backbone that keeps processes efficient and scalable. Core systems generally include accounting tools, telematics for fleet monitoring, and CRM software to manage customer relationships. Together, these systems ensure transparency, efficiency, and scalability.

At the center of this infrastructure sits specialized automotive leasing software. The platform connects dealers, lenders, and customers while automating critical workflows such as digital onboarding, loan management, e-signatures, contract administration, and debt collection.

For customers, this creates an experience that feels straightforward and frictionless. For operators, car leasing software provides consolidated oversight of financial and operational performance.

6. Take Care of Insurance

Insurance protects both the assets you deploy and the revenue streams you rely on.

A comprehensive framework should anticipate both expected risks such as accidents or wear and tear, and unexpected disruptions like theft or major depreciation shifts. Plus, lease agreements must clearly define responsibilities related to servicing, mileage caps, and acceptable wear-and-tear standards.

Chiefly, in the case of electric vehicles, special attention should be devoted to battery warranties as replacement costs can be substantial and directly impact residual value economics.

7. Market Your Car Leasing Company and Scale Your Reach

Once you’ve taken care of all the organizational foundations, the next step is to build and grow your customer base.

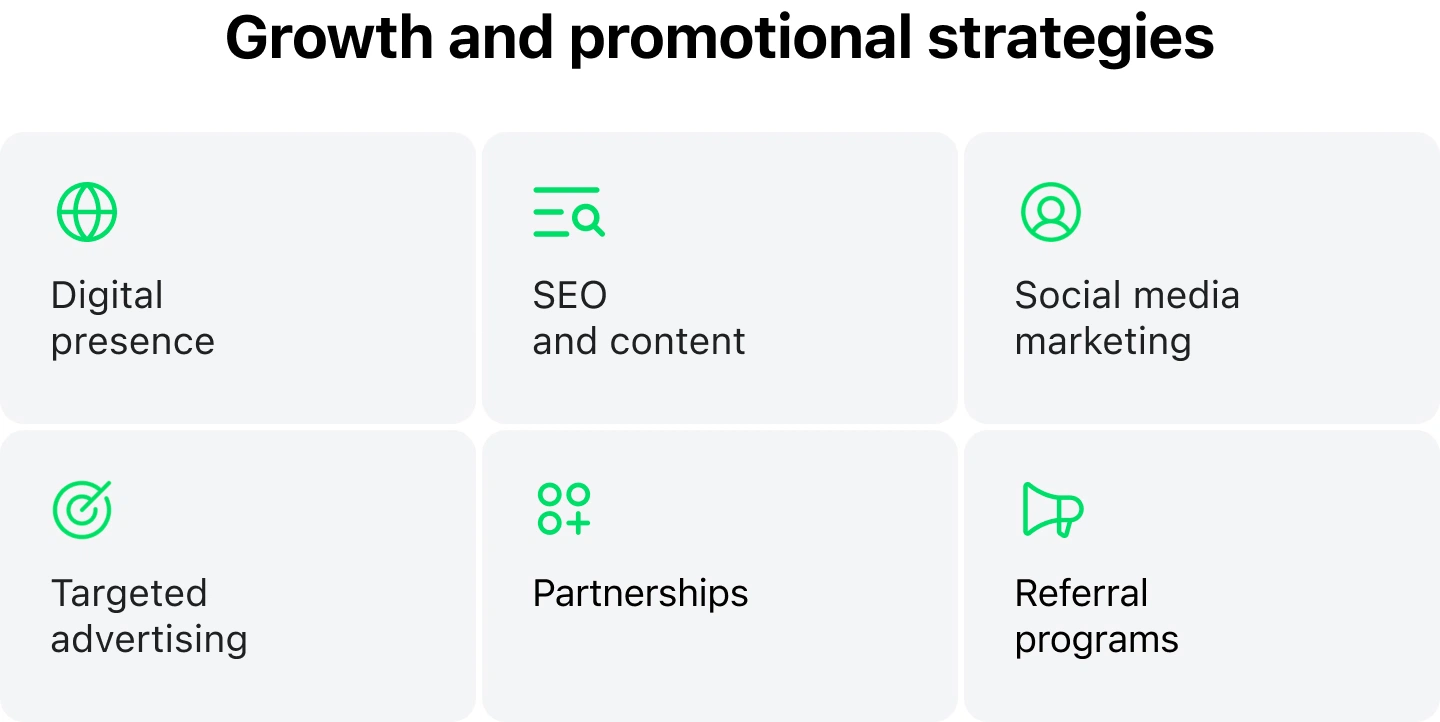

Growth and promotional strategies often combine the following aspects:

- Digital presence—a polished website or mobile app that supports customer interaction and is complemented by digital terms and conditions that formalize engagement;

- SEO and content—blogs, guides, and thought-leadership resources that explain why leasing is a flexible and cost-effective alternative to ownership;

- Social media marketing—consistent messaging across platforms to build awareness and engagement;

- Targeted advertising—precise campaigns on search engines and social platforms that will help you capture defined audiences;

- Partnerships—alliances with automakers, charging providers, or corporate employers that extend market reach;

- Referral programs—structured incentives that encourage existing customers to bring in new clients.

Conclusion

Starting a car leasing company brings about lots of advantages and opportunities, from predictable recurring revenues and the ability to serve diverse market segments to supporting sustainability initiatives and more.

For those considering how to open a car leasing company, success depends on getting the fundamentals right: thorough market research, a solid business plan, regulatory compliance, strategic fleet acquisition, and a strong technology foundation to keep operations efficient, scalable, and focused on the customer experience.